• Quiet night. Equities a little higher. Bond yields consolidated. The USD index edged up slightly. AUD held onto its post RBA gains.

• RBA hike. Cash rate now 4.1% with inflation concerns stepping up. We expect another hike. FX is a relative game. AUD is also influenced by global trends.

• AUD events. RBA Governor Lowe speaks today & Q1 AU GDP is released. China trade data is also due. Bank of Canada meets tonight.

An uneventful night for markets with limited news flow and no major economic releases. European and US equities ticked up. The US S&P500 rose by ~0.2%, with gains across financials and consumer discretionary stocks offsetting falls in healthcare. As a result, the S&P500 is now within 1% of its 1-year high. Bond yields consolidated, with the US yield curve flattening slightly after the 2-year nudged up to 4.48% and the 10-year yield declined by ~2bps to 3.66%. Across FX, the USD index is a little higher compared to this time yesterday, with EUR (the major USD alternative, and ~58% of the index) slipping back under ~1.07. The AUD has held onto its post RBA rate hike gains and is now tracking a bit above its 50-day moving average (~$0.6662).

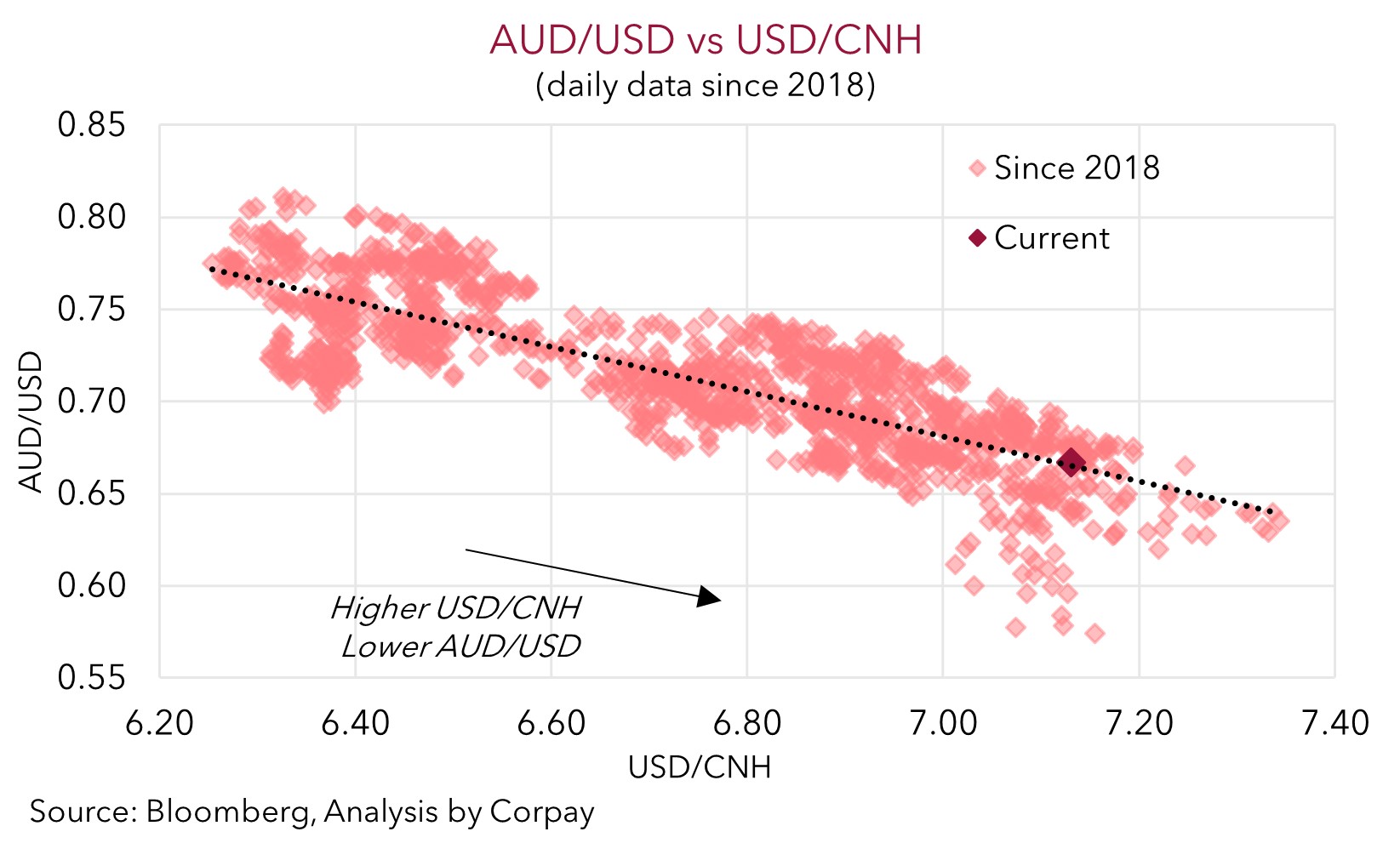

USD/CNH has also continued to lift, touching a fresh year-to-date high above 7.14 overnight before settling around 7.13. China’s faltering post COVID recovery has bolstered bets that policymakers could announce some monetary easing to support growth. Reports that authorities ‘asked’ the biggest banks to cut deposit rates has reinforced these views. China trade data is released today (no set time). Both imports and exports are expected to have contracted from a year ago. Imports are a gauge of domestic demand, so weakness on this front would add to the signs that China’s rebound is losing steam. At the same time, China’s export sector is facing a more challenging external backdrop as higher interest rates and tighter credit conditions constrain growth in other countries. Leading indicators for global industrial activity continue to weaken. Overnight, data showed that factory orders in Germany (a global manufacturing powerhouse) fell for the second straight month and are now ~10% lower compared to a year ago. As we have pointed out previously, the (inverse) correlation between USD/CNH and AUD/USD has tightened over recent years, with a higher USD/CNH a headwind for the AUD. Weak trade data could see the market add to its China policy easing bets, which we think could push USD/CNH higher near-term.

