• Mixed markets. Equities higher & oil lower. Contrasting trends saw European & US yields diverge. USD firmer, with USD/JPY jumping up post the BoJ.

• BoJ tweaks. The BoJ adjusted its yield curve control framework, but it wasn’t enough to appease FX markets. The USD move weighed on the AUD.

• Fed in focus. Attention is on the US with data & Fed policy decision due. With no change in rates expected what Chair Powell says will be important.

It was a rather placid end to another turbulent month for most asset classes. European and US equities edged higher with the major indices rising 0.5-0.9%. Despite this week’s bounce the US S&P500 still ended October in the red with the 2.2% fall the 3rd straight monthly decline. This is the longest losing streak since Q1 2020. Oil prices continued to give up ground despite the risks in the Middle East (WTI crude -1.3%). Bonds were mixed with long-end rates in Europe easing (the German 10yr slipped back ~2bps to 2.8%), while the US 10yr yield ended the day higher (+3bps to 4.93%).

Contrasting macro trends was a factor with Eurozone GDP and inflation undershooting expectations. The Eurozone economy contracted by 0.1% in Q3, and headline inflation decelerated to 2.9%pa, the slowest pace since mid-2021. This mix reinforces the view ECB rates have peaked. In the US, the employment cost index (a broad wages gauge monitored by policymakers) was a bit firmer than anticipated, rising 1.1%qoq. That said, annual growth continues to slow, inline with the signal from forward indicators like the ‘quits rate’ which indicates there is less churn in the jobs market. US consumer confidence was slightly better than forecast, though sentiment remains below average.

