• Data trends. Divergence between the US & Europe weighed on EUR & GBP. The AUD held up against the firmer USD & outperformed on the crosses.

• China stimulus. China will issue more debt to fund infrastructure projects. Supports our view that China’s economy has passed its cyclical bottom.

• RBA & CPI. Gov. Bullock stressed the Board “will not hesitate” to lift rates again “if there is a material upward revision” to the inflation outlook. CPI released today.

Following the bout of volatility induced by sharp swings in bond yields earlier this week markets calmed down overnight. Equities rose with the US S&P500 (+0.7%) posting its first daily increase in a week with further falls in long-end bond yields, solid US business survey data, and positive earnings results from several US corporates boosting sentiment. The pull-back in the US 10yr rate extended (-3bps to 4.82%), while German and UK 10yr yields fell 5-6bps. Another drop in the oil price has somewhat eased inflation concerns. WTI crude declined ~2.1% to be back under ~US$84/brl with Israel’s delay to a Gaza ground invasion and diplomatic efforts to prevent an escalation seemingly factors here.

In FX, the USD Index rebounded with USD/JPY bouncing up towards ~150, EUR tumbling under ~$1.06 (~0.9% below yesterday’s high), and GBP falling by ~1% from Tuesdays peak (now ~$1.2164). The US’ relative economic outperformance was on show once again. The October US PMIs positively surprised (the manufacturing and services gauges ticked higher), while the Eurozone measures moved further into ‘contractionary’ territory. On top of that the ECB lending survey showed that the sharp jump up in interest rates is having the desired impact with credit conditions tightening and demand weakening. The backdrop bolsters the case for the ECB to hold policy steady at this Thursday’s meeting, with no further tightening anticipated this cycle. It is a similar story for the Bank of England with the PMIs tracking at levels indicative of sluggish growth and the cracks in the UK labour market widening. Jobs are being shed and the UK unemployment rate has risen to 4.2%, near a 2-year high.

