• Shaky sentiment. Renewed market wobbles as Middle East tensions were compounded by higher bond yields. Stocks fell & the USD was a little firmer.

• AUD vol. AUD whipped around. Gains on the back of the better than expected China data & ‘hawkish’ tone from the RBA unwound overnight.

• Upcoming events. AU jobs report released today. US jobless claims are due tonight, but more focus will be on a speech by Fed Chair Powell.

Some renewed wobbles in markets overnight with Middle East tensions compounded by another move up in bond yields. Stocks retreated (US S&P500 -1.3%), while oil (WTI crude +1.9%) and gold (+1.4%) rose after Iran stepped up its rhetoric against Israel following the tragic explosion at a Gaza hospital which also triggered the cancellation of a summit between Arab leaders and US President Biden. Bond yields ratcheted up again with a ~15bp jump in the UK 10yr rate (now ~4.65%) leading the charge following a slight upside surprise in the latest UK CPI inflation data. UK core inflation eased to 6.1%pa, its slowest pace since January, but markets were predicting a bit more of a pull-back. We doubt the UK CPI result will see the BoE raise rates again given slowing UK growth, loosening in the labour market, and with the broader disinflation trend still intact. US bond yields increased with the ~7bp lift in the 10yr rate (now ~4.91%) steepening the curve. The US 10yr yield is now at its highest level since mid-2007. Markets are assigning a ~37% change the US Fed hikes rates once again by year-end.

In FX, the USD is a touch stronger on the back of safe-haven demand with EUR (now ~$1.0536) and GBP (now ~$1.2142) slipping back to where they were trading earlier this week. The interest rate sensitive USD/JPY has ticked up towards ~150, the level that has typically led to rhetoric from Japanese officials about excessive JPY weakness. USD/SGD has followed the broader USD trend to be back near the top-end of its October range. The AUD (now ~$0.6337) has given back a little ground with yesterday’s intra-day strength following the better-than-expected Chinese data batch unwinding (see below).