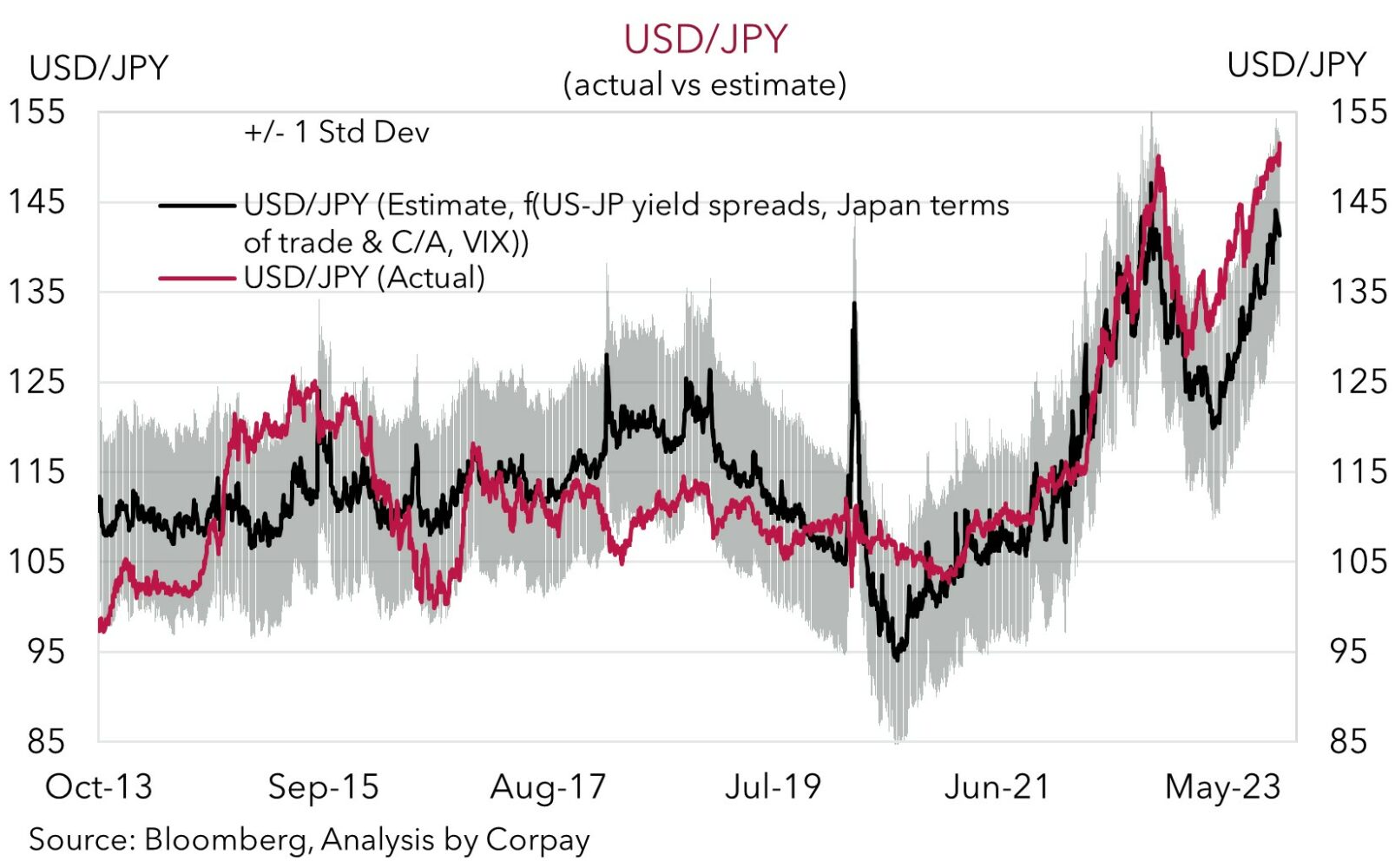

The divergence and reaction to yesterday’s Bank of Japan meeting supported the USD. USD/JPY has risen to ~151.60, just below the multi-decade peak hit last October which triggered a bout of Japanese FX intervention. EUR swung around but ended the day below ~$1.06. USD/SGD tracked the broader USD moves with the pair ticking up towards ~1.37. AUD unwound some of its recent rebound and is tracking where it started the week (now ~$0.6337). The BoJ continued to inch along the policy normalisation path, but it clearly wasn’t enough for myopic FX markets. The BoJ made further tweaks to its yield curve control with the hard upper limit around the 10yr JGB target replaced with a vaguer 1% “reference” point. The BoJ look to be trying to cause as little disruption as possible as they turn course after years of ultra-accommodative policy. We think it remains a matter of when, not if, more substantive changes are made particularly as the BoJ once again upgraded its inflation outlook. We believe there are asymmetric risks around USD/JPY near current lofty heights. On our modelling USD/JPY looks to be ~5-7% too high.

Focus will be on the US tonight with ADP employment (11:15pm AEDT), JOLTS and ISM manufacturing data (both 1am AEDT), the FOMC decision (5am AEDT), and Fed Chair Powell’s press conference (5:30am AEDT) due. No change is expected from the Fed, though it is likely to reiterate it may hike again if the data warrants it. The ‘higher for longer’ outlook already looks well known and priced in. Hence, a repeat of the Fed’s previous rhetoric could see the USD come under a little pressure, in our opinion, particularly if the US data underwhelms.

AUD corner

The AUD has lost some ground over the past 24hrs. The firmer USD on the back of the diverging Eurozone and US data, and markets disappointment to the adjustments made by the BoJ has given the USD a boost (see above). On top of that the China PMIs were softer than expected, with manufacturing dipping slightly into ‘contractionary’ territory. Although we would point out that the early-October Golden Week holiday may have played a role and some payback is likely next month given the return to work. At ~$0.6337 the AUD is back inline with where it was trading at the start of the week, and only slightly under its October average. On the crosses, apart from AUD/JPY which has risen by more than 1% (now ~96.10), the AUD has eased, falling by ~0.2-0.4% against the EUR, GBP, CAD, and CNH compared to this time yesterday.

As discussed, the economic focus will be on the US tonight with ADP employment (11:15pm AEDT), JOLTS and ISM manufacturing data (both 1am AEDT), FOMC decision (5am AEDT), and Fed Chair Powell’s press conference (5:30am AEDT) on the run sheet. The data and events may generate further intra-day volatility in the AUD. Policy wise the overwhelming consensus is for the US Fed to hold rates steady. Given the economic forecasts won’t be updated attention will be on the Fed’s guidance and Chair Powell’s comments. We are looking for the Fed to repeat that the door to another hike is still open, should the data justify it, and that an extended period of ‘restrictive’ policy is required to bring down inflation. That said, this already looks factored into bond yields and the USD, in our view. As such, we think a rehash of the same message could leave FX markets a bit underwhelmed, dragging on the USD, more so if the US data undershoots expectations.

