• Negative vibes. Equities lost more ground on Friday. Bond yields also dipped, with oil, gold, & the USD consolidating. Middle East developments remain in focus.

• AU CPI. Q3 inflation due Wednesday. Quarterly growth in core inflation looks set to step up. A lift could bolster expectations about another RBA rate hike.

• Event radar. In addition to AU CPI, RBA Gov. Bullock speaks (Tues & Thurs). The BoC & ECB meet, & in the US Q3 GDP & the PCE deflator are due.

Markets ended last week on a weaker footing with developments in the Middle East continuing to dampen risk sentiment. Although noticeably not all asset markets reacted equally on Friday. Equities continued to lose ground with the US S&P500 down another 1.3%. Following its recent retreat the S&P500 is in negative territory for October, which if sustained will make it 3 straight monthly declines, something that hasn’t happened since Q1 2020. In a break from its trend bond yields also fell as investors, attracted to the higher returns on offer, shifted towards fixed income assets. The US 2yr and 10yr rates drifted back ~8bps to 5.07% and 4.91% respectively. That said, even after accounting for Friday’s move the US 10yr still ended last week ~30bps higher (the largest weekly increase in the US 10yr yield since April 2022). Oil and gold prices consolidated with WTI crude slipping back -0.3% to just over US$88/brl.

In FX, the USD is little changed, with EUR nudging up towards ~$1.06, GBP a touch higher (now ~$1.2157) and USD/JPY hovering just under ~150 despite weekend media reports flagging that the Bank of Japan has begun to discuss the possibility of another tweak to its Yield Curve Control settings as soon as the 31 October meeting. The AUD has stabilised above ~ $0.63 with the latest dip in equities generating limited reaction.

