• USD upswing. Market pricing for the US Fed has shifted substantially over recent weeks. This is supporting the USD. AUD hit a 2023 low overnight.

• US debt ceiling. Limited progress with the ‘x-date’ fast approaching. Ratings agencies have flagged the risk of a US sovereign rating downgrade.

• AUD underperformer. The global backdrop is weighing on the AUD. Australian retail sales released today, but offshore forces are more important

Mixed fortunes across asset markets, although underlying issues and risks such as the US debt ceiling negotiations, slowing growth, and still high inflation, remain firmly in place. US equities rose as strong results from Nvidia ignited gains across tech stocks exposed to artificial intelligence. The S&P500 ended the day ~0.9% higher, while the tech-focused NASDAQ lifted 1.7%. Elsewhere, bond yields added to their recent upswing. Yields in the UK rose another ~16-19bps across the curve, while in the US 2-year yields increased by ~16bps to 4.53%, a high since mid-March, with the 10-year now up at 3.82%.

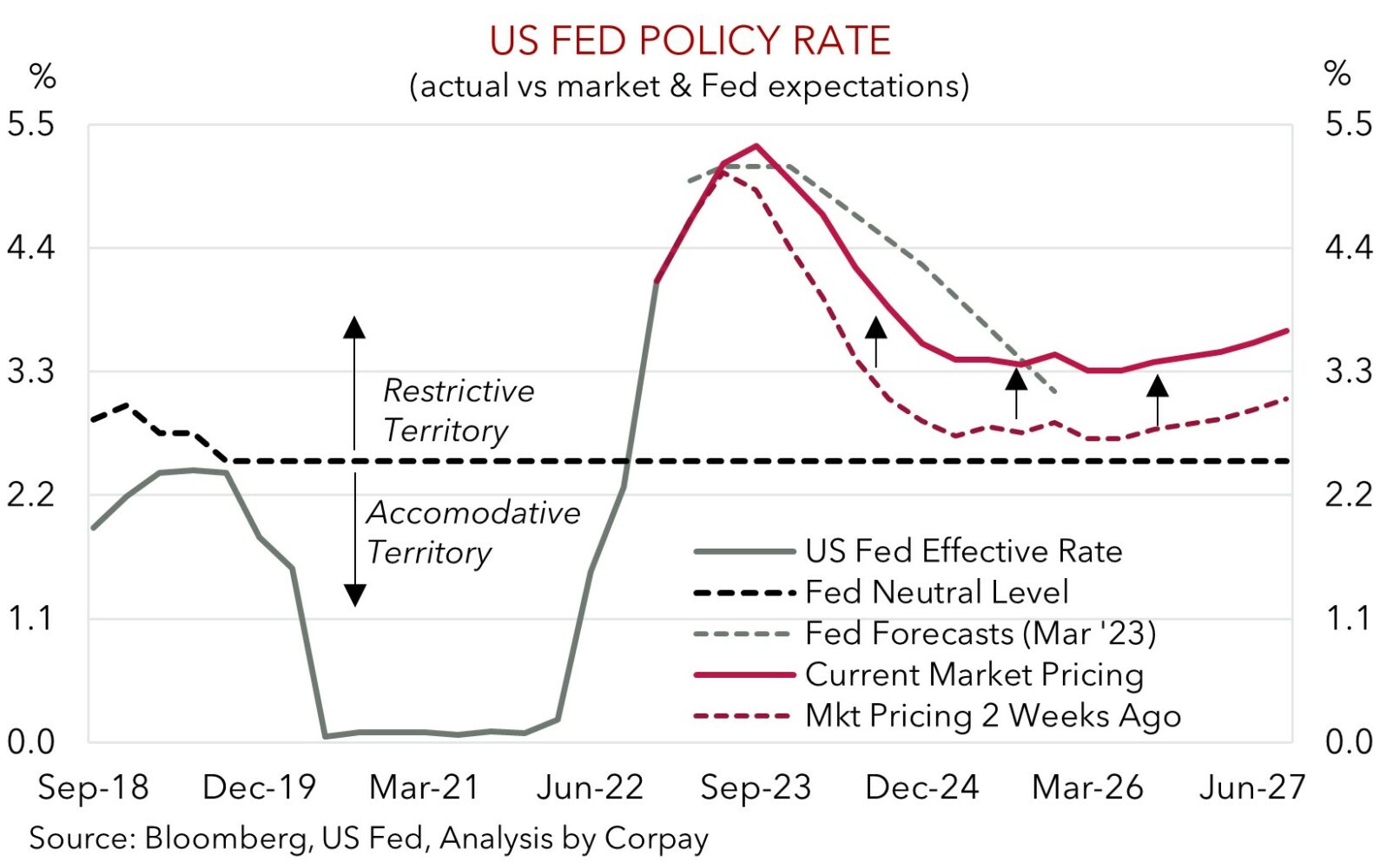

There has been a substantial change in interest rate expectations over recent weeks on the back of some solid data and ongoing inflation concerns. Indeed, overnight US weekly initial jobless claims were revised lower, illustrating that the labour market remains tight. And Q1 US GDP was revised a bit higher due to stronger consumer spending (the US economy is now estimated to have grown at a 1.3% annualized pace). Another rate hike by the US Fed is now almost fully priced in by the July meeting, while rate cut bets over H2 have been drastically pared back (the market is now only discounting ~1 Fed rate cut by January, compared to ~4 cuts priced in two-weeks ago). The Fed’s preferred inflation gauge, the PCE deflator, is released tonight (10:30pm AEST). The core measure is expected to show price pressures are sticky.

In FX, the USD extended its positive run, supported by US debt ceiling jitters and shift in interest rate assumptions. EUR and GBP drifted a little lower, while the interest rate sensitive USD/JPY has pushed above ~140 for the first time since November. NZD (now ~$0.6060) and AUD (now ~$0.6505) touched new 2023 lows. In addition to the global forces that are weighing on the AUD, the NZD is also being pressured by the adjustment in NZ interest rate and growth expectations following the RBNZ’s “dovish” hike earlier this week.

