• Yields fall. Long end yields continued to decline. This has boosted equities. The AUD has edged up to the top of its recent range.

• Central banks. The BoE held rates steady. Outside of the RBA, expectations tightening cycles are nearing their end continue to build.

• US jobs in focus. Soft data would reinforce the slide in yields & the USD. But this isn’t guaranteed. A positive surprise could see recent moves reverse.

The pull-back in long-end bond yields continued overnight as expectations central bank tightening cycles (outside of the RBA) are nearing their end continue to build. The US 10yr rate fell another 7bps to now be down at 4.66%, around where it was a month ago, ahead of the mid-October surge. Yields in the UK declined by more (UK 10yr -12bps), while the German 10yr eased by less (-5bps). The drop helped extend the equities rebound (S&P500 +1.9%, its largest one-day gain since late-April). Oil prices were a little firmer (WTI crude +2%), and in FX the USD has remained under pressure. EUR has edged back up to ~$1.0620, GBP has risen to ~$1.22, while USD/JPY is hovering near ~150.50. Cyclical currencies like the NZD and AUD have held onto their gains with the AUD at the top end of the range it has occupied the past few weeks (now ~$0.6430).

Following on from yesterday’s ‘cautious’ tone from the US Fed, the Bank of England left rates on hold at 5.25% for the 2nd straight meeting. The BoE kept the door open to further tightening and stressed that a ‘restrictive’ stance may be needed for an ‘extended period of time’ to curb inflation with thoughts of rate cuts still premature. But markets appear unconvinced given the unfolding slowdown in the UK economy and widening cracks in the labour market. In the US, weekly initial jobless claims (one of the best real time reads on the jobs market) rose slightly (now 217,000), with continuing claims (a gauge of recurring applications for unemployment benefits) ticking up for the sixth straight week. Notably, US productivity overshot predictions in Q3. Productivity improved by the most in ~3-years. This is helpful in the inflation fight as higher productivity helps alleviate the inflation impacts from faster wage growth.

