• BoC hike. The ‘surprise’ move by the BoC has rattled markets. Bond yields have risen as markets adjust interest rate expectations.

• AUD softer. AUD has given back a little ground. The shift in offshore pricing counteracts the change in RBA thinking. Q1 GDP was also weak.

• Central banks. The US Fed, ECB & BoJ meet next week. Inflation is a hard nut to crack. Further upward adjustment in rates could weigh on risk sentiment.

Markets came back to life overnight. Expectations that central banks have more work to do to get on top of high services/core inflation are growing. Following the RBA rate hike a few days ago, the Bank of Canada surprised markets by lifting interest rates again. The BoC had kept rates steady over the past couple of meetings but decided to increase the policy rate by another 25bps to 4.75% given the persistence of excess demand, concerns that “inflation could get stuck materially above the 2% target”, and view that “monetary policy was not sufficiently restrictive”.

As we flagged yesterday, actions of relatively smaller central banks like the RBA and BoC can often be a ‘canary in the coal mine’. And the BoC’s surprise hike has rattled nerves and spilled over into other markets. European and US bond yields spiked up. The US 2-year yield rose ~8bps to 4.56%, while the 10-year yield increased by ~14bps (now 3.79%) as US Fed interest rate pricing adjusted. While markets are still assuming there is more chance the Fed ‘pauses’ at next week’s meeting, odds of another move by the July meeting have lifted, with pricing of rate cuts over H2 2023 watered down as a ‘higher for longer’ view is factored in.

The jump up in bond yields weighed on equities. After opening in positive territory, the S&P500 reversed course post the BoC announcement, falling by 0.4% on the day. The tech-focused NASDAQ, which has a stronger (negative) correlation to interest rates, fell by 1.3%. In FX, CAD strength following the BoC rate hike saw USD/CAD dip, however the upswing in US bond yields and USD rebound unwound a lot of the move. EUR continues to hover near ~1.07, USD/JPY has tracked the rise in US rates to be back above 140, while the risk-off tone has seen the AUD give back some ground (now ~$0.6650). As outlined before, the rise in USD/CNH, which touched a new 2023 high overnight, is also a headwind for the AUD. In contrast to policy tightening offshore, speculation of policy easing by China continues to grow, and this divergence is a negative for CNH. Data released yesterday showed China’s exports and imports are contracting, signs that global growth is weakening and that the domestic post COVID recovery is faltering.

