• Optimistic markets. Sentiment improves, as a ‘skip’ by the Fed at the June meeting is factored in. Equities higher, bond yields & USD a bit lower.

• US labour data. AUD has been boosted by the improved risk appetite. US labour market report released tonight. This could see the USD bounce back.

• Wage decision. Ahead of the US data, the minimum/award wage decision is handed down this morning. This could influence RBA expectations & the AUD.

The new month has started on positive footing with risk sentiment improving. But, from our perspective, the underlying data pulse and rationale given for some of the moves suggests markets may have once again become shortsighted. Equities rose with the EuroStoxx50 and US S&P500 recording ~1% gains, oil prices rebounded (WTI crude lifted ~3%), and bond yields gave back some more ground. US bond yields fell ~5-7bps across the curve, with the 2-year yield back down at 4.34% (a ~1-week low). In FX, the dip in US yields exerted some pressure on the USD. The interest-rate sensitive USD/JPY has continued to fall back, and at ~138.80 it is now ~1.5% below recent highs. EUR has risen to ~1.0760, NZD is ~0.9% higher compared to this time yesterday, and the AUD (now ~$0.6573) has appreciated by ~1.1%.

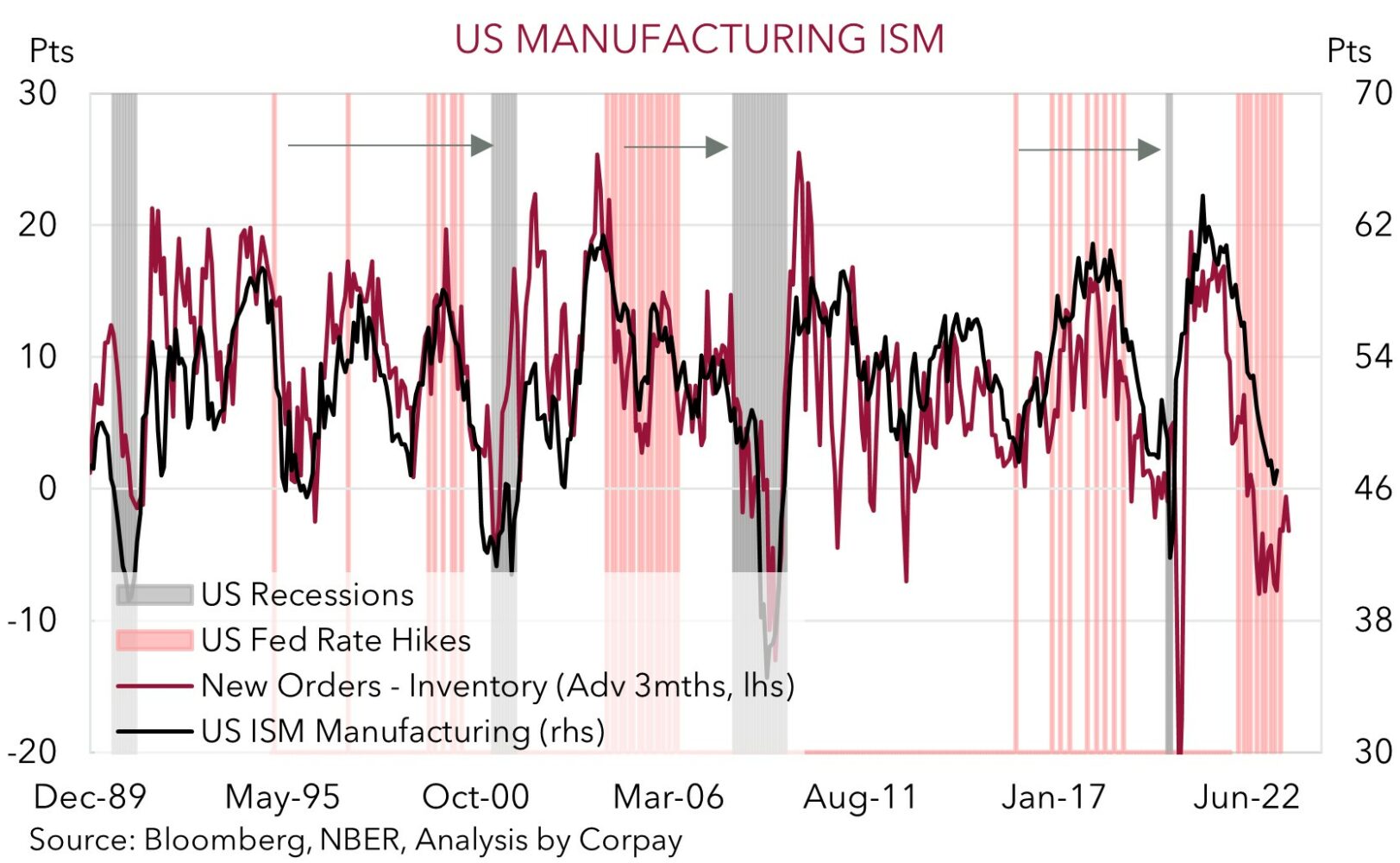

In terms of the news, as expected, the US debt ceiling bill cleared the House of Representatives and it now passes over to the Senate to vote on. Assuming it clears this hurdle, the debt ceiling will be suspended until early-2025. Data-wise various gauges show that the US labour market remains tight. Initial jobless claims, a real-time read of how many people are filing for unemployment benefits, remain low, while ADP employment exceeded expectations (+278,000 in May). At the same time, manufacturing remains in the doldrums. The US ISM slipped to 46.9, the 7th straight month in ‘contractionary’ territory. As our chart shows, the decline in the new orders to inventories gap points to further weakness in the ISM over coming months. Such low levels in the ISM have historically preceded a US recession.

