• Consolidation. Bond yields recovered a bit of lost ground, though moves across FX were limited. The USD is a little firmer. AUD slipped back under $0.65.

• Another RBA hike? RBA in focus today. Most analysts expect another 25bp hike. Markets are less sure with a ~65% chance of a move factored in.

• AUD vol. A hike combined with an ongoing tightening bias should be AUD positive. But a no change decision could trigger a larger knee-jerk AUD fall.

After last weeks outsized market moves, it isn’t surprising to see that there was some modest payback overnight. US equities were flat, while the major European markets lost some ground (EuroStoxx50 -0.4%). Bond yields rose, with the US 2yr rate up ~9bps (now 4.93%) and the 10yr lifting by ~7bps (now 4.65%). It is a bit circular, but markets may be starting to think things have gone too far too fast and that Fed policymakers could lean against the easing in financial conditions given the tightening (i.e. the rise in bond yields, decline in equities, stronger USD etc.) that occurred over Sep-Oct was flagged as a reason why further hikes may not be necessary.

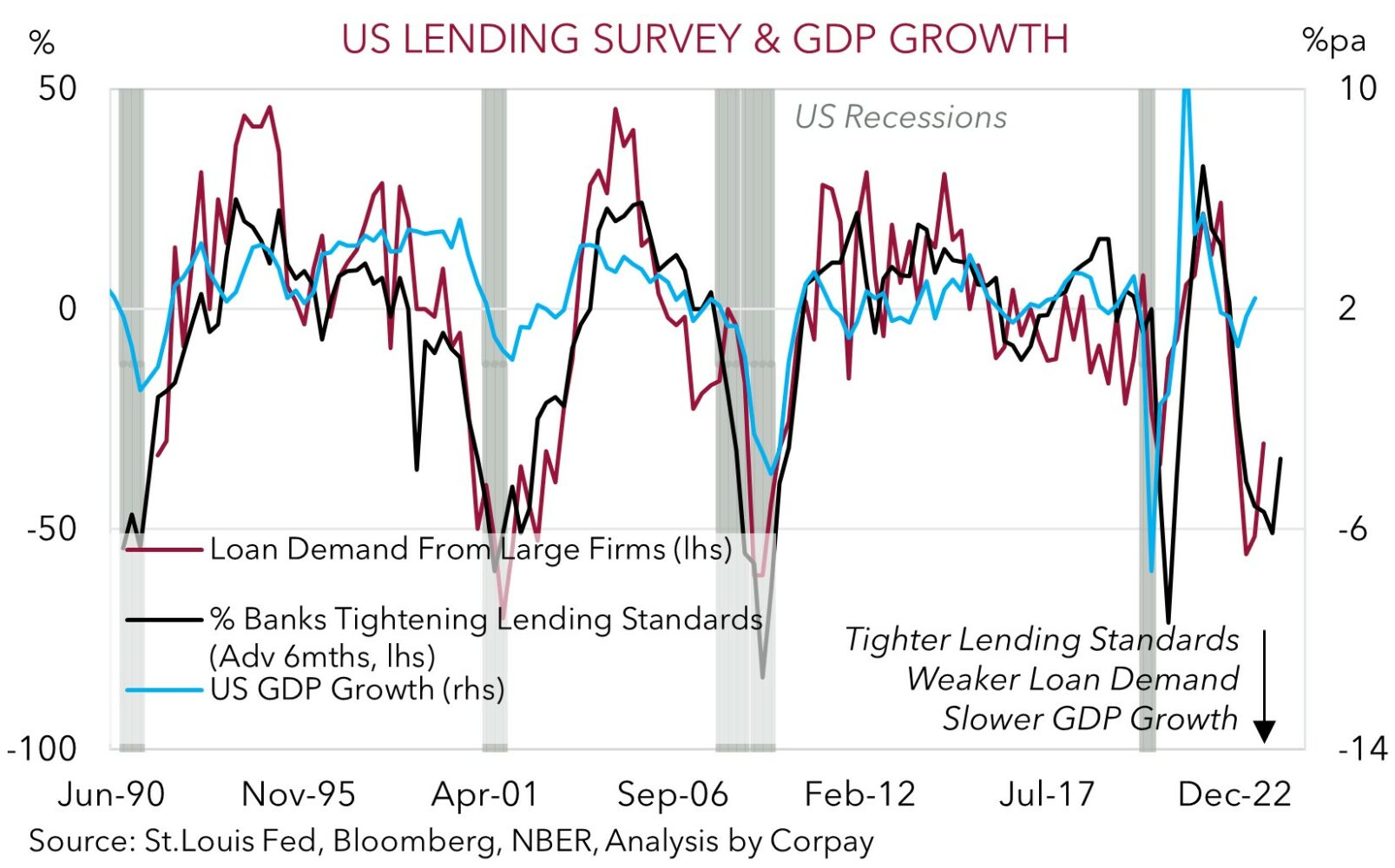

Time will tell, with several Fed officials set to speak this week including Chair Powell who is appearing on a panel about monetary policy challenges (Friday 6am AEDT). Though we would note it’s not just financial market conditions the Fed looks at. What is happening on the ground in the real world is important. And on this front, the Fed’s Senior Loan Officer Survey (released this morning) shows that although there was a slight improvement in Q3, US banks reported that lending standards remain tight and demand for loans is weak. The flow of credit is the lifeblood of an economy. As our chart illustrates, this mix typically translates to a slowdown in the US growth and higher unemployment ~3-6 months down the track.

