• Positive vibes. Equities higher. The risk backdrop & repricing in RBA expectations has pushed the AUD towards the top of its multi-month range.

• Inflation focus. US CPI due tonight. Base-effects should drag down annual headline inflation. But will core inflation hold up and rattle market nerves?

• Event risk. There are several events on Thursday with the US FOMC decision, AU jobs report, China data batch, ECB meeting, and US retail sales on the schedule.

A mixed performance across markets overnight, though the underlying tone was generally positive at the start of an action-packed week. US and European equities rose, with the S&P500 (+0.9%) touching its highest level since April 2022 on the back of strong gains in the tech sector. In bonds, while US yields eased slightly (2-year dipped ~2bps to 4.58%), UK yields jumped up by ~10bps across the curve after Bank of England members Haskel and Mann indicated that further hikes may be needed to guard against persistent inflation risks. By contrast, oil prices tumbled ~4% due to growing concerns about a potential supply glut at a time demand is weakening given slowing global growth. In FX, the USD Index is treading water with EUR tracking near ~$1.0750 and USD/JPY around ~139.50. GBP lost some ground despite the ‘hawkish’ BoE rhetoric with markets potentially starting to factor in what all this policy tightening could do to the UK economy down the track. The risk backdrop and upward repricing in RBA interest rate expectations over the past week has pushed the AUD (now ~$0.6750) towards the top end of the range it has occupied since March.

