• US labour market. Another punchy US payrolls report. US yields rose, as did the USD. Broader risk sentiment remains positive.

• Limited offshore data. Global event calendar is limited this week. Over the weekend Saudi Arabia announced a cut to its oil production.

• RBA in focus. Will the RBA deliver another hike this week? Markets factoring in a ~40% chance. Given pricing, there could be an asymmetric AUD reaction.

Risk sentiment remained positive at the end of last week. Equities added to recent gains with the US S&P500 rising by another ~1.5%. The S&P500 is now at its highest level since last August. Across bonds curves ‘flattened’ as long-end yields rose less than shorter-dated maturities. In the US, the 10-year yield increased ~10bps to 3.69%, while the policy expectations driven 2-year yield jumped up another ~15bps. At ~4.50% the US 2-year yield is near the upper end of the range it has occupied since mid-March. Another punchy US non-farm payrolls report (see below) has shifted US Fed rate expectations. Odds of another hike by the July meeting have ticked up, while pricing for rate cuts further out have been pared back once again. Only ~1 rate cut is now factored in by the Fed’s January meeting.

Across commodities oil prices rose, with WTI crude (now ~US$71.74/brl) up another ~2.3% on Friday. Weekend news that Saudi Arabia will make an extra 1mn barrel-a-day oil supply cut in July, which would take its production to its lowest level in several years, could give the oil price some added support. However, in our view, a stronger oil price at this point in the economic cycle is an unwanted headwind as it could add to ongoing inflation pressures and dampen already slowing growth momentum. In FX, the lift in US yields helped the USD claw back some ground. EUR has slipped back to ~1.0710, GBP has eased to ~1.2450, the interest rate sensitive USD/JPY has rebounded towards ~140, while the AUD (now ~$0.6605) has drifted a little lower from Friday’s highs. Though the upbeat risk appetite and adjustment in RBA rate expectations following the larger than anticipated lift in the minimum/award wage has helped the AUD outperform on the crosses.

