• US labour data. Weekly jobless claims rose more than expected. This has weighed on US bond yields and the USD. AUD is back above ~$0.67.

• Fed expectations. We think the reaction to the data looks overdone. Jobless claims are volatile, and the backdrop remains a long way from where it needs to be.

• Upcoming events. China CPI released today. Next week US CPI, the FOMC meeting, ECB & BoJ decisions, China data batch, & AU jobs report are due.

Markets remain fickle with yesterday’s moves partially unwinding overnight. US equities rose (S&P500 +0.6%), while bond yields declined (US 2yr and 10yr yields fell 4 and 8bps respectively) and the USD came under pressure as the outlook for US interest rates was once again reassessed. EUR jumped back up to ~1.0780, a ~2-week high, USD/JPY (now ~139) tracked the pull-back in US yields, GBP moved above ~1.2550 for the first time since mid-May, and the AUD has risen by ~0.9% to its highest level since 11 May (now ~$0.6715). In commodities, oil prices lost some ground (WTI crude dipped ~1.7%) following reports the US and Iran may be making progress in talks over Iran’s nuclear program, which in turn could be a positive for global oil supply.

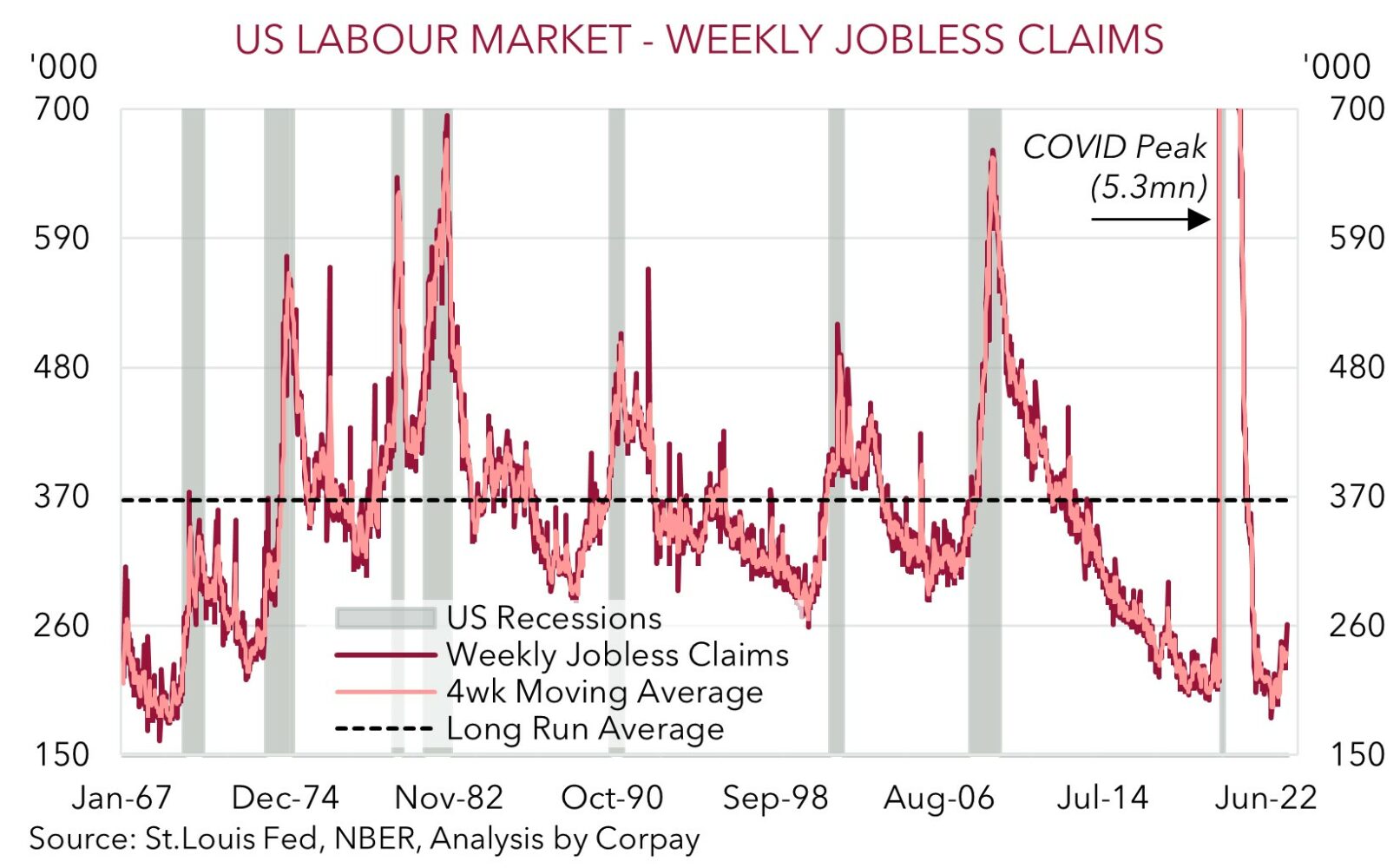

A macro catalyst for the moves was the larger than anticipated lift in US weekly initial jobless claims, a real-time read of how many people are filing for unemployment benefits. Claims rose 28,000 last week to 261,000, their highest level since October 2021. Markets have latched onto the data as a sign the cracks in the US labour market are beginning to widen, and as a result the US Fed may not necessarily tighten monetary policy further and/or eventual rate cuts may not be that far away. We think the market reaction, particularly in the USD, on the back of one week’s data of a series that can be quite volatile looks overdone. Indeed, the timing of last week’s report may have created some distortions. The latest initial claims release corresponds to the week of the Memorial Day holiday, and shortened weeks can generate some statistical issues. A closer look shows that most of the jump appears to have been due to only 4 US states. Moreover, as our chart illustrates, even after the lift, jobless claims remain historically low, so rather than being ‘white hot’ the US labour market may now be just ‘hot’, but either way conditions are still be too tight for the US Fed to declare victory in its fight against inflation.