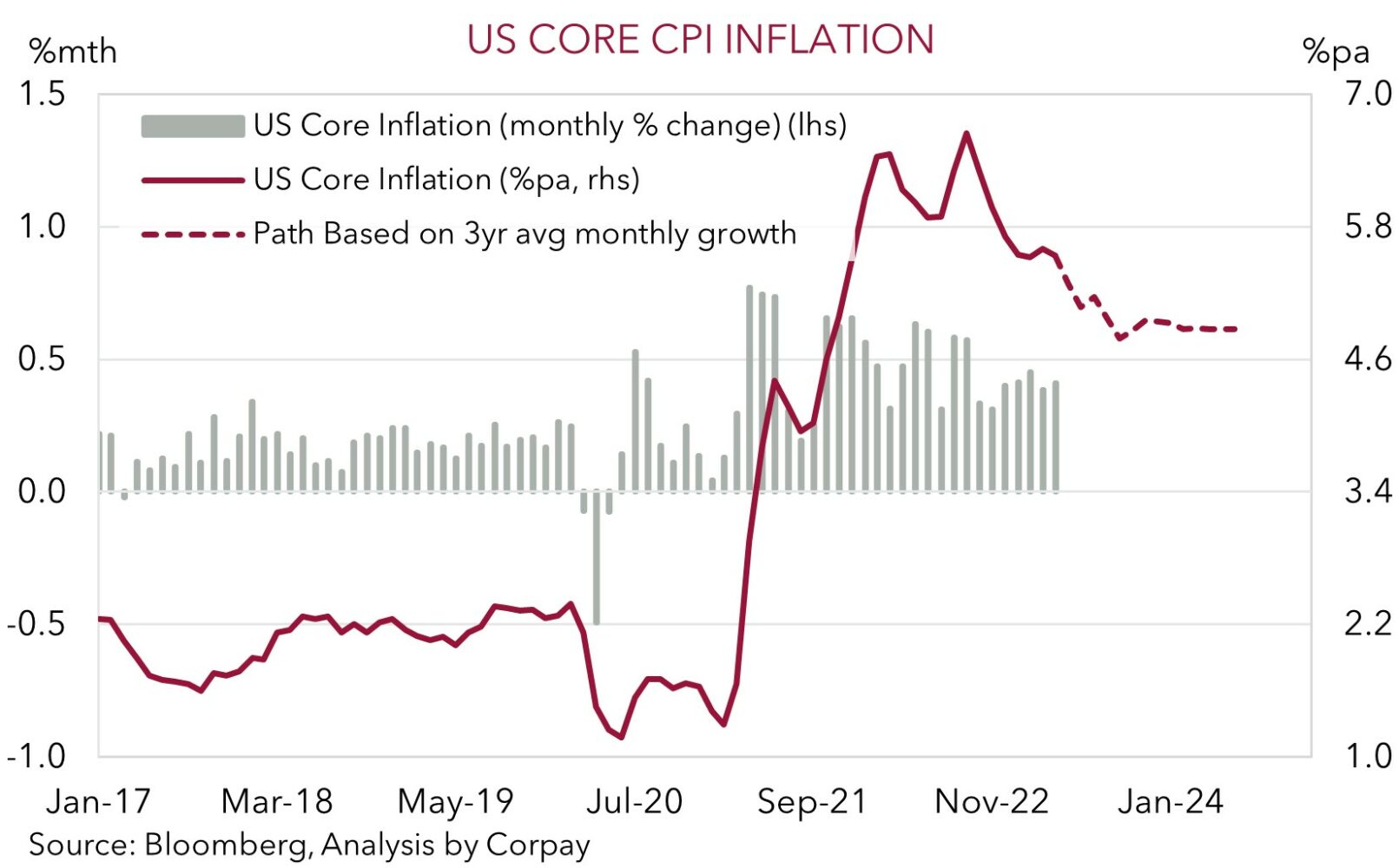

The macro event risks kick off tonight with the latest reading of US CPI inflation (10:30pm AEST). Base effects, as last year’s larger price rises roll out of calculations, are likely to mechanically drag down annual CPI further. However, core inflation (i.e. ex food and energy) could be ‘stickier’ and as our chart shows, may remain well above the Fed’s 2%pa target for some time. Given the markets views about the outlook for US interest rates, we think the reaction to the US CPI could be uneven, with a positive surprise likely to generate a larger lift in US bond yields and the USD.

