• Negative vibes. Little progress on US debt ceiling negotiations, ongoing growth worries, & worrying UK inflation data weighed on risk sentiment.

• Stronger USD. The backdrop has boosted the USD. Base metals & equities declined. AUD dipped to ~$0.6540, its lowest level since mid-November.

• AUD pressure. Except for AUD/NZD, AUD also underperformed on the crosses. More pressure on the AUD expected, but stats show it is entering rarefied air.

Another negative night for markets with little progress on US debt ceiling negotiations, growth worries, and some ‘sticky’ inflation data weighing on risk sentiment. Running through the list, the political impasse in the US and daily reminders from Treasury Secretary Yellen that the government could run out of cash as soon as 1 June is making markets increasingly jittery. As we have flagged, the longer negotiations run and the closer the ‘x-date’ becomes, the higher anxiety levels (and volatility) are likely to go, and this is typically a negative for risk assets and currencies like the AUD which are correlated to equities (see Market Musings: Dancing on the US Debt ceiling).

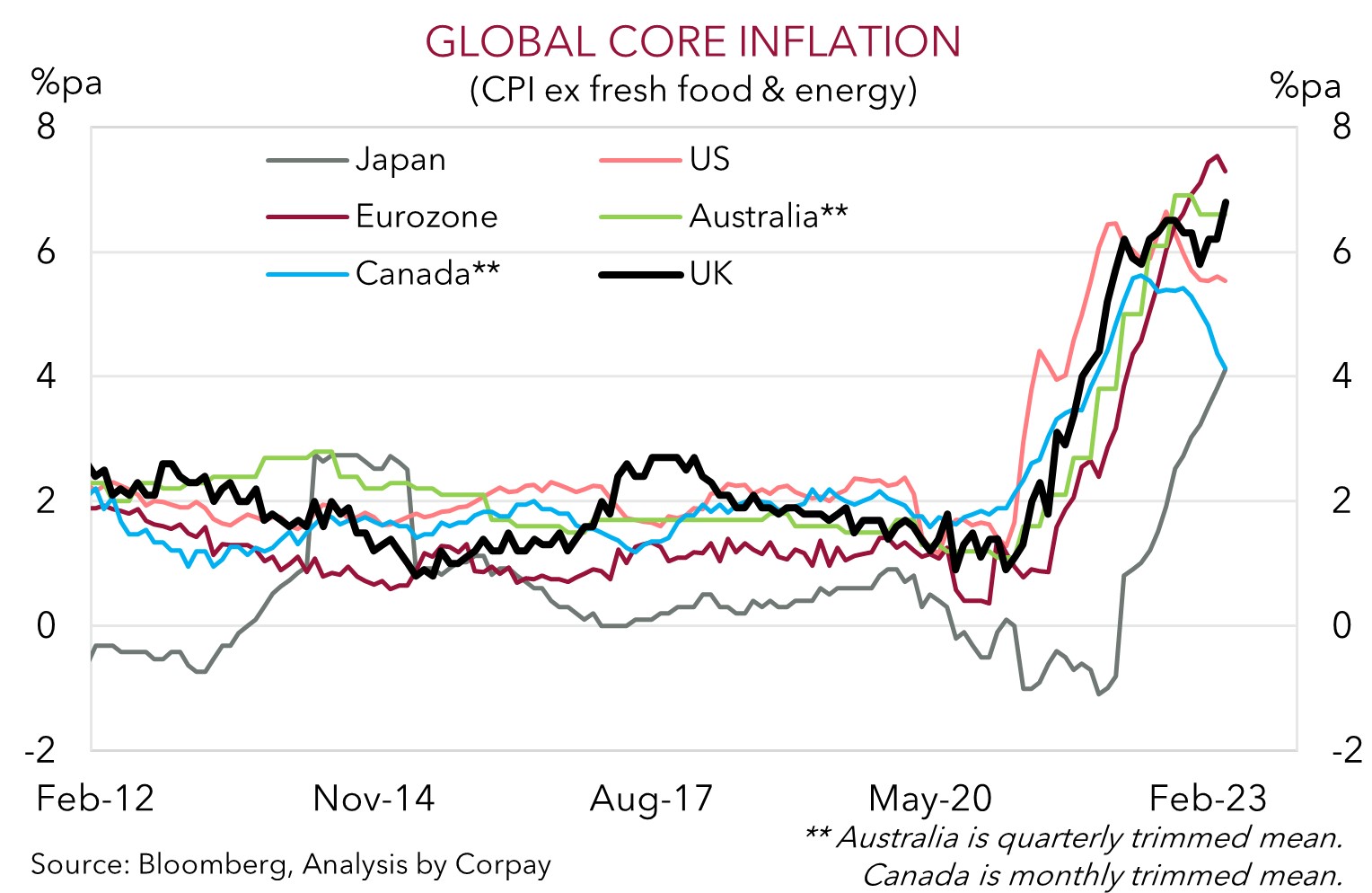

In terms of the data, on the growth-front, the German IFO survey undershot expectations. The forward-looking expectations measure dipped further below average, suggesting the Eurozone recovery is running out of steam. And importantly, in the UK, the inflation report showed some worrying trends. While headline UK CPI declined as base effects from last year’s spike in energy prices rolled out of calculations, the pullback wasn’t as large as predicted (now 8.7%pa). Core inflation, which strips out food and energy, re-accelerated, and at 6.8%pa is at a cyclical high. As our chart shows, core inflation across the major economies remains very high. This stickiness in core inflation takes time, and typically higher unemployment, to wash out of the system, and is a reason why we think market pricing looking for central banks like the US Fed to quickly turn around and start cutting rates is misplaced.