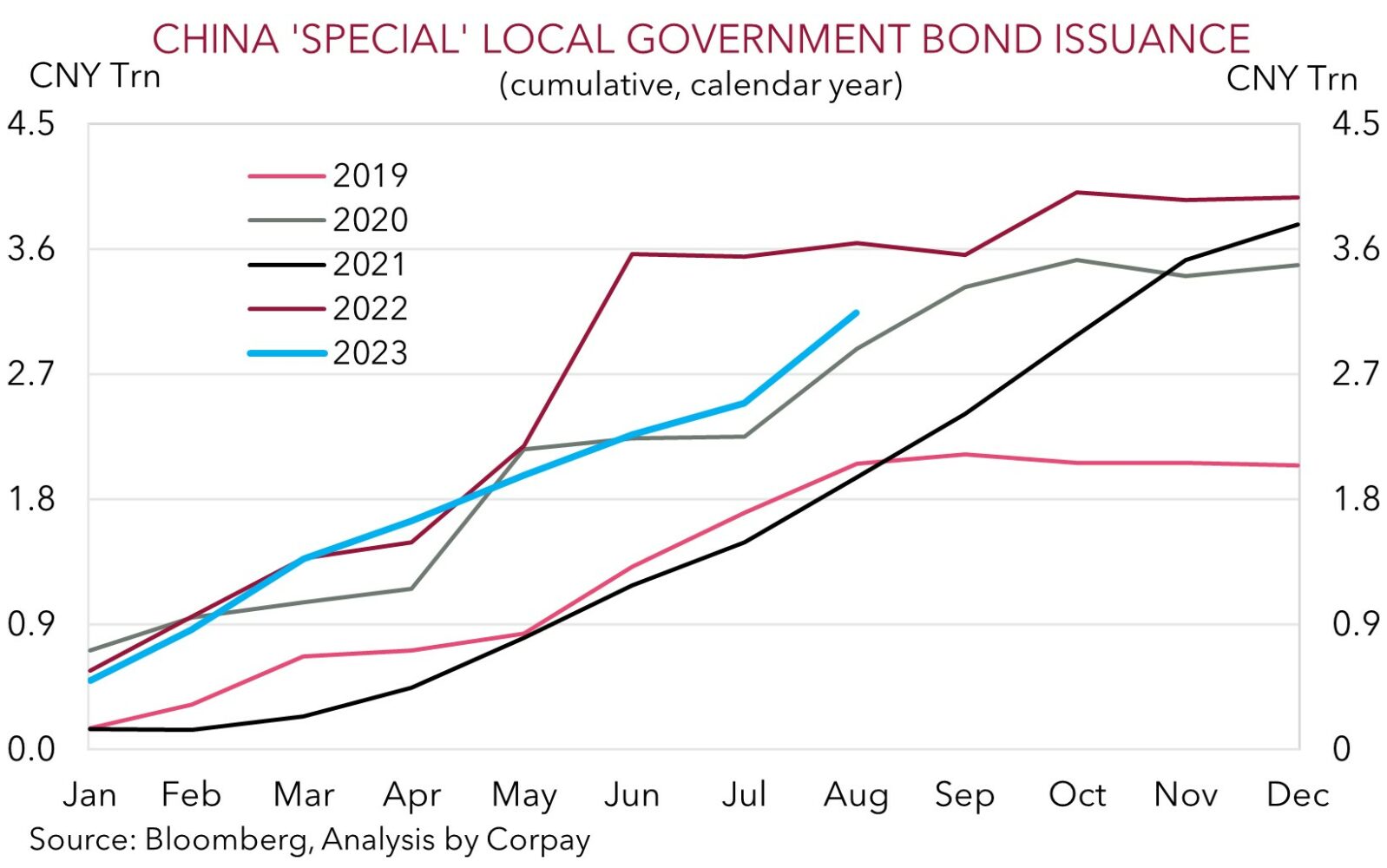

Despite the reversal in the USD, USD/SGD only lifted modestly (now ~1.3683), and the AUD held its ground (now ~$0.6357) and outperformed on the crosses. A ‘hawkish’ tone from RBA Governor Bullock ahead of today’s Australian CPI report (see below) was compounded by developments in China where more economic support looks to be on the way. China’s NPC standing committee approved a mid-year budgetary expansion with the government set to issue an additional CNY1 trillion (0.8% of GDP) of debt to fund new infrastructure projects. This will take the fiscal deficit up to 3.8% of GDP, higher than the usual 3% limit, an important signal the central government may no longer be binding itself to its deficit ceiling and is prepared to keep stepping in. The central government will transfer the proceeds from the special issuance to local governments who will be responsible for carrying out the projects. This latest move adds to the noticeable pickup in local government bond issuance that has come through recently (and which has yet to be spent). Given that execution of investment projects takes time the bulk of the growth impact will occur in 2024. Nevertheless, the news reinforces our thinking that China’s economy has passed its cyclical bottom. In our view, China’s improving macro-outlook should be a medium-term positive for regional Asian currencies, CNH, and the AUD.

AUD corner

In the face of a stronger USD overnight the AUD has held its own (see above). AUD/USD has ticked up ~0.4% compared to this time yesterday (now ~$0.6357) with the AUD performing strongly on the crosses. The AUD has appreciated by 0.4-0.7% against the JPY, NZD, CAD, and CNH, while AUD/EUR and AUD/GBP have recovered a lot of the recently lost ground with both rising by ~1.1% over the past 24hrs. Weaker growth signals from the Eurozone and UK has strengthened the case for no further policy tightening by the ECB or BoE this cycle, in our view. There will be bumps along the way but over the period ahead we see AUD/EUR and AUD/GBP rebounding further as various fundamentals move in the AUD’s favour (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

From the AUD side, as discussed, authorities in China are stepping up their policy support with a more expansionary fiscal deficit and greater bond issuance aimed at commodity intensive infrastructure investment in the pipeline. A reacceleration in China’s growth pulse is one of the factors underpinning our expectations for the AUD to grind higher into year-end and over early-2024. A sturdier Chinese economy should be supportive for commodity demand, and in our opinion is also likely to encourage more CNH-supportive capital inflows. Based on the tight correlations this could be a positive for the AUD (see Market Musings: AUD: Always darkest before the dawn).

