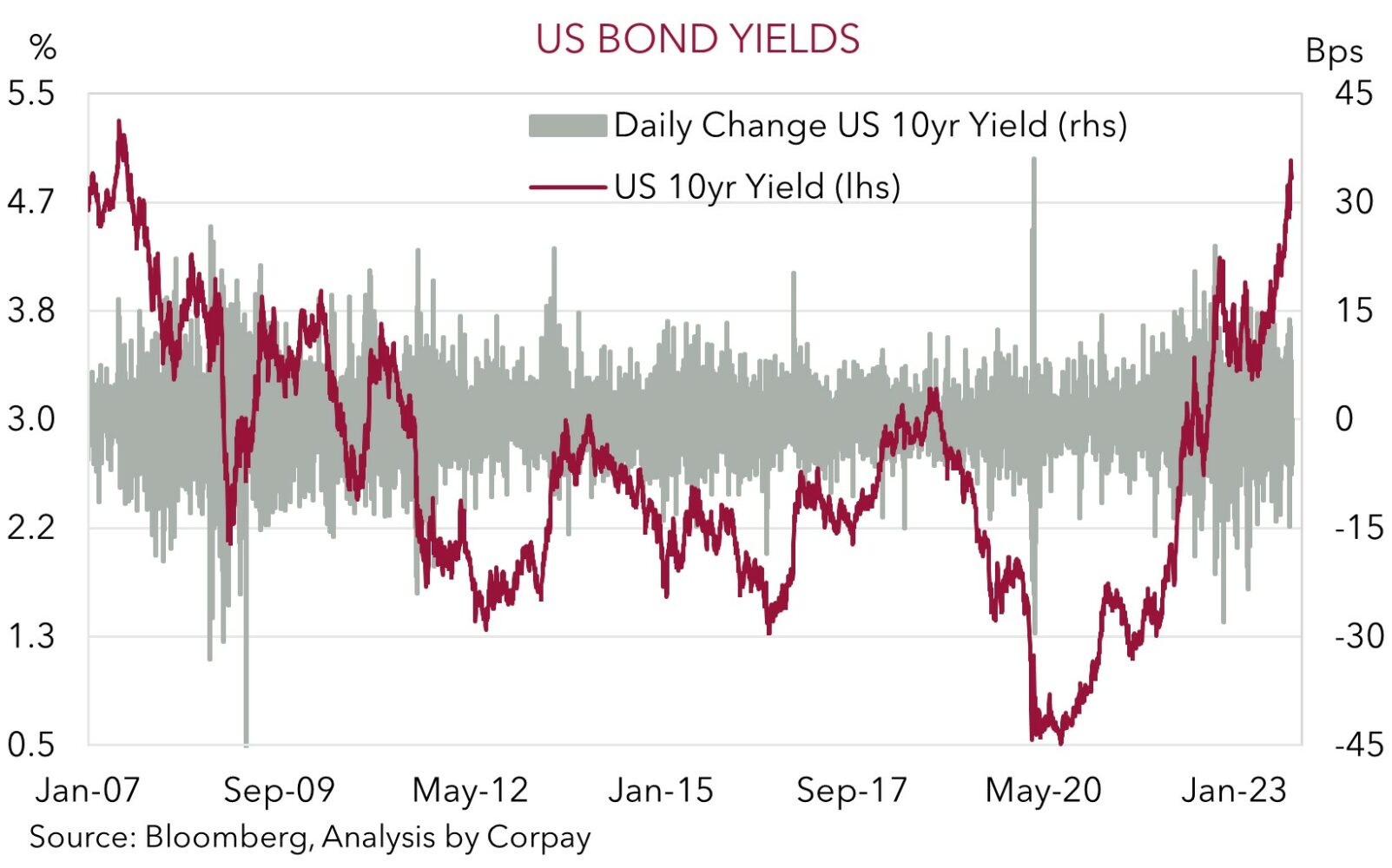

• Bond gyrations. Large swings in US bond yields generated volatility across other asset markets. On net US yields fell & this dragged down the USD.

• AU events. Ahead of tomorrow’s Q3 CPI data, new RBA Governor Bullock speaks tonight. Will Governor Bullock maintain the more ‘hawkish’ tone?

• Global data. The latest batch of Eurozone, UK & US PMIs are due today. The PMIs will provide an update on the pulse of activity & price pressures.

