• Mixed markets. Equities ticked up with the S&P500 enjoying its 8th straight gain. USD index consolidated, but commodity currencies like the AUD slipped back.

• Bonds & oil. The slide in long-end bond yields & oil continued. US 10yr yields are now ~50bps below the late-October peak. Oil is at a multi-month low.

• AUD stumble. AUD has given back ~1/2 its recent rebound. Domestic wage & jobs data released next week could see AU rate expectations rebound.

With not too much economic news most markets have consolidated over the past day. Equities have generally ticked up with the major European indices outperforming (EuroStoxx50 +0.6% vs US S&P500 +0.1%). For the S&P500 this was the 8th straight day of gains, taking the cumulative lift since 27 October to ~6.5%. The rally in long-end bonds has continued with the benchmark US 10yr yield falling another 5bps. At ~4.51% the US 10yr rate is now ~50bps under its late-October highs, with the step down in expectations for further central bank policy tightening and slump in oil contributing factors. Markets are now discounting only a ~10% chance the US Fed raises rates again, with a modest easing cycle priced in from mid-2024.

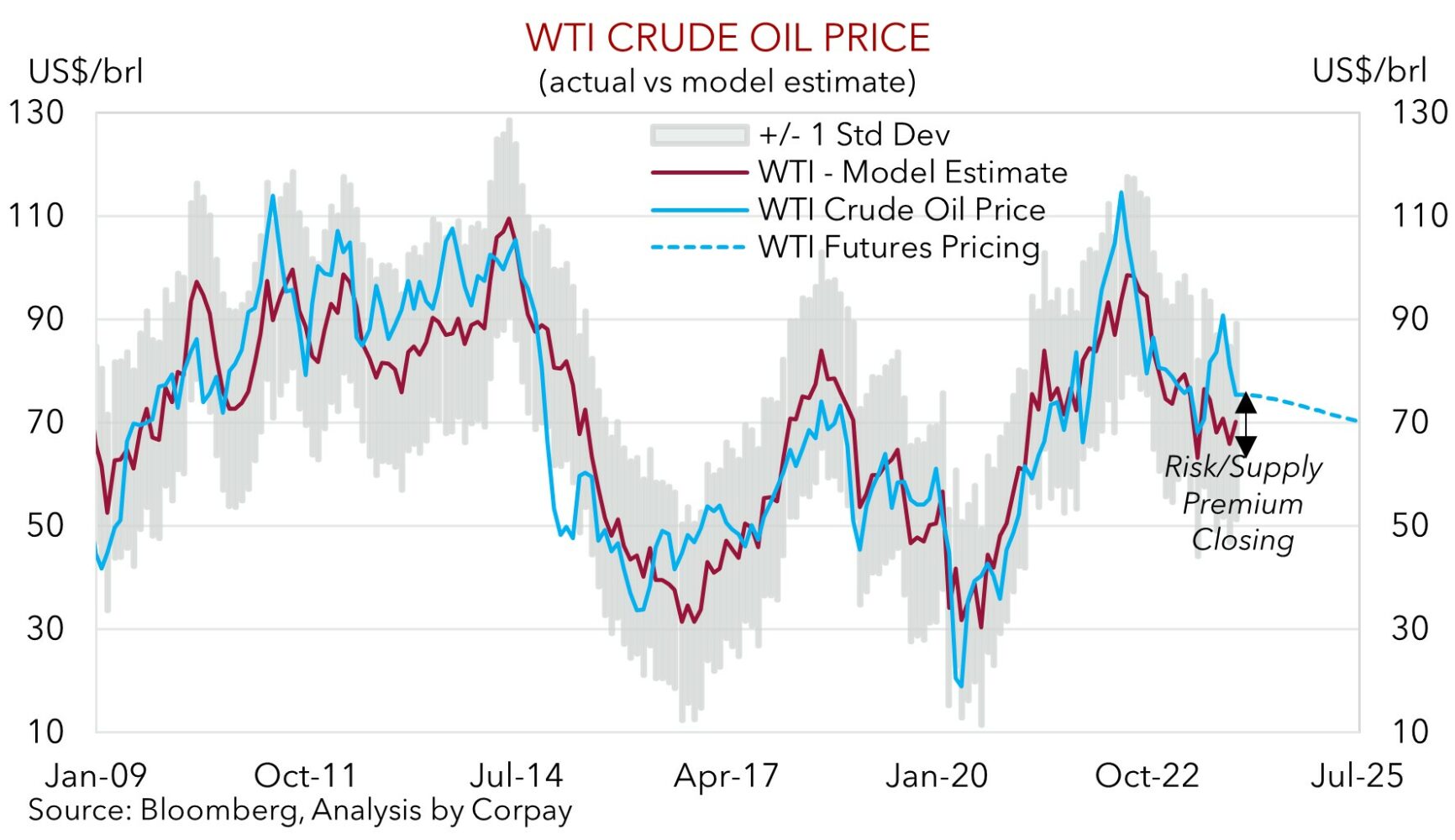

In terms of oil, WTI crude (-2.3% overnight) is now at ~US$75.60/brl. This is its lowest level since mid-July, and nearly ~20% below the September peak. After being boosted by supply/geopolitical concerns, worries about the demand outlook have taken hold recently. The narrative seems to be switching from day to day. While volatility may continue over the near-term, as illustrated in the chart below, the current oil price now looks better aligned to the underlying backdrop, with the gap to our fundamental ‘fair value’ model closing.