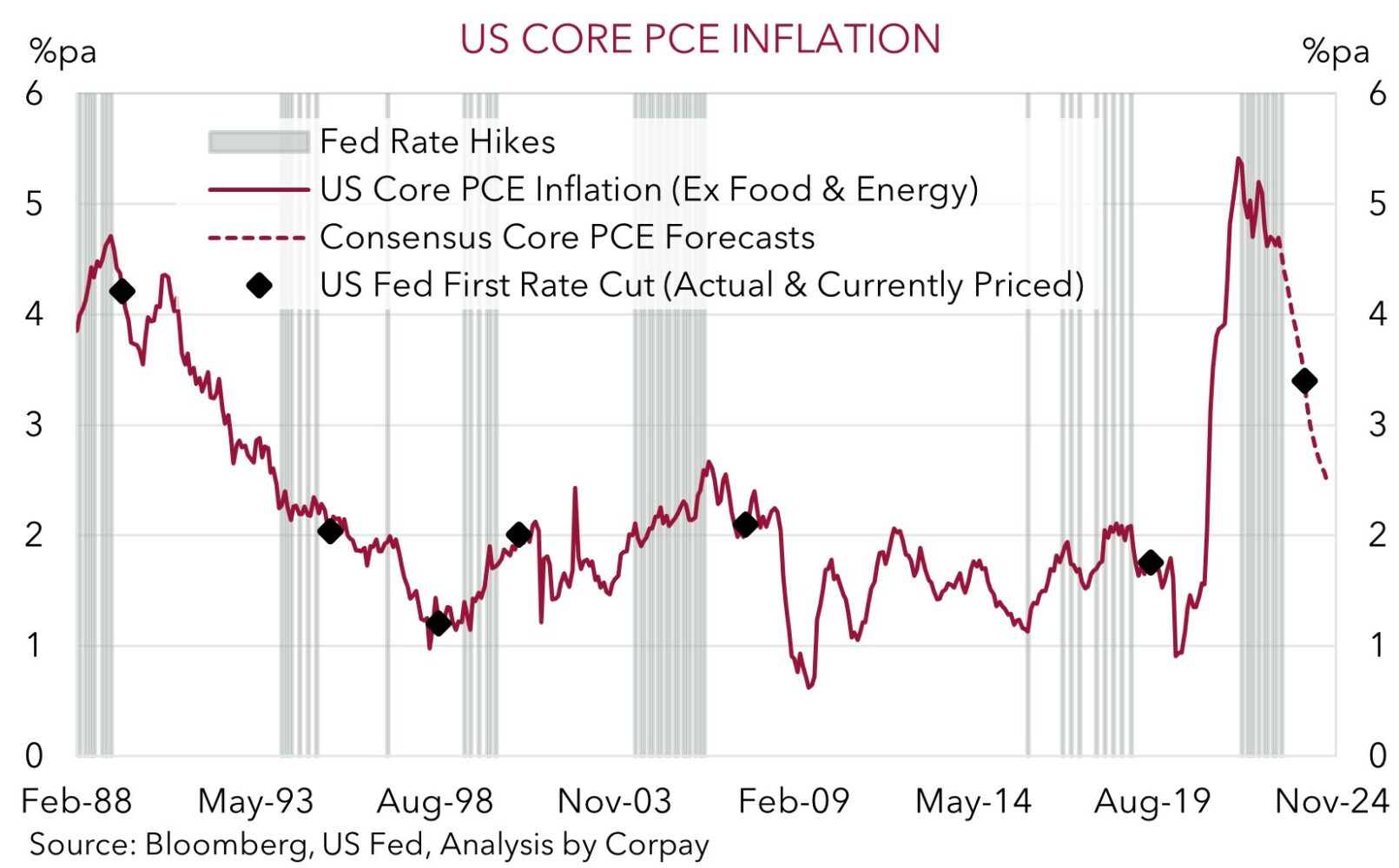

The latest US CPI report is released next Tuesday, with the FOMC policy announcement and Fed Chair Powell’s press conference later in the week (Thursday morning AEST). Base effects, as last year’s larger price increases roll out of calculations, are likely to drag down annual CPI. However, policymakers also look at the recent monthly run-rate and on this score there are signs core inflation pressures are sticky and well above the Fed’s target. Based on recent moves, we believe markets could be vulnerable to a ‘hawkish’ Fed outcome. Indications by the Fed that further hikes are still on the table and/or a strong push back on expectations looking for rate cuts later this year could see the USD bounce back, in our view.

Global event radar: US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

The AUD has bounced back overnight, rising by ~0.9% against the USD which has been under pressure following the unexpected lift in US jobless claims and subsequent downward adjustment in bond yields (see above). At ~$0.6715 the AUD is at its highest level since 11 May. In a sign that the boost has been USD driven, the AUD has been flat against most of the other major currencies over the past 24hrs.

During today’s Asian trade, China CPI and PPI inflation data is due (11:30am AEST). Unlike the rest of the world China doesn’t have an inflation problem. CPI inflation is projected to only nudge up to 0.2%pa in April, with PPI deflation forecast to deepen. China’s weak inflation pulse and faltering post COVID recovery is bolstering expectations that policymakers could announce further policy easing. A soft inflation report could, in our view, see rate cut forecasts rise, which in turn could see USD/CNH lift. And based on the tight (and inverse) correlation, this could exert some intra-day downward pressure on the AUD.

As discussed above, we believe the extent of the negative USD reaction overnight (and by implication the rise in the AUD) from the lift in US jobless claims looks overdone. Next week should be a big week for the USD with US CPI inflation (Tues AEST) and the FOMC policy decision (Thursday morning AEST) on the schedule. In our opinion, based on recent moves, markets appear more at risk of a