• Quiet trade. US equities & the USD consolidated, while yields slipped back a little. The AUD ticked up, although this follows last week’s negative run.

• US inflation. US CPI released tonight. There are a few push-pull factors are play this month. Reaction in US yields & the USD is likely to be binary.

• Event risks. The calendar is packed with other releases the next few days. China data batch & AU wages due tomorrow, & US retail sales is tomorrow night.

It has been a subdued start to the week across markets with investors marking time ahead of the major US and China economic data releases. Focus tonight will be on US CPI Inflation (12:30am AEDT). The China data batch for October is due tomorrow, US retail sales are out tomorrow night (Thurs 12:30am AEDT), and there are several US Fed officials speaking over the next few days. In terms of the numbers European equities played some catch up after Friday’s sharp rise in the US (EuroStoxx50 +0.8%). However, overnight the US indices were flat, with US bond yields slipping back 2-3bps across the curve. The benchmark US 10yr rate is now at 4.63%, where it was tracking a month ago before yields endured a ~40bp rise and then an equally dramatic fall over the subsequent few weeks. Oil prices have edged up again (+1.6%), but at ~US$78.40/brl WTI crude is still near the bottom-end of its multi-month range.

Across FX, the USD index has consolidated with EUR (now ~$1.07) range bound. USD/JPY (now ~151.63) dipped back slightly after touching a new cyclical high. Traders remain jittery as the JPY is at levels that have previously triggered bouts of FX intervention. GBP has nudged up (now ~$1.2279), USD/SGD is marginally lower compared to where it started the week (now ~1.3588), while the AUD has ticked up (now ~$0.6380) after last week’s sizeable fall.

