• Shaky sentiment. US debt ceiling yet to be fully put to bed. US & European confidence weakened, a sign the global downturn is gathering pace.

• Currency concerns. JPY weakness has seen officials fire a shot across the bow of markets. A lower currency makes the inflation fight harder.

• AUD events. Today, RBA Governor Lowe speaks, the monthly CPI indicator is released, and the China PMIs are due.

Some negative vibes across markets as the US and UK returned to work after their long weekend. The US debt ceiling has yet to be fully put to bed. While the in-principle agreement to raise the ceiling is a positive step, it still needs to be voted on by both chambers of Congress by 5 June (the latest update from Treasury Secretary Yellen around when the government could run out of funds). US lawmakers are expected to begin voting today, with most analysts thinking it should pass.

On the economic-front sentiment indicators show the global slowdown is gathering pace, with tighter monetary conditions gaining traction. In the US, the Conference Board measure of consumer confidence fell to a 6-month low. And importantly, the share of consumers saying that jobs are “plentiful” hit a 2-year low, a sign the labour market is losing steam. A turn in the labour market is needed to help bring down sticky services inflation, but it also points to less consumer spending and economic activity. It was a similar story in Europe, where economic confidence (a composite of consumer and business sentiment) dipped to its lowest level since last November. However, there was some positive news on inflation, with the CPI in Spain and Belgium slowing. This suggests the Eurozone data (due Thursday) could show a similar trend.

Across markets, European equities lost ground (the EuroStoxx50 fell ~0.7%), while the US S&P500 ended the day flat after opening in positive territory. Bond yields declined, with US and German yields ~9-12bps lower across the curve. This pushed US and German 2-year yields down to 4.45% and 2.76%, respectively. Elsewhere, oil prices tumbled ~4% as growth concerns build amid signs of ample supply. Reports that Saudi and Russia tensions are rising was another factor at play. In FX, the USD consolidated near recent highs, with EUR ticking up towards ~1.0730, and USD/JPY slipping under 140 after Japanese officials warned that “excessive moves aren’t desirable” and that “the government will take appropriate responses if necessary”. This follows the JPY’s slump to a multi-month low and echoes comments made prior to last year’s intervention to strengthen the JPY. AUD slipped back (now ~$0.6520), tracking the weaker CNH and global growth worries.