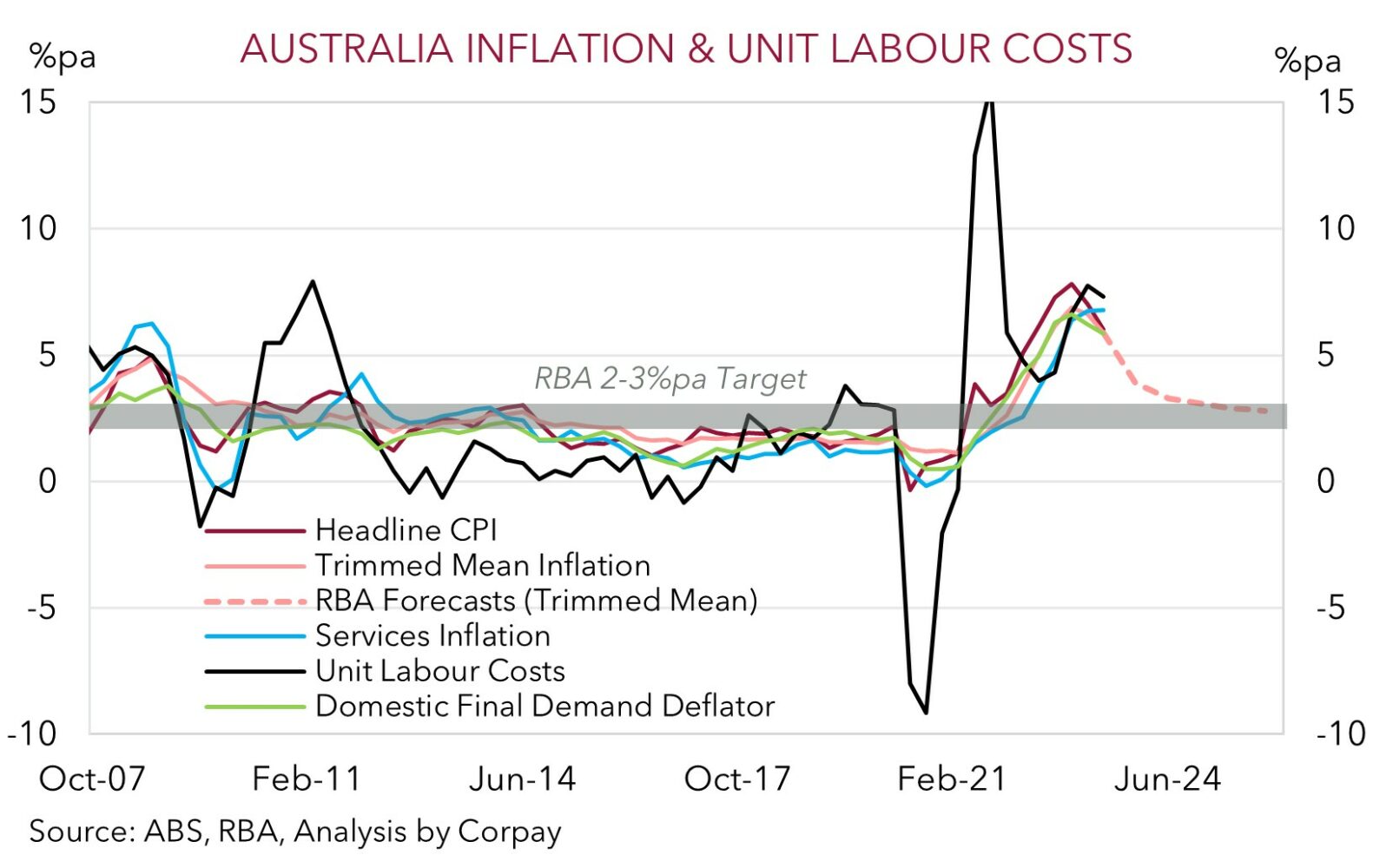

Locally, RBA Governor Bullock spoke last night and inline with recent commentary and the October meeting minutes, she ‘hawkishly’ stressed that “the Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation”. The Board will have new staff economic forecasts at the 7 November meeting, and a key input into those will be today’s Q3 CPI inflation data (11:30am AEDT). As noted over the past few days, base-effects as last year’s outsized increases fall out of calculations will lower annual inflation. But for the RBA what will be in focus is the inflation pulse as measured by the quarterly growth rates, and the how persistent the pressures are. We think quarterly growth is likely to have stepped up. Importantly, the upswing in rents and other services prices given the tightness in the labour market may have boosted sticky core and services inflation. Core inflation is forecast to rise by ~1%qoq in Q3, which is above the RBA’s expectations. We think such an outcome could get the RBA over the line for another rate hike next month given its low tolerance for CPI to take longer to return to target than it currently projects. This would be AUD positive. By contrast, a softer CPI print could see the AUD give back its gains as Australian interest rate expectations adjust lower.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6401, 0.6434