• US CPI. Lower than expected US inflation generated a sharp downward repricing in US rates. The plunge in bond yields weighed on the USD & boosted sentiment.

• AUD jolt. The backdrop has seen the AUD rebound with the over 2% rise over the past 24hrs unwinding the bulk of last week’s fall.

• Data flow. Q3 wages released today, as is the China data batch. US retail sales are due tonight with the Australian jobs report out tomorrow.

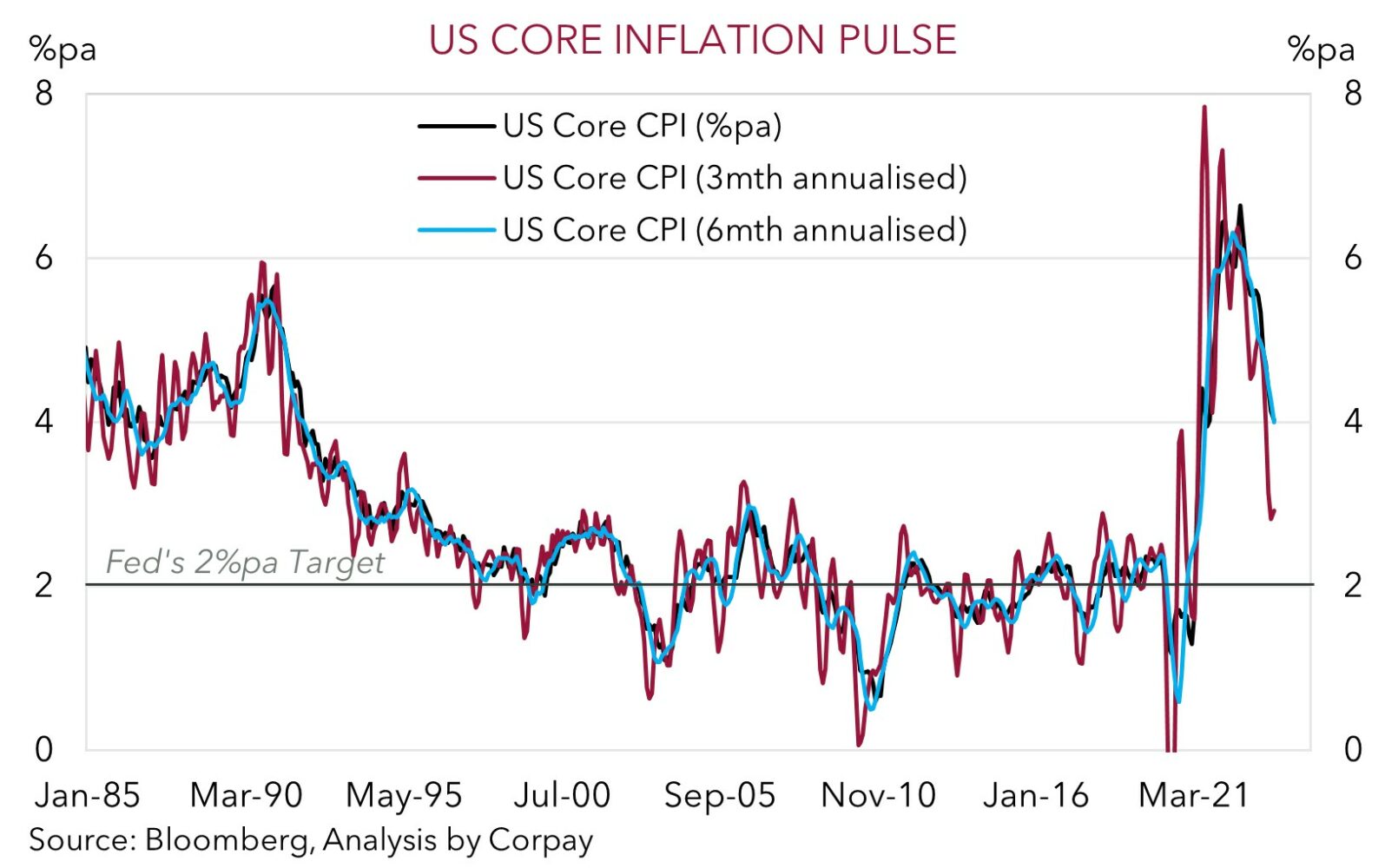

All eyes were on the latest reading on US CPI inflation, and the lower than projected figures jolted markets back to life after a few subdued sessions. US headline inflation was flat in October. As a result, annual growth slowed to 3.2%pa. While lower oil prices played a role, there was more to it, with core inflation (which excludes food and energy) also losing steam. US core inflation stepped down to 4%pa, its slowest pace since Q3 2021, with sticky services prices moderating as rents decelerated and the moderation in wages and softer demand flowed to other areas. Encouragingly, as our chart shows, core inflation momentum is waning with the 3-month and 6-month annualised run-rates around levels last seen a few years ago.

