• US jobs. A softer US jobs report added to the downward pressure on US yields & the USD. Equities continue to bounce back. AUD at its highest since late-August.

• RBA hike? Attention will be on tomorrow’s RBA decision. Most analysts are expecting a rate rise, but markets are less sure (~60% chance is priced in).

• AUD vol. Market pricing points to AUD volatility post the RBA, with a ‘surprise’ no change likely to generate a larger knee-jerk AUD reaction, in our view.

Markets were fixated on the latest US jobs report on Friday night. The weaker than predicted figures extended the pull-back in US bond yields and the USD while the revival in equities and the AUD continued. The US 2yr rate fell ~15bps (now 4.84%) and the 10yr declined ~9bps (now ~4.57%). The latter dropped by ~26bps last week, the largest weekly fall since mid-March as expectations the end of the US Fed’s tightening cycle has been reached ramped up. Markets are now only assigning a ~10% chance the Fed hikes rates again with a rate cutting cycle penciled in from mid-2024. Elsewhere, the S&P500 rose ~0.9%, taking its weekly advance to ~5.8% (the biggest since June 2022), and the USD lost ground. EUR has pushed back above ~$1.07 for the first time since mid-September, GBP is just under ~$1.24, and the rate-sensitive USD/JPY has slipped below ~149.50. Risk sensitive cyclical currencies like the NZD and AUD had a positive end to the week. The AUD (now ~$0.6511, ~3.8% above its 26 October low) touched its highest level since late-August.