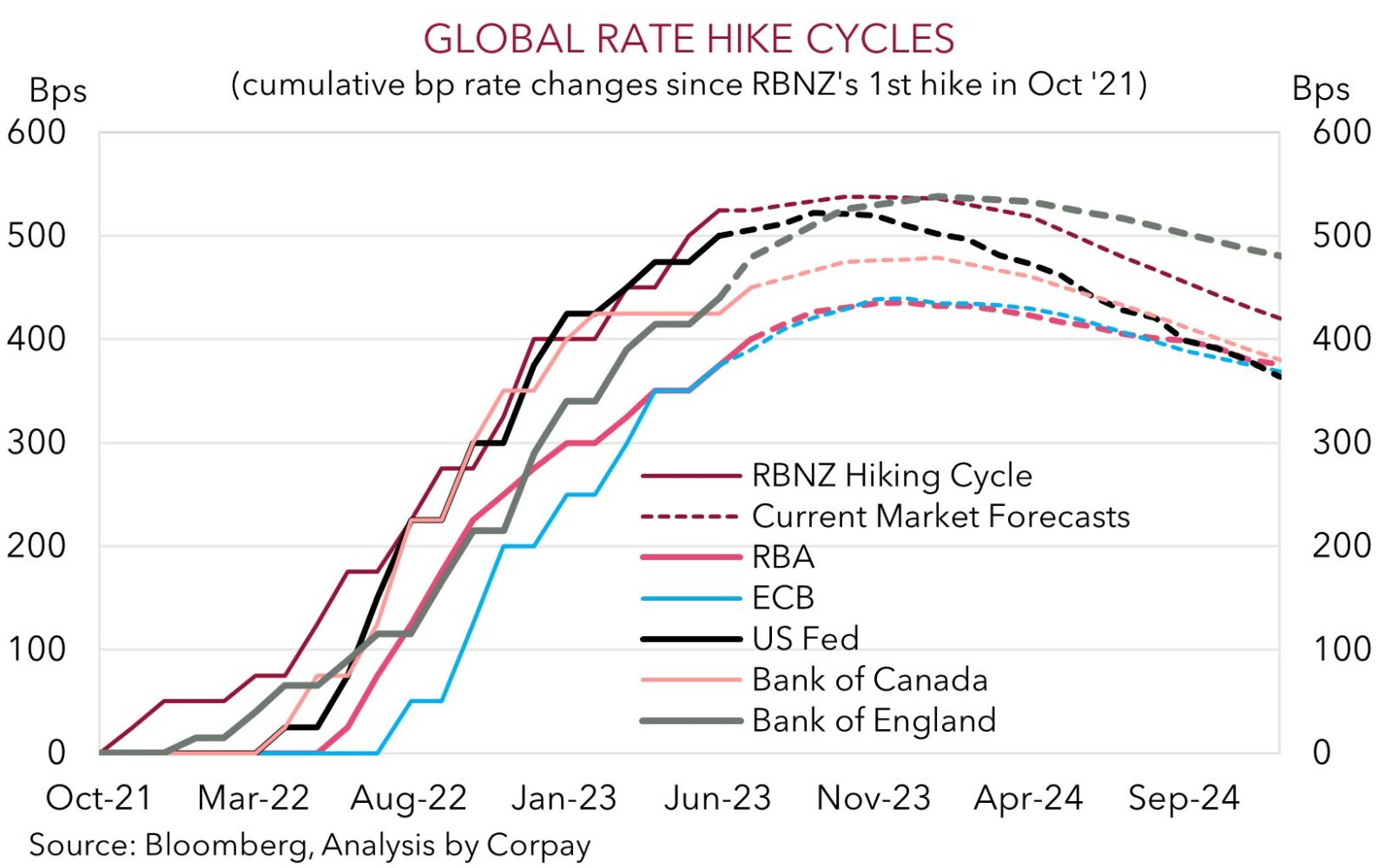

As our chart shows, outside of NZ, markets are assuming differing degrees of additional policy tightening by various central banks over the next few months. The US Fed and ECB meet next week. Markets have moved but given the still strong US inflation pulse and tight labour market, we believe chances of a ‘hawkish’ Fed outcome may still be underpriced. A further upward adjustment in US interest rates should be USD positive, in our opinion.

Global event radar: US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

AUD eased back a little overnight with the ‘surprise’ rate hike by the BoC generating a shift in global interest rate expectations, which in turn dampened risk sentiment. The AUD has slipped back under its 50-day moving average (~$0.6661), with the AUD also underperforming the EUR, GBP, and CAD. By contrast, AUD/NZD has added to its recent gains, with the narrowing in the AU-NZ two-year swap spread pushing the pair above ~1.10 for the first time since late-February.