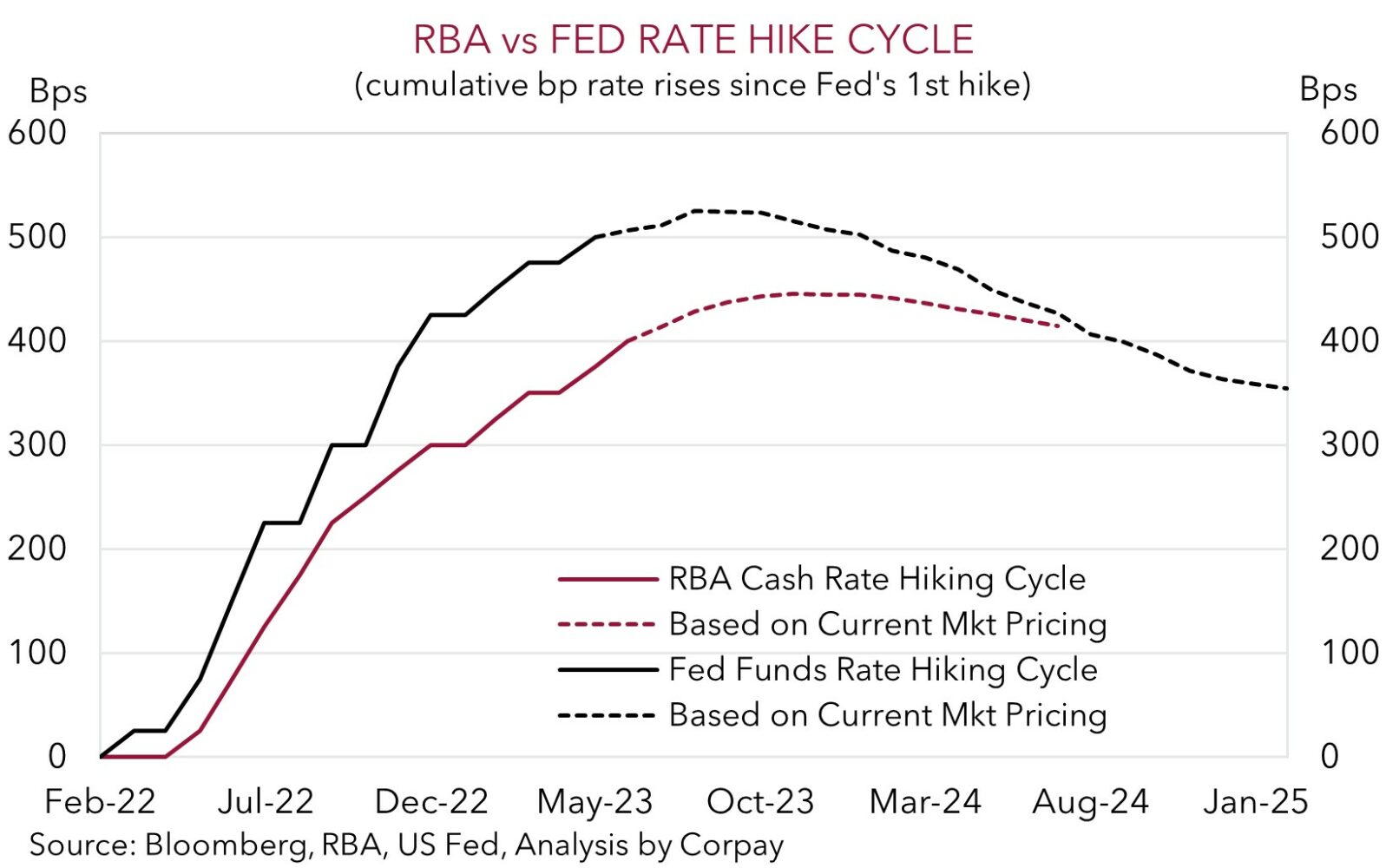

Beyond the US CPI, Thursday is filled with potential market landmines. The US FOMC policy decision is handed down (Thurs 4am AEST), Fed Chair Powell speaks (4:30am AEST), the Australian employment (11:30am AEST) and China activity data are released (12pm AEST), the ECB rates decision is announced (10:15pm AEST), US retail sales and initial jobless claims are due (10:30pm AEST), and ECB President Lagarde speaks (10:45pm AEST). Markets are looking for the Fed to ‘skip’ a hike this week. While we believe this should be the more likely outcome, with the Fed expected to upgrade its near-term GDP, labour market, and inflation forecasts, another rate rise can’t be ruled out. The experience in Canada and Australia shows that central banks remain committed to winning the battle against inflation. Indeed, we think the Fed may be more ‘hawkish’ than markets anticipate. In our view, signals from the Fed that further hikes are still on the table and/or a strong push back on expectations looking for rate cuts later this year could see the USD bounce back. At the same time, further signs China’s post lockdown recovery is faltering, and a ‘hawkish’ rate hike from the ECB may also dampen risk sentiment.

Global event radar: US CPI (Tues), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Fed Chair Powell Speaks (23rd June), Eurozone PMIs (23rd June), ECB Sintra Conference (28th June).

AUD corner

The AUD’s upswing continued overnight. The upbeat risk tone, as illustrated by the lift in global equities, has compounded the upward adjustment in RBA interest rate expectations that has come through over the past week. Markets are now assuming the RBA raises rates by another ~40bps by November. At ~$0.6750 the AUD is near the top-end of the range it has traded in since March. The AUD has also outperformed on the crosses. AUD/EUR is near a ~3-month high, AUD/GBP is around its highest level since late-April, AUD/JPY touched a new 2023 high, and AUD/NZD is holding above ~1.10 (levels last seen in late-February).

As outlined above, it is a jam-packed week of economic events. In today’s local trade, Australian consumer confidence (10:30am AEST) and business conditions (11:30am AEST) are released. Tonight US CPI inflation is due (10:30pm AEST), while on Thursday the US FOMC meeting, Australian labour market and China activity data, ECB rate decision, and US retail sales report have the potential to generate some meaningful market and AUD volatility.

On net, based on current market expectations, we think the USD could regain some ground this week, which in turn could pull the AUD back down. In our judgement, markets appear more at risk of a ‘positive’ US CPI surprise, and/or a ‘hawkish’ Fed outcome. On the latter, while we believe the Fed is more likely to ‘pause’ its rate hiking cycle this week, it is not guaranteed, and based on the tightness in the US labour market, loosening in financial conditions, and still well above target inflation we think the Fed could indicate that further hikes are still on the table and/or that rate cuts are a long way off. This type of message could see US interest rate expectations shift back up and also rattle risk sentiment. Indeed, a relatively more ‘hawkish’ Fed than anticipated, combined with a sluggish China activity data batch, particularly on the commodity-intensive industrial side, and/or another soft Australian labour market report, could see rate differentials narrow in favour of a lower AUD. This mix may also see the AUD give back some of its gains on the crosses, with another hike by the ECB and signals that it still has more work to do a potential drag on AUD/EUR.

AUD event radar: US CPI (Tues), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), NZ GDP (Thurs), AU Jobs (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June).

AUD levels to watch (support / resistance): 0.6662, 0.6691 / 0.6781, 0.6824

SGD corner

USD/SGD has drifted back over the past few trading sessions to be down near ~$1.3435. As discussed above, there are several major global economic events and data releases this week which could generate market volatility. US CPI inflation is released tonight, while on Thursday the US FOMC meeting, China activity data batch, US retail sales, and the ECB policy announcement are on the schedule.

In terms of US inflation, as outlined, while we think headline CPI should continue to fall back as last years larger price rises roll out of calculations, core inflation (i.e. ex food and energy) risks holding up more than predicted. And based on current market views, we believe a ‘positive’ inflation surprise could generate a larger market and more supportive USD reaction. Further ahead, we also think US interest rate markets and the USD appear somewhat vulnerable to a ‘hawkish’ Fed outcome. Although we judge that a ‘pause’ at this week’s meeting is the more likely outcome, another rate hike can’t be completely ruled out given the resilience in the US labour market and still high inflation. An upward adjustment in longer-dated US interest rate expectations, stemming from the Fed leaning against current rate cut pricing and/or indicating that further hikes are possible, could see the USD (and USD/SGD) recoup some lost ground, in our opinion.

SGD event radar: US CPI (Tues), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Singapore CPI (23rd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June).

SGD levels to watch (support / resistance): 1.3354, 1.3377 / 1.3520, 1.3595