• Market vol. Equities lower as earnings disappoint. US yields reverse despite robust US GDP as inflation pressures ease. Oil lower in spite of Middle East tensions.

• USD trends. Lower yields took some of the heat out of the USD. US economic strength boosted the USD recently. But was Q3 as good as it gets?

• AUD pulse. AUD traded in a ~2% range this week. Q3 CPI supports the case for another RBA hike. Yield spreads shifting in favour of a higher AUD.

Financial market gyrations are continuing, though overnight not all asset classes reacted uniformly. The slide in equities extended amid disappointing earnings from large US tech firms. The S&P500 declined 1.2%. As a result, the S&P500 has now fallen by ~10% from its July highs. Geopolitical tensions in the Middle East remain elevated, and are keeping some investors on edge, however we would point out that oil prices remain well behaved. WTI Crude declined ~2.1% to be back under ~US$84/brl, only slightly above where prices were ahead of the attacks on Israel earlier this month.

Bond yields tumbled with the US 2yr rate down ~8bps (now 5.04%) and the 10yr ~11bps lower (now 4.84%). The moves unwound the previous days spike with a combination of factors at play. On top of the weaker equity earnings, the European Central Bank held rates steady for the first time since it began hiking in July 2022. Although the ECB stressed a ‘higher for longer’ mantra and that the door to further tightening is open, if needed, markets think rates have ‘peaked’. In the US, in contrast to yesterday, there was strong demand at the latest bond auction with elevated yields attracting investors. And data wise, the bits and pieces within the Q3 US GDP kept alive hopes a ‘soft landing’, whereby inflation slows and a disruptive recession is avoided, can be achieved. As expected given the signal from the high frequency activity data, US GDP growth re-accelerated. Underpinned by consumer spending the US economy expanded at a 4.9% annualised pace. Importantly, the inflation metrics improved (the core PCE price index rose by 2.4%saar, the slowest since late-2020). As a result, expectations for another hike by the US Fed were trimmed. There is less than a ~20% chance of another move factored in by year-end.

The pull-back in US yields took some of the heat out of the USD. EUR nudged up (now ~$1.0560), as did GBP (now ~$1.2127), while USD/JPY eased from its peak with markets also on edge about possible FX intervention after Japanese Finance Minister Suzuki stated he was ‘watching FX moves with the same sense of urgency’. USD/SGD has slipped back under ~1.37 and the AUD has picked itself up off the canvas. It has been a volatile few days, and geopolitical risks remain, but at ~$0.6325 the AUD is inline with where it was trading at the start of the week.

