• Softer US data. The dip in the services ISM exerted some downward pressure on US bond yields & the USD late in US trading.

• RBA in focus. Will they or won’t they hike today? We think it is a line ball call. Most analysts & the rates market are leaning towards no change.

• AUD reaction. Given expectations, AUD reaction could be uneven, with a hike likely to generate a relatively larger lift compared to the pull-back on an on hold decision.

US markets consolidated overnight, with equities easing slightly (S&P500 -0.2%) and bond yields a bit lower. After rising early on, the US 2-year yield ended the session ~10bps below its intra-day peak to now be near ~4.46%. There were similar moves in the US 10-year yield (now 3.68%), while in FX, the USD lost some ground as US interest rate expectations shifted. EUR ticked up slightly to be back around ~1.0715, the interest rate sensitive USD/JPY has dipped under ~140, while the AUD (now ~$0.6620) and NZD (now ~$0.6070) have posted some modest gains.

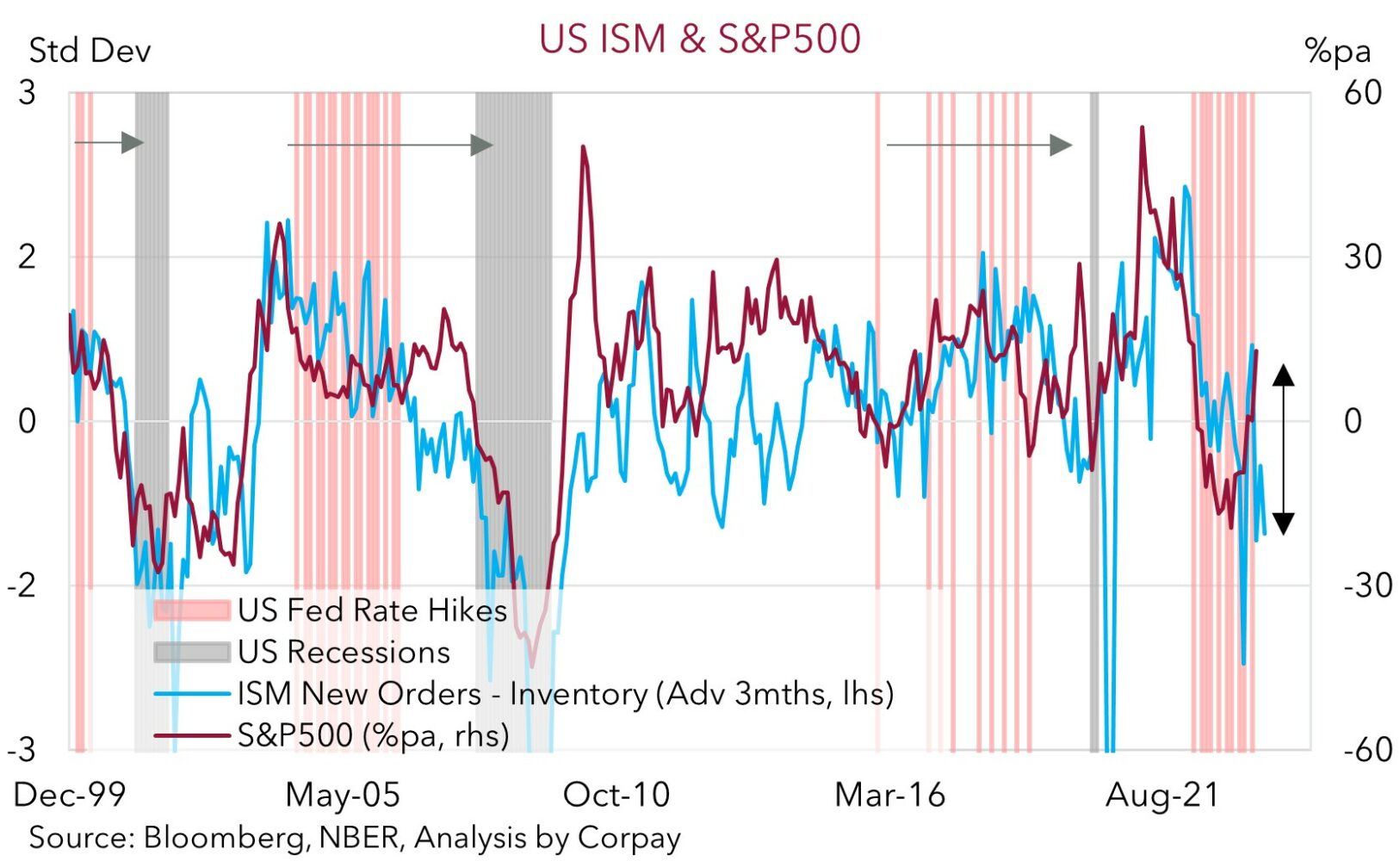

A macro catalyst for the overnight intra-day swings was the weaker than expected US services ISM data. The US economy is services driven (services contribute ~80% of US GDP). While the services ISM remains in ‘expansionary’ territory, at 50.3 the index is around the bottom of its post initial COVID wave range. The falls indicate that tighter credit conditions and increased uncertainty about the outlook may be starting to bite. Notably, a suite of forward-looking and activity gauges such as new orders, inventories, and employment intentions also weakened, while the prices index fell to a three-year low. As our chart shows, the gap between new orders and inventories is quite negative and at levels usually associated with a US recession. Yet the performance of risk assets, such as equities, has diverged and in our mind doesn’t appear to reflect the unfolding economic backdrop. We think some markets could be becoming complacent, which suggests volatility could lift over coming months as the harsher economic climate is factored in. This is normally a challenging environment for cyclical currencies such as the AUD and NZD.

The softer services ISM data has seen markets water down US Fed interest rate expectations, with odds of another near-term rate hike falling and probabilities of rate cuts over late 2023 rising slightly. The US Fed meets next week, and while we don’t think another rate hike is likely, the still strong inflation pulse and tight labour market conditions could see the Fed keep its options open. At the same time, we think that the Fed may stress that thoughts of rate cuts occurring so quickly are misplaced. In our opinion, this can help the USD remain at elevated levels.

Global event radar: RBA Meeting (Today), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

The AUD has held its ground over the past 24hrs and is hovering near ~$0.6620 following the softening in the USD post the weaker than expected US Services ISM figures (see above). On the crosses, AUD/EUR continues to track near the top of its ~2-month range, AUD/JPY remains near its 2023 highs, AUD/GBP is just under its 50-day moving average (~0.5347), and AUD/NZD continues to move in line with the narrowing in the AU-NZ two-year swap spread differential to be above ~1.09.