Another bout of bond market volatility cascaded through other asset classes overnight. There was little new news or data to rattle nerves or shift the economic outlook, but bonds still went on a wild ride. The benchmark US 10yr rate poked its head above 5% for the first time since 2007 during European trade, which in turn supported the USD and dampened risk sentiment. However, yields swiftly reversed course with the US 10yr rate ending the day down at ~4.84%. It is unclear what drove the unwind, though the elevated yields on offer no doubt attracted some investors, particularly given the outlook for slower growth and with central banks at or very close to the end of their rate hiking cycles.

The retreat in bond yields helped cushion the impact on US equities with the S&P500 ending the day down just -0.2%. The USD also gave back ground with EUR rising by ~0.7% to over $1.0660 (near a ~1-month high), and USD/JPY slipped back modestly (now ~149.70). GBP also bounced back (now ~$1.2246), while USD/SGD tracked the broader USD moves lower with the pair near a ~2-week low (now ~1.3670). AUD was whipped around trading in a near ~1% range over the past 24hrs. But on net, the AUD has ticked up relative to this time yesterday (now ~$0.6333).

Offshore, the latest batch of Eurozone (7pm AEDT), UK (7:30pm AEDT), and US (12:45am AEDT) business PMIs are due today, as is the ECB lending survey (7pm AEDT) and the rest of the UK jobs report (5pm AEDT). The PMIs will provide an update on the pulse of activity and price pressures. The US’ relative economic outperformance has been a pillar behind the USD’s strength (and EUR’s weakness) over the past few months. The US economy exceeded expectations in Q3 but a range of leading indicators, the tightening in monetary/financial conditions, and depleted pool of ‘excess savings’ suggests this was as good as it gets and that growth should slow into year-end. In our view, further stabilization or a slight pickup across the Eurozone PMIs, combined with some softening in the US measures (particularly on the services side) could exert a bit more downward pressure on the USD, though a lot will also depend on Middle East developments. As we have been arguing, from a macro perspective, a ‘higher for longer’ US Fed interest rate outlook looks well priced, and a lot of positives appear baked into the USD. Barring an escalation in the Middle East conflict we see more downside than upside potential for USD over the medium-term.

AUD corner

Swings in US bond yields and the USD generated another bout of intra-day AUD volatility. The AUD traded in a near 1% range over the past 24hrs, but the pull-back in yields and the USD during the US trading session helped the AUD more than recover earlier lost ground. On net the AUD is ~0.3% higher (now ~$0.6333) compared to this time yesterday. On the crosses the AUD has been mixed. Modest gains have been recorded against the JPY and CAD, while the AUD has underperformed the EUR and GBP by 0.4-0.5%. AUD/EUR (now ~0.5937) has drifted towards its lowest level since early-September, and AUD/GBP is down near its 50-day moving average (~0.5167).

