• US debt ceiling. An agreement to raise the ceiling looks to have been reached. It must now be voted on by both chambers of Congress.

• Back to fundamentals. Removing a tail risk should see markets refocus on the policy outlook. US inflation is still too high. Another strong labour market report should be USD supportive.

• AUD cross-currents. AUD found some support. Shift in relative interest rate expectations & softer global growth pulse likely to limit the AUD’s rebound.

Markets ended last week on more positive footing, with equities rising (the US S&P500 rose 1.3% while the tech-focused NASDAQ outperformed (+2.2%)), and bond yields hovering up around recent highs. The US 2-year yield lifted another ~4bps to 4.56%, a high since early March, with the 10-year yield (now ~3.80%) near a two-month peak. The upswing in US bond yields continues to support the USD. EUR has edged down to ~$1.0720, the interest rate sensitive USD/JPY touched its highest level since late-November, GBP is tracking just above its 100-day moving average (~$1.2290), and the AUD (now ~$0.6530) has consolidated near 6-month lows.

The better tone for markets stemmed from constructive comments about the US debt ceiling negotiations. These expectations were crystalised over the weekend with reports President Biden and Republican House Speaker McCarthy reached an agreement in principle to raise the ceiling past the 2024 election and reduce government spending over the next two years. From here, the agreement needs to be voted through both chambers of Congress before 5 June, which is the latest update from Treasury Secretary Yellen around when the government could run out of funds and start to default on its obligations. US lawmakers aren’t expected to be back at work from the Memorial Day long-weekend until Tuesday. The last-minute agreement, while assumed by most, should remove a potential tail risk.

