• US debt ceiling. Lack of progress has weighed on risk sentiment. US equities fell overnight and the USD added to its recent gains.

• Two-speed economy. Manufacturing PMIs in ‘contractionary’ territory, while services remain robust. The former is a negative for commodity demand & the AUD.

• RBNZ in focus. Another RBNZ hike expected today. The debate is around how big it could be (25bps or 50bps)? AUD/NZD is sub 1.06.

US debt ceiling negotiations continue to hog the headlines and the lack of progress has weighed on risk sentiment. Equity markets lost ground with the US S&P500 falling by 1.1%. Base metals also edged a bit lower (the copper price is now ~15% lower compared to this time last year). Oil prices bucked the trend with WTI Crude up over 1% after the Saudi Energy Minister fired a warning shot against speculators ahead of the upcoming OPEC+ meeting. Elsewhere, bond yields consolidated (the US 10yr yield fell a modest ~2bps to 3.69%), while in FX the USD added to its recent gains. The USD Index is near a 2-month high with EUR slipping below ~1.08, GBP down around ~1.24, and USD/JPY hovering up near its 2023 highs (now ~138.60). The negative backdrop has seen the AUD fall towards ~$0.6610.

In terms of the debt ceiling, while President Biden and House Speaker McCarthy called their talks “productive” a deal is far from complete with one meeting attendee stating that the two sides were “not anywhere near close”. Republicans continue to stand firm on no tax changes and large spending cuts, while the Democrats are looking to raise revenue and reduce spending. A deal needs to be agreed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is fast approaching. As we have outlined, the longer the negotiations drag out and the closer the ‘x-date’ becomes, the higher anxiety levels (and volatility) are likely to go, and this is typically a negative for risk assets and currencies like the AUD which are highly correlated to equities. For more see Market Musings: Dancing on the US Debt ceiling.

