• Higher yields. Markets reprice BoE rate hike expectations after UK wage growth quickens. This supported GBP, and pushed AUD/GBP a bit lower.

• US inflation. Headline CPI ‘mechanically’ falls, while core inflation is stickier. Tomorrows Fed meeting in focus. A ‘hawkish skip’ looks most likely.

• AUD cross currents. AUD mixed overnight. The lift in USD/CNH remains a AUD headwind. A ‘hawkish’ Fed could see the AUD dip lower.

There has been quite a bit of news to digest, with some developments, particularly in the UK, generating sharp market reactions. On net, US and European equities added to recent gains (S&P500 +0.7%), oil prices bounced back (WTI crude +3.4%), and bond yields rose. In FX, the USD Index eased back thanks in large part to the stronger GBP which is above ~$1.26 for the first time in a month following the BoE rate hike repricing, and more modest uptick in EUR (now ~$1.0790). The interest rate sensitive USD/JPY has tracked the rise in yields to be above ~140, while the AUD (now ~$0.6765) has given back some overnight gains to only be a touch higher compared to this time yesterday. Given the tight/inverse correlation the uptrend in USD/CNH remains an AUD headwind. USD/CNH touched a new 2023 high overnight (~7.18) after China credit growth underwhelmed and policymakers cut the short-term policy lending rate (i.e. reverse repo rate) by ~10bps in an effort to boost activity.

From our perspective the bond market moves standout with the data reaffirming that the battle against inflation is far from over and that central banks may need to keep at it for some time. UK yields jumped up with the 2-year spiking by ~26bps (now 4.87%) after data showed the labour market remains tight. UK unemployment dipped to 3.8%, and average weekly earnings (ex bonuses) accelerated to 7.2%pa. Faster wage growth points to sticky/high services inflation. The data prompted markets to bolster their BoE rate hike bets. Another ~5 25bp rises by the BoE are factored in by year-end.

