• Growth worries. Weaker than expected China PMIs added to global growth concerns. This has dampened risk sentiment. AUD touched a new ~6-month low.

• AU CPI. Inflation indicator re-accelerated more than expected. Data bolsters the case for another RBA hike. Tomorrow’s minimum/award wage decision is important.

• USD firm. The USD remains near its recent highs. US ISM manufacturing survey released tonight, with non-farm payrolls due on Friday.

Another negative night for risk sentiment with more signs the world economic downturn is gathering pace coming through. Across equities, the EuroStoxx50 fell 1.7% and the US S&P500 was down 0.6%. This followed falls across Asia yesterday. Bonds moved in a risk-off manner. US yields dipped another 4-7bps across the curve (the US 2-year yield is down to 4.4%, a one week low), while European yields lost a bit more ground (German and UK yields declined 6-12bps across their respective curves). Elsewhere, oil prices remained under pressure with WTI crude down another ~2%. At ~US$68/brl WTI is back near its 2023 lows. Copper also extended its weak run. The ~6.5% plunge in May compounded Copper’s ~5.2% drop in April. In FX, the USD endured some intra-day month-end related volatility, but on net, it remains near recent highs. EUR is sub-1.07, USD/JPY has drifted below 139.50, while the global backdrop pushed the AUD and NZD to fresh ~6-month lows.