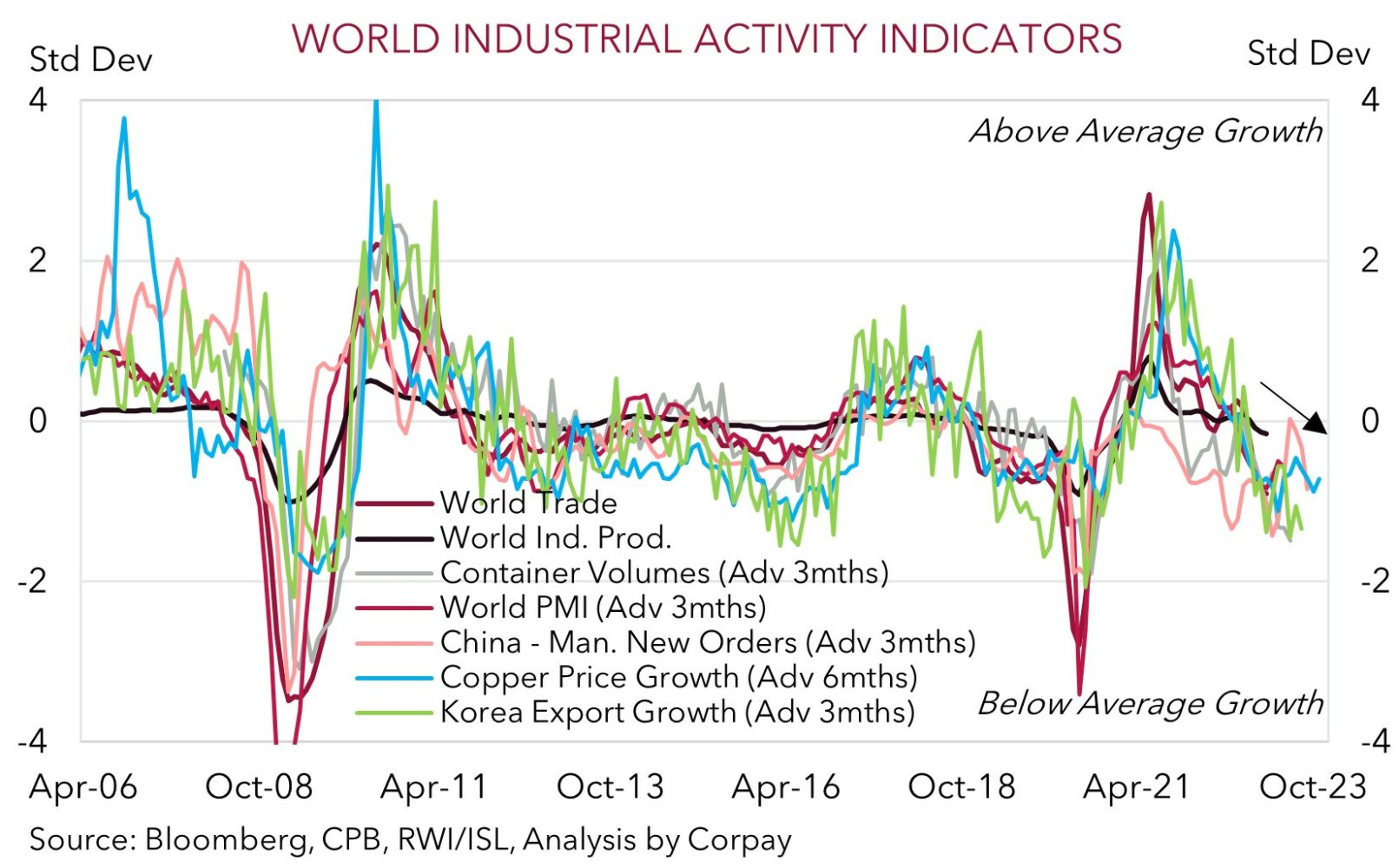

Data wise, the latest batch of US and European business PMIs were released. The data paints a picture of a two-speed economy. The US and European manufacturing gauges are in “contractionary” territory, while services continue to have positive momentum. As our chart shows, the forward-looking indicators for industrial activity, such as manufacturing PMIs, point to a step down in growth over Q2/Q3. This is normally a negative for commodity demand and cyclical currencies like the AUD. While at the same time, still strong services is an upside risk for inflation, and means central banks like the US Fed are a long way from shifting course to an easing cycle. Assuming a debt ceiling deal is reached, we believe the US Fed is unlikely to crystallise market pricing looking for ~2-3 rate cuts by January. In our view, a paring back of rate cut expectations is likely to be USD supportive. The minutes of the early-May FOMC meeting are released tomorrow (4am AEST).

Global event radar: RBNZ Meeting (Today), FOMC Meeting Minutes (Thurs), US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

AUD corner

AUD/USD has dipped back down towards ~$0.6610, and the AUD has underperformed on the crosses as the lack of progress in the US debt ceiling negotiations dampened risk sentiment (see above). As mentioned, a deal needs to be agreed quickly given the ‘x-date’ is coming into view. Some estimates put this as early as 1 June. As discussed previously, we think the longer the talks go and the closer to the ‘x-date’ we are without a deal, the higher market volatility could go. Typically, episodes of heightened volatility are a negative for the AUD.

On the assumption sanity prevails and an agreement is reached, we don’t expect the bounce back in the AUD to be overly pronounced. Various fundamentals continue to move against the AUD, and we expect downside pressure to remain in place for a while yet. Signs that global industrial activity is slowing continue to pile up. Overnight, the US and European manufacturing PMIs printed in “contractionary” territory, while earlier in the week data from South Korea (a bellwether for global trade) showed that exports fell back further in the year to May. This is an environment that should continue to pressure commodity demand, which in turn should be an AUD headwind. And as mentioned above, given the ongoing strength in services and the risks this poses to inflation, we think pricing factoring in rate cuts by the US Fed over H2 is misplaced. A shift up to a “high for longer” view should, in our opinion, see relative rate differentials move in favour of a bit more USD strength.

