• Positive sentiment. US equities rose sharply on Friday, while oil & bond yields ticked up. USD consolidated. AUD stabilised after a torrid few days.

• RBA projections. RBA revised up its growth outlook. It is also forecasting a slower return by inflation to target. Risk of another rate hike remains.

• Event radar. Offshore, US CPI, US retail sales & the China activity data are released this week. Locally, Q3 wages & the monthly jobs report are due.

In contrast to the softness during Friday’s Asian and European sessions, risk appetite was positive in US trade. US equities rose sharply with the S&P500 rising ~1.6% and the tech-focused NASDAQ up ~2% (the best one-day performance since May). The S&P500 has now more than unwound its October falls to be at a ~6-week high. Oil prices also increased (+1.8%), though at ~US$77.20/brl WTI crude is still near the bottom of its ~4-month range. Bond yields ticked higher with the US 2yr and 10yr rates lifting 4bps and 2bps respectively. The more ‘hawkish’ tone from Fed Chair Powell the day earlier and lift in 5-10yr ahead inflation expectations to a fresh high outweighed the slump in the University of Michigan consumer sentiment gauge and move by ratings agency Moody’s to lower the outlook on the US’ AAA rating to ‘negative’. At 5.06% the US 2yr yield is back around its September-October average with markets pricing in a ~30% chance the US Fed delivers another hike by the January meeting. This is up from ~15% last Tuesday.

In FX, the USD held onto its recently recouped ground. The USD Index is hovering at a ~1-week high. EUR is tracking sub ~$1.07 and USD/JPY is at the top of its cyclical range (now ~151.38). The more positive risk sentiment helped the NZD and AUD stabilise. Although at ~$0.6360 the AUD is down where it was trading earlier this month, ~2.5% below its 6 November peak.

Volatility may be elevated this week with several important macro events on the radar which could influence central bank expectations. The latest readings of US CPI inflation (Weds morning AEDT) and US retail sales (Thurs morning AEDT) are due, several members of the US Fed are set to speak (19 appearances are scheduled, although not all are policy related), President’s Biden and Xi look set to meet up at the APEC summit, and the China data batch for October is released (Weds AEDT).

