• Weaker USD. ECB delivered another hawkish hike. Policy divergence between the ECB & US Fed has boosted the EUR & weighed on the USD.

• AUD stronger. Compounding the softer USD was another strong local labour market report & expectations China could announce stimulus to boost growth.

• BoJ today. No changes expected. But tweaks appear inevitable. JPY is at quite low levels. We think there are more upside than downside risks from here.

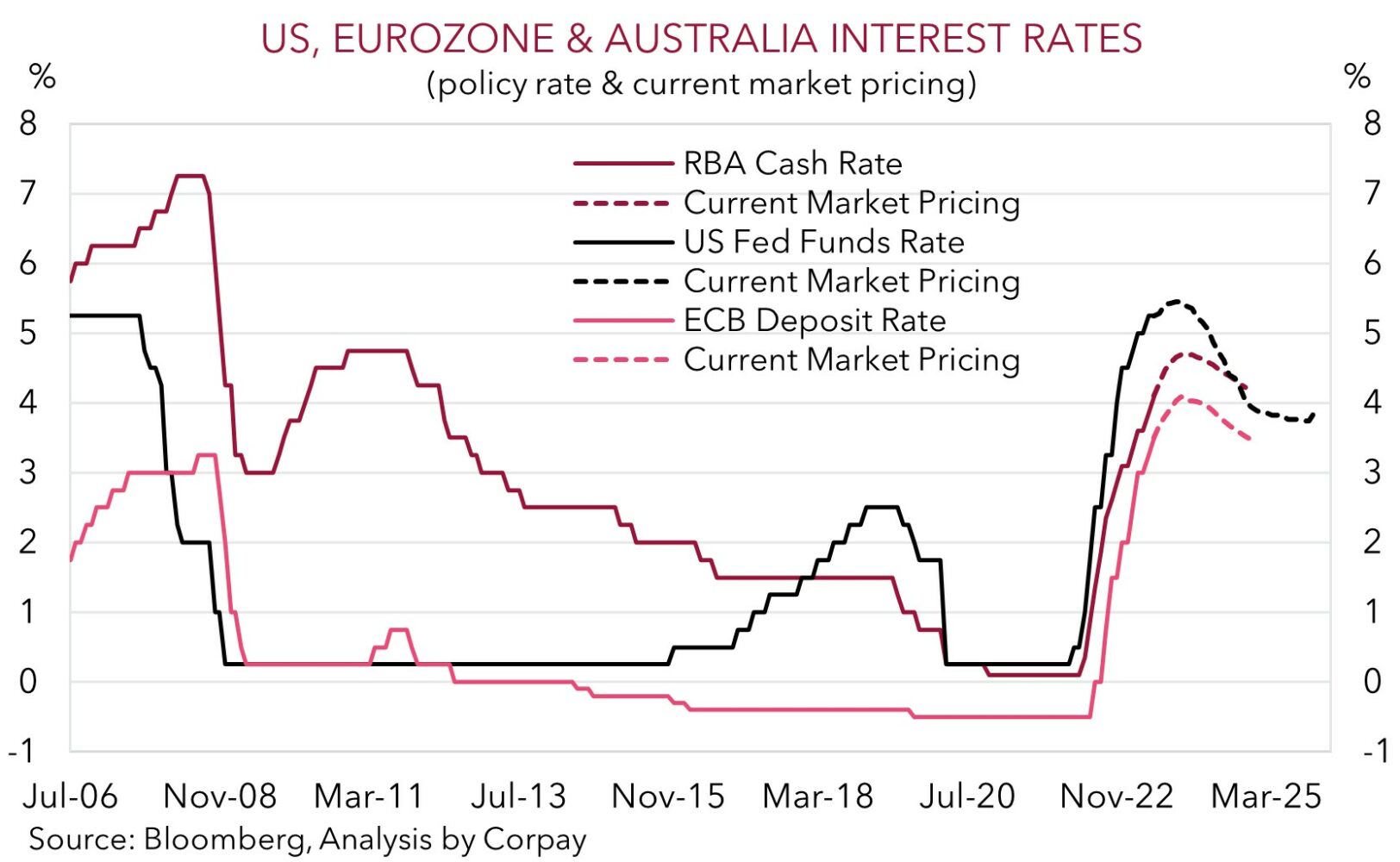

US and European markets diverged overnight, with contrasting central bank expectations a driver. European equities eased back (EuroStoxx50 -0.3%) and bond yields rose after the ECB delivered another 25bp rate hike and a ‘hawkish’ message. The ECB deposit rate is now 3.5%, equal to its highest since mid-2001, with the bank now having delivered 400bps of hikes this cycle. And there is more to come. In contrast to the downgrade to its Eurozone growth outlook, the ECB revised up its inflation forecasts. As a result, President Lagarde stressed that the ECB has more to do and would “very likely” raise rates in July. In response, more tightening has been added to the market’s rate track. German 2-year yields increased ~11bps to 3.13%.