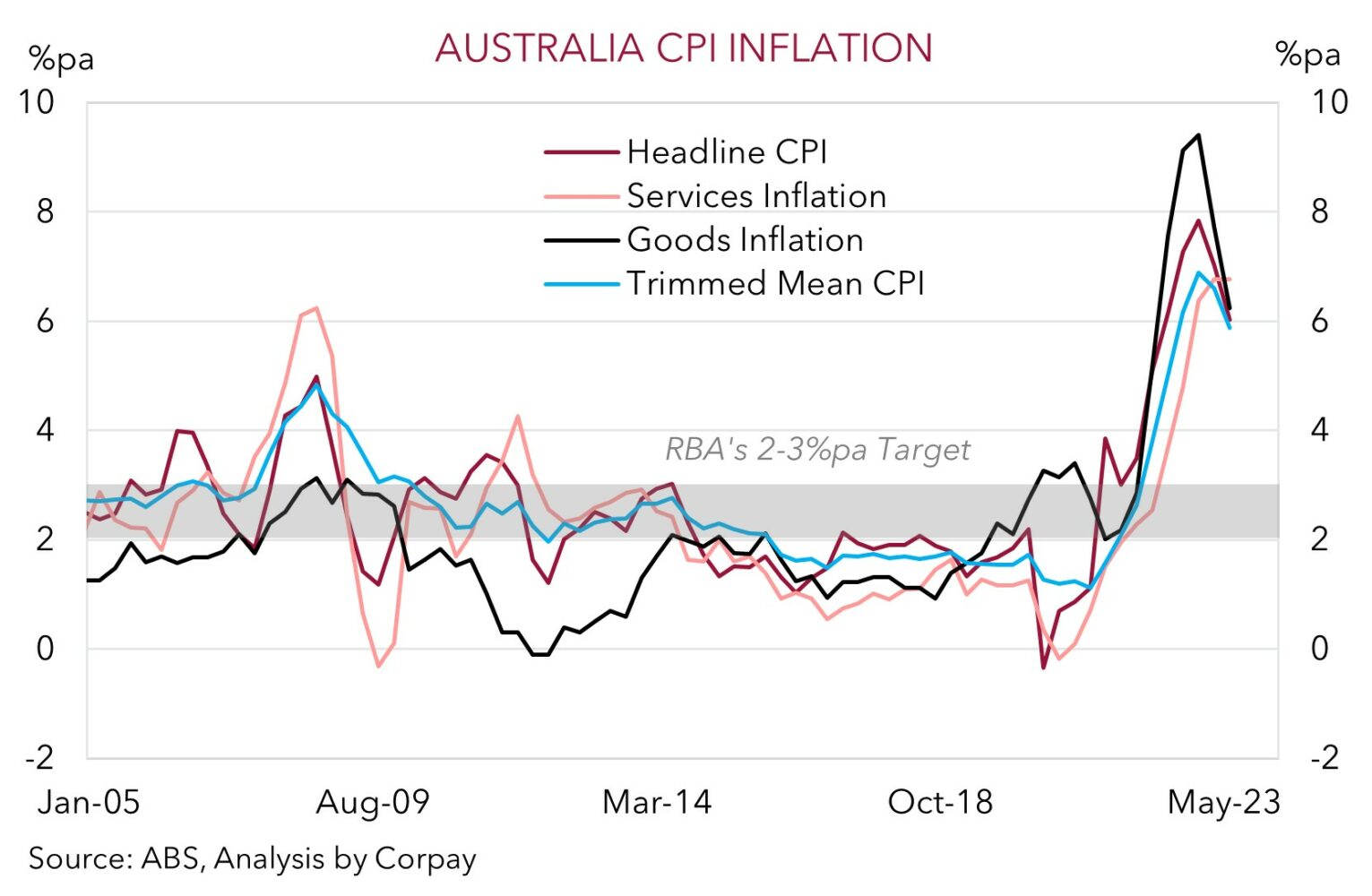

Locally, new RBA Governor Bullock gives her first speech (“Monetary Policy in Australia: Complementarities and Trade-offs”) in the top job later today (7pm AEDT), while the important Q3 CPI inflation data is released tomorrow. The minutes of the last RBA meeting and last week’s ‘fireside chat’ by Governor Bullock surprised many with there more ‘hawkish’ undertones. The door to further RBA tightening, should the data and inflation risks warrant it, remains open, and this could be a message Governor Bullock reiterates. In our judgement, this type of rhetoric may encourage a further upward repricing in near-term RBA rate hike expectations, providing the AUD with some further support, particularly if the incoming Eurozone and US PMIs lead to some further softening in the USD (see above). This is inline with our underlying view that while volatility can continue over the near-term, barring a sharp escalation in the Middle East conflict the fundamental drivers for AUD/USD to edge higher into year-end are moving into place. Negative AUD positioning (as measured by CFTC futures) is very stretched, suggesting a lot of ‘bad news’ is already in the price at current low levels; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; and momentum in China’s economy looks to be turning the corner.

In terms of the CPI, as discussed yesterday, on an annual basis, thanks to positive base-effects as last year’s outsized increases fall out of calculations, inflation should have slowed in Q3. However the near-term pulse is likely to have quickened with quarterly growth likely to have stepped up. This is what policymakers will be looking at. Importantly, the upswing in rents and other services prices given the tightness in the labour market may have boosted sticky core inflation. Core inflation is forecast to rise by 1.1%qoq in Q3, which is above the RBA’s expectations. Such an outcome could raise concerns about the trajectory of future inflation and potentially get the RBA over the line for another hike as soon as the 7 November meeting given its low tolerance for CPI to take longer to return to the 2-3% target than it currently projects.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6403, 0.6434