From our perspective the disinflation trend should be welcomed by the US Fed, and it supports our thinking that while they will continue to talk tough about the risks of doing more, the policy tightening phase has ended. Markets seem to agree with the US CPI report generating a sharp downward repricing in US interest rates. Expectations for another Fed rate hike have been removed with rate cuts factored in from mid-2024. As a result, the US 2yr bond yield tumbled ~21bps to 4.83%, the bottom of its multi-month range, and the 10yr yield fell by ~19bps (now 4.45%). The drop in US bond yields boosted risk appetite (the US S&P500 rose by ~1.9%, its best one-day result since April), and weighed on the USD. EUR has jumped up to ~$1.0886 (levels last traded in early-September) and USD/JPY tracked the fall in US yields to be down near ~150.24. USD/SGD also declined with the pair now at ~1.3482, around the lowest since the start of September. AUD and NZD rocketed higher. The AUD’s ~2% lift over the past 24hrs (now ~$0.6512) has largely unwound last weeks falls.

Market volatility may remain elevated over the near-term as the impacts of the lower US inflation wash through, and with the China activity data (1pm AEDT) and US retail sales (tonight 12:30am AEDT) due. In our judgement, on the back of the stimulus support that has been injected the China data is likely to show that activity is re-accelerating, while at the same time reduced ‘excess savings’ and tighter credit conditions point to US retail sales underwhelming. Household consumption is the engine room of the US economy (it is ~3/4’s of US GDP). If realised we think this type of mix can keep the USD on the backfoot. Signs the US consumer is cracking at a time China’s economy is firing back up should reinforce views the US’ relative economic outperformance has ‘peaked’, and/or that the next move by the US Fed will probably be an interest rate cut, albeit at some point in H2 2024.

AUD corner

The AUD has snapped back over the past 24hrs with the softer than predicted US CPI data drastically reshaping US interest rate expectations (see above). The plunge in US bond yields and the USD has boosted risk sentiment (as illustrated by the large rise in equities and firmer base metal prices) and the AUD. The over 2% rise in the AUD (now $0.6512) over the past 24hrs has unwound the bulk of last weeks fall. The backdrop has also helped the AUD to generally outperform on the crosses. AUD/EUR edged a bit higher (now ~0.5982), AUD/JPY has shot up to ~97.84 (its highest since September 2022), and AUD/CNH has risen towards its 100-day moving average (~4.7207).

There are a few important data points for the AUD to contend with over the next few days. Locally, Q3 wages are released today (11:30am AEDT) with the monthly jobs report due tomorrow. Offshore, the China activity data batch is on today’s schedule (1pm AEDT), and US retail sales are tonight (12:30am AEDT). The data is likely to generate further volatility, but on net, we think the outcomes, combined with the fact market positioning (as measured by CFTC futures) remains very bearish (a sign in our mind that too much ‘bad news’ has been priced in), could see the AUD’s upswing extend a bit further.

