• Positive tone. Equities rose & oil prices extended their slide. Markets are taking the Middle East developments in their stride. The USD also softened.

• AUD rebound. Firmer equities & a positive AU retail sales report which reinforced RBA rate hike expectations has helped the AUD recover some lost ground.

• Asian focus. Today attention will be on the China PMIs & the BoJ decision. Another BoJ tweak could support the weak JPY, which in turn weighs on the USD.

Markets have started the week on a more positive footing. Investors appear to be taking the Middle East developments in their stride with Israel’s incursion into Gaza so far not as extensive as feared and regional tensions not escalating. Oil prices, a key benchmark for the geopolitical risks, have continue to slide. WTI crude fell ~3.4%, the 5th fall in the past 7 sessions, to be back down at ~US$82.60/brl (where it was trading ahead of the attacks on Israel in early October). Equity markets rose with the US outperforming (S&P500 +1.2%), though the rebound only partially offsets the recent decline. The S&P500 is still a bit over 9% below its late-July highs.

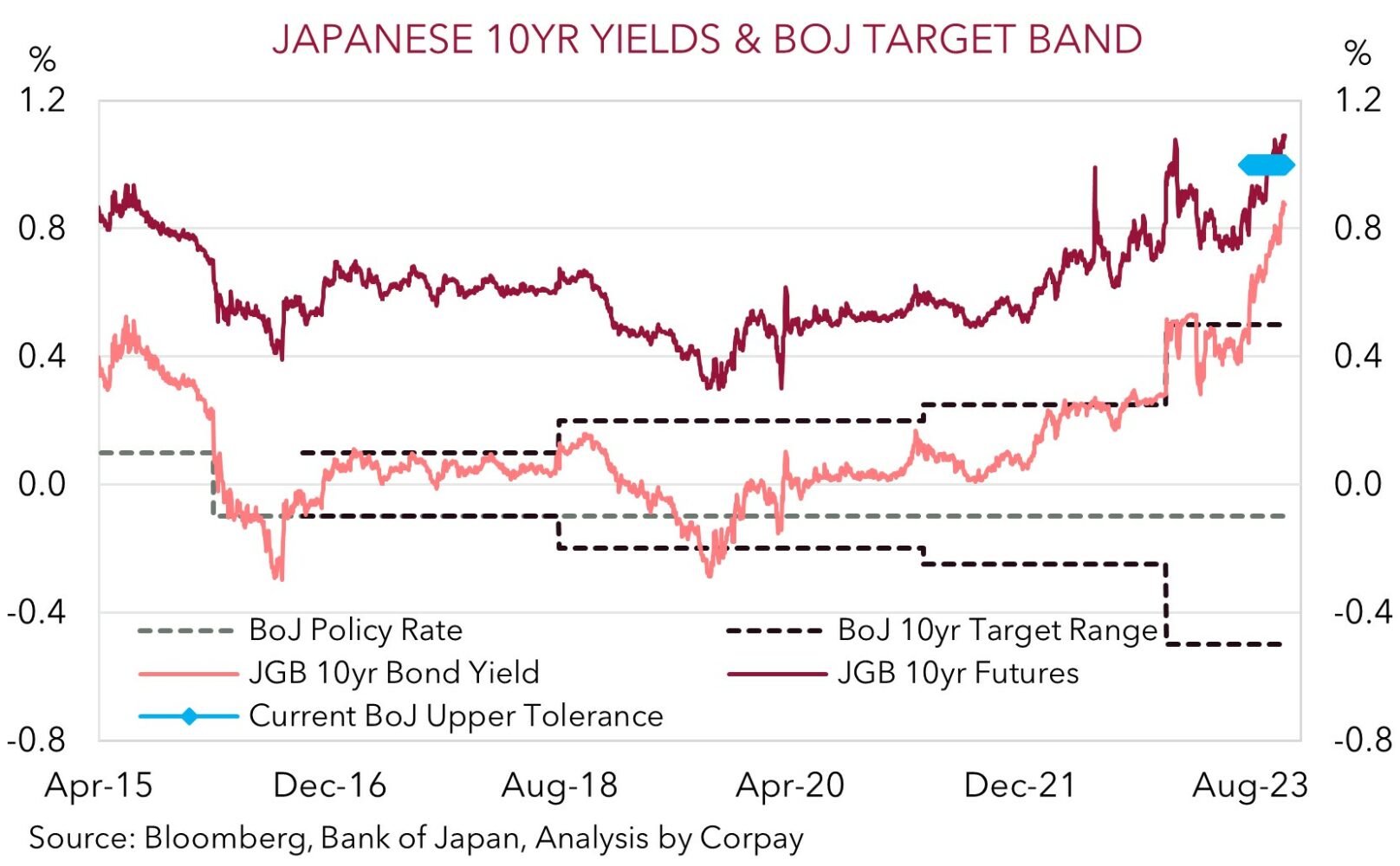

Bond yields ticked up with the US 10yr rising by ~5bps (now 4.89%). While the US Treasury reduced its estimate for Q4 federal borrowing due to stronger government revenues, which was a bit of a relief for markets given concerns about the ability to absorb the greater bond supply, news from Japan worked in the other direction. According to media reports, at today’s meeting the Bank of Japan will discuss a further tweak to its yield curve control policy and will consider allowing Japanese 10yr yields to move up above the current ~1% tolerance level. The news helped the JPY strengthen a little, with the dip in USD/JPY down towards ~149 dragging on the USD. EUR has edged back over ~$1.06 for the first time in a week despite signs tonight’s Eurozone GDP and CPI data could undershoot consensus forecasts (released 9pm AEDT). GBP is up near ~$1.2170, and the AUD has risen to ~$0.6374 with yesterday’s stronger Australian retail sales print also reinforcing expectations of another RBA rate hike.