Markets seem to have been buoyed by a downward revision to US unit labour costs and comments from US FOMC voter Harker who repeated recent thoughts that the Fed could “skip” hiking rates again at the upcoming June meeting to give it more time to assess the state of play. However, a ‘skip’ doesn’t equal a pivot, and a ‘pause’ doesn’t mean rate cuts should be anticipated any time soon. US inflation remains uncomfortably high and central banks appear prepared to keep settings ‘restrictive’ to make sure the job gets done. Overnight Eurozone developments highlight this point. While Eurozone inflation slowed more than predicted, at 6.1%pa it is still well above target and according to President Lagarde the ECB still has “ground to cover” with the central bank not wanting to lower its guard too soon.

Market focus will be on the US labour market data (10:30pm AEST). Leading indicators point to another solid report with US unemployment expected to remain near a ~55-year low, and wage growth still above rates consistent with the Fed’s 2%pa inflation target. Positive US labour market data should reinforce the need to keep rates “higher for longer”, and in our opinion, this can help the USD bounce back.

Global event radar: US Jobs Report (Tonight), OPEC+ Meeting (4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

After an extended negative run, the AUD has enjoyed a positive 24hrs on the back of the improvement in risk appetite (see above). At ~$0.6573, the AUD is near a ~1-week high, having risen by ~1.1% against the softer USD. The AUD has also outperformed, to differing degrees, on the crosses.