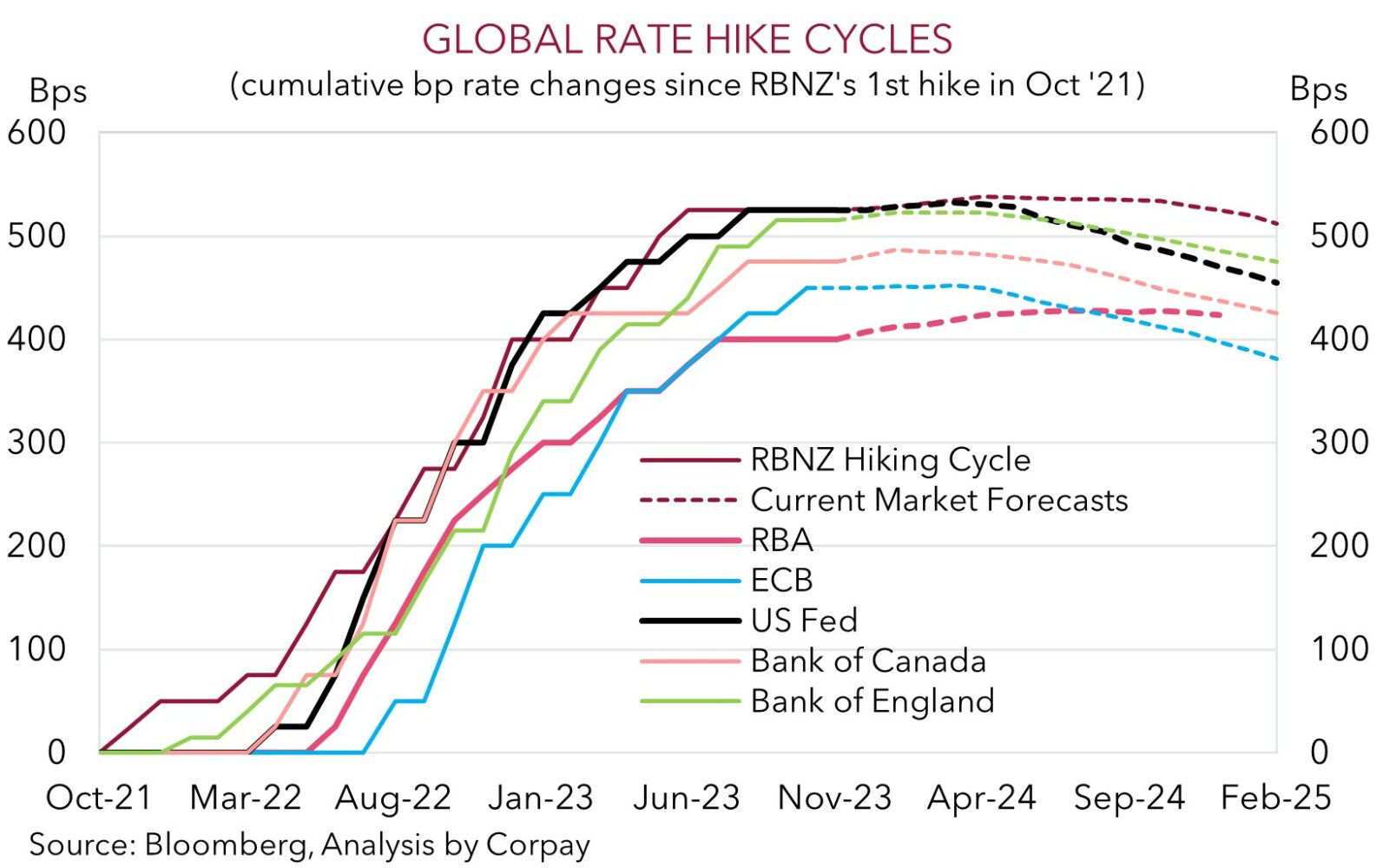

Economically it is a quiet start to the week with no major events/data scheduled. Though there are a few offshore events coming up to keep an eye on including the latest batch of European and US business PMIs (Tues/Weds AEDT), monetary policy decisions by the Bank of Canada (Thurs morning AEDT) and ECB (Thurs night AEDT), Q3 US GDP (Thurs AEDT), and the US PCE deflator (the Fed’s preferred inflation gauge) (Fri AEDT). No policy changes are anticipated from the BoC or ECB, though the ‘higher for longer’ mantra and optionality of another move if needed is likely to be reiterated. In the US GDP growth is forecast to have (temporarily) re-accelerated thanks to increased consumer spending, but core inflation pressures look set to ease. This mix, coupled with the events in the Middle East and any negative spillovers into risk appetite can keep the USD firm over the near-term, in our view.

Although with US financial conditions tightening, comments from various US Fed officials suggesting another rate hike is far from locked-in, the US’ relative outperformance unlikely to last, and with ‘long’ USD positioning stretched, we believe a lot of positives are already factored into the USD. In our judgement, barring an escalation in the Middle East conflict, over the medium-term we see more downside than upside potential for the lofty USD.

AUD corner

In the face of another negative day across global equity markets as Middle East developments continue to rattle nerves (see above) the AUD held up fairly well and consolidated just above $0.63 on Friday. On the crosses, the AUD eased back by ~0.2-0.3% against the EUR, JPY, GBP, CAD, and CNH, though AUD/NZD bucked the trend with the pair (now ~1.0840) near edging up to its highest level in ~1-month.