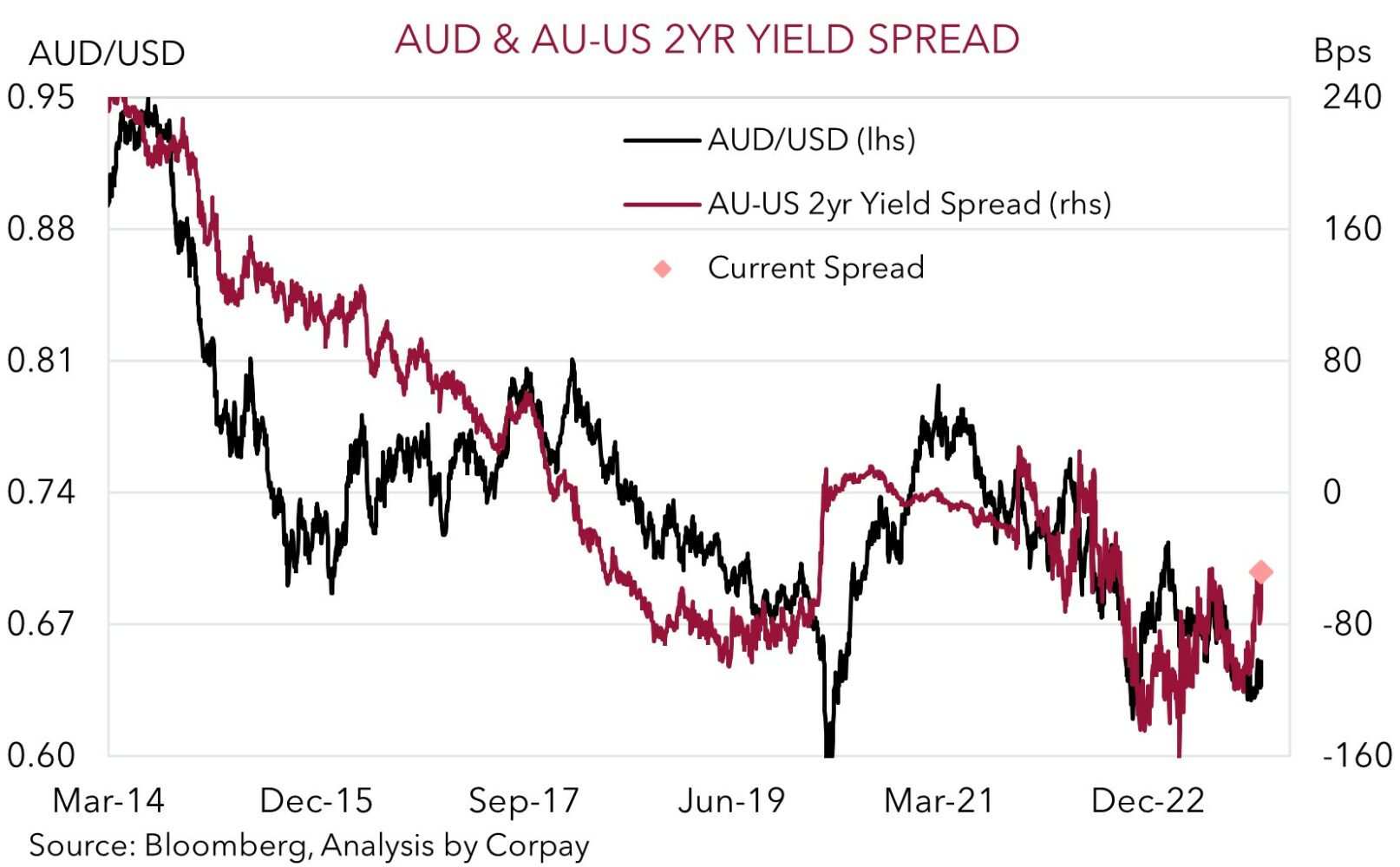

In our opinion, Q3 wages could exceed expectations given the boost from the large lift in the minimum and award wage, the general tightness in labour market conditions, and catch up across the public sector (mkt +1.3%qoq/3.9%pa). A stronger wages pulse may raise doubts about core inflation coming down quickly enough to satisfy the RBA and may bolster rate hike bets. Markets are only assigning a ~4% chance of another move by the RBA in December, with a ~42% chance of a hike by February factored in. And as mentioned above, we believe the China data should show that activity is accelerating with various policy measures gaining traction, while US retail sales risk undershooting forecasts. If realised, this combination could, in our view, further support a lift in regional growth prospects and base metal prices, and/or see relative interest rate expectations become more AUD supportive. As shown, the Australia-US 2yr yield spread has narrowed to -47bps. The last time this differential was near current levels was in mid-June and back then the AUD was above ~$0.67.

Potential intra-day volatility aside on the back of the incoming data, the broader unfolding macro developments are in line with our thoughts that the drivers for the AUD to bounce back into year end and over H1 2024 are falling into place (see Market Wire: RBA: it ain’t over till it’s over). We also continue to expect the AUD to recoup lost ground on the crosses (see Market Musings: Cross-Check: AUD/EUR & AUD/GBP – the tide is turning).

AUD levels to watch (support / resistance): 0.6420, 0.6480 / 0.6540, 0.6580