• Positive vibes. Equities & bond yields rose, & the USD eased as diplomatic efforts aimed at avoiding a wider Middle East conflict calmed nerves.

• AUD bounce. The backdrop supported the AUD. RBA minutes released today. China data due tomorrow, with new RBA Gov. Bullock also speaking.

• US data. US retail sales & industrial production data released tonight. The US economy is consumer driven. There are signs spending is cooling.

A reversal of fortunes overnight with financial markets starting the week on a more positive footing. In terms of the Middle East diplomatic efforts aimed at avoiding a wider conflict, with US Secretary of State Blinken returning to Israel following talks with Arab officials and reports President Biden is mulling a trip, have somewhat helped calm nerves following Friday’s bout of risk aversion.

European and US equities rose with the S&P500’s ~1.1% lift largely unwinding the softness at the end of last week. Energy prices slipped back with Brent crude oil ~0.9% lower and European natural gas falling ~11%. Across bonds, the ‘risk on’ tone saw yields rebound with the US 10yr rate up ~8bps (now 4.70%) and the 2yr rising a more modest ~4bps (now 5.10%). That said, the USD gave back some ground as safe-haven demand eased. EUR has ticked up towards ~$1.0560, GBP is tracking above ~$1.22, and USD/JPY has consolidated near ~149.50 as the crosscurrents of a weaker USD and higher bond yields offset each other. In line with broader USD trends USD/SGD has drifted a touch lower (now ~1.3680). The beleaguered AUD has outperformed (+0.6% to ~$0.6343) due to the more upbeat risk appetite.