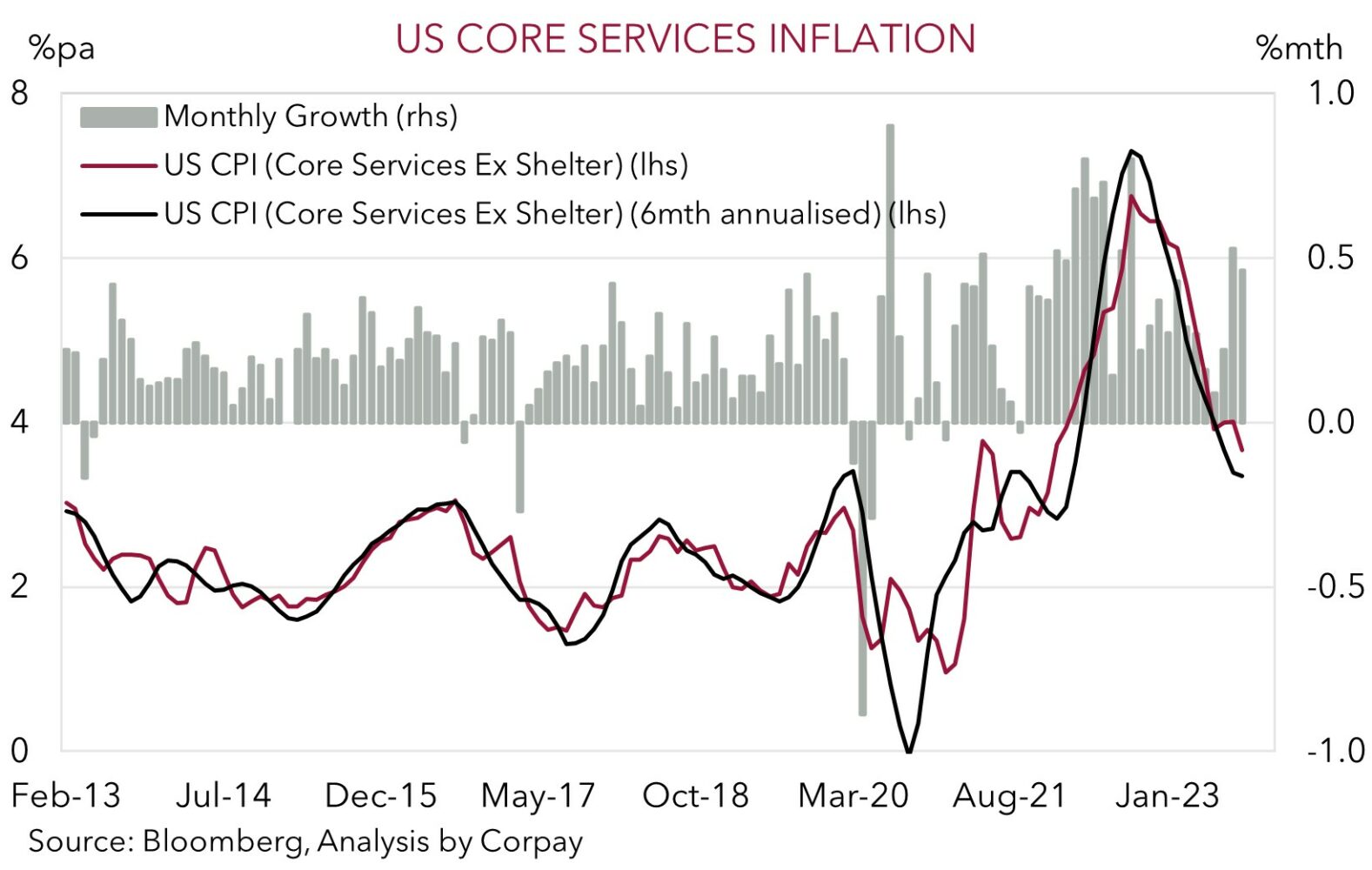

As mentioned yesterday, given the incoming data will shape central bank expectations, market and FX volatility could be quite elevated over the next few days. In terms of tonight’s US CPI the pull-back in oil prices should weigh on headline inflation, however there are a couple of quirks that may throw up a curve ball such as the auto-workers strikes impact on car prices, annual changes to health insurance calculations, and volatility in other services components like rents. Consensus is looking for headline inflation to step down to 3.3%pa, but core inflation is projected to hold steady at 4.1%pa. In our view, market reaction will probably be binary with lower-than-expected US inflation likely to generate a downward repricing in US interest rates and the USD, while a positive surprise could give US yields and the USD a boost. That said, we doubt a CPI induced lift in the USD will be sustained if it is driven by one of the temporary factors mentioned, and/or based on our thinking growth momentum in China is improving and risks US retail sales underwhelms given reduced ‘excess savings’ and tighter credit conditions. Household consumption is the engine room of the US economy (it is ~3/4’s of US GDP). Signs the US consumer is cracking should raise doubts the US Fed will tighten policy further.

AUD corner

After last week’s torrid spell the AUD has clawed back a little ground at the start of the new week in relatively quiet trade (see above). Although at ~$0.6380 the AUD is still only tracking a little higher than where it started November, and ~2.2% under its 6 November high. On the crosses the AUD has also ticked up rising by ~0.5% against the JPY and NZD over the past 24hrs. AUD/JPY (now ~96.74) is now within ~1% of its cyclical peak, while AUD/NZD has edged back up towards ~1.0840. AUD/EUR is a bit firmer (+0.2%), though at ~0.5960 it is still near the bottom end of its ~2-month range.

In today’s Asian session, the latest reads on Australian consumer confidence (10:30am AEDT) and business conditions (11:30am AEDT) are due. Based on the early November RBA rate hike and other cost of living pressures consumer sentiment should remain quite low; however this is still not being reflected in business conditions which were still tracking a little above average a month ago. The jump up in the population remains an offsetting factor for aggregate demand. The data may generate a bit of intra-day AUD movement, but volatility is likely to step up over the next few days given the important global and domestic releases on the calendar.