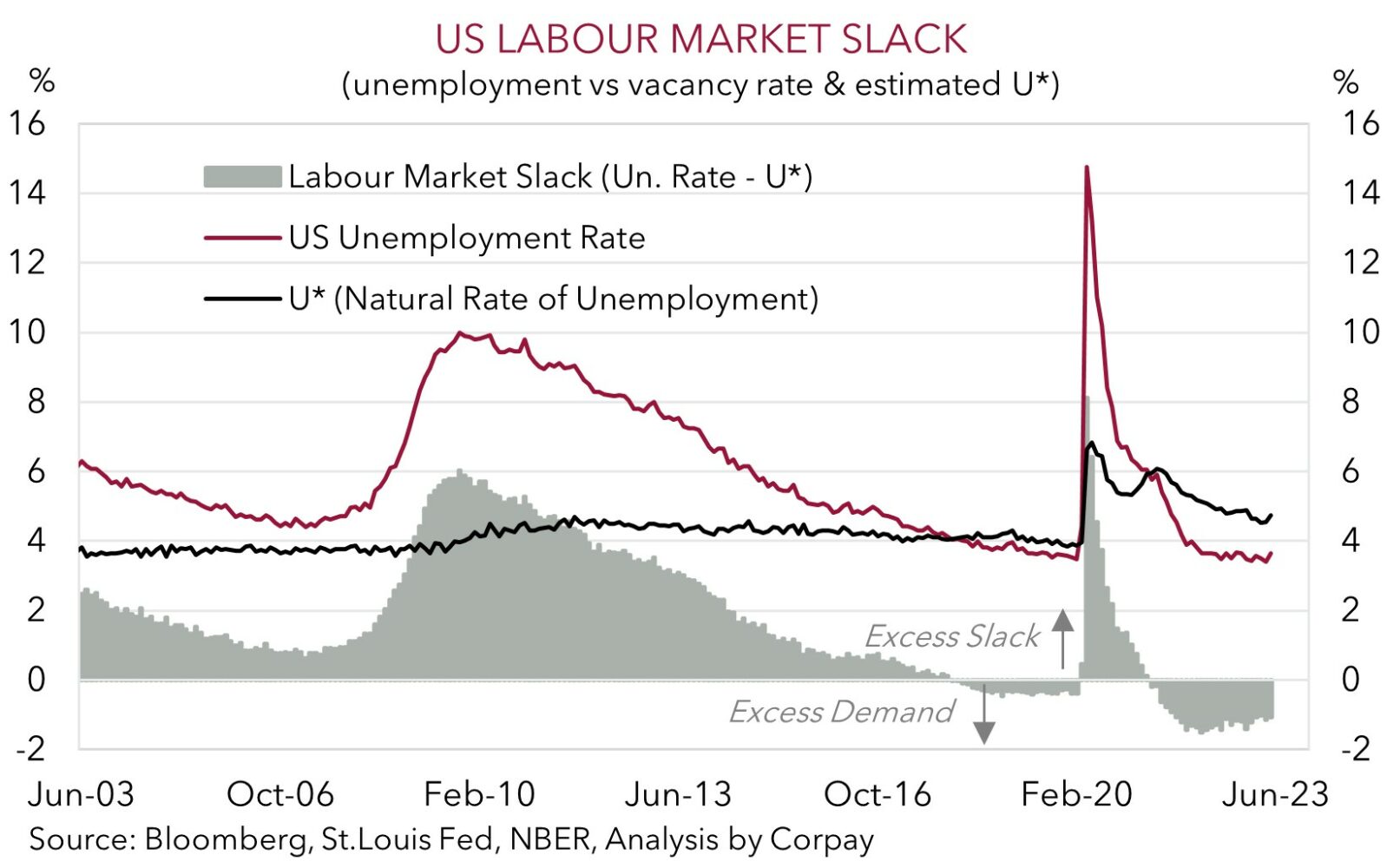

The latest report showed that the US labour market remains on solid footing. Non-farm payrolls increased by an outsized 339,000, with the past few months also revised higher. US unemployment rate edged up from its ~55-year low, but as our chart shows, at 3.7% conditions remains in a state of ‘excess demand’. This is underpinning wages and in turn core/services inflation, and supports our thinking that the US Fed may keep the door open to raising rates further and/or push back on thoughts rate cuts could come any time soon. The volatile average hourly earnings measure of wages softened slightly, however at 4.3%pa it remains well above levels consistent with the Fed’s 2%pa inflation target.

Offshore, it is a quiet data/event week. We think the US services ISM (Tues), China trade data (Weds), and US jobless claims (Thurs) could show that the services sector and labour market are still on positive footing, while the slowdown in global industrial activity could see China’s trade underwhelm. In our opinion, this mix should keep the USD firm leading into next week’s events which include US CPI, the Fed meeting, ECB decision, China activity data, and US retail sales.