All eyes will be on today’s RBA announcement (2:30pm AEST). As mentioned previously, we think the sizeable lift in the minimum/award wage is a positive impulse for inflation given Australia’s lacklustre productivity growth, and when combined with already elevated services inflation we expect the RBA to raise the cash rate by another ~50bps, to 4.35%, over coming months (see Market Musings: The RBA has more work to do). As our chart shows, additional rate hikes from here would push settings deeper into “restrictive” territory, so the economic impacts should be quite impactful. It is a hard pill to swallow, but to break the back of services driven inflation an extended period of weak growth and higher unemployment is the price that needs to be paid.

In our view, it is a matter of when, not if the RBA moves again. Today’s meeting is ‘live’ for a change, though in what should be a line-ball call we think the RBA could be marginally more inclined to wait to assess the GDP report (released Weds), see a bit more information on the labour market, household spending, and the fixed rate mortgage refinancing cliff, and avoid the ‘bad optics’ of raising rates right after the wage announcement. Indeed, most analysts are also looking for the RBA to hold fire (only 10 of the 30 surveyed by Bloomberg have the RBA moving today), while interest rate markets are assigning a ~35% chance. However, more than a full 25bp rate hike is priced into the rates curve by August.

Given market expectations, we think there could be an uneven AUD reaction to today’s RBA outcome (i.e. a relatively larger AUD spike, up to the 200-day moving average (~$0.6693), if the RBA delivers another rate rise as markets adjust their ‘peak’ interest rate assumptions, compared to a smaller pull-back on a no change decision given the RBA should retain a ‘hawkish’ tightening bias).

On the crosses, while we continue to think that the slowing global economy and further rate hikes by the ECB and Bank of England later this month should counteract RBA actions and see the upswing in AUD/EUR and AUD/GBP peter-out, we do expect AUD/NZD to remain in an uptrend. Interest rate differentials are becoming more supportive of a higher AUD/NZD given the RBNZ has signaled no further action and more moves by the RBA are anticipated, and we continue to believe that Australia’s economy should outperform NZ over the coming year.

AUD event radar: RBA Meeting (Today), AU GDP (Weds), RBA Gov. Lowe Speaks (Weds), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6485, 0.6550 / 0.6663, 0.6693

SGD corner

USD/SGD has dipped back under ~$1.35, with the softer US services ISM data weighing on US bond yields and the USD overnight (see above). There is limited major global data released over the rest of this week, with several key events such as the US CPI, the China activity data batch, US Fed meeting, ECB decision, and US retail sales on the schedule for next week.

Over coming days the China trade data (Weds) and US initial jobless claims (Thurs) are due. In our judgement, signs the US labour market remains on sturdy ground could see US interest rate expectations rebound, with pricing of rate cuts over late-2023 being pared back. If realised, we think this could give the USD (and USD/SGD) some support. Added to that, indications that China’s trade sector has continued to lose momentum is likely to reinforce concerns about global industrial activity, and this could act as a headwind for Asian currencies like the SGD.

SGD event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3359, 1.3377 / 1.3590, 1.3611