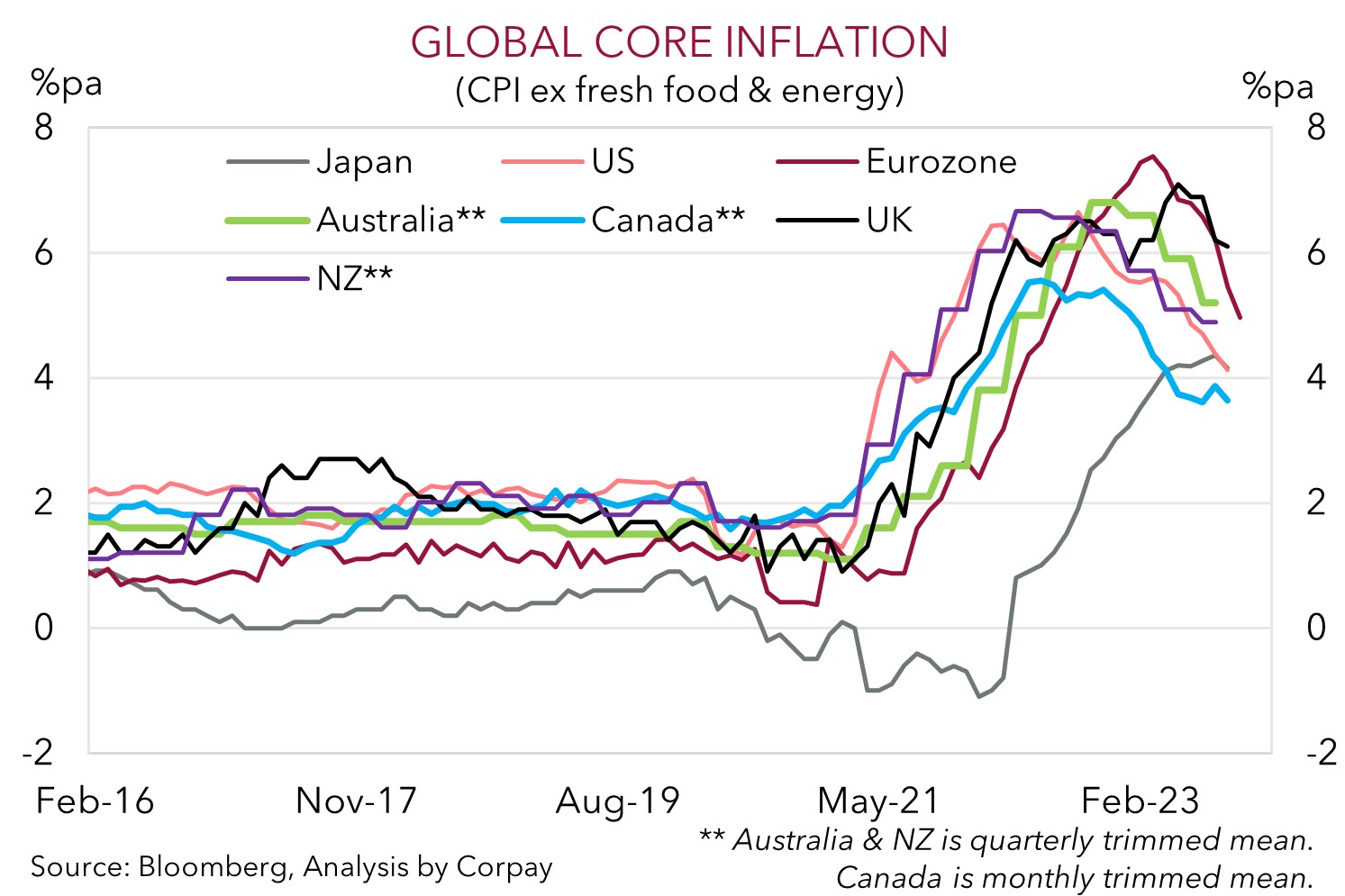

As mentioned, all eyes will be on tonight’s US CPI (12:30am AEDT). Given how influential it is on US interest rate pricing short-term reaction in the USD and AUD is likely to be binary. In our view, a positive US inflation surprise would likely see the AUD fall, while a negative surprise should see the AUD lift. Based on the push-pull forces are work in this month’s US CPI data there look to be higher than normal two-way risks. That said, as discussed above, we doubt a lift in the USD driven by a slightly higher US CPI print will be sustained if we are right and tomorrow’s China activity data improves and the upcoming US retail sales report (Thurs 12:30am AEDT) undershoots consensus forecasts. On top of that, we also believe tomorrows Q3 Australian wages data could exceed expectations given the boost from the large lift in the minimum and award wage, the general tightness in labour conditions, and catch up across the public sector. A stronger wages pulse could raise doubts about core inflation coming down quickly enough to satisfy the RBA and may bolster rate hike bets. Markets are only assigning a ~6% probability of a follow up move by the RBA in December, with a hike by February viewed as a ~44% chance. As our chart shows, core inflation in Australia is looking a bit stickier than its peers, and the pressure on the RBA to tighten policy further remains.

AUD levels to watch (support / resistance): 0.6270, 0.6320 / 0.6430, 0.6480