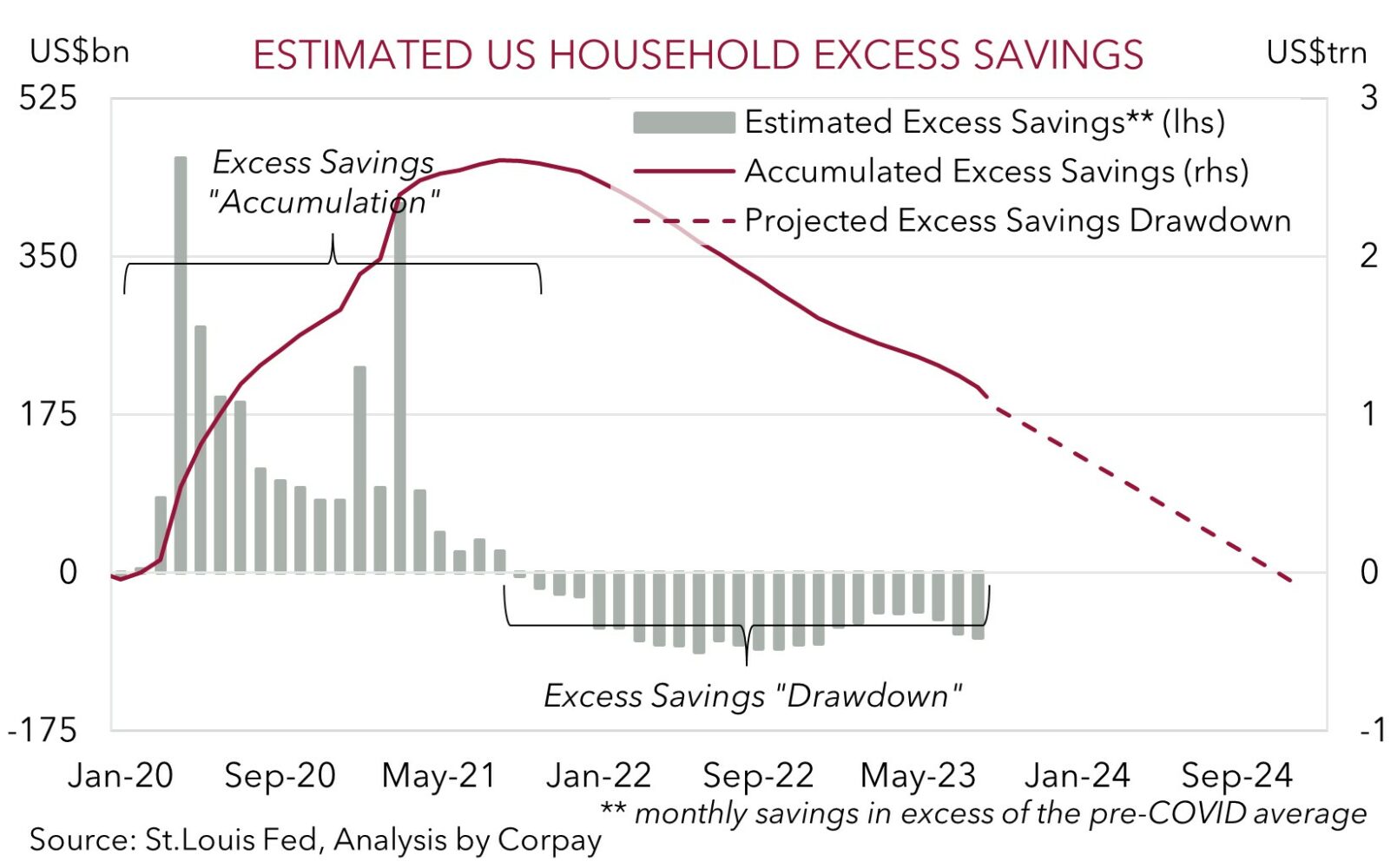

Time will tell if this newfound optimism holds given the twists and turns that might still be ahead of us. As noted yesterday, barring an escalation in the conflict, we think the incoming macroeconomic information points to the elevated USD losing steam. We continue to view last week’s jump up in the USD following the slight upside surprise in US inflation as a bit of an over-reaction. Tonight, US retail sales (11:30pm AEDT) and industrial production (12:15am AEDT) data for September are due, the China activity data batch (which includes Q3 GDP) is released tomorrow, and US Fed Chair Powell speaks later in the week (Fri morning AEDT). The US economy is consumer driven (~3/4’s of US GDP is household spending). While higher petrol prices and auto sales may support headline retail spending, we believe the mix of below average consumer sentiment, dwindling COVID-era ‘excess savings’, and tighter credit conditions could see core sales (i.e. excluding autos and gas) underwhelm. In our opinion, if realised, this, coupled with risks industrial production also weakens due to the autoworkers strike, could see markets trim recently built-up US interest rate expectations, dragging on the USD.

AUD corner

The AUD has enjoyed a relatively more positive start to the week. The improved risk sentiment and reduced USD safe-haven demand as Middle East related concerns simmered down have pushed the AUD up towards ~$0.6343. The AUD has also clawed back ground on most crosses. AUD/JPY has risen ~0.7% (now ~94.83), AUD/EUR is tracking over ~0.60, and AUD/CNH (+0.6%) is just under its ~1-month average. AUD/NZD has pushed up to ~1.0730 this morning following the downside surprise in Q3 NZ CPI. NZ headline inflation slowed to 5.6%pa (below the market (5.9%pa) and RBNZ (6%pa) forecasts), with the rebound in tradeables (i.e. external prices) coming in well under expectations (1.8%qoq vs mkt 2.4%qoq).

The unfolding geopolitical backdrop continues to point to further bouts of market and AUD volatility, in our view. But given already stretched negative AUD positioning (as measured by CFTC futures); the flow support stemming from Australia’s current account surplus (now ~1.2% of GDP); and the low levels the AUD is already trading at (since 2015 the AUD has only traded below $0.63 ~1% of the time), we think that unless there is a sharp escalation in the conflict further AUD weakness on this factor alone may be hard to come by. Indeed, from a fundamental standpoint we believe the incoming news flow could be AUD supportive. As mentioned, the lofty USD appears at risk of giving back some of its gains given the downside risks we see to US core retail sales and industrial production (released tonight), and possibility the upcoming US Fed speakers stick to the script and note that they can ‘proceed carefully’ when it comes to further policy tightening.