Elsewhere, oil prices nudged up (WTI crude rose ~0.6% to just under US$81/brl), while copper added another 0.8%, its 5th increase in the past 7 sessions. Given its wide-ranging uses, copper has often been a leading indicator of global momentum. The upturn suggests industrial activity could be stabilising, with signs of improvement and fiscal support being injected in China providing a helping hand. The latest China trade data is released today (no set time) and further recovery in import and export growth is predicted. FX markets were quiet. The USD ticked up a touch with EUR drifting back from its multi-week highs (now ~$1.0721). USD/JPY tracked the rebound in US bond yields higher to be near ~150, while USD/SGD consolidated above ~$1.35. NZD and AUD eased slightly over the past 24hrs with the latter back sub-$0.65 ahead of today’s RBA decision (2:30pm AEDT).

Globally, it is a quieter week with Fed Chair Powell’s appearance a macro highlight. However, things should heat up again next week with the China activity data, US CPI inflation (both 15th Nov), and US retail sales (16th Nov) due. Things don’t move in a straight line, but barring an intensification of the Middle East conflict we remain of the opinion that the drivers for a further deflating in the USD are moving into place.

AUD corner

Following on from its sharp jump up over the past few weeks the AUD’s upswing paused for breath overnight. After rising by ~4% from its 26 October low, the rebound in US bond yields and slightly firmer USD has seen the AUD drift back a little (now ~$0.6488) (see above). The AUD has also had a mixed 24hrs on the crosses weakening a bit against the EUR (-0.3%), GBP (-0.2%), and CNH (-0.4%), but ticking up versus the NZD (+0.2%).

Market attention will be on today’s RBA decision (2:30pm AEDT). After a 4-month ‘pause’ we believe the stickiness across services inflation, still firm labour market conditions with unemployment below ‘full-employment’, turnaround in house prices, quickening wages, and boost to aggregate demand from the large increase in the population should see the RBA deliver another 25bp rate hike. This would take the cash rate up to 4.35%, its highest level since November 2011 (see Market Wire: CPI keeps the pressure on the RBA). Based on the ongoing inflation risks we also think the RBA should keep the door ajar to further tightening, if needed.