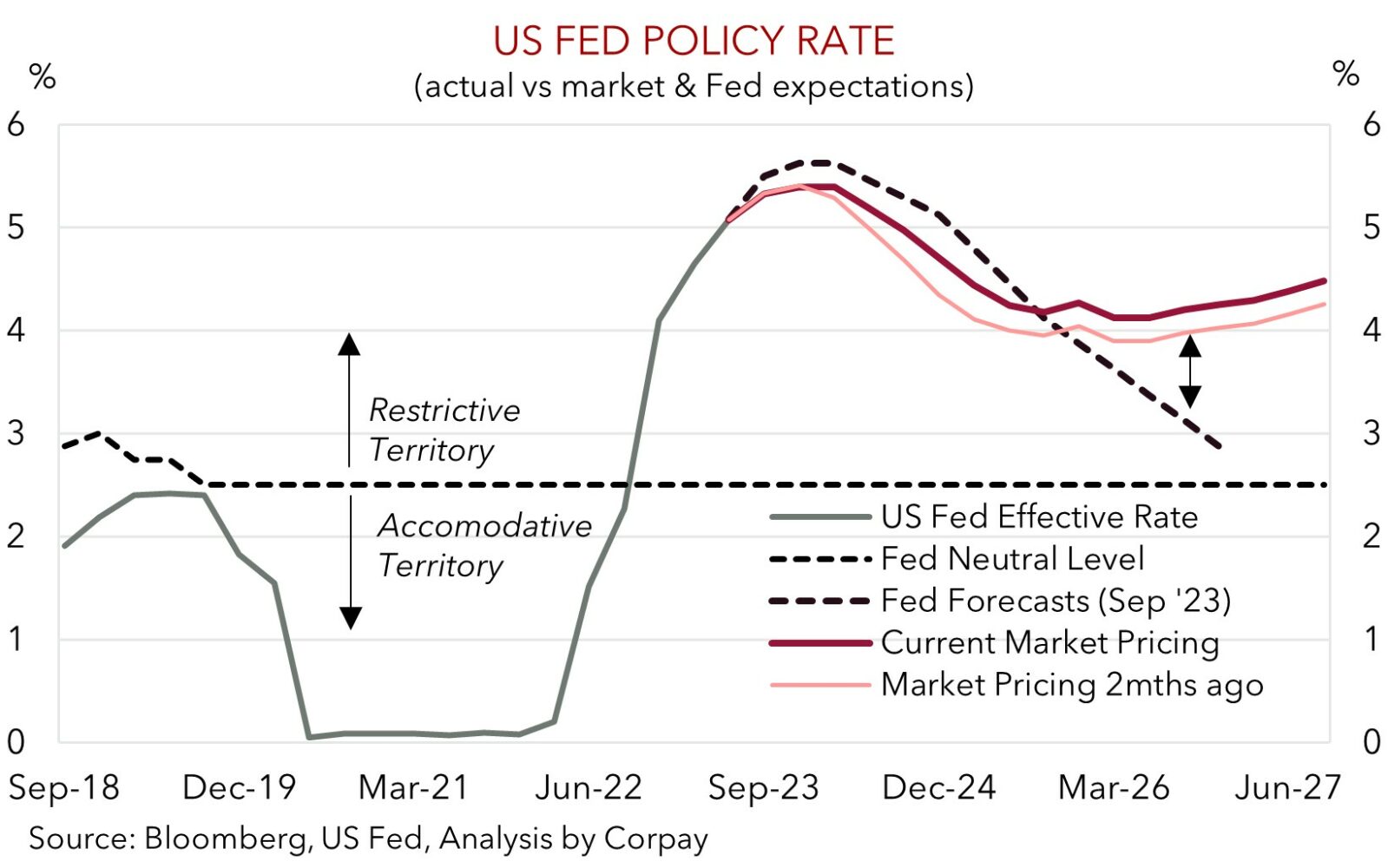

In addition to the unfolding Middle East developments market attention will be on tonight’s speech by US Fed Chair Powell (3am AEDT). Over the past few days, the US data has positively surprised with retail sales and industrial production better than predicted. Yet despite this, the heightened geopolitical risks, and higher US bond yields, while the USD was slightly firmer overnight it hasn’t pushed on to fresh highs. The USD index is hovering around its October average. This lack of follow through continues to make us think that a lot of positives are already baked into the USD, and there are uneven risks at such lofty heights. As our chart shows, the markets interest rate assumptions remain more ‘hawkish’ than the Fed’s view, a sign that a ‘higher for longer’ outlook is well priced. As such, we believe a repeat of previous comments by Chair Powell that the Fed can ‘proceed carefully’ from here, which has been a central theme of several other Fed members that have spoken recently, may underwhelm built-up expectations, dragging on the USD. Although a lot will also depend on news out of the Middle East.

AUD corner

The AUD has been whipped around over the past few sessions. The hard-fought gains over recent days on the back of the more ‘hawkish’ tone from the RBA which has bolstered expectations of another near-term rate hike and better than forecast China data was more than offset by a renewed bout of risk aversion overnight (see above). After rising towards ~$0.64 the AUD shed ~0.9% to be back where it was tracking earlier in the week (now ~$0.6337).

Developments in the Middle East and broader risk sentiment will be important for near-term AUD direction. But as discussed before given already stretched negative AUD positioning (as measured by CFTC futures); the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); and the low levels the AUD is already trading at (since 2015 the AUD has only traded below $0.63 ~1% of the time), we think that barring a sharp escalation in the conflict further AUD weakness on this factor alone may be hard to come by. When this level of extreme positioning is in place it often doesn’t take much of a change in sentiment for the AUD to bounce back. And this is where we think the fundamentals are moving.

As mentioned, the China activity batch exceeded predictions supporting our thoughts the economy has passed its cyclical bottom. China’s GDP grew by 1.3%qoq. Consumer spending was stronger with retail sales growth accelerating. Industrial production was also firmer. The virtuous cycle policymakers have tried to engineer is starting to gain traction, and more measures aimed at reinforcing the upswing may be forthcoming. This typically bodes well for the cyclical AUD down the track.