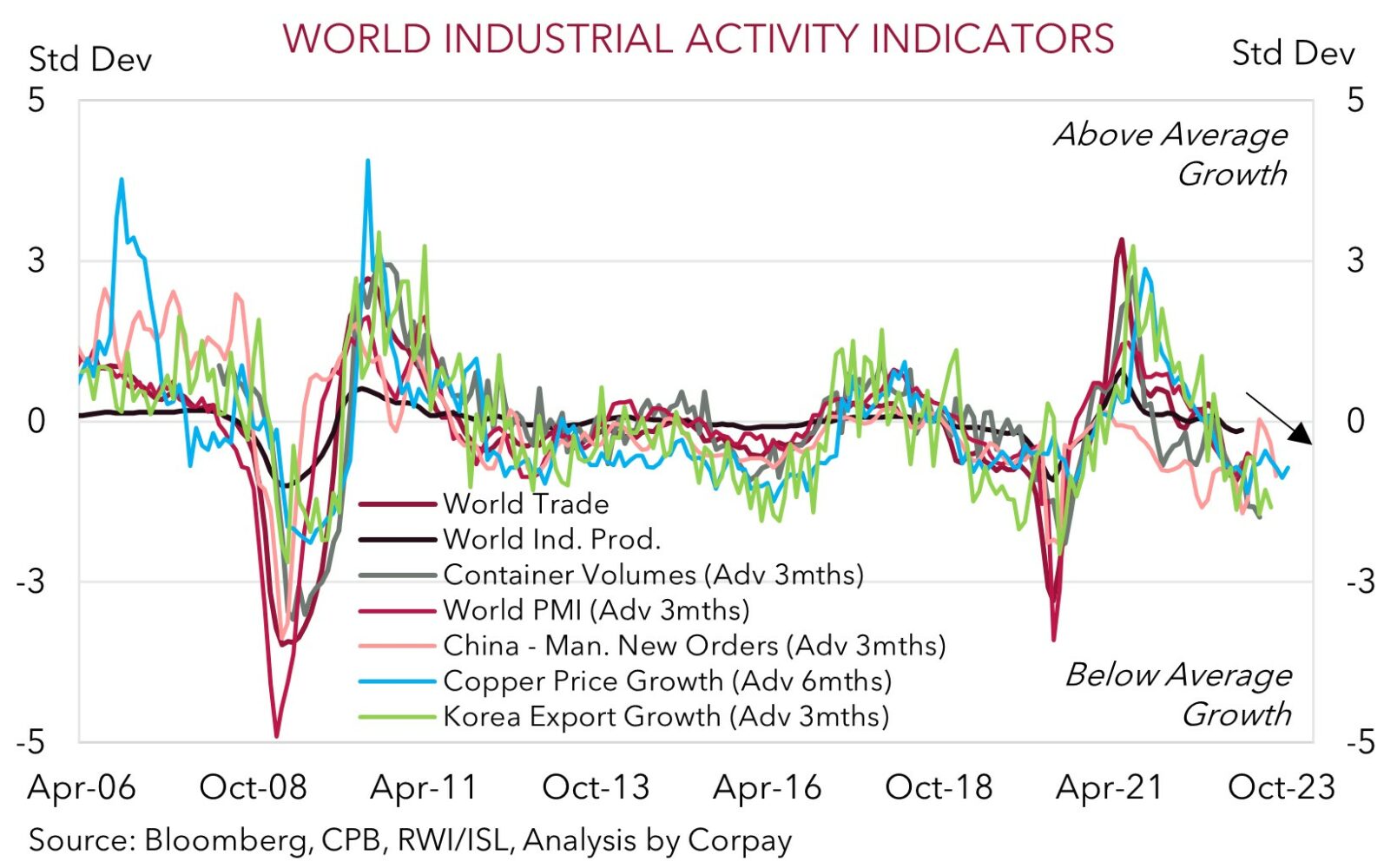

Ahead of Friday’s US labour market report, focus today will be on the China PMIs (11:30am AEST). Signs China’s post COVID lockdown rebound is faltering have been piling up. We think the China PMIs are at risk of undershooting consensus forecasts. In our opinion, further signs that China’s recovery is stumbling could bolster expectations that monetary policy could be eased in China (a negative for CNH), and is likely to keep risk sentiment and cyclical currencies like the AUD on the backfoot. As our chart shows, a range of leading indicators for global industrial activity are pointing to a step down in industrial activity over coming months.

Global event radar: China PMIs (Today), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