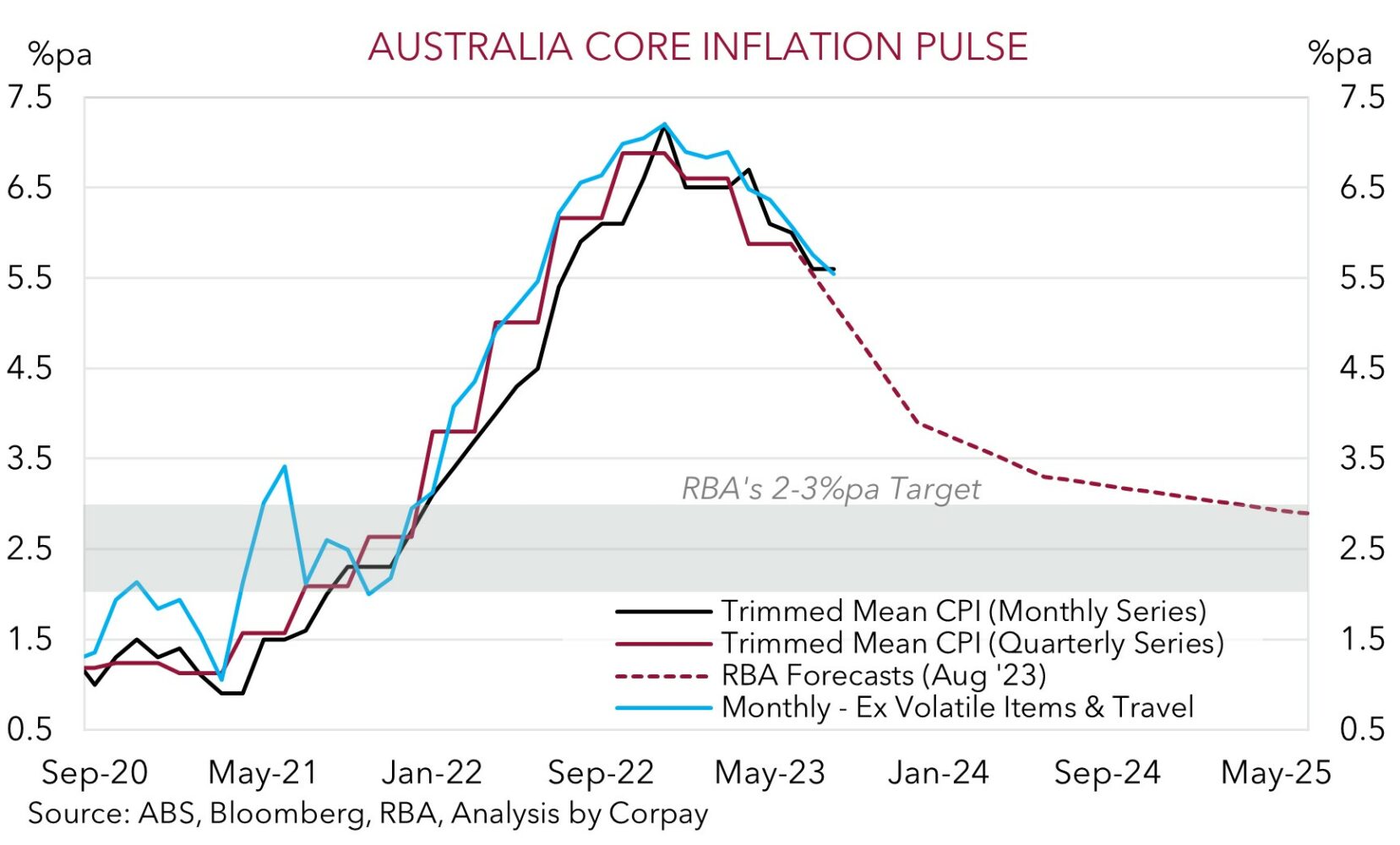

Locally, it is an important economic week with Q3 CPI inflation due (Weds), new RBA Governor Bullock giving her first speech in the top job (Tues), and the Governor also testifying to the Senate Economics Committee (Thurs). On an annual basis, thanks to positive base-effects as last year’s large increases roll out of calculations, inflation is set to have slowed in Q3, however the near-term pulse rate is likely to have quickened with quarterly growth forecast to have stepped back up. Higher petrol and energy prices should boost headline inflation, while the upswing in rents and other services prices given the tightness in the labour market looks set to boost sticky core inflation. Core inflation is projected to rise by 1.1%qoq in Q3, which is above the RBA’s forecasts. If realised, this may bolster the case for another rate hike as soon as the 7 November meeting, in our view, particularly given the more ‘hawkish’ undertones in recent RBA commentary about the lingering inflation risks.

An upward shift in RBA rate hike expectations on the back of firmer domestic inflation pressures should give the beleaguered AUD some support, particularly on the crosses, but it may by more of a slow grind against the USD which we believe may remain firm near-term (see above). Over the period ahead we see AUD/EUR and AUD/GBP rebounding as various fundamentals shift in the AUD’s favour (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning), and as discussed before barring a sharp escalation in the Middle East conflict we think the fundamental drivers for AUD/USD to drift higher into year-end are moving into place. Negative AUD positioning (as measured by CFTC futures) is now very stretched, suggesting a lot of ‘bad news’ is already in the price; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; momentum in China’s economy is turning the corner; and relative yield spreads could become more favourable if US Fed expectations are trimmed and/or the RBA crystallises its tightening bias.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6403, 0.6434

SGD corner

USD/SGD has consolidated near the top end of its October range (now ~1.3725) with the negative risk sentiment stemming from Middle East developments supporting the USD and keeping cyclical currencies like the SGD on the backfoot (see above). On the crosses, EUR/SGD (now ~1.4543) has edged back up recently with the pair tracking above its 200-day moving average for the first time in ~1-month. SGD/JPY has drifted slightly lower, though at ~109.15 it remains historically high.

The September reading of Singapore inflation is released today, but barring an outsized surprise we doubt it will move the needle on USD/SGD given the geopolitical tensions still firmly in the markets focus. The backdrop, a re-acceleration in US GDP growth (Thurs), and no change by the ECB (Thurs) should keep the USD (and USD/SGD) firm in the near-term, in our opinion. That said, over the medium-term, give the improvement in China’s economic momentum, with a ‘higher for longer’ US Fed outlook already looking well factored in, and with the US’ relative economic strength set to fade, we continue to see the USD and USD/SGD easing back from elevated levels over the medium-term.

SGD levels to watch (support / resistance): 1.3630, 1.3670 / 1.3764, 1.3801