By contrast, markets remain skeptical that the US Fed will deliver on its updated thinking. The Fed is now looking for ~2 more hikes this year, while markets are struggling to factor in another move. Some mixed US data did little to challenge the market’s views. While US retail sales were a bit better than expected, rising 0.3% in May, this was largely due to an unexpected jump in auto sales. Elsewhere, the Philly Fed (negative) and Empire State (positive) deviated, industrial production softened, and initial jobless claims (the weekly read on the number of people filing for unemployment benefits) remained near its highest level since October 2021. A closer look suggests some state specific issues are still at play, however markets remain fixated on the thought that the US labour market is cracking and hence the Fed may have done enough. US yields fell back, with the 2 and 10-year down 5-7bps. This supported equities, with the S&P500 (+1.2%) hitting a 14-month high.

In FX, the diverging policy expectations between the ECB and US Fed exerted more pressure on the USD, with the EUR (the major alternative) moving up to a ~1-month high (now ~$1.0940). GBP hit its highest level since April 2022, USD/CAD fell to a fresh 2023 low, and NZD brushed off NZ’s move into a ‘technical recession’ to be above its 100-day moving average (~$0.6220). The AUD (now ~$0.6880) has extended its positive run with the robust Australian labour market data and expectations policymakers in China may announce more policy stimulus to support the faltering recovery compounding the softer USD.

The Bank of Japan is today (no set time). 44 out of 47 economists surveyed expect no changes. This suggests that if the BoJ springs a surprise, which we think is a low probability but not impossible given the lift in Japanese inflation and depreciating JPY, there could be an outsized reaction. Looking beyond today’s outcome, at current levels we believe there are asymmetric risks around the JPY (i.e. there is more scope for a large snapback with any further JPY weakness likely to be limited). It appears inevitable the BoJ will have to jettison its ultra-accommodative stance.

Global event radar: BoJ Meeting (Today), Bank of England Meeting (22nd June), Fed Chair Powell Speaks (23rd June), Eurozone PMIs (23rd June), ECB Sintra Conference (28th June).

AUD corner

The AUD upswing has continued. At ~$0.6880 the AUD is now near its highest level since late-February. The AUD has also remained firm on the crosses. AUD/EUR is hovering near its highest level since mid-March, AUD/GBP is still tracking above its 50-day moving average (~0.5342), diverging interest rate and macro trends are holding AUD/NZD over ~1.10, AUD/CNH has touched a ~2-year high, and AUD/JPY is north of ~96.40 (heights it hasn’t been at since last September).

As discussed, ECB and US Fed policy expectations continue to diverge, with the former delivering another ‘hawkish hike’, while markets continue to challenge the latter’s view that further increases are likely. This is weighing on the USD. Added to that, from the AUD’s perspective, the resilience in the Australian labour market has reinforced thoughts the RBA has more work to do. ~75,900 jobs were added in May and unemployment dipped to 3.6%. And although the China activity data again underwhelmed, with momentum slowing across retail sales, industrial production, and fixed asset investment, markets remain focused on potential stimulus measures that could be announced to boost the recovery.