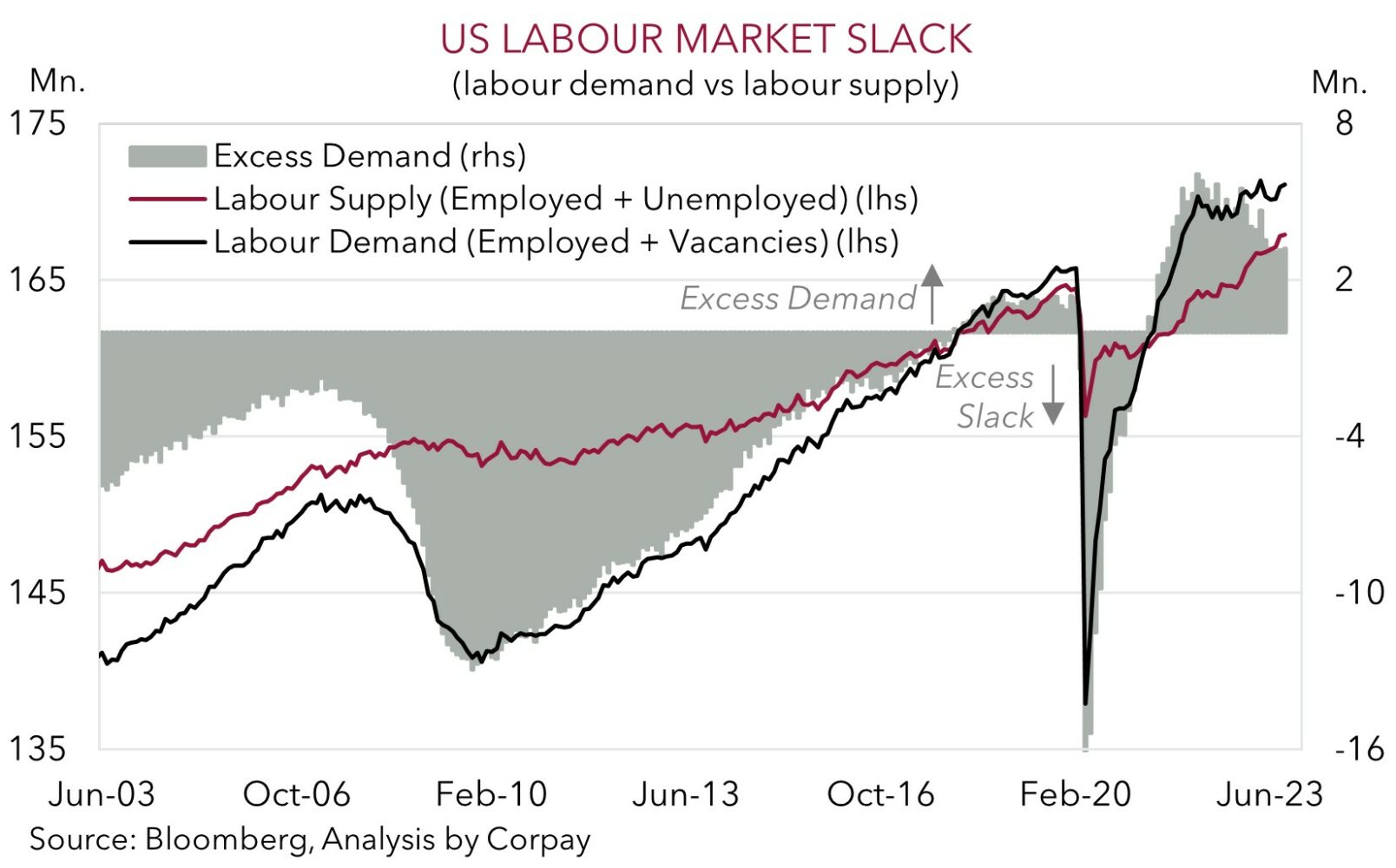

Attention will remain in the US tonight with the release of the monthly jobs report (11:30pm AEDT) and the ISM services index (1am AEDT). The data will be a big test for the markets newfound belief policy tightening may be at an end and that the next move for most central banks could be rate cuts, albeit in H2 2024. The excessive heat is coming out of the US labour market as demand weakens and supply improves. After a positive surprise last month market consensus is looking for non-farm payrolls to slow to 180,000 in October, for unemployment to hold at 3.8%, and for average hourly earnings (a wages proxy) to decelerate to 4%pa. In our view, this type of mix may reinforce views the US Fed has reached its ‘peak’, further weighing on US yields and the USD. That said, given the recent volatility in the data another positive surprise can’t be ruled out. If realised, this could see US yields and the USD snapback.

AUD corner

The AUD has held onto yesterday’s post-US Fed inspired gains. A further dip in long-end US bond yields and lift in equities has underpinned the AUD, which at ~$0.6330 is near the top-end of the range it has traded in since early-October (see above). On the crosses, the AUD has edged up a bit more against the EUR (+0.2% to ~0.6055) and GBP (+0.2% to ~0.5270). We remain of the view that the unfolding macro trends should see the AUD continue to outperform these currencies over the period ahead (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning). The positive risk backdrop has also pushed AUD/JPY higher (+0.4% to ~96.77, the top of its ~4-month range), while AUD/CNH has moved above its 1-year average (~4.7058).

Today in the Asian session Australian quarterly retail sales volumes are released (11:30am AEDT). We think retail volumes could positively surprise consensus forecasts looking for a 0.3% fall. Helped by robust population growth nominal retail turnover has been positive, and at the same time goods price disinflation has continued. A better than anticipated result could give the AUD a little intra-day support, though with the US labour market report released tonight (11:30pm AEDT) we wouldn’t expect any overly large moves.

Given the size of the recent swings in bond and equity markets, AUD volatility could be quite high around tonight’s US data. As mentioned above, we believe signs the US labour market is cooling should exert more downward pressure on US bond yields and the USD, with the cyclical AUD likely to get a boost. However, this is far from guaranteed. The US data has been somewhat volatile. A positive surprise in the US jobs report could generate a spike higher in US yields and the USD, unwinding the AUD’s rebound. This is something to be mindful of.