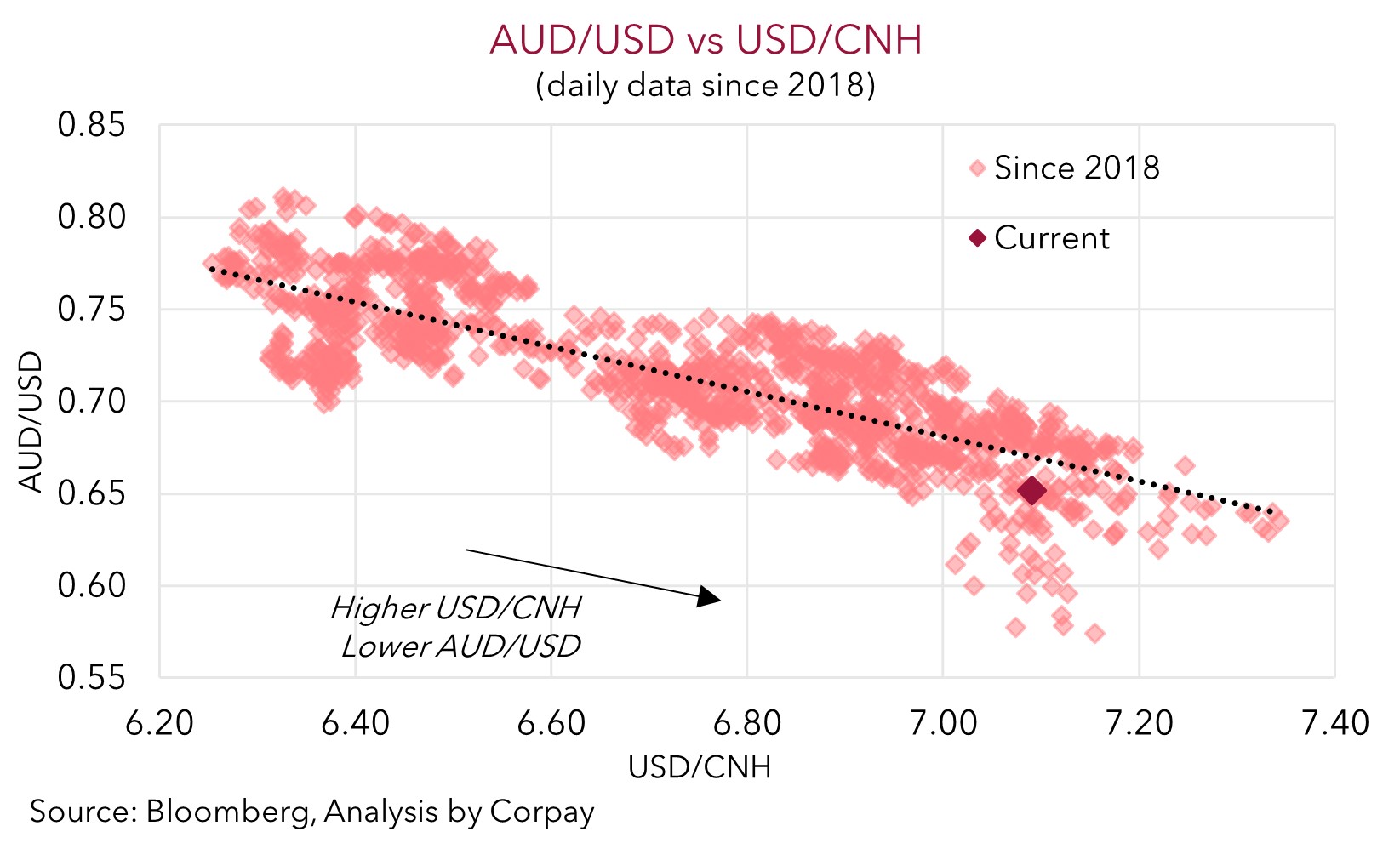

The AUD has underperformed over the past 24hrs. AUD/USD has eased back towards ~$0.6520, while the AUD also lost ground against the other major currencies as shaky risk sentiment, global growth concerns, a weaker CNH, and stronger JPY on the back of the perceived intervention threat by Japanese officials played through (see above). Trends in USD/CNH are important to watch. As our scatter chart shows, moves in USD/CNH and the AUD/USD are tightly aligned, with a higher USD/CNH generally translating to a lower AUD/USD.

There are several AUD-centric events on the schedule over the rest of this week, with a number due today. These events could generate AUD intra-day volatility. Locally, RBA Governor Lowe’s Senate testimony (from 9am AEST) and the monthly CPI indicator (11:30am AEST) are in focus. Base effects related to the timing of Easter and relatively higher petrol prices compared to a year ago suggest CPI re-accelerated a little in April. We think the ongoing inflation risks, and likely comments by Governor Lowe that the RBA is prepared to do more, if needed, to ensure inflation is on a path back to target should keep chances of another rate hike over coming months alive. While this may give the AUD some support, FX is a relative price, and global forces typically have a longer lasting impact on the currency.

Indeed, the slowing global growth pulse remains a fundamental headwind for the AUD, and today’s China PMI data (11:30am AEST) will be an important gauge for how things are tracking. As outlined above, China’s post COVID recovery has been faltering, and we see risks the PMIs undershoot consensus expectations. If realised, we believe softer China PMI data could swamp any AUD support generated by local economic events. This feeds into our bigger picture thinking that while Australia’s positive capital flow dynamics (the current account surplus is ~1% of GDP) should act to limit further downside from here, the global downturn, weaker commodity demand, and higher relative interest rates offshore are likely to cap AUD upside.

AUD event radar: RBA Gov. Lowe Speaks (Today), AU CPI (Today), China PMIs (Today), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6595, 0.6671

SGD corner

USD/SGD has eased back a touch, but at ~$1.3510 it remains within ~0.6% of its 2023 year-to-date highs. As outlined above, risk sentiment was somewhat negative overnight as concerns about global growth and lingering uncertainty regarding the US debt ceiling weighed on investors’ minds. While we expect the in-principle agreement to raise the US debt ceiling to be voted through both chambers of Congress over coming days, the bigger picture concerns about the global economy look set to remain in place for some time. Indeed, we think the sharp rise in interest rates and tighter credit conditions around the world should continue to gain traction and act to meaningfully constrain activity over the period ahead. Today, market attention will be on the China PMIs. In our judgement, the China PMIs are at risk of underwhelming, which if realised, could be a negative for risk sentiment and cyclical Asian currencies like the SGD which are tethered to the global cycle.

SGD event radar: China PMIs (Today), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3347, 1.3377 / 1.3590, 1.3617