• US yields fall. No change from the US Fed, but the tone was ‘cautious’. This, softer US data, & lower debt issuance projections weighed on US yields.

• Positive sentiment. The moves in US rates helped support equity markets & cyclical currencies like the AUD. The AUD outperformed over the past 24hrs.

• Yield spreads. The RBA is expected to hike rates next week & further steps are possible. This shift has seen yield spreads move in favour of a higher AUD.

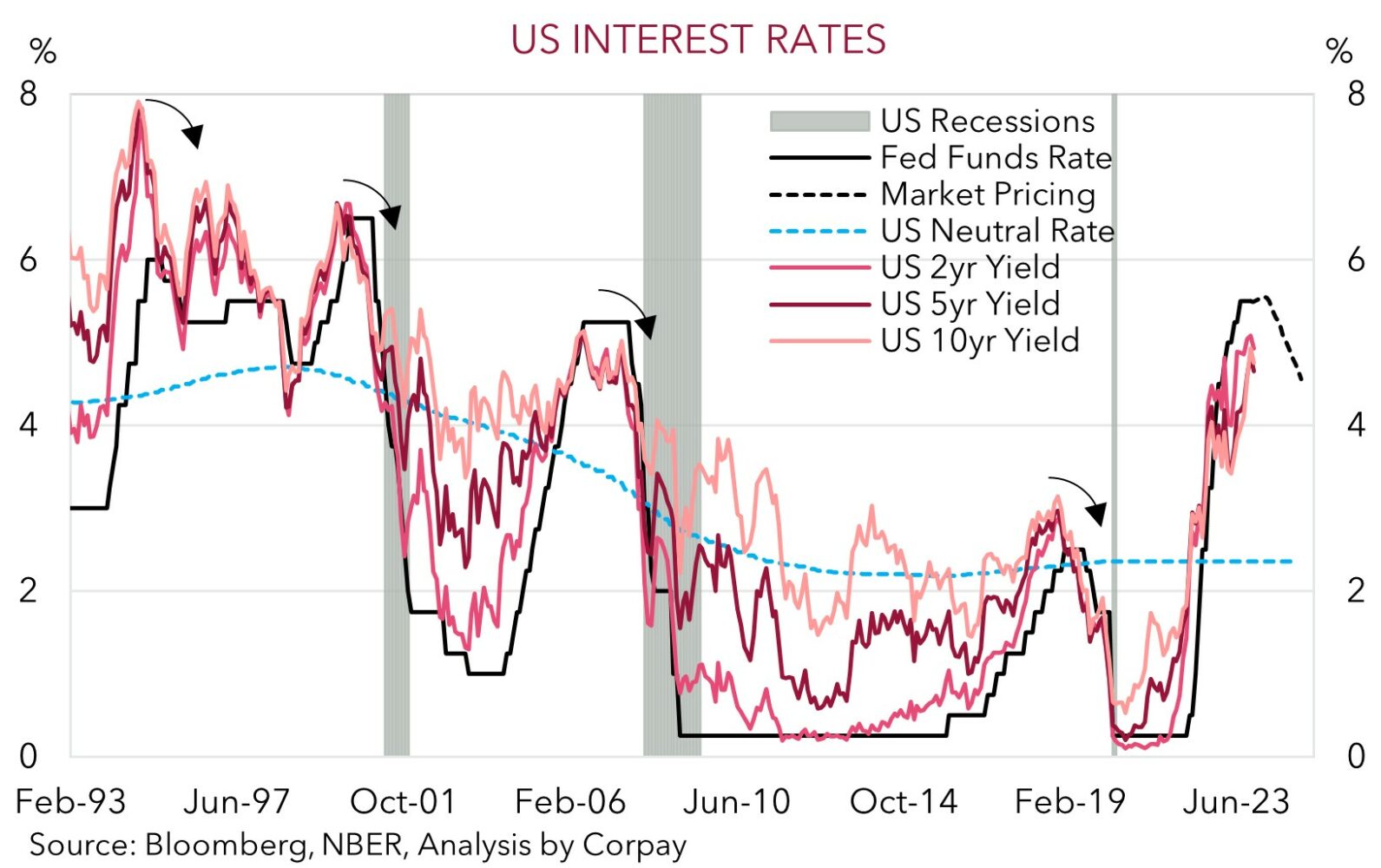

A sizeable drop in US bond yields was the dominating market development overnight. US yields fell by 14-19bps across the curve with the 2yr and 10yr rates now down at 4.95% and 4.74% respectively. The moves flowed through to other asset classes with equity markets rising (the S&P500 rose ~1.1% with the tech-focused NASDAQ outperforming (+1.6%)) and the USD losing some ground against cyclical currencies like the AUD (now up at ~$0.6387) and NZD (now ~$0.5845). USD/SGD also eased back towards ~1.3680. There were more muted moves on the other majors. USD/JPY has drifted back under 151, EUR is still tracking sub $1.06, and GBP has remained range bound (now ~$1.2146).

