• US Fed. Rates kept on hold, but the Fed’s message was ‘hawkish’. Fed is forecasting another ~50bps of hikes this year. Market pricing looks too low.

• Intra-day volatility. Markets whipped around by the Fed decision. US retail sales & jobless claims tonight. Data could influence Fed expectations & the USD.

• AUD events. Australian labour force & China activity data released today. ECB policy meeting is tonight with another 25bp rate hike expected.

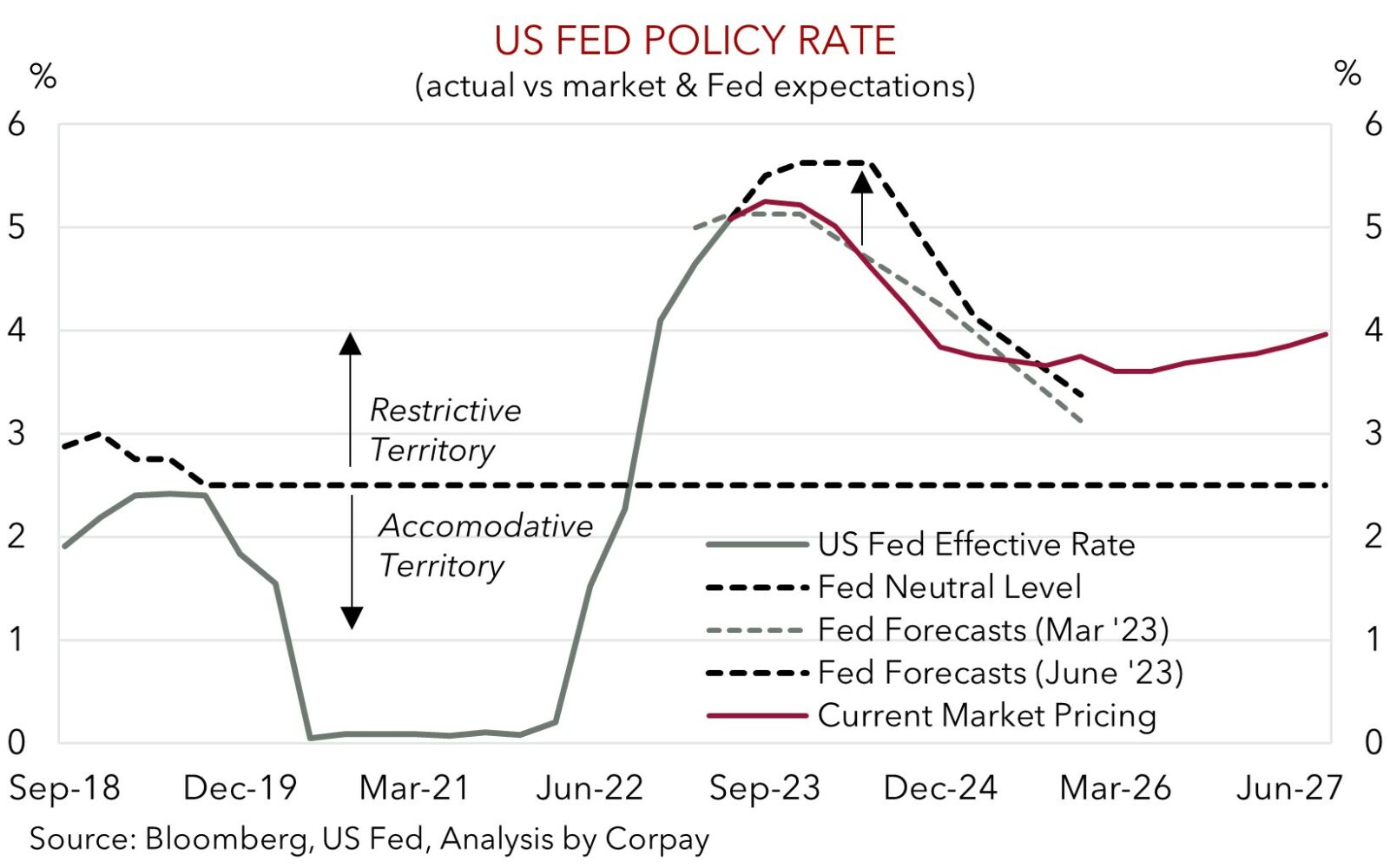

Markets whipped around overnight, with the US Fed policy decision and Chair Powell’s press conference in focus. As was broadly expected, after hiking interest rates aggressively over the prior 10 meetings, the Fed ‘paused’, keeping the funds rate at its 5-5.25% range with policymakers wanting to “assess additional information”. However, it was a rather ‘hawkish skip’ with the FOMC now penciling in another 50bps of rate hikes this year on the back of the resilience in the US economy and still high/sticky inflation before a modest easing cycle kicks off at some point in 2024. Chair Powell gave no strong guidance on when rates could rise again, noting that July (and each meeting) was ‘live’ and dependent on the data. As our chart shows, the Fed’s updated projections are now comfortably above market pricing, with rates expected to stay in ‘restrictive’ territory for some time. Indeed, the level of rates is something Chair Powell pointed to as being more of a focus at this point in the cycle rather than the hiking speed. The further (and longer) rates are above ‘neutral’ the greater the economic impact becomes, with an extended period of sub-trend growth and higher unemployment needed to get inflation back down to the 2%pa target.