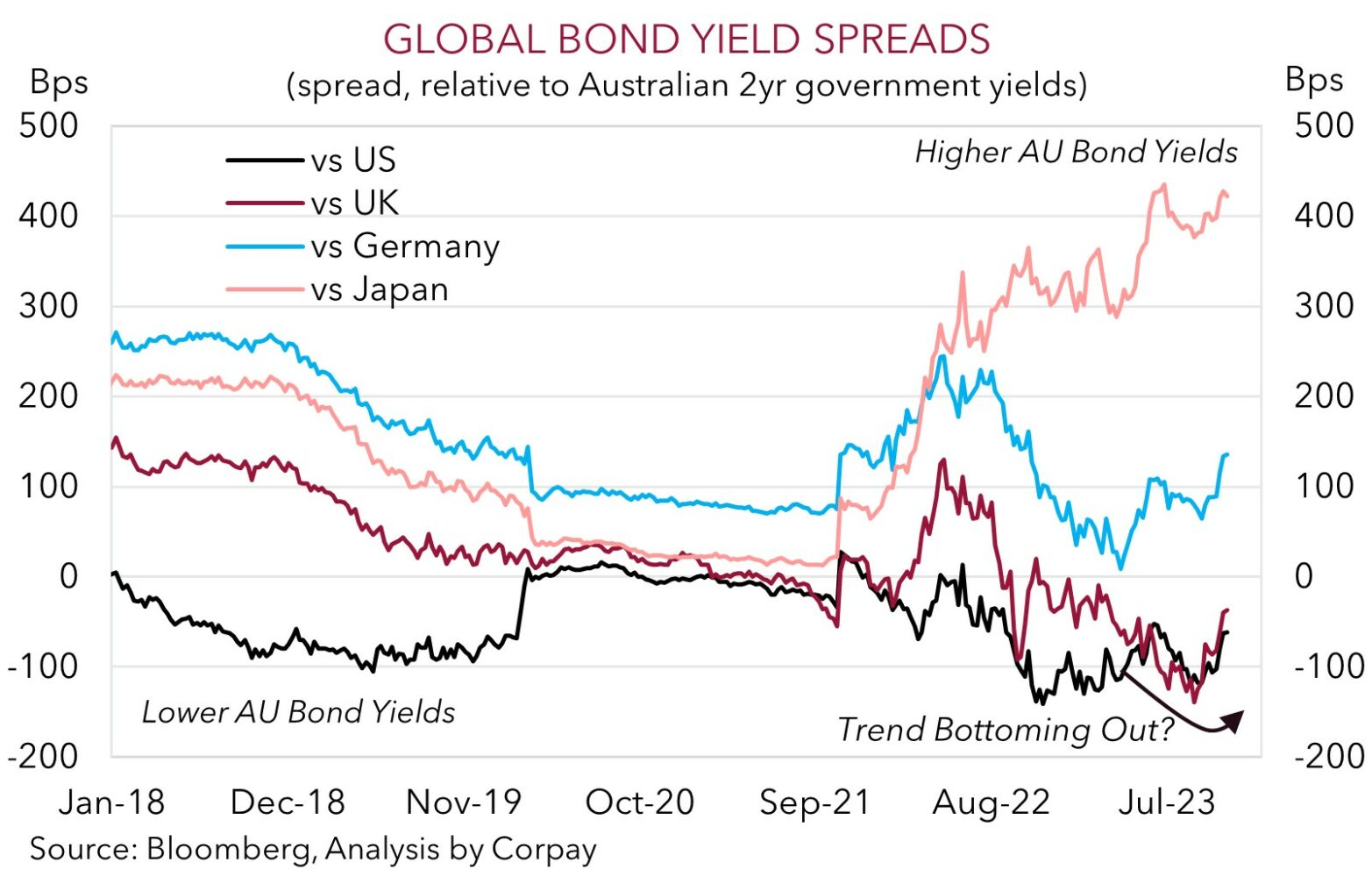

Stepping back from the potential near-term gyrations, we remain of the opinion that fundamental drivers for AUD/USD to gradually recoup lost ground into year-end are moving into place. Negative AUD positioning (as measured by CFTC futures) is still quite bearish; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) remains; policymakers in China appear set to inject additional stimulus aimed at commodity-intensive infrastructure spending; the US’ relative economic strength looks likely to fade as tighter conditions and less savings crimp activity; and relative yield spreads have become more AUD supportive as further tightening by the RBA is factored in. A move at the 7 November RBA meeting is anticipated (see Market Wire: CPI keeps the pressure on the RBA). 21 out of 24 analysts surveyed are looking for a hike. Interest rate markets are assigning a ~63% chance.

AUD levels to watch (support / resistance): 0.6330, 0.6392 / 0.6480, 0.6519