positive US CPI surprise, and/or a ‘hawkish’ Fed outcome. And this is where we think the risks reside. We expect the Fed to remain firm in its views that policy will need to stay ‘restrictive’ for some time to be confident inflation is on a sustainable path back to target. As our chart shows, in past cycles, the US Fed has only started to cut interest rates when the core PCE deflator (its preferred inflation gauge) has, on average, been ~2%pa. This is well below current rates, with current market pricing looking for a rate cut by January 2024 inconsistent with where the consensus is projected core inflation to be at that point. We judge that a push back by the Fed on expectations looking for rate cuts to kick off later this year could see the USD rebound, which in turn could drag the AUD lower.

AUD event radar: US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6620, 0.6662 / 0.6743, 0.6790

SGD corner

USD/SGD has edged down towards ~$1.3430 as the larger than forecast lift in US jobless claims generated a fall in US bond yields and the USD. As outlined above, we think the size of the market moves on the back of the US data, which can be quite volatile week to week, looks overdone.

Today, China CPI and PPI inflation is due. China’s sluggish post-lockdown recovery is likely to keep inflation pressures quite subdued. We think that a soft CPI result (mkt 0.2%pa) could bolster expectations for fresh monetary easing to be announced by China, and this may generate some intra-day downward pressure on CNH and other Asian currencies like the SGD due to their positive correlations.

Further ahead, there are several key events such as the US CPI, the China activity data batch, US Fed announcement, ECB decision, and US retail sales on the schedule for next week. As discussed, based on the overnight moves, we think interest rate markets and the USD appear somewhat vulnerable to a positive US inflation surprise, and/or ‘hawkish’ Fed rhetoric. An upward adjustment in longer-dated US interest rate expectations, stemming from the Fed leaning against current rate cut pricing, could see the USD (and USD/SGD) recoup some lost ground, in our opinion.

SGD event radar: US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3354, 1.3377 / 1.3520, 1.3590