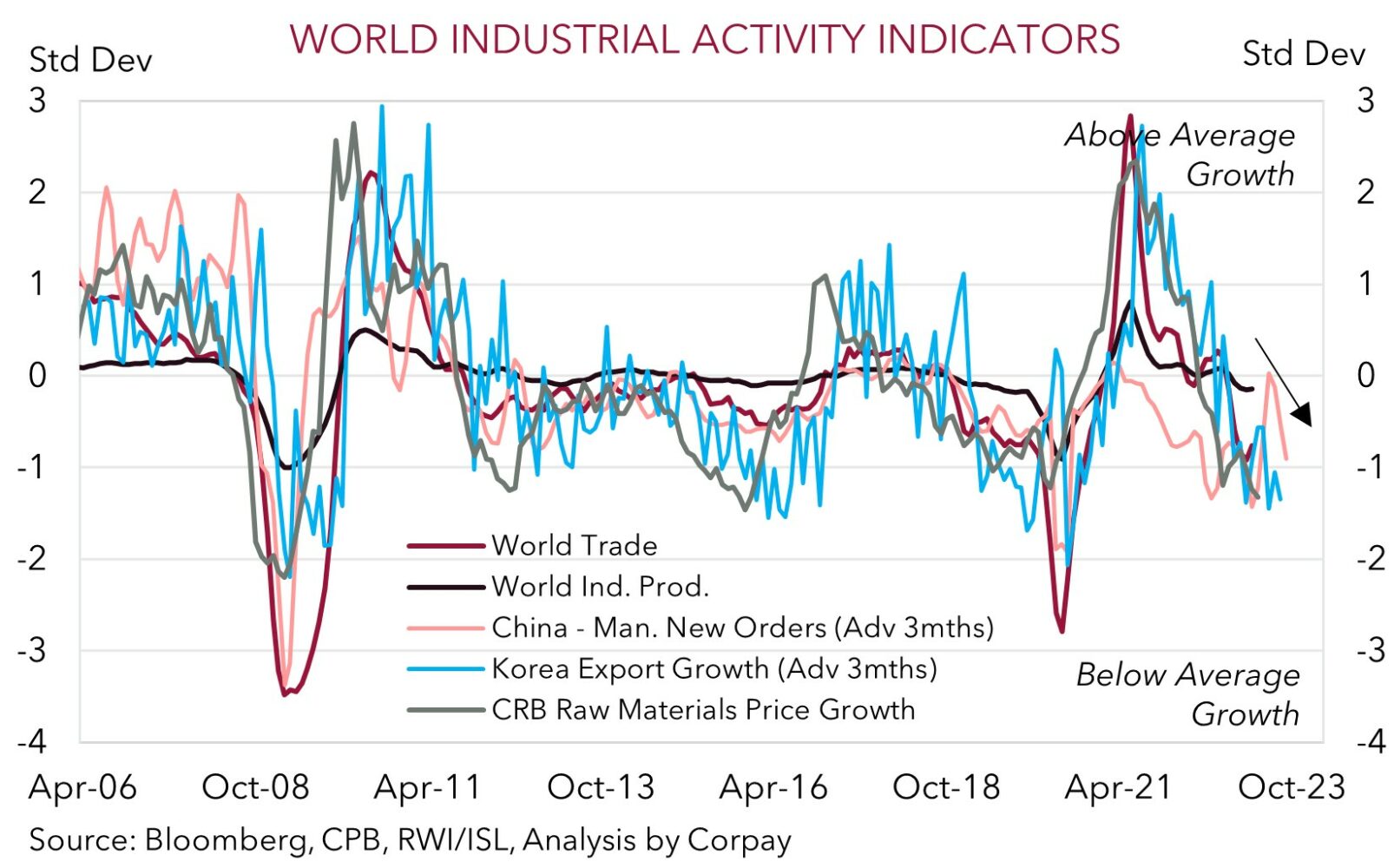

Data wise, the China PMIs kicked things off. As we flagged, the China PMIs underwhelmed expectations. The services PMI slipped to 54.5, while the manufacturing gauge fell to 48.8, a low since December. The sluggish PMIs are another sign that China’s post COVID recovery is faltering. Importantly, the weakness across the forward-looking components in the manufacturing PMI, like output, new orders, and new export orders, are signaling a further loss of momentum. As our chart shows, global industrial activity is losing steam, and this is a negative for commodity demand and cyclical currencies like the AUD.

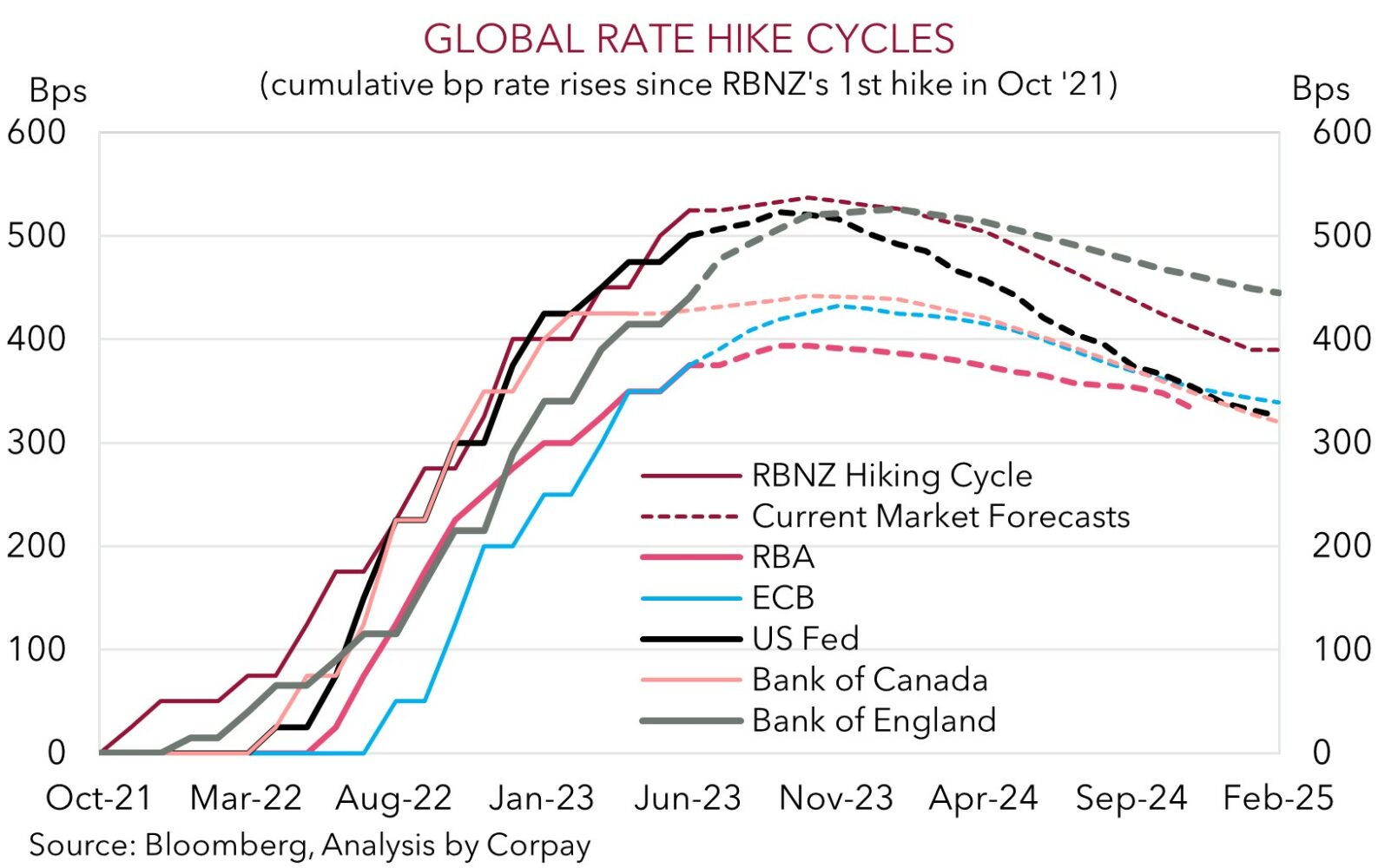

In Europe, German CPI came in below expectations, with inflation slowing to 6.3%pa (a low since February 2022). There was a similar undershoot in France. This suggests the Eurozone data (released 7pm AEST) could come in weaker than predicted. The softer inflation pulse has seen markets pare back their ECB rate hike bets, with less than 2 more rises now factored in.

