• Market divergence. Equities under pressure, oil & gold higher. Long end yields rose, but the US 2yr rate fell as Fed rate hike bets were pared back.

• Fed speak. Chair Powell reiterated his ‘cautious’ stance, disappointing recently built up expectations. The USD lost some ground after he spoke.

• AUD vol. AUD has traded in a ~1% range. AU jobs data mixed, but conditions still tight. CPI next week. This could make or break the case for another RBA hike.

Markets continue to be whipped around with Middle East developments, equity earnings results, and comments by US Fed Chair Powell generating volatility and diverging asset class performance over the past 24hrs. Risk sentiment has generally remained under pressure with equities extending their negative run. The S&P500 shed another 1% with falls recorded across most sectors and mega-cap Tesla tumbling ~10% following a disappointing update. Across commodities, oil prices edged higher again (WTI crude +2.5%), as did gold (+1.4%). Israel is reportedly continuing to prepare for significant ground operations in Gaza with President Biden’s trip and the US’ diplomatic efforts not providing enough confidence tensions will simmer down.

Across bonds, US long-end yields continued to move higher (the 10yr rose ~7bps to 4.99%), however the US 2yr rate fell ~6bps (now 5.16%) as markets pared back expectations about further near-term rate hikes by the US Fed following Chair Powell’s speech (see below). Interest rate markets are assigning little chance the Fed moves at the early-November meeting, with odds of a hike by year-end now sitting at ~26% (down from ~40% yesterday). The downshift has offset the risk backdrop with the USD giving up some ground late in the US session. EUR has edged up towards ~$1.0580, and although GBP (now ~$1.2140) has picked up from its intra-day lows USD/JPY has consolidated near ~149.80. USD/SGD has drifted a touch lower, in line with the broader USD moves, and the AUD (now ~$0.6330) has clawed back ground after being under pressure post the Australian labour market stats to be little changed from this time yesterday.