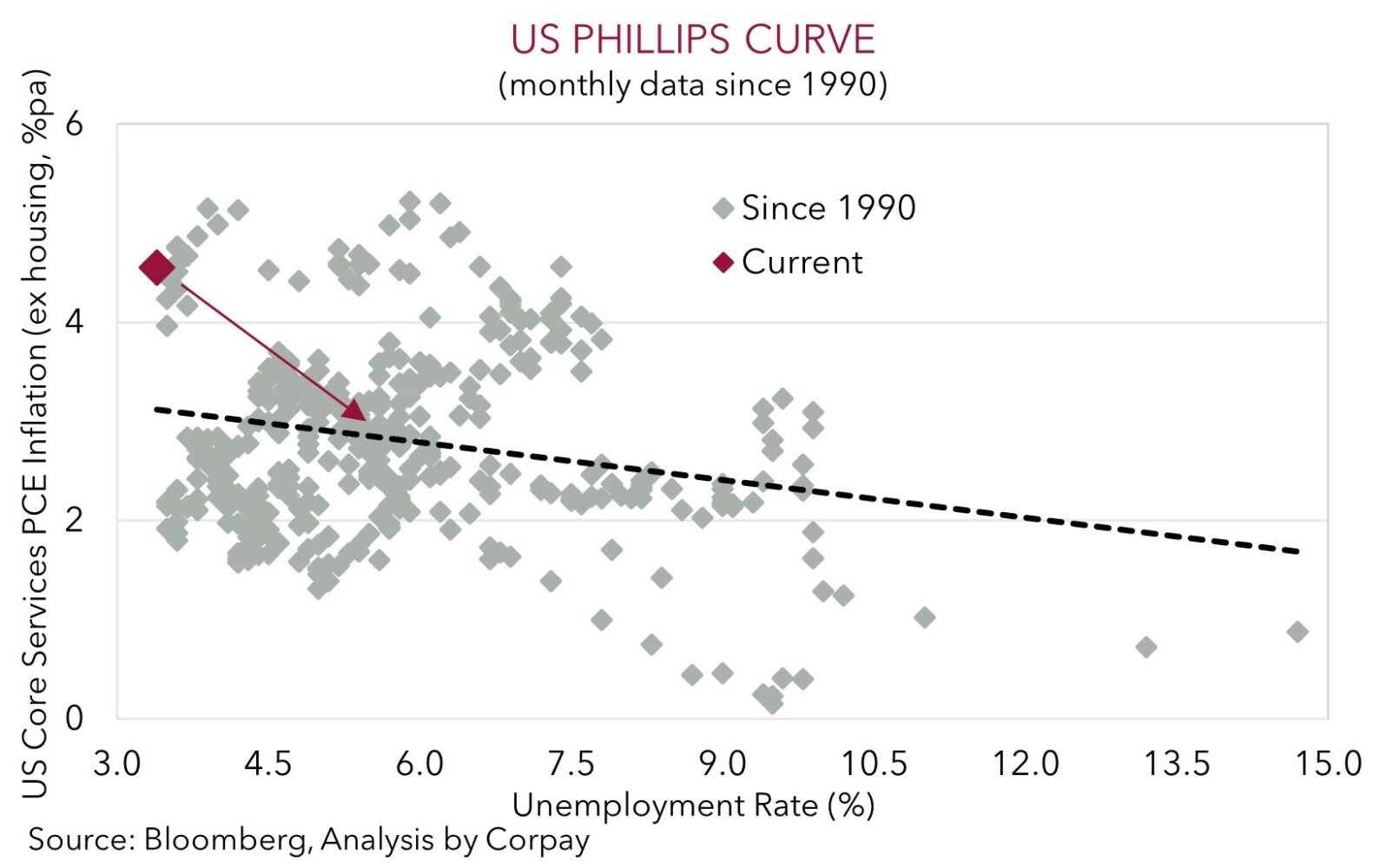

Barring a hiccup in the voting through Congress later this week, the debt ceiling issue should begin to move into the rear-view mirror. And this should allow markets to refocus their attention on other factors like inflation and growth trends and the outlook for central bank policy. On this front, data released on Friday reaffirmed that the US Fed looks to be a long way from shifting to an easing cycle, with further near-term rate hikes still possible. Markets are now fully discounting another Fed rate hike by the July meeting, with less than 1 rate cut priced in by January. The core PCE deflator, the Fed’s preferred inflation gauge, came in stronger than forecast, rising by 4.7%pa. The services measure, excluding housing, which the Fed looks at closely, also remains uncomfortably high. As our chart shows, this is due to the tight US labour market. For services inflation to cool down, policy needs to remain ‘restrictive’ for some time for the economy to slow and for unemployment to increase.

Given its importance, the May US labour market data (released Friday) will be a focal point. Leading indicators point to another solid report with unemployment expected to remain historically low, and wage growth still well above rates consistent with the Fed’s 2%pa inflation target. Positive US labour market data should reinforce the upward adjustment in interest rate expectations and continue to underpin the USD, in our view.

Global event radar: China PMIs (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD corner

After falling by ~2.4% the AUD found some support on Friday thanks to some relative outperformance on the major crosses, but at ~$0.6530 it remains near its 6-month lows. Weekend news that President Biden and Speaker McCarthy reached an agreement in principle to raise the debt ceiling should remove a tail risk. The agreement now needs to be voted on by both chambers of Congress. Successful passage appears more likely than not. However, given a deal was the working assumption for most, we doubt market reaction to the news will be overly pronounced. Indeed, we think the agreement should see markets refocus their attention on the global growth pulse, inflation trends, and interest rate outlook. And as discussed above, on this basis we expect the USD to remain firm, which should act to limit the AUD’s rebound, though some local events could generate AUD volatility this week.