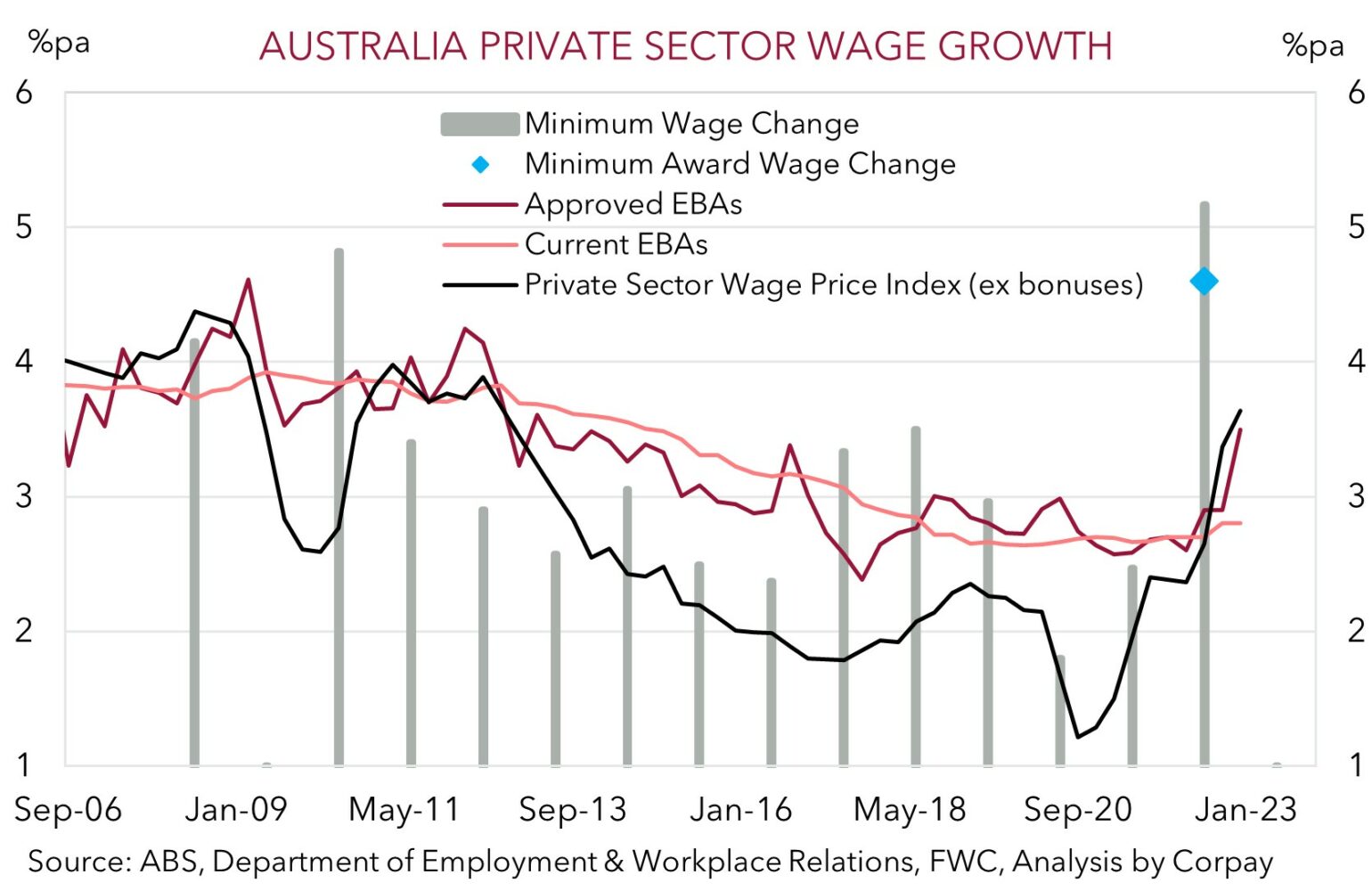

Ahead of tonight’s US labour market report (10:30pm AEST), local focus will be on the minimum and award wage decision (10am AEST). The outcome is likely to influence near-term RBA expectations and generate AUD volatility. While only ~200,000 people are directly impacted by the minimum wage outcome, close to ~1/4 of the workforce is covered by awards. As our chart shows, last year the minimum wage was lifted 5.2% and awards rose by 4.6%. We think an award wage lift of 4.5% or more would add to the RBA’s inflation challenge given the positive impulse on overall wages and Australia’s lackluster productivity. This type of outcome could see pricing for another RBA rate hike as soon as next week lift, which in turn could give the AUD a further intra-day boost.

That said, FX is a relative price, and global forces have proven to be far more influential on the AUD’s performance. Hence, a strong US labour market report, which is where we think the risks reside, could sap the markets new found optimism and see the USD rebound as a ‘higher for longer’ US interest rate view is factored in and concerns about global growth re-emerge due to the ‘restrictive’ policy settings.

Bigger picture, while we think the AUD’s revival could be limited given the global dynamics at play, we also remain of the view, that barring an exogenous shock, the AUD is likely to find solid support down around current levels. As we have pointed out before, since 2015, the AUD has only traded at ~$0.65 of lower ~3% of the time, with Australia’s positive capital flow dynamics a strong support that hasn’t been there historically. Australia’s current account surplus is now ~1.2% of GDP, this compares to a long run average ~3% of GDP deficit.

AUD event radar: US Jobs Report (Tonight), OPEC+ Meeting (4th June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6595, 0.6665

SGD corner

USD/SGD has dipped back down to ~$1.3475, a ~1-week low, on the back of the improved risk sentiment and softer USD (see above). As outlined, optimistic markets appear to have latched onto repeated comments by a FOMC official that the Fed could ‘skip’ raising rates again in June, and the successful passage of the debt ceiling bill through the US House of Representatives. However, from our perspective, this could be missing the bigger picture that inflation remains too high, policy needs to remain ‘restrictive’ for some time even in the face of an unfolding recession, and that a ‘pause’ doesn’t equate to a ‘pivot’. Tonight attention will be on the latest US labour market report. In our view, the US labour market data is likely to show that conditions remain tight, and as such, US interest rates will need to stay at elevated levels for some time to help bring down wage growth and core inflation. If realised, we expect this to be USD (and USD/SGD) supportive.

SGD event radar: US Jobs Report (Tonight), OPEC+ Meeting (4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3355, 1.3377 / 1.3590, 1.3613