In FX, the USD index has tracked sideways and has held onto the slight gains from earlier this week. EUR is hovering around ~$1.07, GBP is just under ~$1.23, and USD/JPY has pushed up to ~151, supported by the relatively higher US bond yields, more restrained market volatility, and climb higher in equities over the past week. USD/SGD has held steady, with the pair trading just above its 100-day moving average (~1.3545). That said, commodity currencies have lost some ground. In addition to oil, copper dipped, recording its 2nd straight ~1% fall yesterday. NZD (now ~$0.5912) is back where it was prior to last Friday’s US non-farm payrolls data, and the AUD (now ~$0.6402) is down at levels traded a week ago.

CPI/PPI data from China is due today (12:30pm AEST), US initial jobless claims are released tonight (12:30am AEDT), and Fed Chair Powell is speaking on a panel tomorrow morning (6am AEDT). If the policy outlook is discussed, we don’t expect Powell to deviate from the script (i.e. the door to more tightening is still open, but it will depend on the data). This may disappoint those thinking he may push back harder against the loosening in conditions, exerting a little pressure on the USD. However, next week is shaping up to be more important with the China activity data, US inflation (both 15th Nov), and US retail sales (16th Nov) due. In our judgement, signs growth in China is improving, combined with softer US CPI and/or retail sales (which is where we believe the risks reside) could reinforce the view US rates have ‘peaked’. In turn, this can be a positive for risk sentiment, and see the USD’s downturn recommence.

AUD corner

The AUD has extended its post-RBA unwind. The dip in oil and copper prices has compounded the pairing back in RBA rate rise expectations following the latest hike on Tuesday and the watering down of the Board’s forward guidance (see Market Wire: RBA: it ain’t over till it’s over). At ~$0.6402 the AUD is back where it was tracking a week ago, with around half of its recent rebound unravelling. On the crosses, the AUD has also been on the backfoot with falls of ~0.4% recorded against GBP and CNH over the past 24hrs. AUD/EUR (-0.6%) is back sub ~0.60 for the first time since the start of November.