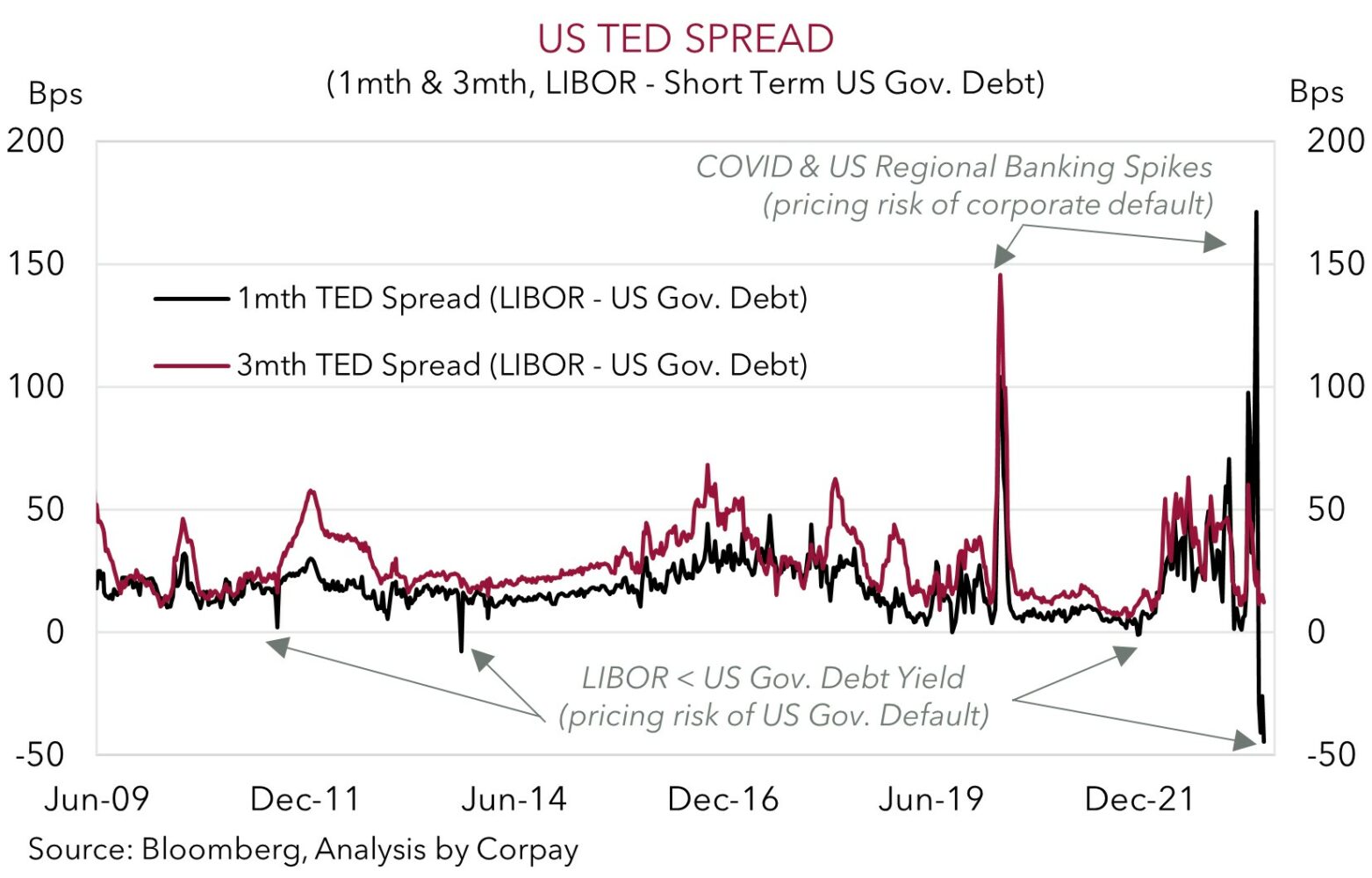

In terms of the US debt ceiling, no deal has been agreed and the clock is ticking with the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) fast approaching. Just like the August 2011 episode, the ratings agencies have started to weigh in. Fitch moved the US to “rating watch negative”, a step towards a possible downgrade to its current AAA rating, while Moody’s said that a 15 June Treasury coupon payment is critical. If it was missed, that is a default and Moody’s could downgrade the US by one notch. As we have flagged, the longer negotiations run and the closer the ‘x-date’ becomes, the higher anxiety levels (and volatility) could go, and this is typically a negative for risk assets and currencies like the AUD (see Market Musings: Dancing on the US Debt ceiling).

Global event radar: US PCE Deflator (Today), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

AUD corner

The AUD’s downturn extended overnight, with the adjustment in US interest rate expectations, upswing in global bond yields, and underlying US debt ceiling worries supporting the USD (see above). At ~$0.6505 the AUD is ~4.6% below its May high point and at its lowest level since 10 November. The AUD has also continued to underperform on most crosses, though it has nudged up against the beleaguered NZD. As noted before, we expect AUD/NZD to trend higher over the medium-term as rate hike cycles give way to other relative fundamentals such as growth, labour market trends, and current account positions (see Market Musings: Cross-Check: AUD/NZD – RBNZ: end of the line).

In today’s Asian session, April Australian retail sales data is released (11:30am AEST). The market consensus is looking for a modest 0.3% rise. We think AUD reaction to the data could be asymmetric, with a downside surprise likely to generate a relatively larger dip in the AUD as it would indicate that the RBA’s rapid fire rate hikes are gaining traction. That said, domestic influences continue to play second fiddle to global developments, with the US debt ceiling negotiations still very much in focus.

A debt ceiling deal needs to be agreed quickly given the ‘x-date’ is coming into view. The ‘x-date’ could be as early as 1 June. As shown in the chart below, market participants are nervous. The TED spread (i.e. the gap between the yield on short-dated US Government and Corporate debt) has become quite negative, implying that investors are demanding a higher risk premium to hold US government debt over the next month due to the greater perceived chance of default. The closer to the ‘x-date’ without a deal, the higher volatility could go, and this is normally an AUD negative.