This mix saw European and US equities fall (the EuroStoxx and US S&P500 declined by 1.8% and 0.7% respectively), as did base metals. Copper, which is a real time global growth gauge given its wide-ranging uses, fell another 2.5% to be at its lowest level since early-November. Iron ore has also extended its downward run, slipping back below US$100/tonne. By contrast, bond yields rose, particularly at the front-end of the curve and in the UK where the 2-year yield jumped up ~23bps to 4.33% as another rate hike by the Bank of England was factored into the rates curve. The odds of a 50bp rise at the next BoE meeting also increased. In the US, the 2-year yield rose by 11bps to 4.38%, a high since mid-March, and the 10-year yield also lifted (now 3.74%). In FX, the risk off vibes boosted the USD. USD/JPY touched a new 2023 high, while GBP eased despite the shift up in UK yields as growth concerns came back into focus. NZD has been weighed down by yesterday’s ‘dovish’ RBNZ rate hike, with the backdrop also pressuring the AUD, which at ~$0.6540 is at its lowest since mid-November. We think the various forces at play are unlikely to fade in the near-term, and the USD is likely to remain firm.

Global event radar: US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

AUD corner

AUD has remained under pressure overnight falling by ~1% from this time yesterday to ~$0.6540, the lowest since mid-November. Except for AUD/NZD, the AUD also underperformed on the crosses. As discussed above, the lack of progress in the US debt ceiling negotiations, signs the global economy is feeling the weight of higher interest rates, and worrying trends in core inflation after the re-acceleration in the UK has unnerved markets. Given its high correlation to growth assets like equities and base metals the more negative backdrop has weighed on the AUD. We don’t think these pressures will fade in the near-term, and the AUD is likely to remain heavy.

In terms of the US debt ceiling, as we have stressed recently, a deal needs to be agreed quickly given the ‘x-date’ is fast approaching. The closer to the ‘x-date’ we are without a deal, the higher market nerves could go. As observed overnight, heightened volatility is a negative for the AUD. And on the assumption a deal is agreed, we don’t believe the rebound in the AUD will be overly large. Signs that the world economy is slowing are piling up and this is a negative for commodity demand. At the same time, sticky inflation points to rates needing to stay higher for longer than many were anticipating. A further upward shift in market pricing to a “high for longer” view for the US Fed should give the USD a bit more of a lift, in our opinion.