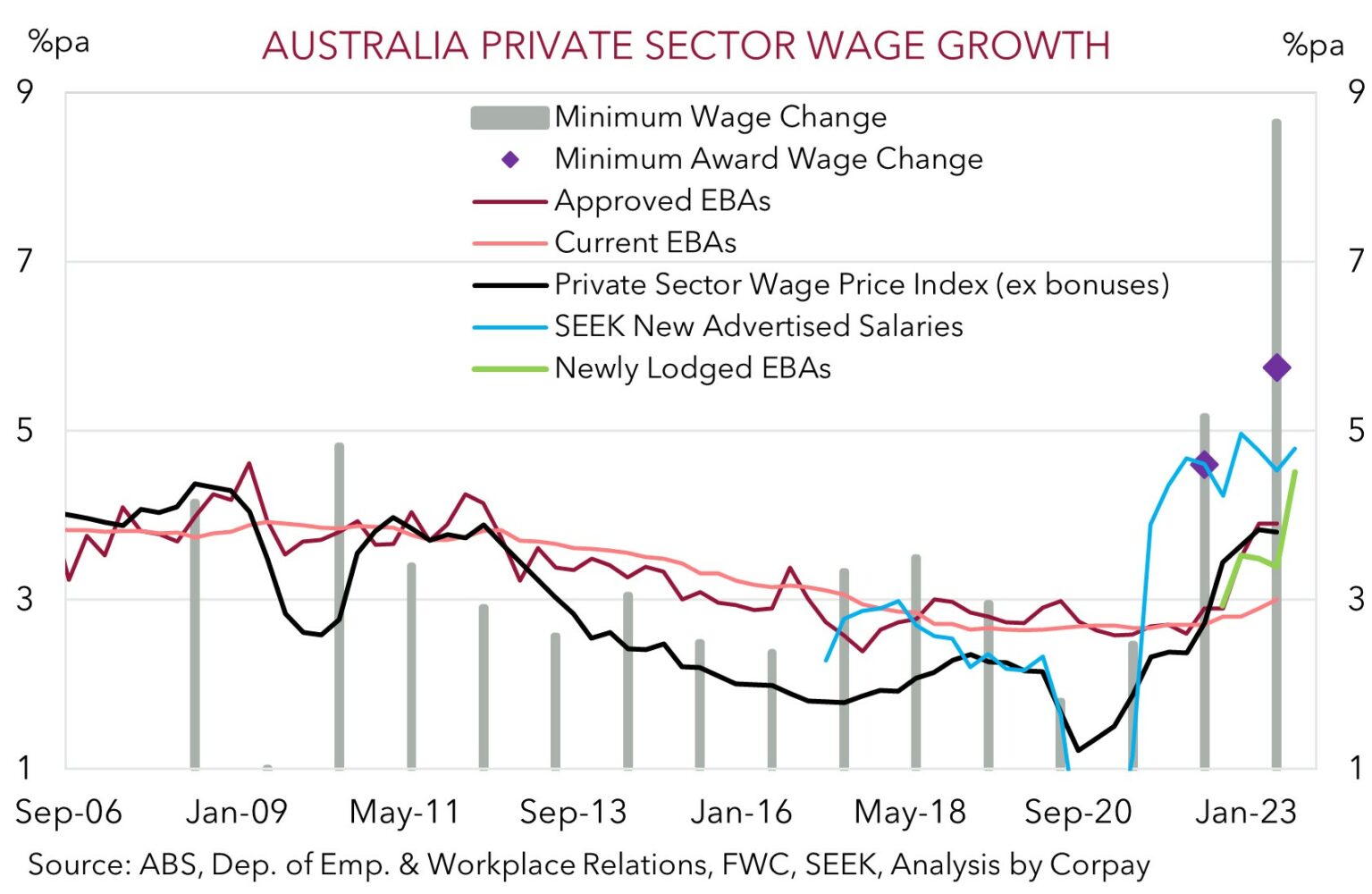

Markets and analysts aren’t anticipating the RBA to follow up its November hike with another move in December. That said, we believe the door to further action remains open. The risk of more tightening being delivered in February remains quite high, in our view, given the stickiness in services inflation, the resilience in aggregate demand thanks to the surge in the population, still tight labour market conditions, and with income supportive tax cuts coming in in mid-2024. We think odds of another move by the RBA (now sitting at ~30% chance by February) may pick up next week if the quarterly wage price index (released 15 Nov) and/or the monthly jobs report (released 16 Nov) positively surprise. If realised, this could see the AUD recover lost ground.

At the same time, as mentioned above, the China activity data (15 Nov) is expected to show growth momentum is improving, while in our judgement US inflation (15 Nov) and US retail sales (16 Nov) could underwhelm. This mix may see the USD come under renewed downward pressure, as it would reinforce expectations that the data-dependent US Fed is unlikely to raise rates further.

The slip back in the AUD over the past few days has been a bit of a setback, but markets don’t move in straight lines, particularly after a ~4% rapid-fire rally like the AUD enjoyed recently. Overall, we remain of the opinion that the underlying drivers for the AUD to tick up to ~$0.66 by year-end are falling into place. The mix of narrower Australia-US yield differentials (the AU-US 2yr spread is now -71bps, the last time spreads were at this level was in mid-July and back then the AUD was around ~$0.67); still very bearish AUD positioning (as measured by CFTC futures); flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); more stimulus injections in China aimed at commodity-intensive infrastructure spending; and an anticipated slowing in the US economy as tighter conditions restrain activity should be AUD supportive.

AUD levels to watch (support / resistance): 0.6320, 0.6393 / 0.6450, 0.6504