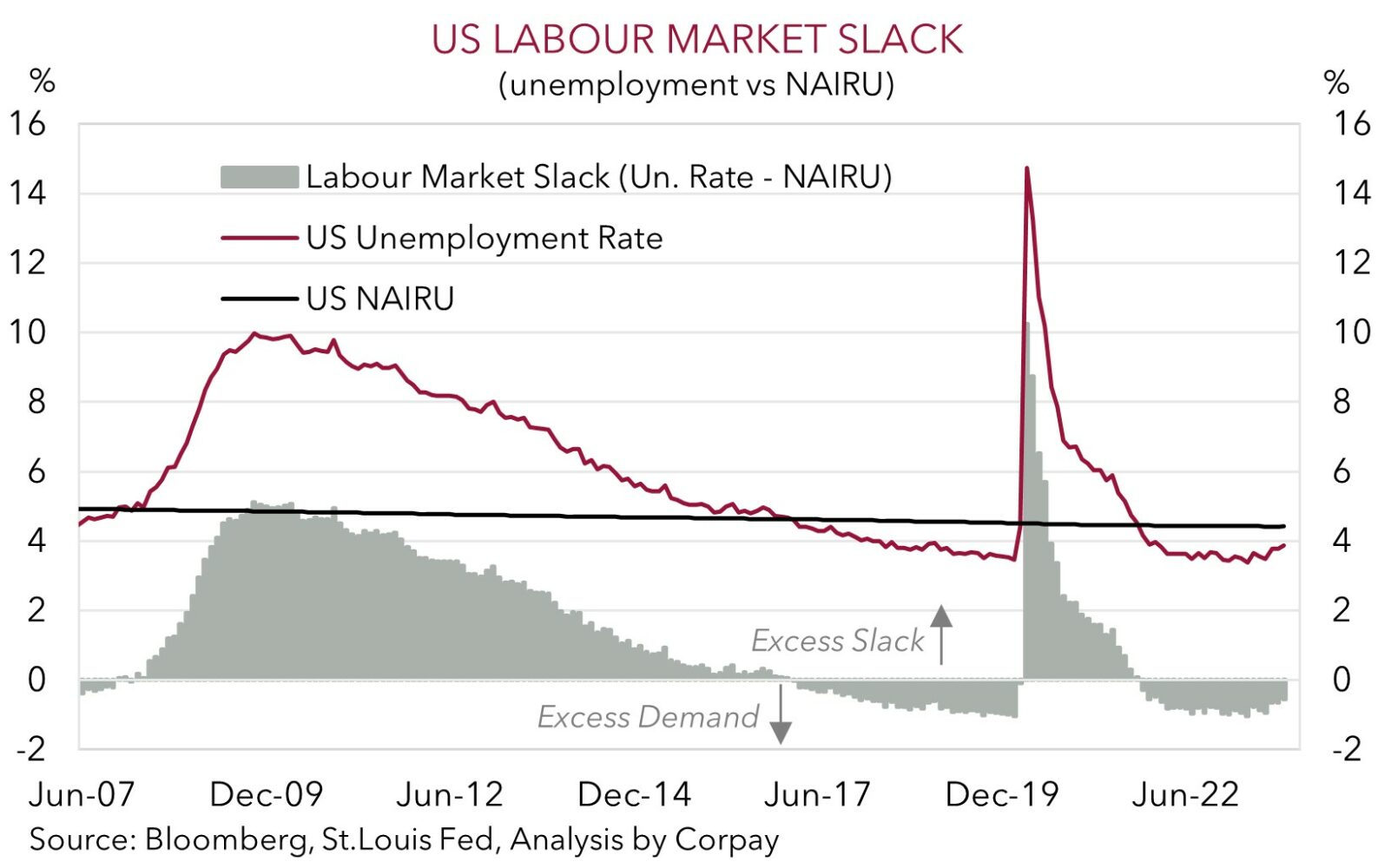

In terms of the US data, hiring and wage growth softened with non-farm payrolls rising by 150,000 in October and average hourly earnings slowing to 4.1%pa. There were also downward revisions to the previous few months of jobs data. Some temporary weakness due to strike actions, which should reverse in time, was at play, however the slowdown across several sectors also shows that the tide is turning and tighter credit conditions are starting to bite. The excessive heat that drove up wages and sticky core inflation is coming out of the US labour market. The US unemployment rate rose to 3.9%, its highest since early 2022. The multi-month grind up in US unemployment, coupled with the weaker ISM services survey and signal from other leading indicators, hints at increasing odds of an eventual recession and reinforces the case for the US Fed to refrain from lifting rates further, in our view.

It is a quieter week on the global economic front. But we believe signs trade out of China is improving (released Tues), credit standards in the quarterly US loan officers survey are tight (Tues 6am AEDT), and/or a repeat of the ‘cautious’ rhetoric by Fed officials (including Chair Powell (Fri morning AEDT)) could see the USD remain on the backfoot. Last week’s US economic and Fed policy developments are in line with our thinking that barring an intensification of the Middle East conflict the fundamental drivers for a deflating in the USD into year-end are moving into place.

AUD corner

The AUD’s recovery has continued. Further falls in US bond yields and the USD, and resultant boost to risk sentiment generated by the softer US jobs data has propelled the AUD to its highest level since late-August (now ~$0.6511) (see above). On the crosses, the AUD ticked up a bit more versus the EUR (+0.2% to ~0.6069). The positive risk backdrop also supported AUD/JPY (+0.5% to ~97.25, the top end of its 2023 range) and AUD/CNH (+0.7% to ~4.7467, also a high since late-August), with the rebound in AUD/CAD (now ~0.8894, around its highest since late-July) helped along by an underwhelming Canadian jobs report.