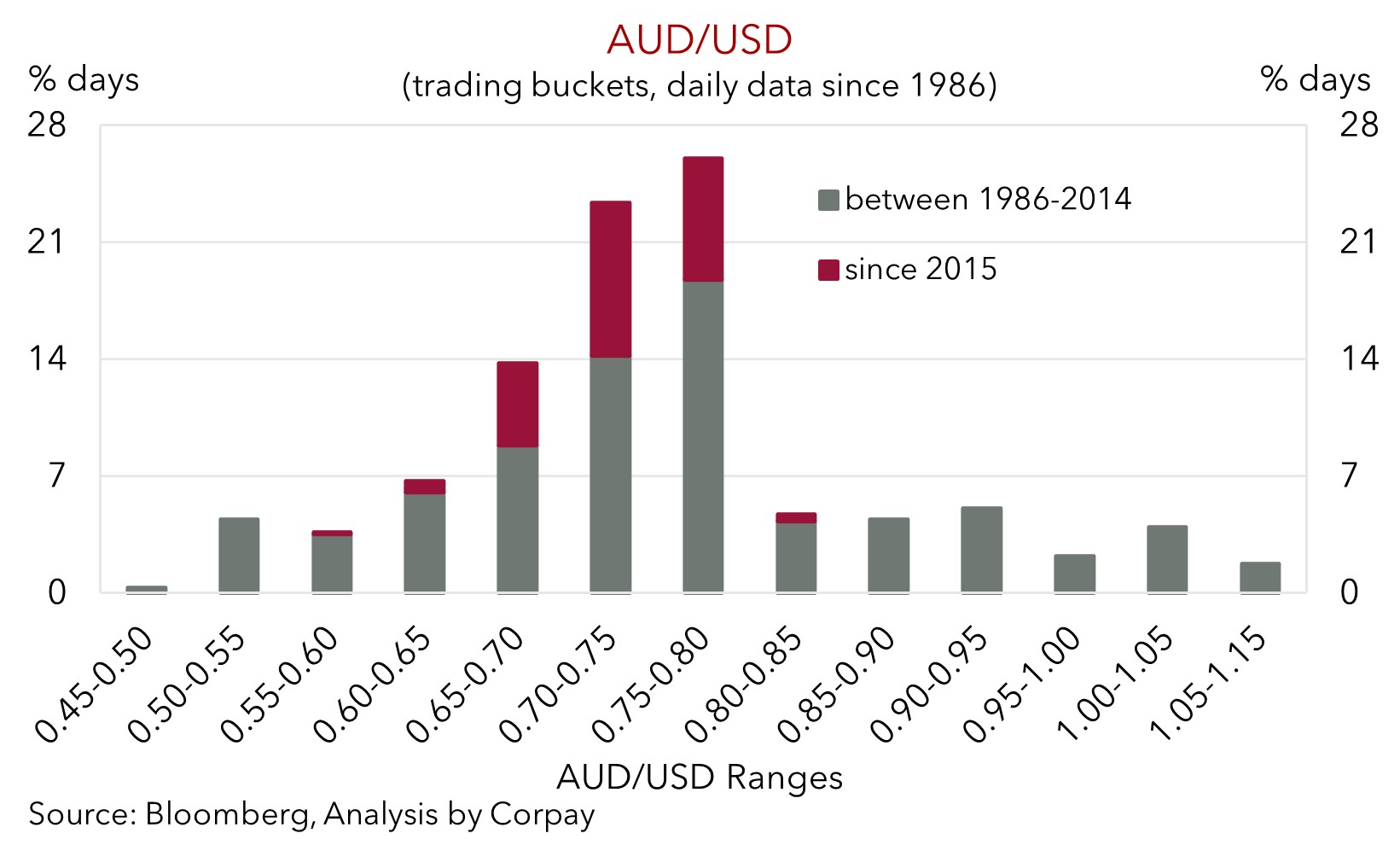

That said, we also don’t want to be overly bearish the AUD down near current levels. While we don’t see the AUD snapping back sharply, we also think that fundamentals such as Australia’s current account surplus (now ~1% of GDP) and the high level of the terms of trade should continue to act as a downside support. Indeed, as the chart shows, the AUD is in somewhat rarefied air. Since the mid-80s, the AUD has only traded sub-$0.65 ~15% of the time, and the bulk of that occurred pre-2015 when Australia’s capital flow and terms of trade dynamics were very different.

On the crosses, AUD/NZD bucked the trend, rising back above 1.07 following yesterday’s RBNZ meeting. As expected the RBNZ hiked rates by 25bps, but its forward guidance and projections strongly suggested that this was likely to be the ‘peak’ in rates. Given the tightening phase now looks to be over, markets are beginning to pay more attention to other relative differentials such as growth, labour market trends, and current account positions. On these metrics, we expect the AUD to outperform the NZD over the medium-term. For more see Market Musings: Cross-Check: AUD/NZD – RBNZ: end of the line.

AUD event radar: AU Retail Sales (Fri), US PCE Deflator (Fri), AU CPI (31st May), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June).

AUD levels to watch (support / resistance): 0.6433, 0.6510 / 0.6684, 0.6708

SGD corner

USD/SGD has drifted up towards ~$1.35 and is now only ~0.7% below its 2023 highs. As outlined above, risk sentiment soured overnight with the lack of progress around the US debt ceiling, more signs the global economy is slowing, and concerning core inflation trends rattling markets. This has boosted the USD. We think the stronger USD trend can continue in the near-term. With respect to the debt ceiling, a deal needs to be agreed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is coming into view. In our judgement, the longer the talks drag out, the more nervous markets will become, and this is typically USD positive.

On the assumption a debt ceiling deal is agreed, we expect markets to turn their attention back to the US/global inflation problem, Fed policy outlook, and the global growth pulse. In our judgement, based on the high/sticky US services inflation and tight labour market conditions, market pricing still looking for ~1-2 Fed rate cuts by January is unlikely to materialise. In addition to the slowdown in global growth, which is normally a headwind for cyclical currencies like the SGD, we think a further paring back of Fed rate cut bets is likely to give the USD (and USD/SGD) a further lift.

SGD event radar: US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

SGD levels to watch (support / resistance): 1.3337, 1.3377 / 1.3540, 1.3590