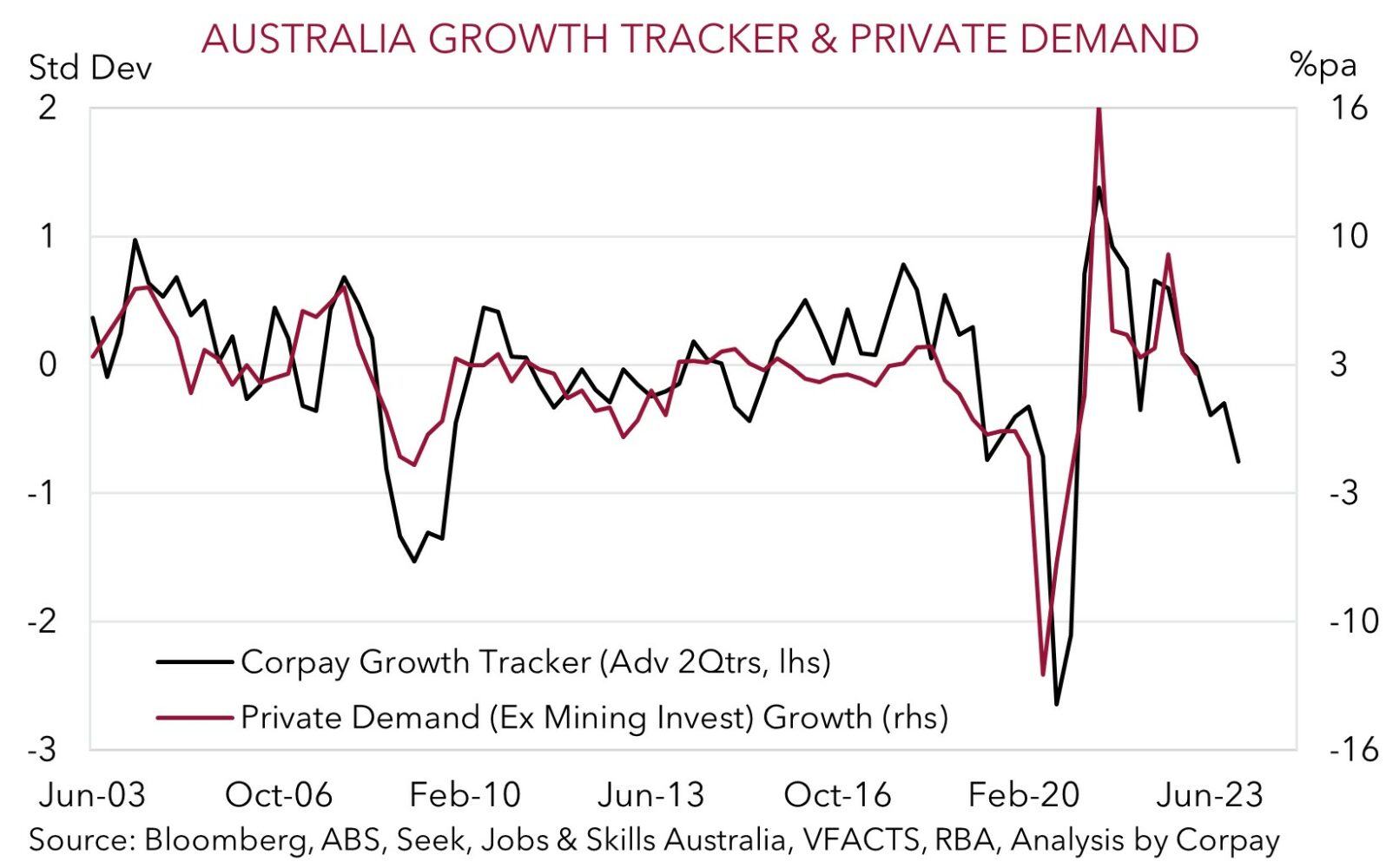

Locally, Q1 GDP confirmed that the growth slowdown is coming through. The economy expanded by a paltry 0.2%, this dragged down annual growth to a sub-trend 2.3%pa pace. Notably, when the boost from the jump in the population following the reopened international borders is stripped out, the picture is even less rosy. GDP per capita declined by 0.3% in Q1. The detail shows that a range of interest rate sensitive areas are losing steam, with households bearing the brunt as the squeeze on budgets from cost-of-living pressures and higher mortgage costs bite. In our view, the outlook for a material slowing in activity over coming quarters remains firmly intact, particularly with interest rates moving further into ‘restrictive’ territory. Our Private Demand Tracker, which incorporates a range of sentiment and high frequency data, is pointing to a meaningful step down in private sector activity over the Q2/Q3.

While growth is weakening, the GDP report also showed that price pressures are elevated, and productivity continues to fall. These are problematic trends called out by RBA Governor Lowe in yesterday’s speech. And given these issues are difficult to unwind quickly, further policy tightening will be needed to get inflation on a sustained path down to target. We expect the RBA to raise rates further over the next few months (see Market Wire: RBA: hiking until it hurts).

However, FX is a relative price, and the global environment is a major AUD driver. We continue to think that near-term upside in AUD/USD is limited. In our opinion, the slowdown in global activity and weaker CNH remain AUD headwinds. And while RBA rate hike pricing has risen, as outlined above, offshore interest rate expectations have also increased. This is offsetting the change in RBA thinking. The US Fed meets next week, and despite the adjustment in pricing, we believe odds of a ‘hawkish’ outcome still look underpriced. A further lift in US interest rates could be USD positive. On the crosses, we remain of the view that slowing global growth and further hikes by the ECB and Bank of England are likely to see AUD/EUR and AUD/GBP give back ground.

AUD event radar: US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6580, 0.6620 / 0.6692, 0.6745

SGD corner

USD/SGD is hovering near ~$1.3485. The swings in offshore markets, particularly bonds, only generated a modest amount of intra-day volatility in USD/SGD (see above). There is limited major global data released over the rest of this week, with several key events such as the US CPI, the China activity data batch, US Fed announcement, ECB decision, and US retail sales on the schedule for next week. The US Fed and ECB meetings will be particularly important for markets.

From our perspective, the moves by the relatively smaller central banks (the RBA and BoC) to hike interest rates further over the past few days, shows that the battle against inflation is far from over. While global growth momentum is weakening, as illustrated once again by yesterday’s China trade data, concerns that inflation could be far ‘stickier’ than previously assumed are growing. And this remains the major focus for central banks. An extended period of slower growth/higher unemployment is the price that needs to be paid to get core inflation back down to target, and this requires very ‘restrictive’ policy settings. US initial jobless claims are released tonight. In our view, indications that the US labour market remains tight could see US interest rate expectations lift further, which in turn could be USD (and USD/SGD) supportive.

SGD event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3371, 1.3377 / 1.3590, 1.3603