On the assumption a last-minute deal is agreed once again, we continue to believe that the AUD’s rebound is unlikely to be overly pronounced. The global economy is slowing and China’s post lockdown recovery is faltering. This should be a drag on commodity demand. Concurrently, high core inflation means interest rates are likely to stay at ‘restrictive’ levels for some time. Markets have repriced, but a further adjustment in expectations to a “high for longer” view for the US Fed should keep the USD firm, in our opinion. The US PCE deflator (the Fed’s preferred inflation measure) is released tonight (10:30pm AEST).

AUD event radar: AU Retail Sales (Today), US PCE Deflator (Today), AU CPI (31st May), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June).

AUD levels to watch (support / resistance): 0.6433, 0.6485 / 0.6681, 0.6706

SGD corner

USD/SGD has continued to edge higher, and at ~$1.3550 it is within striking distance of its 2023 highs. The upswing in global and US yields, and underlying US debt ceiling concerns continue to underpin the USD (see above). We think the USD uptrend can continue in the near-term, with USD/SGD at risk of pushing through its 200-day moving average (~$1.3621), in our view.

In terms of the US debt ceiling, a deal needs to be agreed soon given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is around the corner. As we have outlined before, the longer the talks drag out, the more nervous markets could become, and this is typically USD positive.

On the proviso a debt ceiling deal is agreed, we expect markets to refocus their attention to the US/global inflation problem, Fed policy outlook, and waning global growth pulse. In our opinion, based on the high/sticky US core inflation and tight labour market, a shift by the US Fed to an easing cycle remains a long way off. In addition to the global slowdown, which is typically a drag on cyclical currencies like the SGD, we believe a further shift up in US Fed expectations should give the USD (and USD/SGD) more of a boost.

SGD event radar: US PCE Deflator (Today), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

SGD levels to watch (support / resistance): 1.3338, 1.3377 / 1.3590, 1.3623