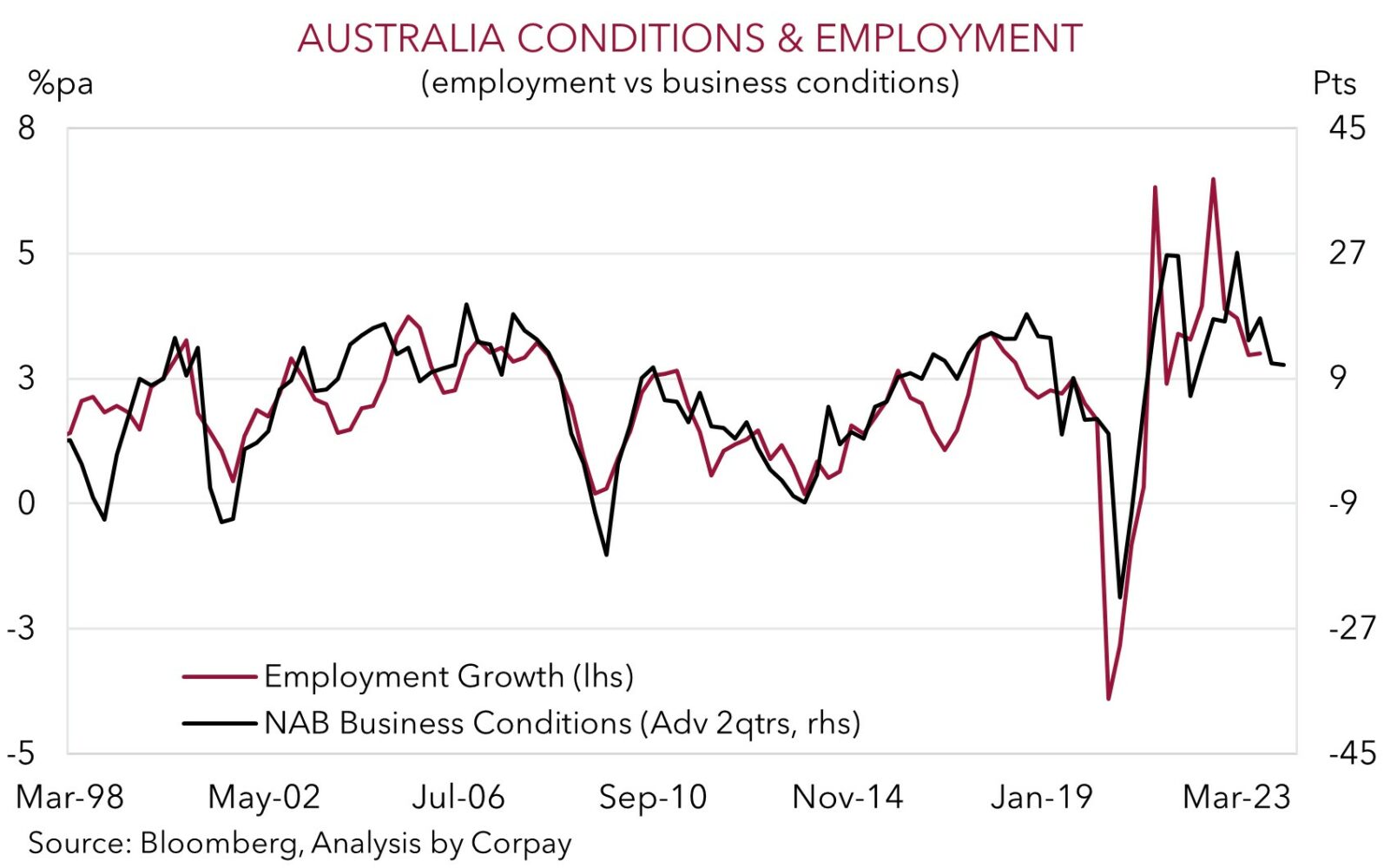

Domestically, comments from the RBA have amped up thoughts that another rate rise may be on the horizon. The minutes of the October meeting indicated the Board has “a low tolerance for a slower return of inflation to target than currently expected”, and when speaking yesterday Governor Bullock stated “there’s a few things that are suggestive that it’s going to be difficult to get inflation down”. In our judgement, it may not take much of a positive surprise in the Q3 CPI (released 25 October) to get the RBA over the line, particularly if today’s labour report shows solid job creation and a low unemployment rate (11:30am AEST). As shown, forward indicators such as business conditions point to still decent employment growth. A simmering down of market volatility, coupled with a solid Australian jobs report, and/or a repeat of the previous ‘proceed carefully’ message by Fed Chair Powell tonight could give the AUD some renewed near-term support if the USD loses ground (see above). More broadly, we are also forecasting the rebound in AUD/EUR and AUD/GBP to continue over the next few months as various drivers move in the AUD’s favour (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

AUD levels to watch (support / resistance): 0.6240, 0.6280 / 0.6400, 0.6434