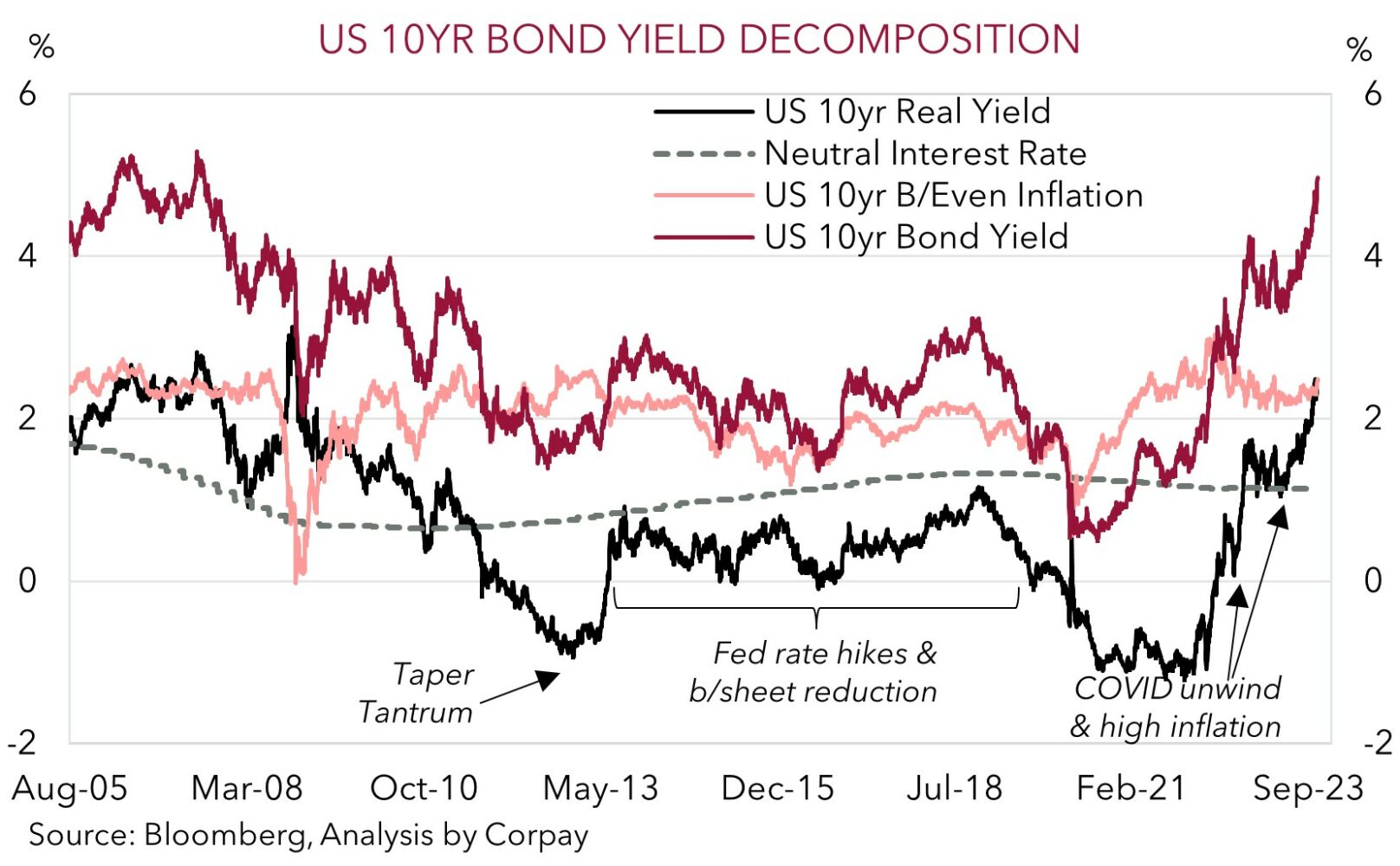

In terms of his remarks, despite various upside data surprises Fed Chair Powell rehashed past rhetoric, reiterating that “given the uncertainties and risks, and how far we have come, the committee is proceeding carefully”. And while ongoing resilience in growth and labour demand “could put further progress on inflation at risk and could warrant further tightening of monetary policy” this is still far from assured based on the lags policy changes work with and the “meaningful tightening in the pipeline”. Indeed, Chair Powell also echoed remarks from other Fed members that the tightening in financial conditions and rise in bond yields may mean there is “less need to hike”. As our chart shows, real yields in the US have jumped up well into “restrictive” territory. This is a key policy transmission channel in the US as the tightening influences credit flows, investment decisions, and in time the labour market, growth, and inflation. A lot will depend on news out of the Middle East and risk sentiment, but in our view, from a macro standpoint the USD could lose steam as markets continue to adjust probabilities of additional Fed action. As we have been arguing market interest rates have been more ‘hawkish’ than the Fed’s view, a sign a ‘higher for longer’ outlook was already well priced in the USD.

AUD corner

Looking at the level of the AUD it would be easy to think that nothing much has happened over the past 24hrs, but this masks the intra-day volatility that has come through. While the AUD is little different from this time yesterday (now ~$0.6330) it has traded in a near 1% range with shaky risk sentiment and a negative take on the Australian labour market data counteracted by the slip in the USD following Fed Chair Powell’s cautious comments (see above). On the crosses, the AUD, on net, is fairly steady, though AUD/EUR (which has slipped under ~0.60) is one pair that hasn’t bounced back. That said, over the period ahead we continue to see AUD/EUR rebounding as various fundamentals shift in the AUD’s favour (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

Locally, the Australian labour report was a mixed bag, though we think markets were too focused on a few headline figures rather than the underlying story. Employment, which has been volatile recently, was softer with ~6,700 jobs added. Jobs growth has slowed slightly with the 3-month average run-rate moderating from 30,000/mth in Q2 to still above average 23,000/mth pace. Full-time jobs were lost with part-time employment picking up in September. This shows that although employers are less willing to provide hours, they are not yet reducing headcount.