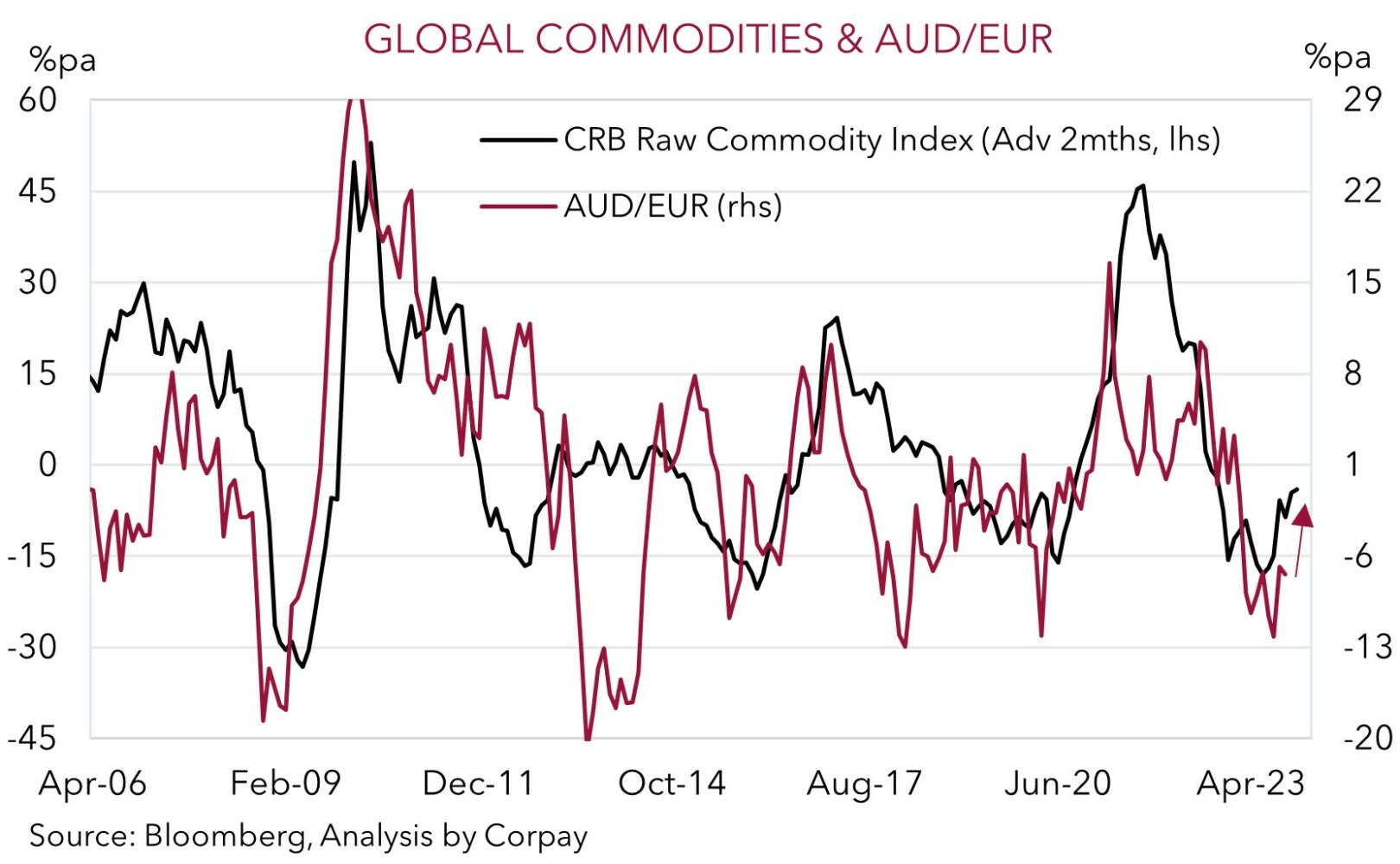

On the other side of the ledger, various forward indicators suggest the China activity data (released Weds) may show growth momentum is turning the corner. Locally, while demand is cooling the unemployment rate is also expected to remain low (released Thurs), and on the policy front the minutes of the last RBA meeting (released today at 11:30am AEDT) and new RBA Governor Bullock (speaks Weds) may reiterate that the door to further tightening remains open. While it is likely to be slow going we continue to see more medium-term upside than downside potential from here (see Market Musings: AUD: Always darkest before the dawn). As our chart shows, the signal from leading indicators such as raw material prices suggests that some crosses such as AUD/EUR have scope to rebound over the period ahead.

AUD levels to watch (support / resistance): 0.6240, 0.6280 / 0.6360, 0.6421