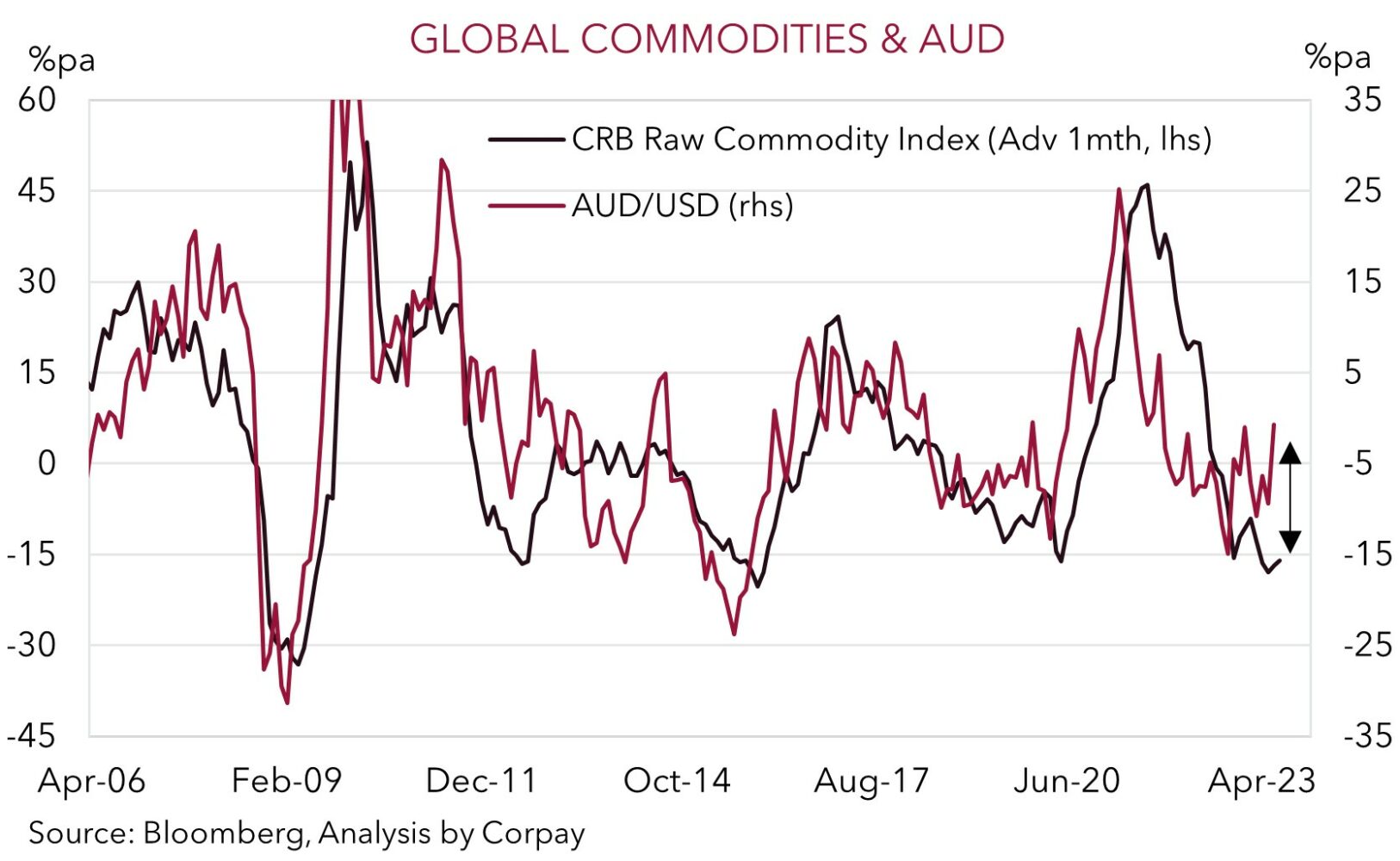

In our view, the AUD looks to have moved too far too fast, and the upturn may soon run out of steam, as external headwinds re-emerge. This could generate some renewed underperformance against currencies like the EUR, GBP, JPY, and to a lesser extent the USD. We continue to forecast the AUD’s more sustained revival to only come through later this year and over early 2024.

In our judgement, with another ~2 hikes now factored in, the last legs of the RBA rate cycle appear well priced. By contrast, we believe markets are underestimating the Fed’s resolve, and an upward adjustment in US rate expectations could occur, which if realised, may reinvigorate the USD. Similarly, the ECB has further rate hikes in them, as does the BoE. In terms of global dynamics, world growth is slowing, and the step down should intensify over coming months. As our chart shows, the AUD has decoupled from raw material prices, but this seldom lasts. And while fresh stimulus from China looks probable, we believe high debt levels and worries about financial stability mean a targeted approach is likely. Failure by Chinese policymakers to match lofty stimulus expectations, either in size or scope, could be a drag on the AUD. For more see Market Musings: AUD: break-out or bull-trap?

On the crosses, AUD/JPY is in focus today given the BoJ policy announcement (no set time). As outlined, we don’t expect changes today, but the risk of a surprise is always there, with a shift by the BoJ from its accommodative stance inevitable. At ~96.50 AUD/JPY is tracking more than 2 standard deviations above its ~5-year average. Our analysis has found that this type of ‘extreme divergence’ hasn’t tended to last, with AUD/JPY only trading at ~96 or above ~5% of the time since 2010.

AUD event radar: BoJ Meeting (Today), Bank of England Meeting (22nd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June), AU Monthly CPI (28th June), AU Retail Sales (29th June).

AUD levels to watch (support / resistance): 0.6728, 0.6781 / 0.6925, 0.6975

SGD corner

USD/SGD has slipped back below its 100-day moving average (~$1.3369) due to the weaker USD. As discussed above, the ‘hawkish’ hike delivered by the ECB has seen markets add to their rate rise bets, while US yields have fallen back following some patchy US economic data. The divergence and shift in relative interest rates has boosted the EUR, the major USD alternative. EUR/SGD (now ~1.4632) is around a 1-month high.

We think markets are wrong to test the US Fed’s resolve. US inflation remains uncomfortably high, and while there has been a bit of softening, the labour market is still quite tight. This mix points to further rate hikes by the US Fed over the next few months, in our view. This isn’t priced into markets. We think an upward adjustment in US interest rate pricing could give the USD (and USD/SGD) some renewed support, particularly if China stimulus measures designed to boost the faltering recovery also fail to meet lofty expectations.

The BoJ announcement is today. Ahead of the event, JPYSGD is down within ~1.3% of its October 2022 lows. While we don’t expect the BoJ to make any changes today, accelerating Japanese inflation and JPY weakness suggests it is inevitable tweaks are made at some point. We believe at current low levels, there are more upside than downside risks to the JPY.

SGD event radar: BoJ Meeting (Today), Bank of England Meeting (22nd June), Singapore CPI (23rd June), Eurozone PMIs (23rd June), Fed Chair Powell Speaks (23rd June), ECB Sintra Conference (28th June).

SGD levels to watch (support / resistance): 1.3200, 1.3320 / 1.3500, 1.3550