A few factors combined to trigger the moves. As expected, the US Fed extended its pause and kept the funds rate band steady at 5.25-5.50%. There was also no change to the policy guidance with the Fed continuing to keep the door ajar to further tightening, if needed. However, the explicit reference to the “tighter financial conditions” following the run up in bonds yields, stronger USD, and lower equities, and expectation this should weigh on activity, hiring, and inflation, has raised doubts more steps will be taken. Indeed, Fed Chair Powell openly stated that the question the committee is asking is “should we hike more?”, and that based on how far policy has already been moved, and the lagged impacts of past changes, the FOMC is “proceeding carefully”.

The data will dictate the Fed’s next steps, and on this score, the softness in the bulk of the overnight releases reinforced thoughts the Fed’s tightening phase could be over. Markets are now assigning a ~1/4 chance of another hike, with a modest cuts anticipated from mid-2024. And as our chart shows, once markets think Fed policy rates could have ‘peaked’ bond yields typically also tend to top out. Ahead of Friday’s US non-farm payrolls report, signs the heat is coming out of the labour market are coming through. ADP employment was weaker than expected (+113,000 in October), and while job openings remain high the ‘quits rate’ (a gauge of labour market churn and wages) is at pre-COVID levels. Notably, the ISM manufacturing survey tumbled further into ‘contractionary’ territory with weaker demand flowing through to hiring intentions. On top of this, confirmation the US Treasury will slow the pace it issues longer-dated debt also came as a relief. Concerns about the market’s ability to absorb greater bond supply after years of very large budget deficits has been a factored pushing up US yields.

Overnight trends are inline with our thinking that barring an intensification of the Middle East conflict the fundamental drivers for a gradual deflating in the lofty USD are moving into place. The US’ relative economic outperformance and upswing in US yields have underpinned the USD’s strength, but we expect these supports to fade over the period ahead as tightening conditions constrain growth and the Fed easing cycle is discounted.

AUD corner

The AUD has a bit more of a pep in its step. The large drop in US bond yields on the back of some underwhelming US data, lower than feared US debt issuance projections, and a ‘cautious’ tone from the US Fed about further tightening, has supported equities and cyclical currencies like the AUD (see above). At ~$0.6387 the AUD is ~0.8% higher compared to this time yesterday and is tracking just over its 50-day moving average.

The AUD has also outperformed on the crosses, with gains of 0.7-0.9% recorded against the EUR, GBP, CAD, and CNH over the past 24hrs. At ~0.6044 AUD/EUR is up around its highest level since mid-October. Ahead of tonight’s Bank of England announcement (11pm AEDT) where no change is anticipated given the widening cracks appearing in the UK labour market, AUD/GBP has jumped back up towards a 1-month high (now ~0.5259). AUD/NZD has also edged up to the top of the range it has occupied since late-June (now ~1.0929) with yesterdays sluggish NZ labour market report reinforcing expectations the RBNZ’s rate hiking phase has ended.