Globally, there will be a lot of economic information to digest over the next few days. The China PMIs (12:30pm AEDT) and BoJ announcement (no set time) are in focus in today’s Asian session. Tonight, in addition to the Eurozone data, the US Employment Cost Index (a broad wage gauge looked at closely by policymakers) is due (11:30pm). Later this week the US Fed (Thurs morning AEDT) and Bank of England (Thurs night AEDT) decisions are announced, with the US labour market report (Fri AEDT) rounding things out. On net, we believe that further signs China’s economy has passed its cyclical bottom and a modest adjustment by the BoJ could exert more pressure on the still lofty USD, especially if markets start to discount bigger leaps by the BoJ down the track. USD/JPY is the 2nd most traded currency pair, so shifts by the BoJ can have a broader USD impact, particularly as the US Fed is expected to keep rates steady this week and looks likely to repeat its ‘cautious’ tone about further tightening, and with the US labour market data at risk of underwhelming market projections.

AUD corner

The beleaguered AUD has had a solid start to the week. The more positive risk sentiment (as illustrated by the rebound in equities) and softer USD on the back of firmer JPY (see above) has been supportive. At ~$0.6374 the AUD is ~1.7% above last Thursday’s low point. The AUD has also outperformed on the crosses, with the AUD appreciating by ~0.2-0.3% against the JPY, GBP, NZD, and CAD over the past 24hrs. AUD/CNH has risen by ~0.5% to be tracking just under its 50-day moving average (~4.6695), while AUD/EUR has poked its head back above ~0.60.

