• Holiday markets. Limited moves with the US, UK, & parts of Europe on holiday. In-principle agreement to raise US debt ceiling to be voted on over coming days.

• Global data pulse. Global data flow picks up later this week. China PMIs (Weds), Eurozone CPI (Thurs) & US labour market report (Fri) in focus.

• AUD consolidating. Global forces should act as a AUD headwind, offsetting support expected to be generated by upcoming local events.

A quiet 24hrs across global markets with the US, UK, and some European countries on holiday, and no major economic data released. Across the markets that have been open, reaction to the weekend news that an in-principle agreement has been reached to raise the US debt ceiling triggered a bit of a ‘relief rally’, though some caution remains as investors continue to have an eye on other factors like the unfolding growth slowdown, still high inflation, and outlook for interest rates. US equity futures posted modest gains (contracts on the S&P500 are up ~0.3%), bond futures point to a slight pull-back in yields, while the USD remains near its recent highs. EUR has drifted down to ~1.0710, USD/JPY remains above 140 (the top end of its 6-month range), and the AUD has nudged up to ~$0.6540 (~0.3% higher from last week’s close).

The in-principle US debt ceiling agreement will now get tested. President Biden and Speaker McCarthy are confident that the deal will be passed by Congress. Most market analysts expect the deal to be voted through. But you can never be sure. Some politicking is likely ahead of the vote, and this may generate intra-day volatility. US lawmakers return to work today, with voting expected to begin from Wednesday. The agreement needs to be voted through both chambers of Congress before 5 June, which is the latest update from Treasury Secretary Yellen around when the government could run out of funds and start to default on its obligations.