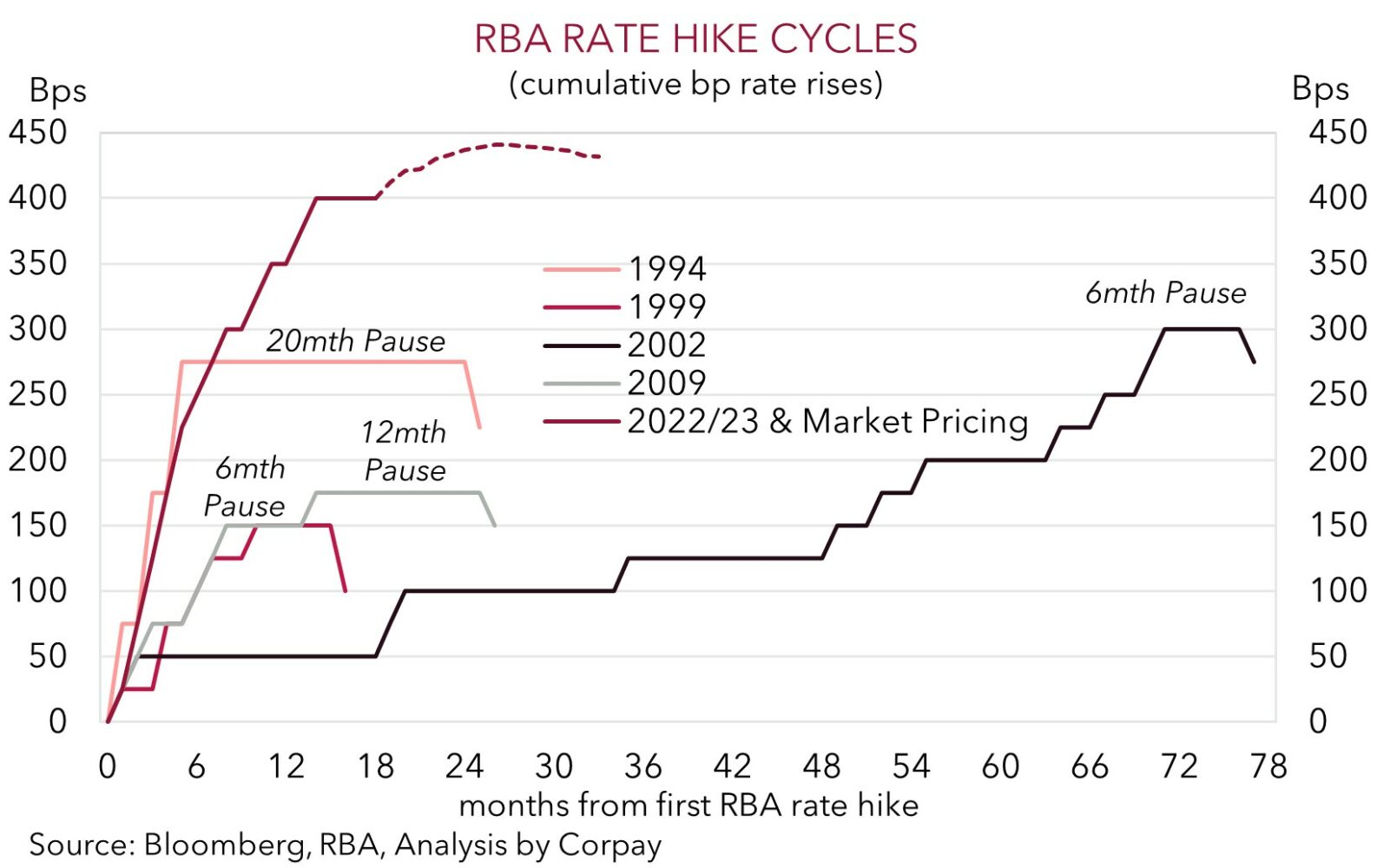

Locally, attention this week will be on the RBA decision (Tues 2:30pm AEDT). After a 4-month ‘pause’ we think the stickiness across services inflation, still firm labour market conditions with unemployment tracking below ‘full-employment’, upswing in house prices and wages, and boost to aggregate demand from the large increase in the population should see the RBA deliver another 25bp rate hike, taking the cash rate up to 4.35% (see Market Wire: CPI keeps the pressure on the RBA). Given the underlying inflation pulse we also believe the RBA should keep the door open to further tightening down the track, if needed. For the AUD, although 21 out of 24 analysts surveyed are looking for a hike, interest rate markets are less convinced and are assigning a ~60% chance of a move on Melbourne Cup day, with a full 25bp increase only discounted by February. As such, AUD volatility around the RBA announcement should be elevated with another move set to give the AUD a lift, while a surprise no change decision (which can’t be ruled out) would trigger a knee-jerk drop. That said, if the RBA holds fire, we don’t believe it should be on the sidelines for long with domestic conditions showing that policy settings still aren’t tight enough to stamp out inflation.

Stepping back from the potential near-term RBA-induced swings, we remain of the view that the global drivers for AUD/USD to edge up to ~$0.66 into year-end and onto $0.68 in Q1 are moving into place. Negative AUD positioning (as measured by CFTC futures) remains bearish, suggesting too much ‘bad news’ is still factored in; the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP) is ongoing; policymakers in China look set to inject more stimulus aimed at commodity-intensive infrastructure spending; the US’ relative strength is set to fade as tighter conditions and less savings curtail activity; and yield spreads have become more AUD supportive. We also continue to think that the unfolding macro trends should see the AUD outperform currencies like the EUR and GBP over the period ahead (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

AUD levels to watch (support / resistance): 0.6430, 0.6480 / 0.6580, 0.6609

SGD corner

The pull-back in US bond yields and the USD over the past week as the US Fed’s ‘cautious’ tone and softer US jobs data dampened further rate hike bets has weighed on USD/SGD (see above). At ~1.3538 USD/SGD is now ~1.6% below its early-October highs. On the crosses, EUR/SGD (now ~1.4527) has inched a bit higher, while SGD/JPY remains historically high with the positive risk backdrop continuing to limit reversals in the JPY.

As outlined above, the global economic calendar is limited this week, with the China trade data (Tues) and speeches by Fed officials including Chair Powell (Fri) the focal points. In our view, signs China’s trade pulse is continuing to improve should be a supportive for regional growth prospects and cyclical currencies like the SGD. This, combined with further ‘cautious’ comments from Fed members about the need for additional policy tightening may exert more pressure on the USD (and USD/SGD).

SGD levels to watch (support / resistance): 1.3452, 1.3510 / 1.3630, 1.3680