There was a burst of intra-day volatility across markets as the Fed outcome was digested. US 2-year yield traded in a ~20bp range, ending the day a few basis points higher at ~4.69%. Equities also swung around, with the S&P500 eking out a small gain on the day (+0.1%), while in FX, the USD Index also endured a bit of volatility, with earlier weakness partially unwinding later in the day. On net, EUR has edged up to ~$1.0830, USD/JPY is near ~140, and after touching a new multi-month high the AUD has slipped back under ~$0.68.

Today, the China activity data batch (12pm AEST), ECB rate decision (10:15pm AEST), US retail sales and initial jobless claims (10:30pm AEST), and ECB President Lagarde’s press conference (10:45pm AEST) are the global focal points. Another 25bp rate rise by the ECB and a ‘hawkish’ message is anticipated, while we think the China data risks underwhelming predictions given the faltering post-COVID recovery. If realised, we believe this mix could dampen risk sentiment. At the same time a better than anticipated US retail sales report and/or an unwind of last week’s holiday-induced spike in jobless claims could, in our view, see US interest rate expectations lift up towards the Fed’s latest thinking. This in turn could give the USD some renewed support, particularly against cyclical currencies like the AUD and NZD.

Global event radar: China Activity Data (Today), US Retail Sales (Today), ECB Meeting (Today), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Fed Chair Powell Speaks (23rd June), Eurozone PMIs (23rd June), ECB Sintra Conference (28th June).

AUD corner

The AUD, much like other risk markets, experienced a bout of intra-day volatility around the overnight Fed decision and Chair Powell’s press conference (see above). After rising to a multi-month high, the AUD has slipped back below ~$0.68 after the USD recovered some lost ground as the Fed’s more ‘hawkish’ message was processed. On the crosses, the AUD is little changed against GBP, AUD/EUR is hovering near the top-end of its ~3-month range, and AUD/JPY has pushed up above ~95 for the first time since early-November. After falling overnight, AUD/NZD has rebounded this morning (now ~1.0975) after GDP data showed NZ has entered a ‘technical’ recession. The NZ economy contracted by 0.1% in Q1, following on from a 0.6% fall in Q4.

In our view, markets appear to be underestimating the Fed’s resolve to tackle the US’ ongoing services driven inflation problem, and there is scope for market pricing to lift towards the Fed’s updated ‘hawkish’ projections. We believe a stronger than expected US retail sales report and/or retracement of last week’s spike in initial jobless claims (both released 10:30pm AEST) could generate a USD supportive shift up in US interest rate expectations.

Ahead of the US data, in today’s Asian session the Australian labour market report (11:30am AEST) and China activity data batch (12pm AEST) are released. Based on the surge in population growth the hurdle to keep the Australian unemployment rate steady has risen markedly. And when combined with the softening in various labour demand indicators, we think the risks are tilted to a lift in unemployment. Similarly, in China, the post COVID recovery has been losing momentum, and we believe the data, particularly on the commodity-intensive industrial side, could underwhelm consensus forecasts. Weaker Australian and/or China data could take the sting out of the AUD’s tail as RBA rate hike expectations are trimmed back, while a sluggish China data pulse may dampen risk sentiment and commodities. As our chart shows, following its rebound the AUD has outpaced the signal from China’s growth impulse. While on the domestic front, we remain of the view that interest rate markets are too aggressive in their thinking for how high the RBA cash rate could reach. On the crosses, we think this mix, combined with another ‘hawkish’ rate hike by the ECB tonight (10:15pm AEST) could see AUD/EUR fall back towards its 100-day moving average (~0.6229).

AUD event radar: AU Jobs (Today), China Activity Data (Today), US Retail Sales (Today), ECB Meeting (Today), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June).

AUD levels to watch (support / resistance): 0.6691, 0.6729 / 0.6836, 0.6865

SGD corner

USD/SGD (now ~$1.3414) has remained range bound overnight, with markets whipped around by the US Fed decision and Chair Powell’s press conference (see above). As discussed, while the Fed kept rates steady at the June meeting, its underlying message was quite ‘hawkish’ with another 50bps worth of rate hikes now projected over the rest of this year. Over the period ahead, we think there is scope for market interest rate pricing to move up towards the Fed’s updated thinking, which if realised, should be USD (and USD/SGD) supportive.

Following on from the US Fed meeting, there are several major economic events over the next 24hrs which can generate market volatility. The list includes the China activity data batch, US retail sales, US initial jobless claims, and the ECB policy decision. In our opinion, stronger than expected US retail sales and/or a dip back in initial jobless claims could be USD positive as further Fed rate hikes are factored in. Added to that, we also believe that the China activity data could underwhelm expectations. China’s post COVID recovery is faltering, and more signs that economic momentum is sluggish could add to policy easing expectations. This could exert pressure on CNH, which in turn may flow through and drag on other Asian currencies like the SGD.

SGD event radar: China Activity Data (Today), US Retail Sales (Today), ECB Meeting (Today), BoJ Meeting (Fri), Bank of England Meeting (22nd June), Singapore CPI (23rd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June).

SGD levels to watch (support / resistance): 1.3364, 1.3377 / 1.3520, 1.3588