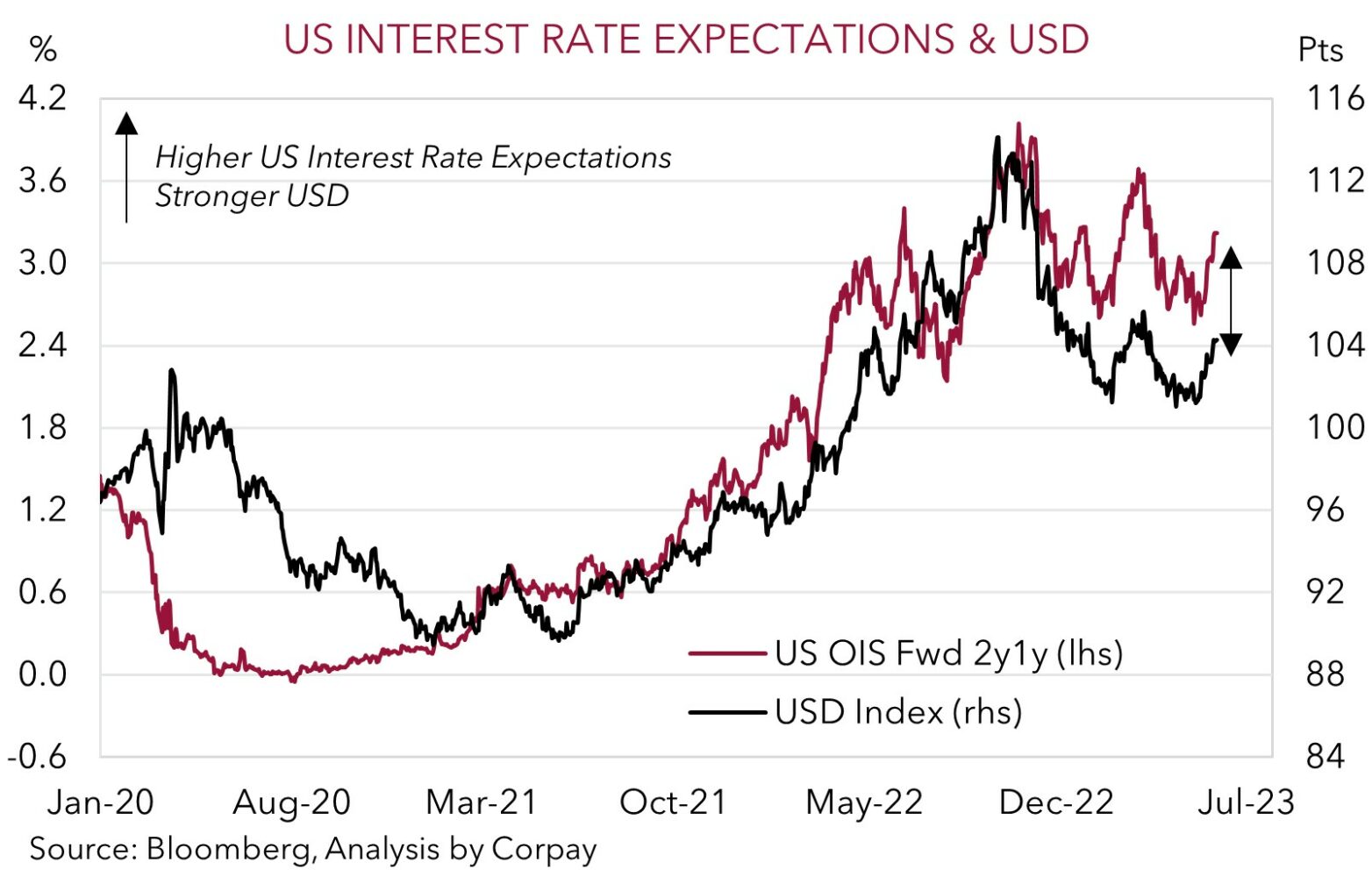

The global economic calendar remains light today, with US consumer confidence the pick of the bunch (12am AEST). Consumer sentiment, a forerunner of future spending, is expected to show some further moderation. The data flow picks up over coming days, with the China PMIs (Wednesday), Eurozone CPI inflation (Thursday), and US labour market report (Friday) due. We think the China PMIs are at risk of undershooting consensus forecasts. Further signs that China’s post COVID recovery is faltering, particularly on the commodity intensive industrial/manufacturing side, is likely to keep cyclical currencies like the AUD on the backfoot, in our opinion. And in the US, leading indicators point to another solid labour market report, with unemployment expected to remain historically low, and wage growth above rates consistent with the Fed’s 2%pa inflation target. Positive US labour market data should reinforce the upswing in interest rate expectations as markets factor in the chance of further Fed hikes and push back pricing for the start of the rate cutting cycle. We believe this adjustment should continue to support the USD over the near-term.

Global event radar: China PMIs (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

AUD has ticked up slightly, rising by ~0.3% to ~$0.6540. With the US, UK and parts of Europe enjoying a long weekend there has been little movement across markets, with news that an in-principle agreement has been reached to raise the US debt ceiling generating a bit of a positive reaction. President Biden and Speaker McCarthy appear confident the deal will pass. Voting is due to kick off on Wednesday, with it needing to be voted through both chambers of Congress by 5 June.

With the US debt ceiling issue now (seemingly) put to bed, we expect markets to refocus on the global growth pulse, inflation trends, and interest rate outlook. As discussed, on this basis we expect the USD to remain firm, and this should act to cap any AUD strength generated by upcoming local events.