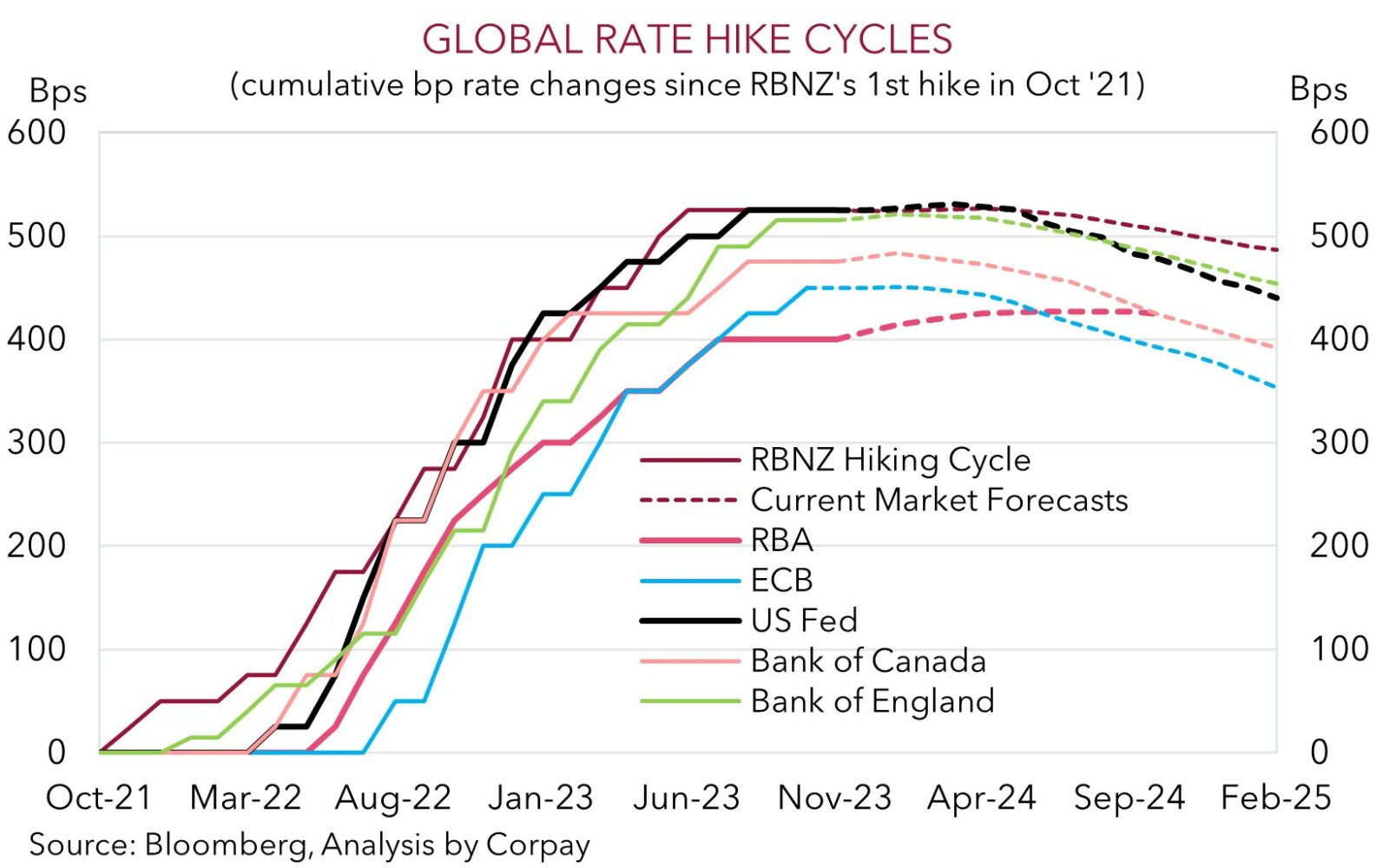

Given the Fed’s and markets uncertainty about whether further policy tightening is needed, we would expect AUD volatility to pick up around the incoming US data. Jobless claims are released tonight (11:30pm AEDT), while the monthly jobs report is due on Friday night. That said, in the main, as we have been flagging recently, we believe the fundamental drivers for AUD/USD to recoup lost ground into year-end are moving into place. Negative AUD positioning (as measured by CFTC futures) is still stretched, suggesting too much ‘bad news’ may be factored in; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains in place; authorities in China appear likely to inject fresh fiscal stimulus aimed at commodity-intensive infrastructure spending to bolster the recovery; the US’ relative economic strength looks set to fade as tighter conditions and less savings crimp activity; and relative yield spreads have become more AUD supportive as further tightening by the RBA is factored in. A move at the 7 November RBA meeting looks likely (see Market Wire: CPI keeps the pressure on the RBA). As our chart shows, after lagging its peers this cycle, the RBA now looks to be the odd one out with it being the only major central bank where additional rate hikes are anticipated. In addition to the AUD ticking up against the USD, we also see the AUD outperforming the EUR and GBP (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

AUD levels to watch (support / resistance): 0.6280, 0.6320 / 0.6434, 0.6480