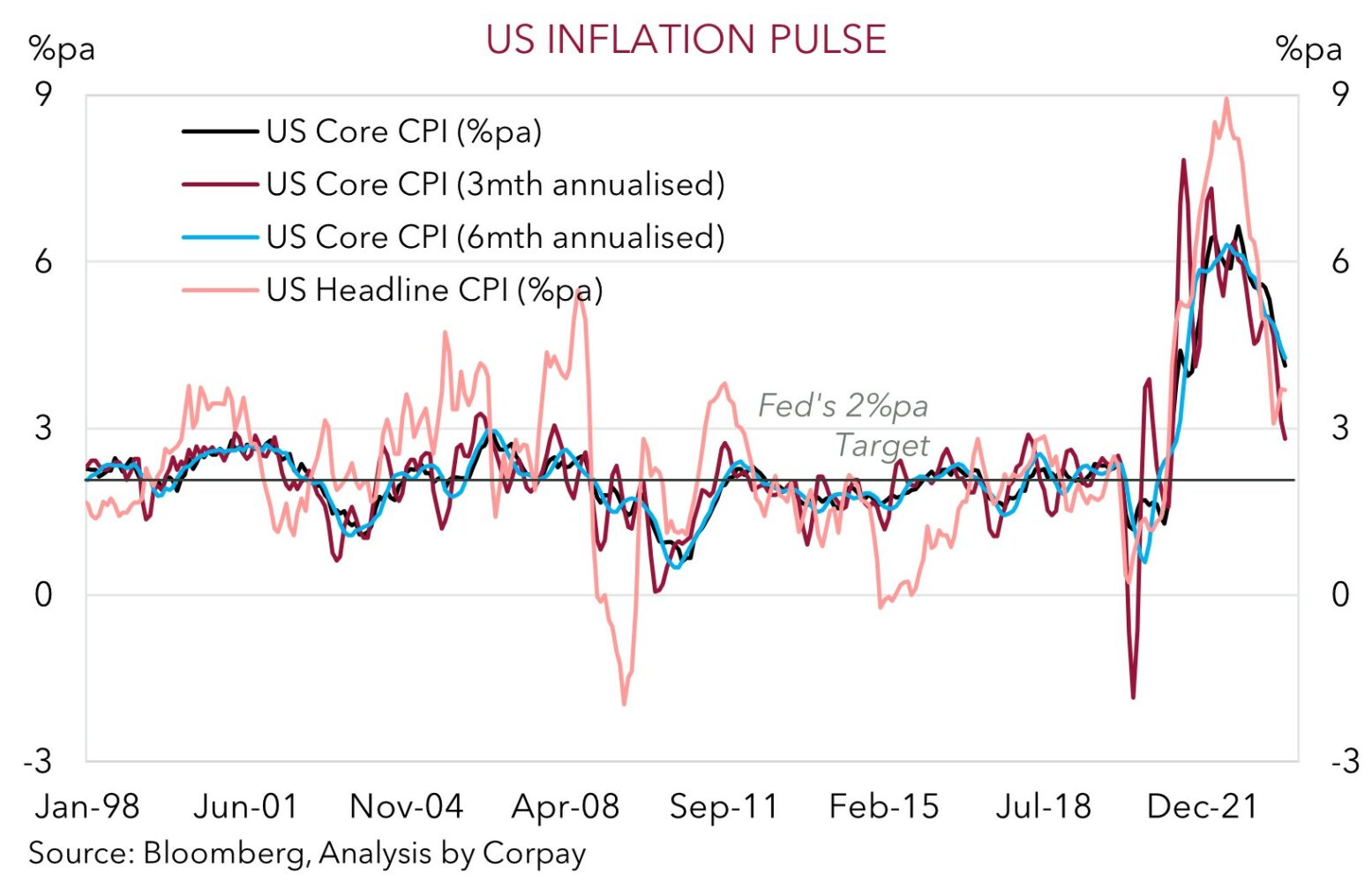

There are a few quirks that might throw up a curve ball in the US CPI data, such as the auto-workers strikes impact on car prices, and changes to health insurance inflation. That said, we think the pull-back in oil prices, slowing rents, and signal from the Cleveland Fed ‘nowcast’ point to some downside risks to consensus forecasts looking for headline CPI to step down to 3.3%pa, although core inflation is likely to hold steady at 4.1%pa. In our opinion, a softening US inflation pulse, coupled with waning momentum in US consumption (the engine room of the economy) after a strong few months as reduced ‘excess savings’ and tighter credit conditions bite, and signs activity in China is accelerating as stimulus support gains traction could reinvigorate views US interest rates and the US’ relative economic outperformance have ‘peaked’. This could see the USD fall back.

AUD corner

The AUD consolidated on Friday thanks to positive risk sentiment (see above). But this comes after falling over the bulk of last week. At ~$0.6360 the AUD is now just above where it started November, with the early month upswing unwound. On the crosses, the AUD has remained on the backfoot. The AUD weakened by ~0.2-0.3% against the EUR, JPY, GBP, CAD, and CNH compared to where it was tracking at this time on Friday. At ~0.5952 AUD/EUR is down near the bottom of its ~2-month range, AUD/GBP is hovering around its ~50-day moving average (~0.5208), and AUD/NZD (now ~1.0784) is at a multi-week low.

On Friday the RBA released its Statement on Monetary Policy. As was flagged, the RBA revised up its growth outlook, thanks in large part to the population surge. This in turn flowed through to a smaller projected uptick in unemployment over the next few quarters and a slower return by inflation to the 2-3% target. The RBA only sees inflation sneaking back into the band by late-2025. Importantly, these projections incorporated the November hike and where conditioned on one further partial move. In our mind, this suggests the RBA isn’t operating with much margin of error, and while it appears reluctant to raise rates further, the data might again force its hand. Acting RBA Assistant Governor Kohler is speaking today (10:30am AEDT).