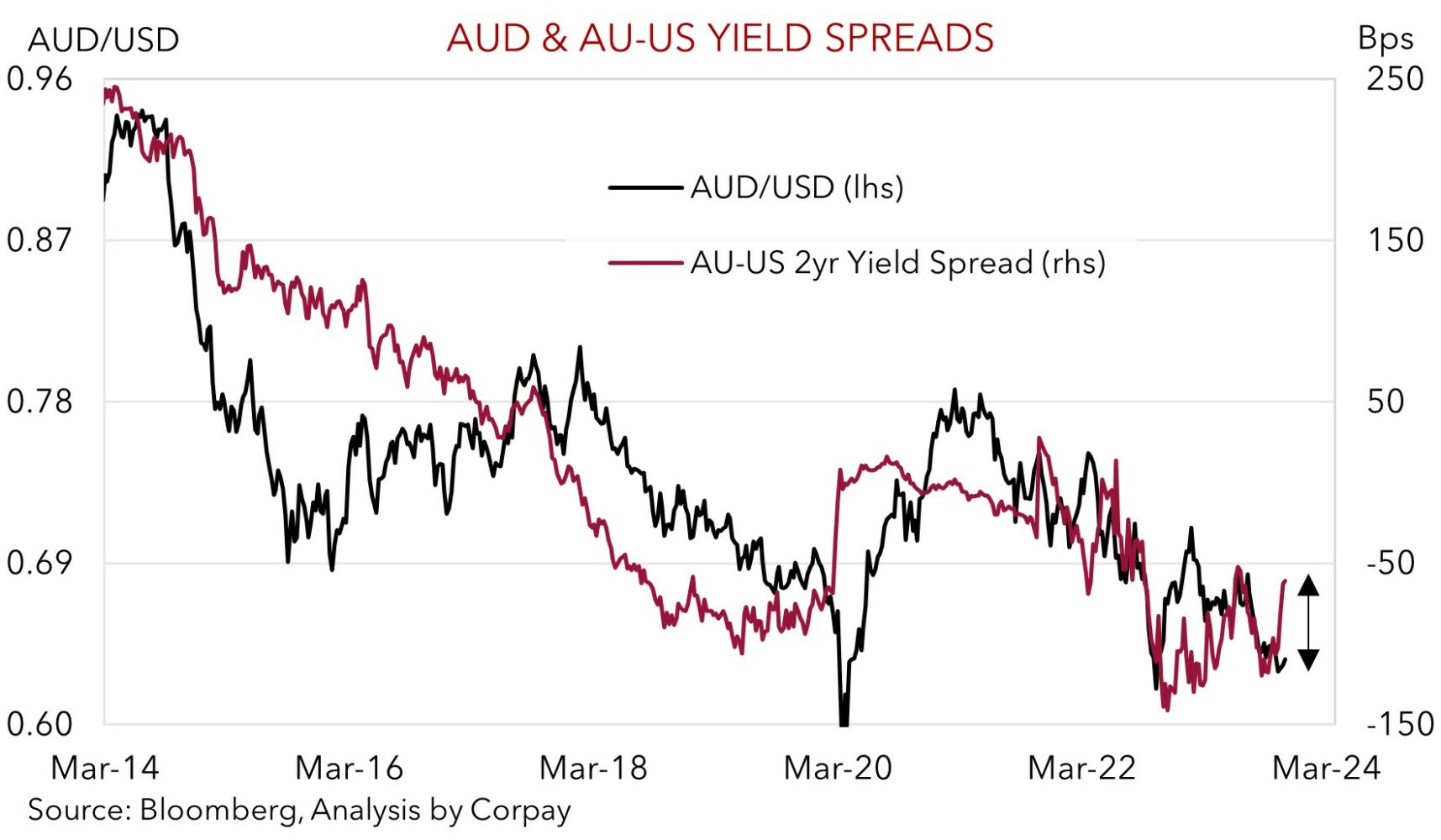

Stepping back, we continue to believe that a lot of ‘bad news’ is priced into the AUD down around current low levels, and that the broader fundamental story is turning in favour of a modest recovery. The flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; authorities in China are flagging more fiscal stimulus aimed at commodity-intensive infrastructure spending to bolster the recovery; the US’ relative economic strength should fade as tighter conditions and less savings crimp activity; and relative yield spreads have become more AUD supportive as more tightening by the RBA is discounted. A move at the 7 November RBA meeting looks likely (see Market Wire: CPI keeps the pressure on the RBA). As our chart shows, the Australia-US two-year yield spread has narrowed to -58bps (from -123bps in late-August). On its own, this is pointing to a higher AUD.

AUD levels to watch (support / resistance): 0.6210, 0.6280 / 0.6393, 0.6434