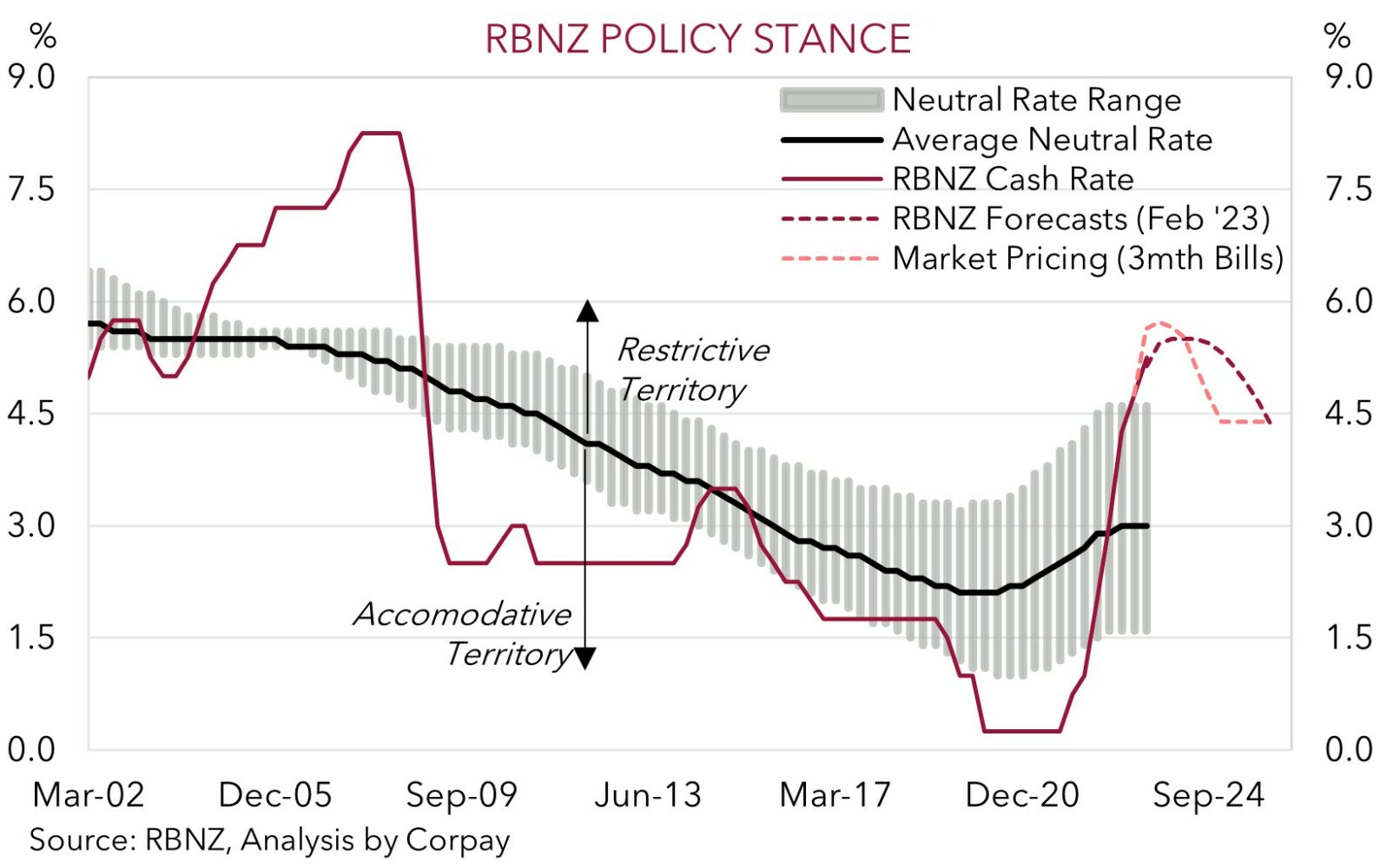

On the crosses, AUD/NZD remains sub ~1.06 with today’s RBNZ announcement (12pm AEST) and press conference by Governor Orr (1pm AEST) in focus. The debate is centered on how big the RBNZ could hike rates. We (and the market consensus) think a 25bp rise is more likely, which would take the OCR up to 5.5%, however a bigger lift can’t be ruled out as NZ’s fiscal picture and pick up in net migration means there is more work to do to tame inflation. We also believe the RBNZ could signal an ongoing tightening bias by lifting the peak in its Official Cash Rate forecast track. Another RBNZ hike and ‘hawkish’ rhetoric is expected to keep AUD/NZD under pressure. However, over the medium-term we continue to see AUD/NZD rebounding as focus shifts away from rate hikes to other fundamentals. The RBNZ’s aggressive actions should generate a larger hit to the NZ economy.

AUD event radar: RBNZ Meeting (Today), FOMC Meeting Minutes (Thurs), AU Retail Sales (Fri), US PCE Deflator (Fri), AU CPI (31st May), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), AU GDP (7th June), RBA Gov. Lowe Speaks (7th June), Bank of Canada Meeting (8th June).

AUD levels to watch (support / resistance): 0.6565, 0.6595 / 0.6685, 0.6708

SGD corner

USD/SGD has ticked up slightly towards ~$1.3470, the top end of the range it has occupied since mid-March. The higher than predicted Singapore inflation data, with core CPI remaining at 5%pa in April due to tourism-related items generated little impact on the SGD. External forces continue to dominate. As discussed above, the US debt ceiling negotiations remain in focus, and the lack of progress weighed on risk sentiment overnight. A deal needs to be agreed quickly given the ‘x-date’ (i.e. when the US won’t be able to pay an upcoming obligation) is fast approaching. In our judgement, the longer the talks drag out, the more nervous markets could become, and this is typically a positive backdrop for the USD.

On the proviso a debt ceiling deal is reached, we expect markets to turn their attention back to the US inflation problem and Fed policy outlook. In our opinion, based on the high/sticky US services inflation and tight labour market conditions, market pricing looking for ~2-3 Fed rate cuts by January is unlikely to materialise. In addition to the unfolding slowdown in global growth, which is normally a drag on cyclical currencies like the SGD, we think an unwind of the Fed rate cut expectations is likely to give the USD (and USD/SGD) some further support.

SGD event radar: FOMC Meeting Minutes (Thurs), US PCE Deflator (Fri), China PMIs (31st May), Eurozone CPI (1st June), US Jobs Report (2nd June), RBA Meeting (6th June), Bank of Canada Meeting (8th June).

SGD levels to watch (support / resistance): 1.3336, 1.3377 / 1.3500, 1.3540