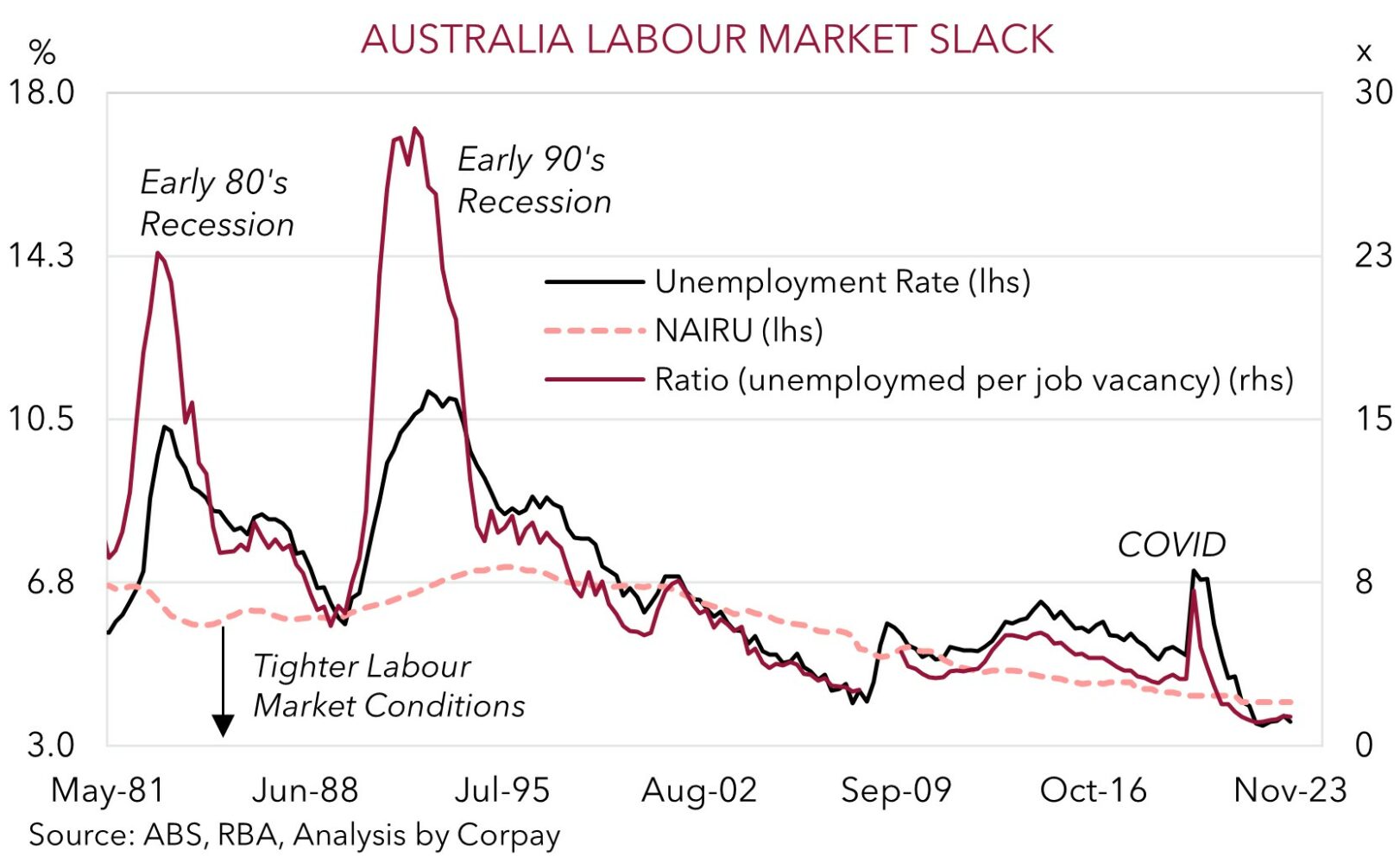

While the labour market is no longer tightening, it isn’t loosening either. This can be seen via the unemployment which at 3.6% is little changed from a year ago. Notably, things appear to be tracking a bit better than where the RBA was assuming with the continued tightness (as shown by unemployment below the equilibrium NAIRU estimate) set to keep the pressure on wages and in turn services/core inflation. In our opinion, the labour market cracks need to widen for the RBA to be confident upside inflation risks have been extinguished. Q3 CPI is released next Wednesday. That will make or break the case for another RBA hike as soon as the 7 November meeting. As things stand, we think core inflation could come in above the RBA’s forecasts.

Events in the Middle East and how they impact risk sentiment will be important for near-term AUD direction. But as discussed previously based on already stretched negative AUD positioning (as measured by CFTC futures); the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); and the low levels the AUD is already trading at (since 2015 the AUD has only traded below $0.63 ~1% of the time), we think that barring a sharp escalation in the conflict the AUD should find solid support around current levels. The fundamental drivers for the AUD to grind higher into year-end remain in place, in our view. Momentum in China’s economy is turning the corner, and relative yield spreads could become more favourable if US Fed expectations are trimmed and/or the RBA crystallises its tightening bias.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6410, 0.6434