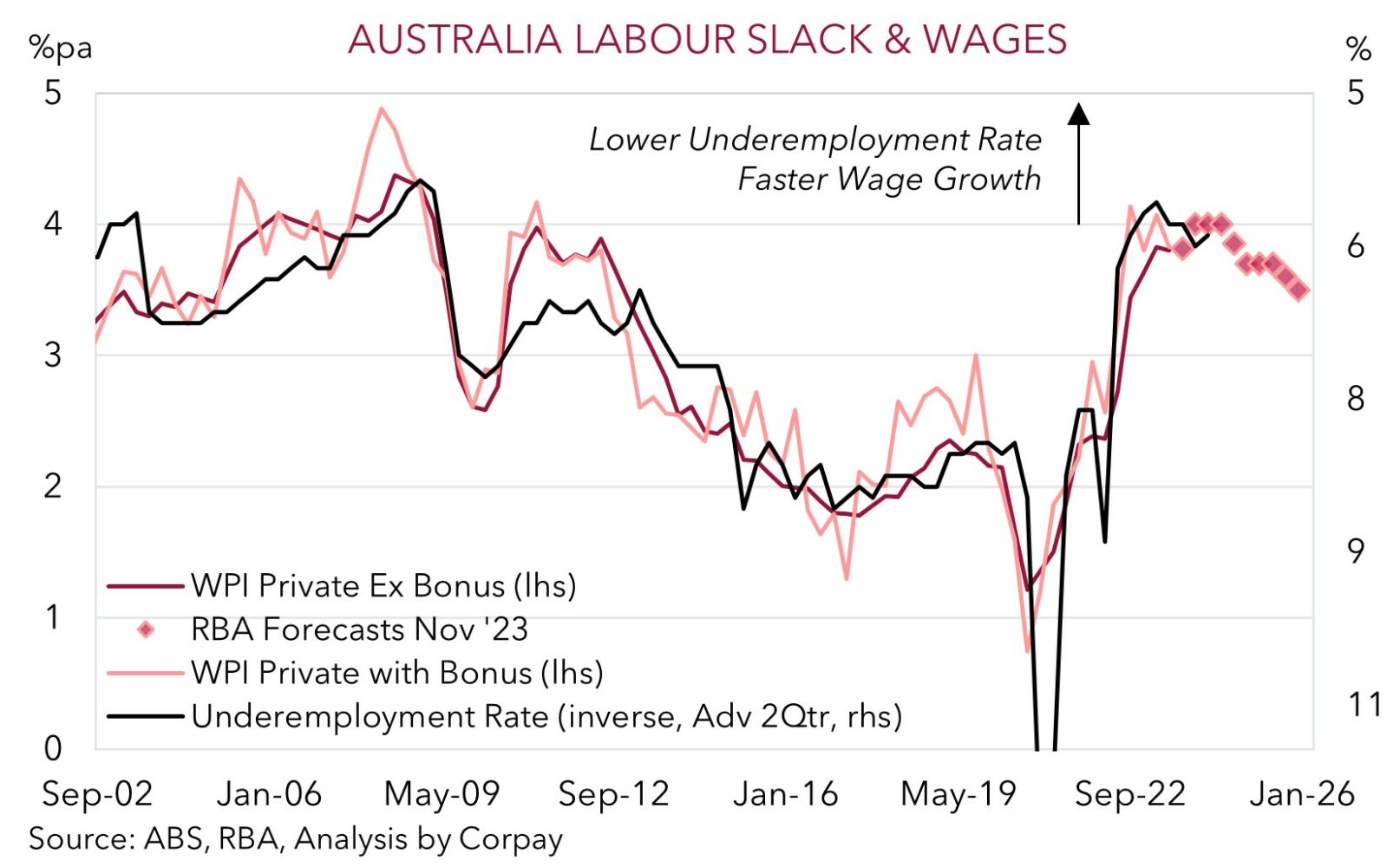

AUD volatility is likely to be elevated this week. In addition to the global events (see above) this week’s Q3 wages (released Weds) and October jobs report (released Thurs) will be a litmus test for the RBA’s thinking. Wage growth looks set to accelerate but we believe it could positively surprise given the boost from not only the large lift in the minimum and award wage but also the general tightness in labour conditions and catch up across the public sector. And while the October jobs data may be nosier than usual thanks to the timing of school holidays, another month of job gains and still low unemployment is anticipated. This type of mix could raise doubts about core inflation coming down quickly enough to satisfy the RBA and may bolster rate rise bets (markets are now assigning a ~37% chance the RBA hikes again by February, and only ~7% in December).

An upward repricing in near-term RBA rate expectations, combined with faster growth in China (the October activity data is released Weds), risks US CPI inflation (Weds morning AEDT) and US retail sales (Thurs morning AEDT) underwhelm, and still bearish AUD positioning (as measured by CFTC futures) could see the AUD claw back ground, in our view. From out perspective, the AUD looks a little low relative to various underlying fundamentals. For example, the Australia-US 2yr yield spread is now -76bps. The last time this differential was at this level was in mid-July and back then the AUD was closer to ~$0.67.

AUD levels to watch (support / resistance): 0.6270, 0.6320 / 0.6430, 0.6480

SGD corner

The rebound in US bond yields and the USD over the past week as some ‘hawkish’ rhetoric from Fed Chair Powell kept alive the chances of another rate rise supported USD/SGD. At ~1.3603 USD/SGD is now back up near its ~3-month average. On the crosses, EUR/SGD (now ~1.4534) has remained range bound, while SGD/JPY remains historically high with the positive risk backdrop weighing on the JPY.

As mentioned above, the global economic calendar is quite full this week with US CPI inflation, US retail sales, the China activity data, and several speeches by Fed officials on the radar. The US data will influence US interest rate expectations and the USD. In our view, a moderation in US inflation, combined with a step down in US retail sales, and signs stimulus measures are gaining traction in China, could see the USD (and USD/SGD) dip back as thoughts US interest rates have ‘peaked’ come back into focus.