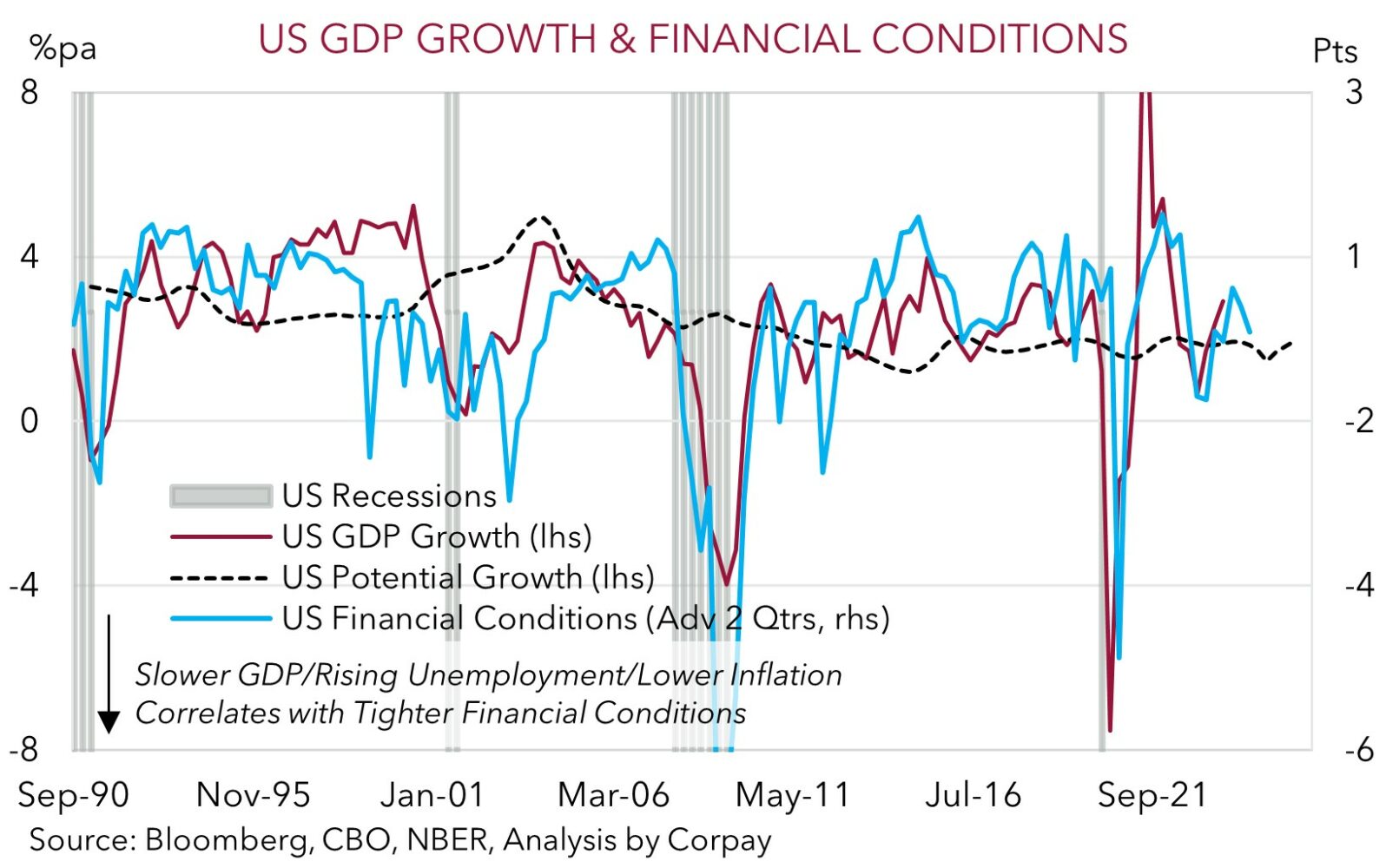

As mentioned previously, barring an escalation in the Middle East conflict, from a macro perspective we see more downside than upside potential for USD over the medium-term. A lot of positives appear priced into the USD. The US’ relative outperformance was a pillar behind the USD’s strength over the past few months. But a range of leading indicators, the tightening in monetary/financial conditions, and depleted pool of ‘excess savings’ suggests this was probably as good as it gets and that growth should slow, which in turn could drag on the USD.

AUD corner

It has been a volatile few days for the AUD. Swings in US bond yields, risk sentiment and the USD have butted up against shifting RBA interest rate pricing following the stronger than anticipated Q3 CPI report and more measured comments by Governor Bullock yesterday about inflation. The AUD has traded in a ~2% range this week but following a tick up overnight on the back of the softer USD, at ~$0.6320 it is pretty much inline with where it was tracking on Monday. On the crosses, the AUD is also a bit firmer against the EUR (+0.3%), JPY (+0.4%) and CAD (+0.5) compared to this time yesterday.

Markets and the world economy are at a tricky juncture. Geopolitical risks in the Middle East remain, and this is a potential source of volatility. Heightened risk aversion stemming from an escalation in the conflict is something to be mindful of, and it would be expected to support the USD and exert more downward pressure on the AUD, if it were to transpire.

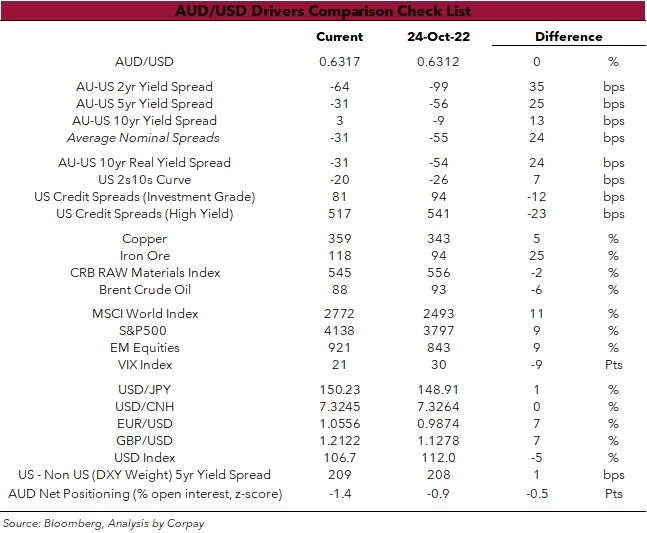

But as outlined before, barring an intensification of the Middle East conflict, we believe the fundamental drivers for AUD/USD to recoup lost ground and drift modestly higher into year-end are moving into place. Indeed, as our table shows, the AUD is now tracking on par with where it was roughly a year ago. However, various factors such as yield spreads, the level of equity markets, credit spreads, and commodity prices are at levels indicative of a higher AUD. Added to that negative AUD positioning (as measured by CFTC futures) is now very stretched, suggesting a lot of ‘bad news’ may already be in the price; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; momentum in China’s economy is turning the corner with authorities flagging even more fiscal stimulus aimed at commodity-intensive infrastructure spending to reinforce the upturn; and the US’ economic outperformance could fade as tighter financial conditions and less savings dampen activity (see above).

Notably, relative yield spreads have become more favourable as markets tempered their US Fed rate expectations and more tightening by the RBA is discounted. We expect this trend to continue. Given the underlying inflation pressures across the domestic economy, particularly in sticky services prices, we are looking for the RBA to deliver another rate hike as soon as the 7 November meeting (see Market Wire: CPI keeps the pressure on the RBA). In our judgement, markets may have read too much into Governor Bullock’s matter of fact comments yesterday noting that inflation was “pretty much where we thought”. The inflation pulse and outlook are important, and on these fronts we don’t think enough progress is being made for the RBA not to act again. And we would also point out it is customary for the Governor not to front-run an upcoming Board decision.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6397, 0.6450