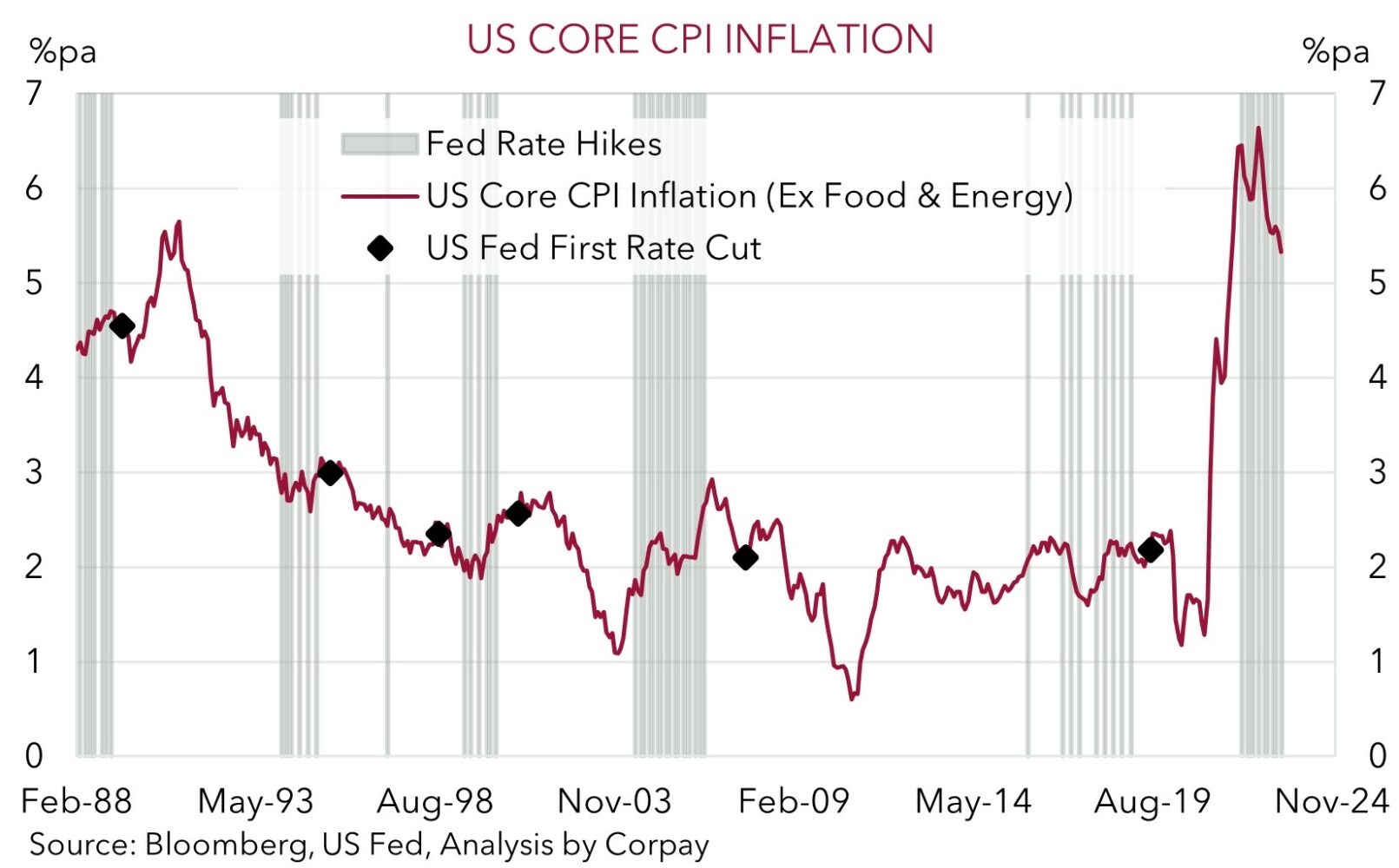

In the US, CPI inflation was broadly inline with predictions. Headline CPI slowed to 4%pa, a low since March 2021, as last year’s large price rises in things like energy dropped out of calculations. By contrast, core inflation (i.e. ex food and energy) only drifted back a bit to 5.3%pa. As our chart shows, this is still historically high, and a long way from where it needs to be. After falling initially US yields ended the day higher (2-year up ~9bps to 4.66%, a high since mid-March) as the slow unwind in core inflation saw markets discount a ‘higher for longer’ Fed interest rate view.

Focus will be on tomorrow’s Fed announcement (4am AEST) and Chair Powell’s press conference (4:30am AEST). Markets are looking for the Fed to ‘skip’ a hike tomorrow. While we believe this is the more likely outcome, with the Fed set to upgrade its near-term GDP, labour market, and inflation forecasts, another rise can’t be ruled out. Indeed, even with a ‘skip’ we think the Fed’s message could be ‘hawkish’, with the Fed likely to send signals that hikes are still on the table and/or that rate cuts remain a distant proposition. If realised, we think this can help the USD regain some ground.

Global event radar: US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Fed Chair Powell Speaks (23rd June), Eurozone PMIs (23rd June), ECB Sintra Conference (28th June).

AUD corner

The AUD has had a mixed 24hrs, with earlier gains against the USD and positive risk backdrop offset by the ongoing upswing in USD/CNH. CNH was weighed down by softer China credit data and modest cut to the short-term interest rate (see above). On net, at ~$0.6765 the AUD is only slightly higher compared to this time yesterday. On the crosses, the surge in UK interest rate expectations following the quickening in UK wage growth has seen AUD/GBP eased back towards its 50-day moving average (~0.5341). The AUD underperformed the EUR, NZD, and CAD. By contrast, AUD/JPY (now ~94.85) and AUD/CNH (now ~4.85) hit their highest levels since November.

Market attention will now be on tomorrow’s Fed decision (4am AEST) and Chair Powell’s press conference (4:30am). As discussed above, headline US CPI inflation has fallen back, with the mechanical unwind of some of last year’s big price rises a major factor. By contrast, core inflation remains uncomfortably high, and the pullback is slow going. While we think the US Fed is more likely to ‘pause’ its rate hiking cycle tomorrow, it is not guaranteed, and based on the tightness in the US labour market, loosening in financial conditions, and still well above target inflation we think the Fed could indicate that further hikes are still possible and/or that rate cuts are a long way away. This type of message could see US interest rate expectations shift up and may also unnerve (seemingly complacent) risk markets.