Tonight, the Bank of Canada announces its policy decision (12am AEST). No change is expected with the policy rate expected to remain at 4.5%. In the face of the large jump up in rates the indebted Canadian economy has, much like Australia, so far remained surprisingly resilient. Although the BoC has been on hold for a few months, it has kept the door open to doing more, based on how things evolve. Markets have started to factor in the chance of another BoC hike over the period ahead given the signs domestically and around the world that it could be a longer battle against inflation than previously assumed. Relatively smaller central banks can often be a ‘canary in the coalmine’. We think a more hawkish turn by the BoC may rattle some nerves, and could see markets pare back expectations looking for central banks like the US Fed to begin cutting rates later this year.

Global event radar: Bank of Canada Meeting (Tonight), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

AUD has added to its recent gains following yesterday’s rate hike by the RBA. Ahead of the meeting, markets were only factoring in a ~35% chance of a move in June, so while the direction of travel wasn’t a surprise, the timing was. AUD/USD is now a little above its 50-day moving average (~$0.6662). On the crosses, AUD/JPY has touched a new 2023 high, AUD/EUR is just below its 100-day moving average (~0.6238), AUD/GBP is at the top end of its ~6-week high, and the interest rate sensitive AUD/NZD has tracked the narrowing in the AU-NZ two-year swap spread to be at its highest level since late-February (now ~1.0975).

According to the RBA, “recent data indicate that the upside risks to the inflation outlook have increased, and the Board has responded to this”. The large lift in the minimum award wage, which covers ~1/4 of the workforce, and rising public sector pay rates are clearly on the RBA’s mind, particularly given Australia’s lacklustre productivity growth. Accelerating unit labour costs without a productivity offset raise the risk higher inflation could become entrenched. Governor Lowe speaks today (9:20am AEST) and we expect him to reiterate the RBA’s tightening bias given the inflation dynamics. We are looking for the RBA to lift the cash rate to 4.35% over the next few months to help slay the inflation dragon (see Market Wire: RBA: hiking until it hurts). Though, we would note that this is now largely discounted by rates markets.