In the US, there was mixed news. The Chicago PMI plunged to 40.4, supporting other regional indicators pointing to a further contraction in manufacturing. The US ISM is released tonight (12am AEST). However, job openings (a measure of labour demand) defied other leading indicators and unexpectedly rose. There are now ~1.8 job openings per unemployed person in the US. For wage growth to be consistent with the Fed’s 2%pa target this ratio needs to be closer to ~1. The data supports our thinking that US monetary policy will need to stay ‘restrictive’ for some time. And while FOMC voters Jefferson and Harker backed a ‘skip’ in hiking rates again at the June meeting, it is likely to be up for discussion, and any thoughts of rate cuts remain a long way off. The US labour market data is released on Friday. We think another solid report should be USD supportive.

Global event radar: Eurozone CPI (Today), US Manufacturing ISM (Tonight), US Jobs Report (Fri), OPEC+ Meeting (4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

When it comes to the AUD global forces continue to swamp domestic economic developments. And the past 24hrs are another example of this. The AUD/USD has continued its slide, touching its lowest level (~$0.6458) since 10 November in overnight trade on the back of the global/China growth worries, negative risk sentiment, a firm USD, and weaker CNH (see above). These trends more than offset the larger than anticipated re-acceleration in Australia’s monthly CPI indicator, which spiked back up to 6.8%pa, and resultant upward adjustment in near-term RBA rate hike expectations.

In our view, the positive surprise in the monthly CPI indicator bolsters the case for further RBA policy tightening over the next few months. Next Tuesday’s meeting is “live” for another hike, in our view, though much will depend on tomorrow’s minimum and award wage decision (Friday 10am AEST). Close to ~1/4 of the workforce is covered by awards. We think an award wage lift of 4.5% or more would add to the RBA’s inflation challenge given Australia’s lackluster productivity. While expectations of another RBA rate rise can give the AUD some support, FX is a relative price, and as our chart shows, the RBA is lagging its peers. We believe relative interest rate expectations should remain an AUD headwind. As should the unfolding slowdown in global growth, weaker commodity demand, and CNH depreciation. As we have been flagging, given the tight correlation between the two pairs, moves in USD/CNH are important to watch when it comes to the AUD. China’s stumbling economic recovery is bolstering expectations that monetary policy could be eased and this is pushing up USD/CNH. A higher USD/CNH generally translates to a lower AUD/USD.

That said, while we think near-term AUD upside could be limited given the global forces, we also remain of the view, that barring an exogenous shock, the AUD is likely to find solid support down around current levels. Since 2015, the AUD has only traded at ~$0.65 of lower ~3% of the time, with Australia’s positive capital flow dynamics a strong support that hasn’t been there historically. Australia’s current account surplus is now ~1.2% of GDP, this compares to a long run average ~3% of GDP deficit.

AUD event radar: Eurozone CPI (Today), US Manufacturing ISM (Tonight), US Jobs Report (Fri), OPEC+ Meeting (4th June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6595, 0.6667

SGD corner

USD/SGD has consolidated up around ~$1.3520, this is within ~0.6% of its 2023 year-to-date highs. As outlined above, concerns about the global growth have continued to build over the past 24hrs, particularly following the weaker China PMIs. The step down in global industrial activity is gathering pace, and we think there is more to come with the sharp rise in interest rates and tighter credit conditions around the world set to meaningfully constrain activity over the period ahead. We believe the slowdown in global growth, and recession risks, should be a negative for cyclical Asian currencies like the SGD over coming months. More near-term, market focus will now be on Friday’s US labour market report. In our view, the US labour market data is likely to show that conditions remain tight, and as such, US interest rates will need to stay at elevated levels for some time in order to help bring down wage growth and core inflation. If realised, we expect this to be USD (and USD/SGD) supportive.

SGD event radar: Eurozone CPI (Today), US Manufacturing ISM (Tonight), US Jobs Report (Fri), OPEC+ Meeting (4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3351, 1.3377 / 1.3590, 1.3615