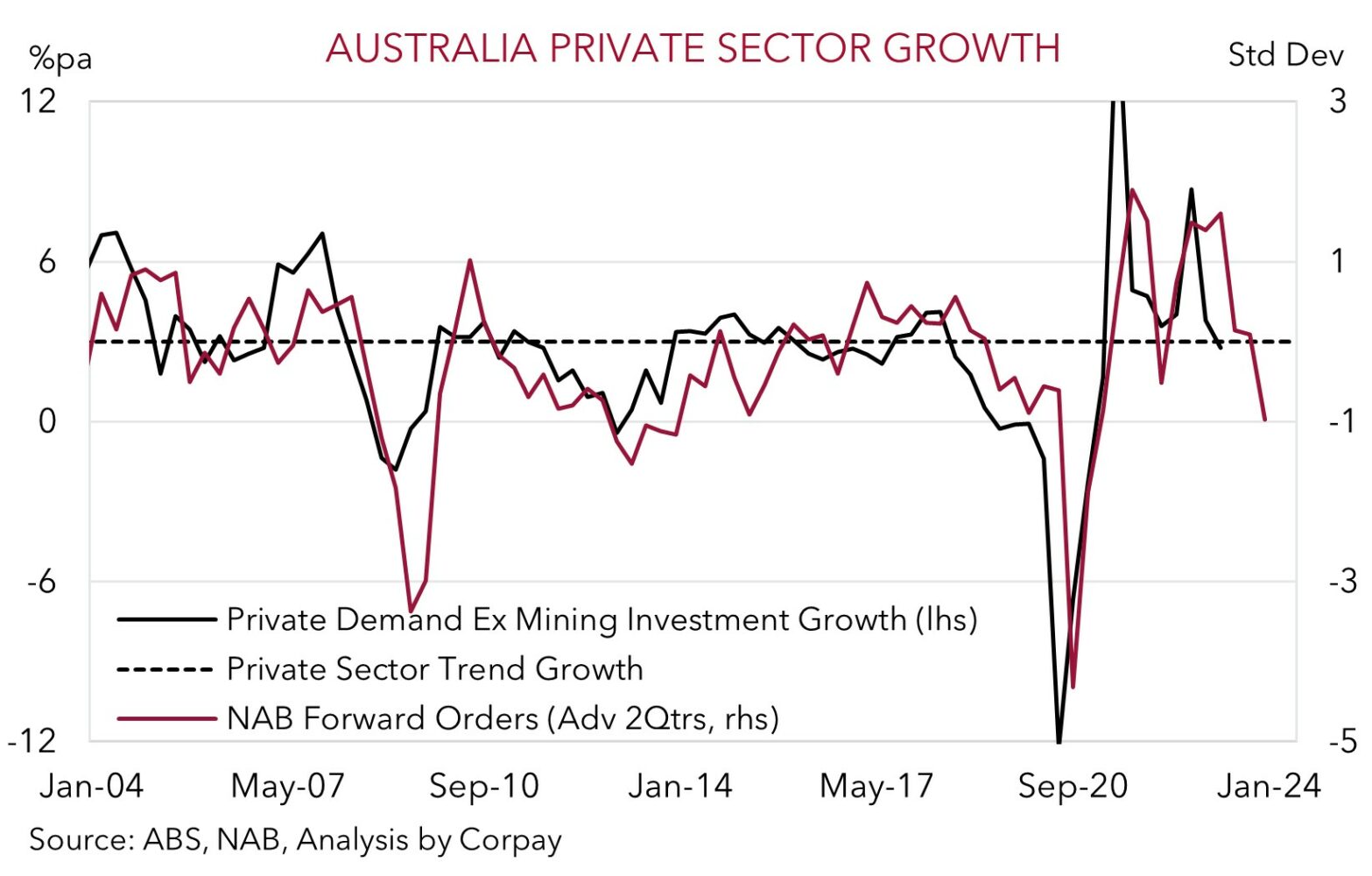

In our view, a ‘hawkish’ Fed, combined with a sluggish China activity data batch (released tomorrow), particularly on the commodity-intensive industrial side, and/or another soft Australian labour market report (also released tomorrow), could see rate differentials adjust in favour of a lower AUD. On the crosses, we think diverging macro trends could also see AUD/EUR and AUD/GBP give back more ground. Indeed, interest rate markets are now discounting the RBA cash rate to reach ~4.46% by year-end. We think this is too aggressive with signs past tightening is gaining traction coming through. Data released yesterday showed that consumer confidence remains in the doldrums, while business conditions have also weakened. As our chart shows, forward orders (a gauge of future private demand) are falling, and this points to a sharp slowdown in activity over coming months.

AUD event radar: US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), NZ GDP (Thurs), AU Jobs (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June).

AUD levels to watch (support / resistance): 0.6664, 0.6691 / 0.6781, 0.6824

SGD corner

USD/SGD has range traded over the past 24hrs, with the pair now tracking near ~$1.3420. As outlined above, the USD has been mixed. The jump in GBP following the stronger labour market data and lift in UK bond yields has been offset by the lift in USD/JPY (on the back of the upswing in US yields) and USD/CNH following the modest cut to the short-term policy rate (see above).

There are several major economic events over the next few sessions, with the US FOMC meeting, China activity data batch, US retail sales, and the ECB policy announcement on the schedule tomorrow. In terms of the US Fed meeting, although we judge that a ‘pause’ is the more likely outcome, another rate hike can’t be completely ruled out given the resilience in the US labour market and still high US inflation. A further upward adjustment in longer-dated US interest rate expectations, stemming from the Fed indicating that more hikes are possible and/or rate cuts aren’t being contemplated could see the USD (and USD/SGD) recapture some lost ground, in our view. Added to that, we also believe that the China activity data could underwhelm forecasts. China’s post COVID recovery is faltering, and more signs that economic momentum is sluggish could add to policy easing expectations. This could exert further pressure on CNH, which in turn may flow through and drag on other Asian currencies like the SGD.

SGD event radar: US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), China Activity Data (Thurs), US Retail Sales (Thus), ECB Meeting (Thurs), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Singapore CPI (23rd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June).

SGD levels to watch (support / resistance): 1.3361, 1.3377 / 1.3520, 1.3591