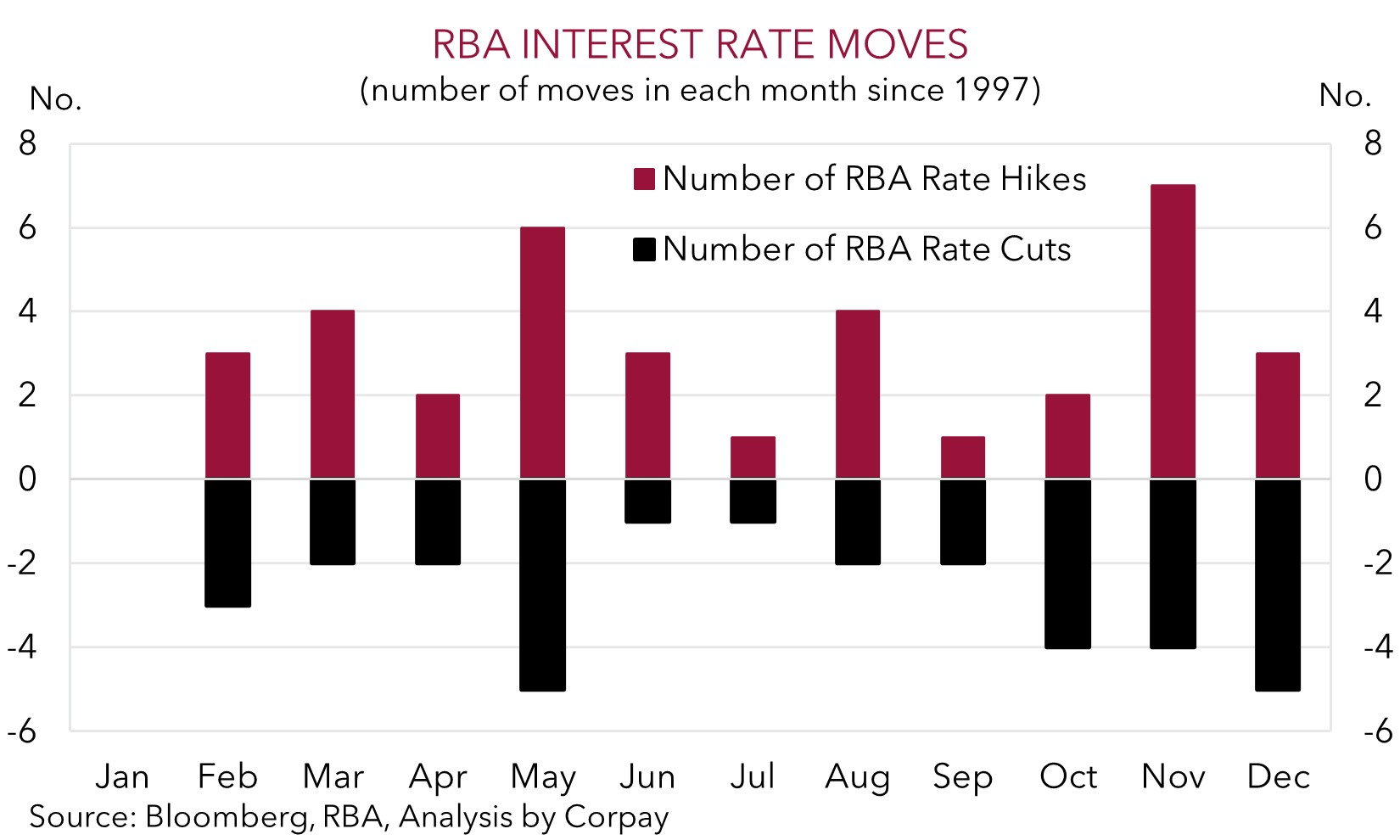

In addition to the offshore trends the upside surprise in the yesterday’s Australian retail sales report also gave the AUD a helping hand. Retail sales rose by 0.9% in September, the strongest monthly growth since January. Five of the six categories were higher in the month, a sign that while many indebted households may be feeling the pinch from higher interest rates, there are others that aren’t with the rapidly expanding population proving to be an underlying source of aggregate demand. Following on from the higher than expected Q3 CPI the resilience in consumer spending supports our thinking that the RBA will need to raise rates further in order to break the back of increasingly domestically driven inflation (see Market Wire: CPI keeps the pressure on the RBA). A move at the 7 November meeting is likely, with markets now assigning a ~63% chance of a hike. As our chart shows, November is the month the RBA has most frequently raised rates, followed by May. These months follow the quarterly CPI and are meetings where new economic forecasts are produced.

Geopolitical risks in the Middle East remain, and this is a potential source of volatility for the AUD over the period ahead. But as outlined before, barring an intensification of the Middle East conflict, we believe the fundamental drivers for AUD/USD to recoup lost ground into year-end are moving into place. Negative AUD positioning (as measured by CFTC futures) is still very stretched, suggesting a lot of ‘bad news’ may already be factored in; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; momentum in China’s economy looks to be turning the corner with authorities flagging even more fiscal stimulus aimed at commodity-intensive infrastructure spending to underpin the upturn; the US’ relative economic strength should fade as tighter conditions and less savings crimp activity; and relative yield spreads have become more AUD supportive as markets temper US Fed rate expectations and more tightening by the RBA is discounted. As discussed above, we think a further improvement in the China PMIs (12:30pm AEDT) and/or another tweak by the BoJ (no set time) which supports a bounce back in the JPY (and weighs on the USD) should reinforce these unfolding medium-term AUD positive impulses.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6395, 0.6434

SGD corner

USD/SGD slipped back yesterday, extending the drift lower at the end of last week. At ~1.3647 USD/SGD is tracking near its 50-day moving average, with the USD losing a bit of steam over the past few days (see above). On the crosses, EUR/SGD (now ~1.4487) has consolidated around the middle of its October range, while ahead of today’s BoJ announcement SGD/JPY has eased back a little, though at ~109.24 it remains historically high.

As outlined above, today the focus will be on the latest batch of China PMIs and the BoJ decision, with the US Fed (Thurs morning), Bank of England (Thurs night), and US jobs report (Fri night) on the radar over the next few days. In our view, signs that China’s economic momentum is continuing to improve, coupled with another adjustment by the BoJ to its yield curve control policy could exert some more downward pressure on the USD (and USD/SGD), with SGD/JPY also likely to lose ground if the BoJ delivers on overnight media reports and markets start to factor in a further policy shift down the line. Beyond that, barring an escalation in the Middle East conflict we think the USD (and USD/SGD) may also be under pressure over coming days if the US Fed holds rates steady and reiterates its ‘cautious’ stance about further tightening, and/or the US economic data underwhelms expectations.

SGD levels to watch (support / resistance): 1.3532, 1.3600 / 1.3700, 1.3750