Global event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

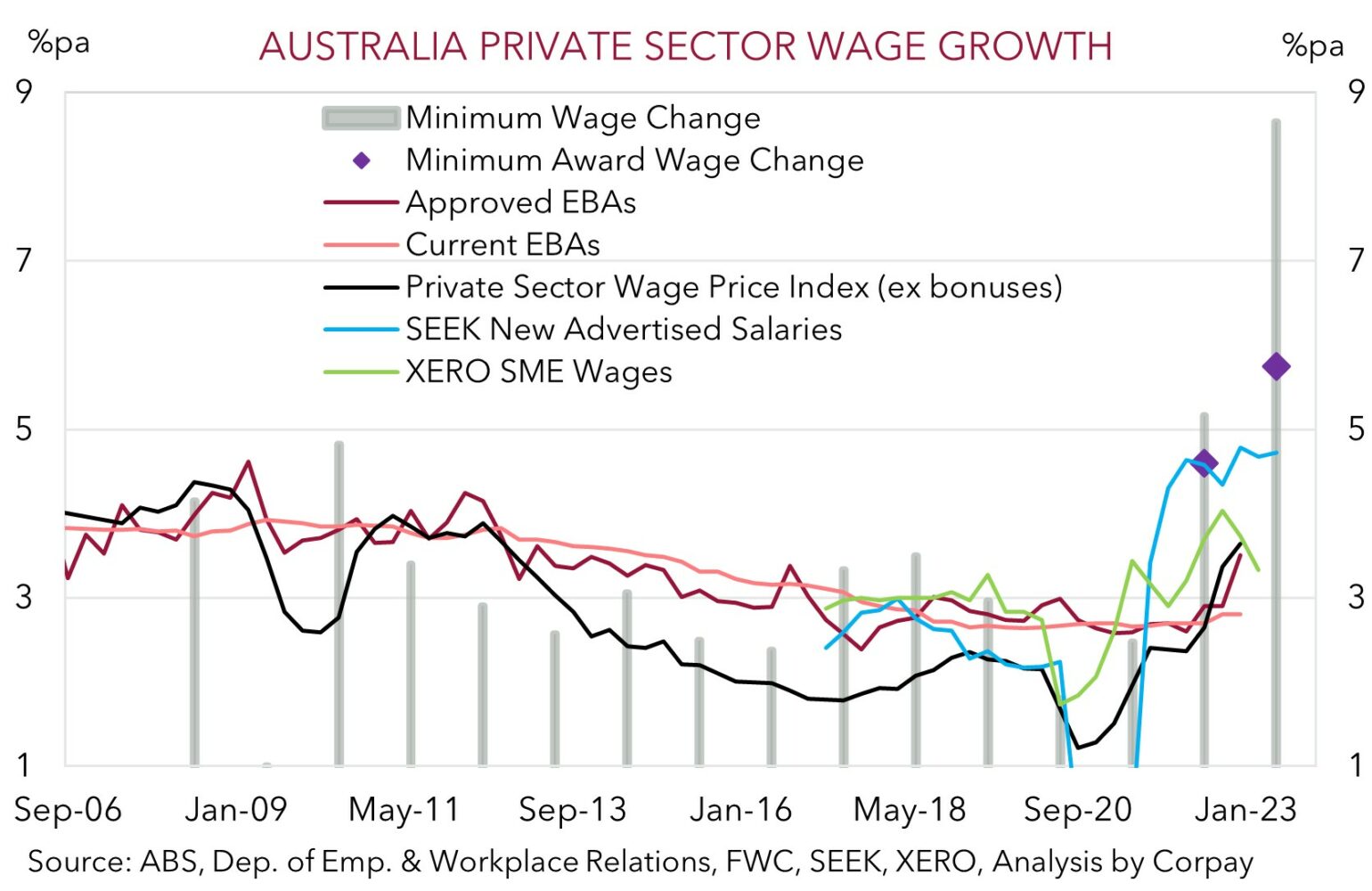

While the AUD drifted back a little following the strong US labour market report and resultant jump in US bond yields, at ~$0.6605 the AUD enjoyed a positive week. The upbeat risk sentiment, and upward adjustment in RBA rate expectations following the larger than expected 5.75% lift to the award wage (which covers ~1/4 of the workforce) has helped the AUD outperform on the crosses. AUD/EUR is back near the top-end of its 2-month range, AUD/JPY has risen above ~92, AUD/GBP is around a 2-week high, and AUD/NZD is north of its 200-day moving average (~1.0891) for the first time since late-February.

There are a few local and global releases that could generate AUD volatility this week, including the RBA announcement (Tues), a speech by Governor Lowe (Weds), and Q1 GDP (Weds). Offshore, the US services ISM (Tues) and China trade data (Weds) are due. As discussed above, we think the US services ISM is likely to remain in ‘expansionary’ territory, which should reinforce the upswing in US yields, while risks are tilted to the China trade data undershooting forecasts given the unfolding global slowdown. While we believe this mix should create some renewed AUD headwinds, in a break from the usual trend domestic events could be a more of a driver and risk overpowering global forces, at least in the near-term, and particularly on the crosses.

The RBA meeting is this week’s focal point. In our view, the large lift in the minimum/award wage is another positive impulse for inflation, particularly due to Australia’s lacklustre productivity growth. When coupled with the already elevated services inflation we expect the RBA to raise the cash rate by another ~50bps, to 4.35%, over coming months (see Market Musings: The RBA has more work to do). While we think the RBA could be slightly more inclined to wait another month to assess the detailed GDP report (released Weds), see a bit more information on the labour market, and avoid the ‘bad optics’ of raising rates right after the wage announcement, it should be a line-ball call. It remains a matter of when, not if the RBA moves again, in our opinion. Tuesday’s RBA meeting is ‘live’ for a change. And given markets are only factoring in a ~40% chance of a 25bp hike this week, there could be an asymmetric AUD reaction to a RBA move (i.e. a relatively larger AUD spike up to the 200-day moving average (~$0.6693) if the RBA delivers another rate rise compared to an on hold outcome as markets adjust their ‘peak’ interest rate assumptions).

AUD event radar: RBA Meeting (Tues), AU GDP (Weds), RBA Gov. Lowe Speaks (Weds), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6485, 0.6550 / 0.6664, 0.6695

SGD corner

USD/SGD has risen back above ~$1.35, with the strong US labour market report boosting US bond yields and the USD (see above). There is limited major global data released this week, with several key events such as the US CPI, China activity data batch, US Fed meeting, ECB decision, and US retail sales on the schedule for next week.

Ahead of these major releases, the US services ISM (Tues), China trade data (Weds), and US initial jobless claims (Thurs) are due. In our judgement, further signs that the US services sector, the engine room of the US economy, and the labour market remain on sturdy ground is likely to keep pricing of more near-term policy tightening by the US Fed in place, and/or water down expectations looking for rate cuts to come through over H2 2023. We think higher US yields should be USD (and USD/SGD) supportive. Added to that, indications that China’s trade sector has continued to lose steam is likely to reinforce concerns about global industrial activity, and this could act as a headwind for cyclical currencies like the SGD.

SGD event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3359, 1.3377 / 1.3590, 1.3611