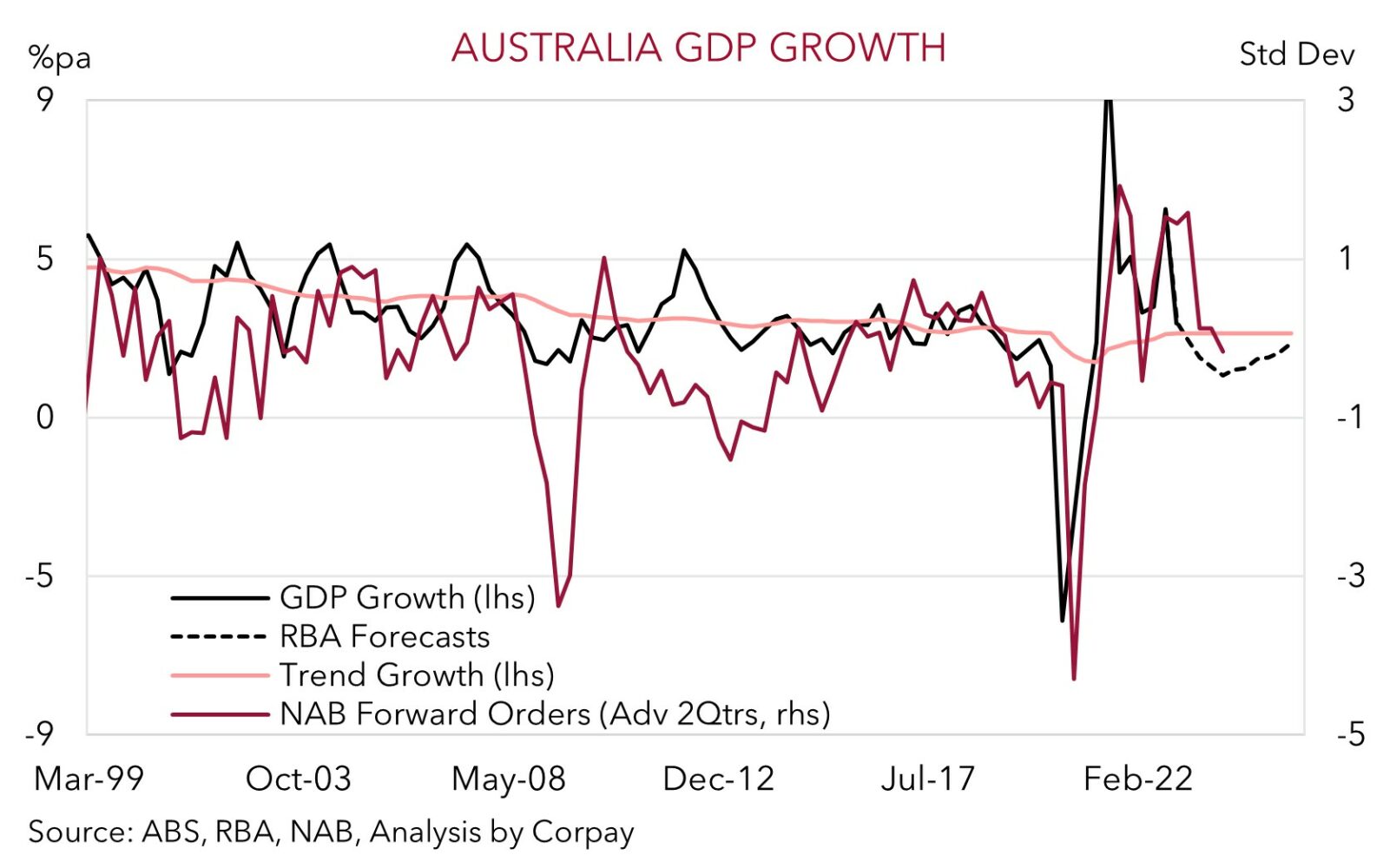

The RBA’s actions won’t be costless. The June hike takes the cumulative tightening delivered since May 2022 to 400bps, by far the most abrupt hiking cycle in several decades. Q1 Australian GDP is released today (11:30am). Partial indicators point to a sluggish quarterly outcome, which would pull-down annual growth (mkt 0.3%qoq/2.4%pa). We are forecasting growth to slow materially over the next few quarters as the substantial cashflow hit on the household sector intensifies, particularly as the large amount of fixed rate refinancing takes place. Surging population growth may help stop the economy from going backwards in aggregate (note, topline GDP is a volume measure), but on a per capita basis GDP is set to head south.

For the AUD, FX is a relative price and global factors are a major driver. In our opinion, the unfolding step down in global activity remains a headwind for the cyclical AUD. These external forces can counteract the boost stemming from the RBA actions. As can ‘hawkish’ rhetoric from the US Fed at next week’s meeting. We think the Fed could stress that any thoughts of rate cuts occurring quickly are misplaced, and if realised this could be USD supportive. On the crosses, we remain of the view that slowing global growth and further rate hikes by the ECB and Bank of England later this month may offset the RBA’s moves. We are looking for the upswing in AUD/EUR and AUD/GBP to peter-out.

AUD event radar: AU GDP (Today), RBA Gov. Lowe Speaks (Today), Bank of Canada Meeting (Tonight), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6580, 0.6620 / 0.6692, 0.6748

SGD corner

USD/SGD is treading water near ~$1.3480. As discussed above, markets have been sedate overnight. There is limited major global data released over the rest of this week, with several key events such as the US CPI, the China activity data batch, US Fed meeting, ECB decision, and US retail sales on the schedule for next week.

Today, the China trade data is released, while tomorrow US initial jobless claims are due. In our view, further indications that the US labour market remains tight could see US interest rate expectations lift, with pricing of rate cuts over late-2023 trimmed back. If realised, we believe this could give the USD (and USD/SGD) some modest support. Ahead of that, we think signs that China’s trade sector has continued to lose momentum on the back of the faltering domestic post COVID recovery and weakening global economy could add to concerns about global industrial activity. In our judgement, this could act as a drag on CNH and other Asian currencies like the SGD.

SGD event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3367, 1.3377 / 1.3590, 1.3606