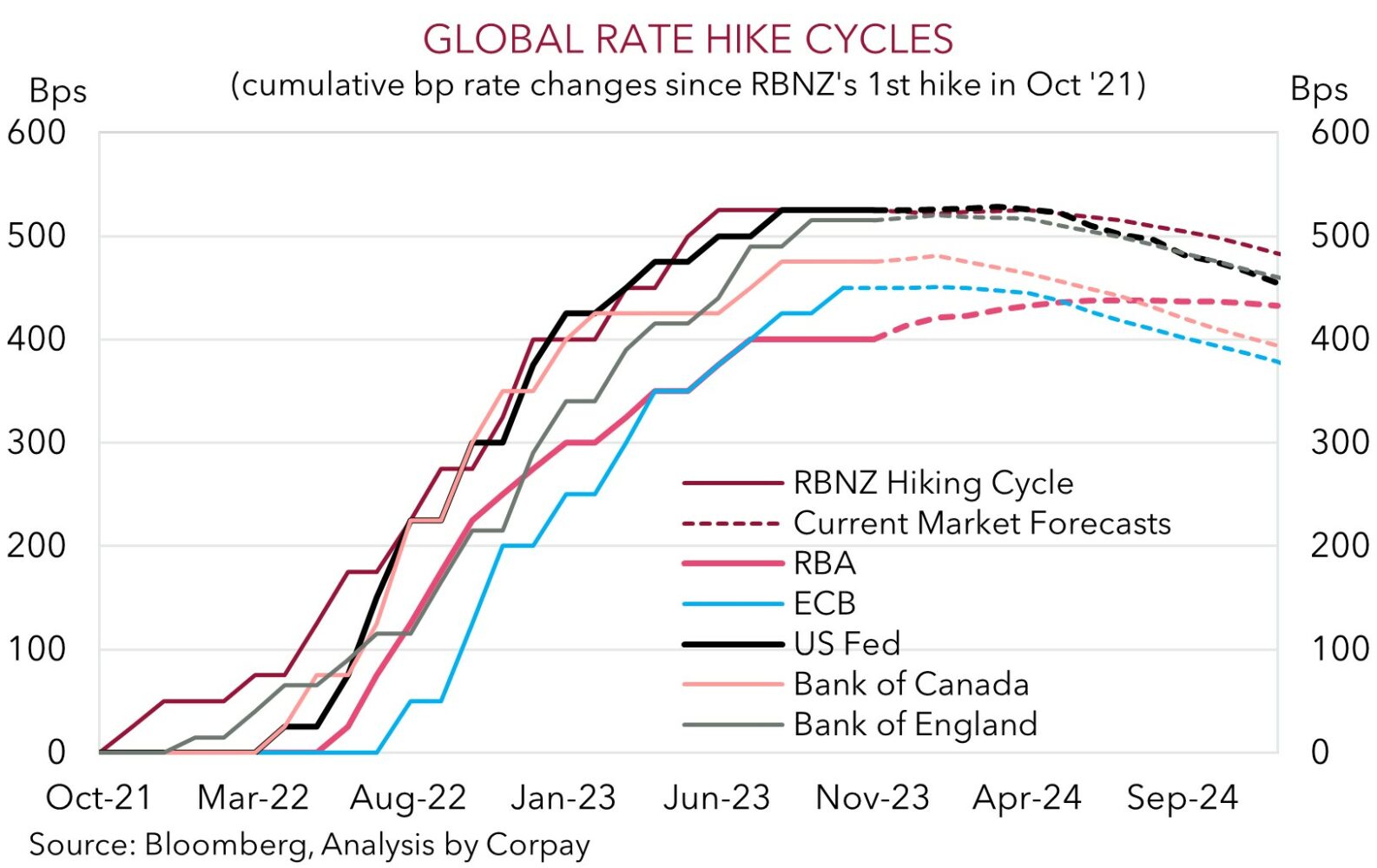

We are not alone in anticipating another rate rise today with 29 of 32 analysts surveyed penciling it in. That said, interest rate markets are less sure with a ~65% chance of a move factored in, and a full 25bp increase only discounted by February. As a result, AUD volatility around the RBA announcement could be elevated with another rate rise likely to generate a lift, particularly if a tightening bias is also retained. As our chart shows, after lagging its peers, the RBA is now the odd one out with it being the only major central bank where additional rate hikes are still anticipated. That said, a surprise no change decision (which can’t be ruled out) would likely to trigger a larger knee-jerk drop in the AUD given it could raise questions about whether the RBA will move again this cycle and/or its independence.

Assuming the RBA crystallises our rate hike prediction, we think the mix of narrowing yield differentials; still very bearish AUD positioning (as measured by CFTC futures); flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); more stimulus injections in China aimed at commodity-intensive infrastructure spending; and a slowing in the US economy as tighter conditions crimp activity should help the AUD recovery more lost ground into year-end.

AUD levels to watch (support / resistance): 0.6395, 0.6460 / 0.6570, 0.6619