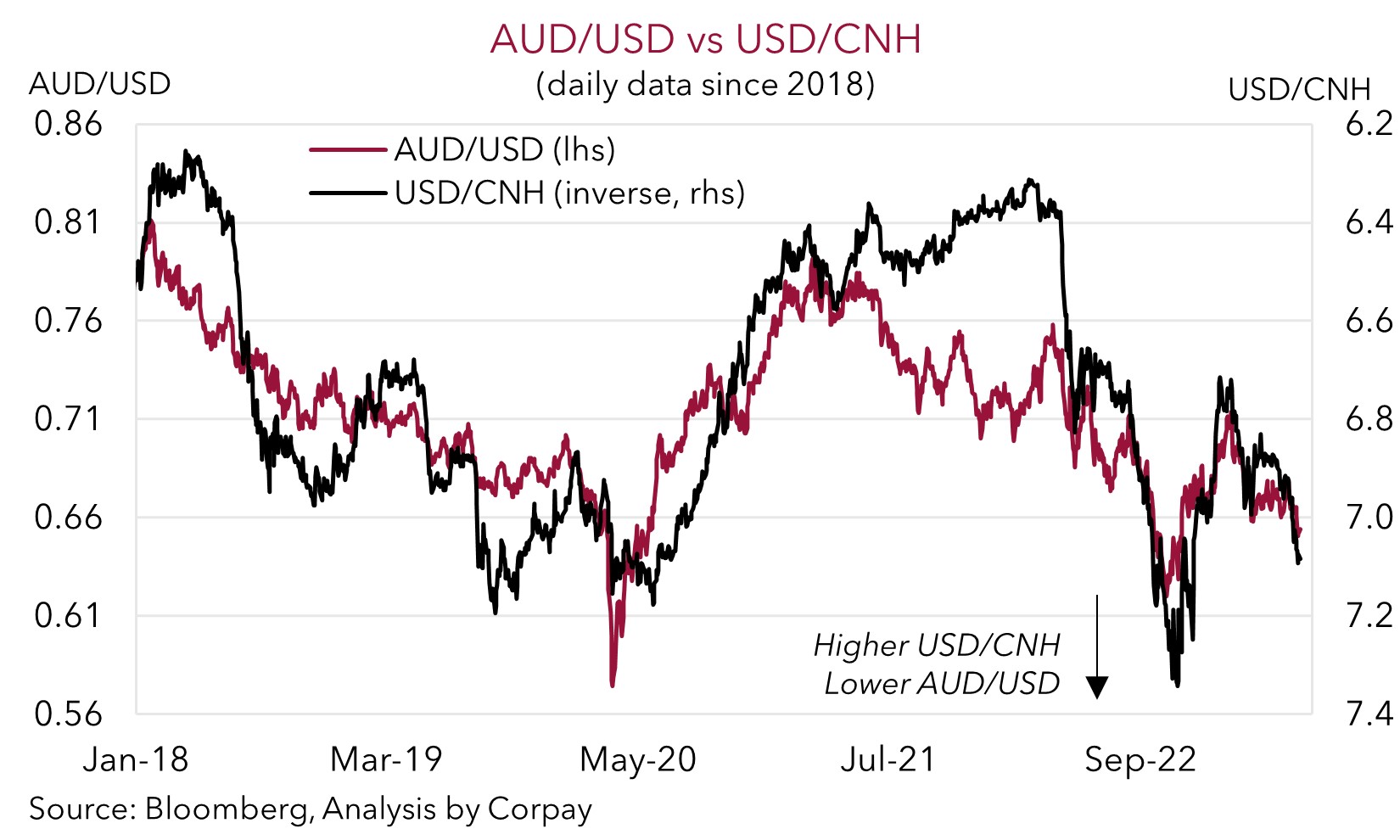

On the US side, recent data confirms that core inflation remains uncomfortably high, and as such we think there is a growing chance the US Fed could raise rates further, with policy set to remain ‘restrictive’ for some time. The US labour market report (released Friday) will be a key input into the Fed’s next decision. In our view, another solid US labour market report should reinforce the uplift in US interest rate expectations and be USD supportive. From a global growth perspective, we also think that the China PMIs (released Wednesday) could underwhelm analyst forecasts. Further signs that China’s post COVID recovery is losing momentum could exert pressure on commodities and bolster expectations that monetary policy could be eased in China. We believe this could keep USD/CNH on an upward trend, and as our chart shows, based on the inverse correlation, this could weigh on the AUD.

That said, we think upcoming local economic event could work in the opposite direction and give the AUD some support. The monthly CPI indicator, RBA Governor Lowe’s Senate testimony (both Wednesday), and the minimum wage decision (Friday) are in focus. Base-effects suggest CPI re-accelerated a little in April, while there appears to be a strong chance that a relatively large lift to the minimum and award wages are announced. An award wage increased of 4% of more could be problematic from an inflation perspective. We think the ongoing inflation risks, and repeated comments by Governor Lowe that the RBA is prepared to do more are likely to keep chances of another rate hike over coming months alive.

AUD event radar: China PMIs (Weds), RBA Gov. Lowe Speaks (Weds), AU CPI (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6595, 0.6674

SGD corner

USD/SGD is hovering just under ~$1.3540, near the top of its 2023 year-to-date range. As discussed above, markets have been subdued due to the holidays across the Northern Hemisphere, with weekend news that an in-principle agreement has been reached to lift the US debt ceiling greeted with cautious optimism. The agreement must now be voted through US Congress over the next few days.

Assuming that it is voted through, market focus should return to the slowdown in global growth and outlook for US monetary policy. In our view, given the high US core inflation, a shift by the US Fed to an easing cycle remains some time away. Indeed, further rate hikes over the next few months are a genuine possibility. The US labour market report is released on Friday. Data showing that the US labour market is still tight should, in our judgement, solidify the upward shift in US interest rate expectations. This is expected to keep the USD (and USD/SGD) supported, particularly given signs the global economy is losing steam. We think the China PMIs (released Wednesday) are at risk of underwhelming, which if realised, could be a negative for cyclical Asian currencies like the SGD.

SGD event radar: China PMIs (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3344, 1.3377 / 1.3590, 1.3619