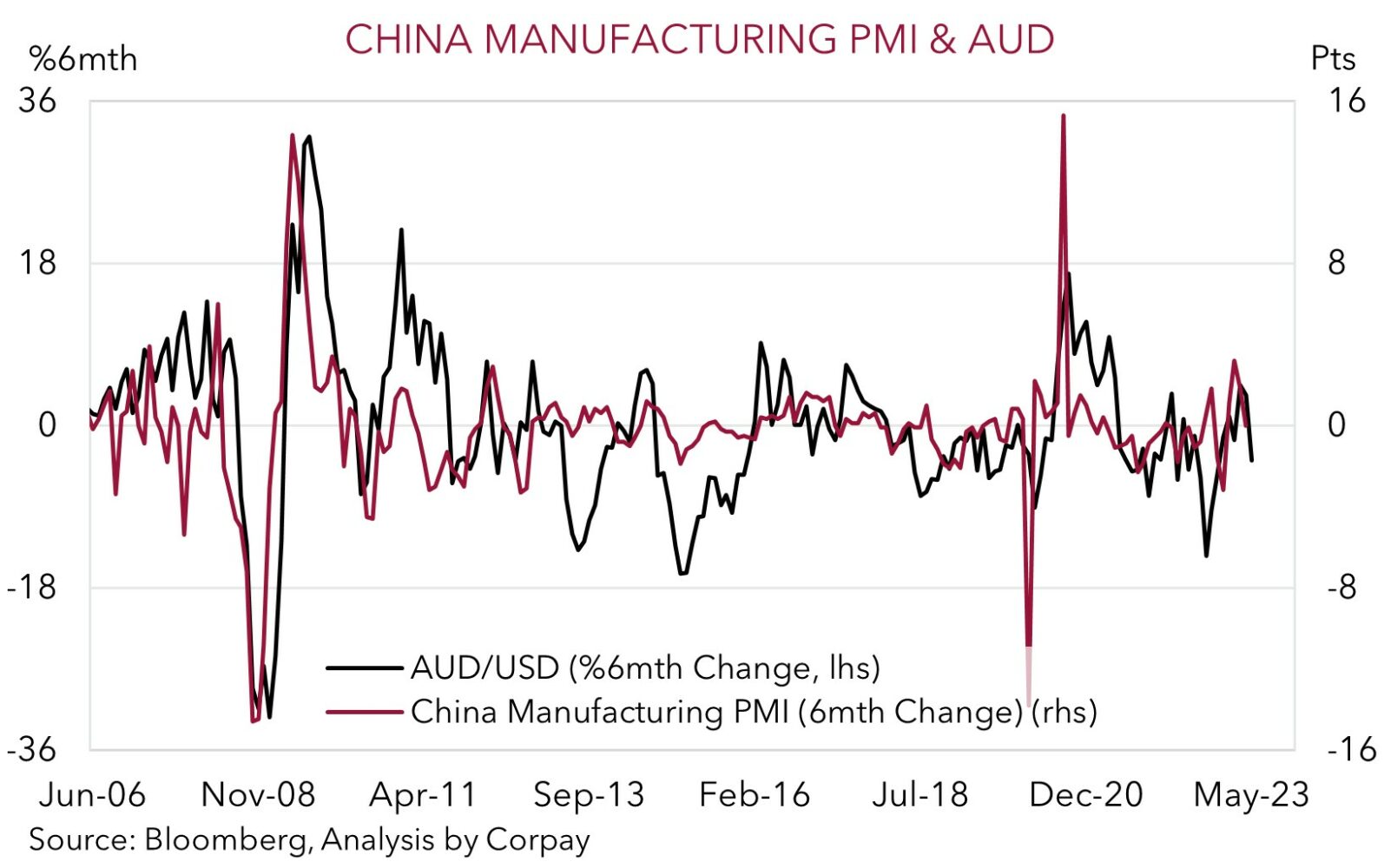

Importantly, the still high US core/services inflation, as illustrated once again by the PCE data last Friday, has seen pricing for the US Fed shift up substantially over the past few weeks. Another Fed rate hike is now fully discounted by the July meeting, with less than 1 rate cut now assumed by January. In our judgement, another solid US labour market report (released Friday) should reaffirm the upswing in US rate expectations and remain USD supportive. Globally, we also believe that the China PMIs (released Wednesday) are at risk of undershooting consensus forecasts. Further signs that China’s post COVID recovery is faltering, particularly on the commodity intensive industrial/manufacturing side, is likely to keep cyclical currencies like the AUD on the backfoot, in our view.

Locally, the monthly CPI indicator and RBA Governor Lowe’s testimony to the Senate Economics Committee (both Wednesday) are in focus. Base effects related to the timing of Easter and relatively higher petrol prices compared to a year ago suggest CPI re-accelerated a little in April. We think the ongoing inflation risks, and comments by Governor Lowe that the RBA is prepared to do more to ensure inflation is on a path back to target are likely to keep chances of another hike over coming months alive. But FX is a relative price, and we expect interest rate differentials to remain in favour of stronger USD/weaker AUD over the near-term.

AUD event radar: China PMIs (Weds), RBA Gov. Lowe Speaks (Weds), AU CPI (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), AU Jobs Report (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6595, 0.6673

SGD corner

USD/SGD is tracking around ~$1.3530, near the top of its 2023 range. As discussed above, reports over the weekend that the two sides have reached an agreement in principle to raise the US debt ceiling beyond the 2024 election should remove a potential tail risk from the markets. However, with focus now set to return to the outlook for US monetary policy we expect the USD to remain firm. In our view, based on the high US core inflation, a shift by the US Fed to an easing cycle remains a long way off. Indeed, further rate hikes over the next few months are possible. The latest US labour market report is released on Friday. Data showing that the US labour market is still tight should, in our view, reinforce the upward adjustment in US interest rate expectations. This is expected to keep the USD (and USD/SGD) supported, particularly given signs the global economy is slowing. We believe the China PMIs (released Wednesday) are at risk of underwhelming market projections. If realised, we think this is likely to be a negative for cyclical currencies like the SGD.

SGD event radar: China PMIs (Weds), Eurozone CPI (Thurs), US Manufacturing ISM (Fri), US Jobs Report (Fri), OPEC+ Meeting (3rd-4th June), RBA Meeting (6th June), Bank of Canada Meeting (8th June), US CPI (13th June), China Activity Data (15th June), US FOMC Meeting (15th June), Fed Chair Powell Speaks (15th June), US Retail Sales (15th June), ECB Meeting (15th June), BoJ Meeting (16th June), Bank of England Meeting (22nd June), Singapore CPI (23rd June).

SGD levels to watch (support / resistance): 1.3344, 1.3377 / 1.3590, 1.3619