• Higher for longer. Solid US services ISM data & rhetoric from central bankers has boosted bond yields. The USD remains near its recent highs.

• AUD stabilises. After a difficult run the AUD has consolidated, albeit at low levels. Q2 GDP was on net a bit better than expected with population growth supportive.

• Event radar. RBA Governor Lowe gives his last speech (“Some closing remarks”) today. China trade & US jobless claims data are also released.

The USD has held its ground and continues to track near multi-month or year-to-date highs against the other major currencies. Data wise, the US services ISM survey came in stronger than predicted which reinforced expectations the US Fed will keep rates ‘higher for longer’. The services ISM rose to 54.5 in August, with increases in employment intentions, new orders, and prices paid (a leading indicator for inflation) coming through. As a result, market pricing for another Fed rate rise ticked up, with a ~50% probability of a move by the November meeting now factored in.

Bond yields continue to edge higher, with the still solid data and further gains in the oil price (WTI crude is up another 1% to now be ~31% above the mid-June low) renewing worries about the inflation outlook. The US 2yr yield increased ~6bps to 5.02%, with 10yr rate up ~2bps. European yields rose by more with German rates rising ~4-9bps across the curve following ‘hawkish’ comments from ECB member Knot. In his view, markets may be underestimating the likelihood of another hike at the 14 September meeting, with the decision set to be a close call. Markets are only discounting a ~1/3 chance of a move by the ECB next week. Further bolstering global rate expectations was a ‘hawkish hold’ by the Bank of Canada. While interest rates were left unchanged at 5%, the BoC explicitly mentioned it was “prepared to increase the policy rate further if needed” in its guidance given concerns about sticky core inflation. That said, it wasn’t all one way with Bank of England Governor Bailey signaling that UK rates “were probably near the top of the cycle”.

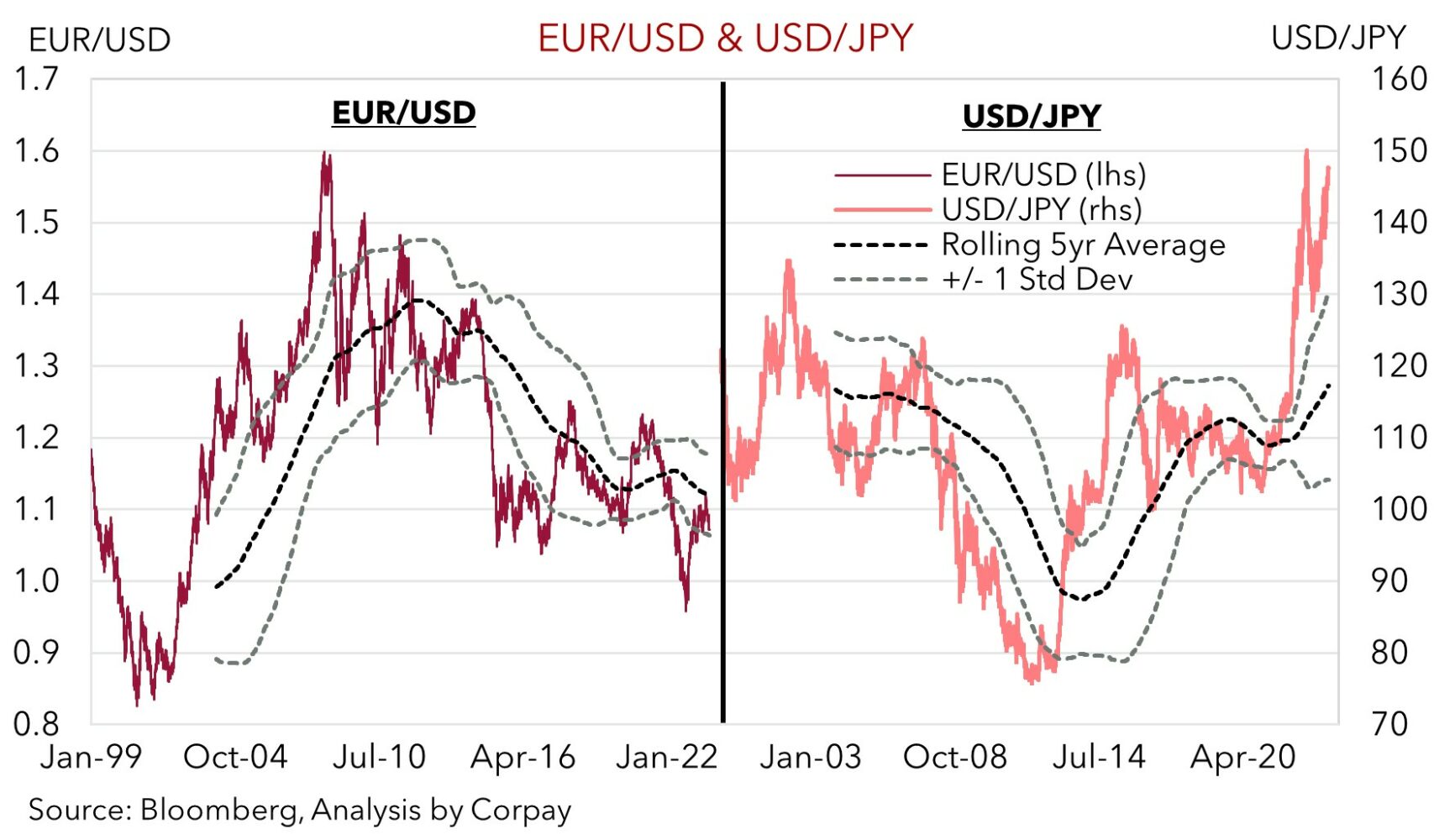

In FX, as mentioned the USD remains at high levels, though the rhetoric and actions of policymakers on the other side of the ledger have offset the support generated by US conditions. EUR has consolidated near ~$1.0725 (the bottom end of its ~5-month range), while GBP (now ~$1.2505) lost ground as yield differentials moved against the UK. AUD is hovering slightly above its 2023 lows (now ~$0.6383). Elsewhere, USD/JPY (now ~147.61) and USD/CNY (now ~7.3180) are around the top of their respective ranges. However, the recent currency weakness has seen authorities in China and Japan step up their defenses. In China the PBoC continues to set the daily CNY fix rate at much stronger than expected levels, with yesterday’s negative bias a new record. In Japan the verbal intervention has ramped up with Vice Finance Minister Kanda stressing that if speculative moves continue, they “will respond without ruling out any options”. The push back in China and Japan, fact that a ‘higher for longer’ Fed view is well discounted, and our thoughts that the US’ relative outperformance could soon fade are reasons why we think the USD’s upswing may be nearing its end. China trade and US jobless claims (10:30pm AEST) are released today.

Global event radar: China Trade Data (Today), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

After a difficult run the AUD has consolidated over the past 24hrs, albeit at low levels with AUD/USD (now ~$0.6383) just above its year-to-date lows. On the crosses the AUD has stabilised against the EUR, JPY, and CAD, while AUD/NZD (+0.2% to ~1.0868) and AUD/GBP (+0.5% to ~0.5104) have nudged up, with comments by BoE Governor Bailey weighing on GBP (see above).

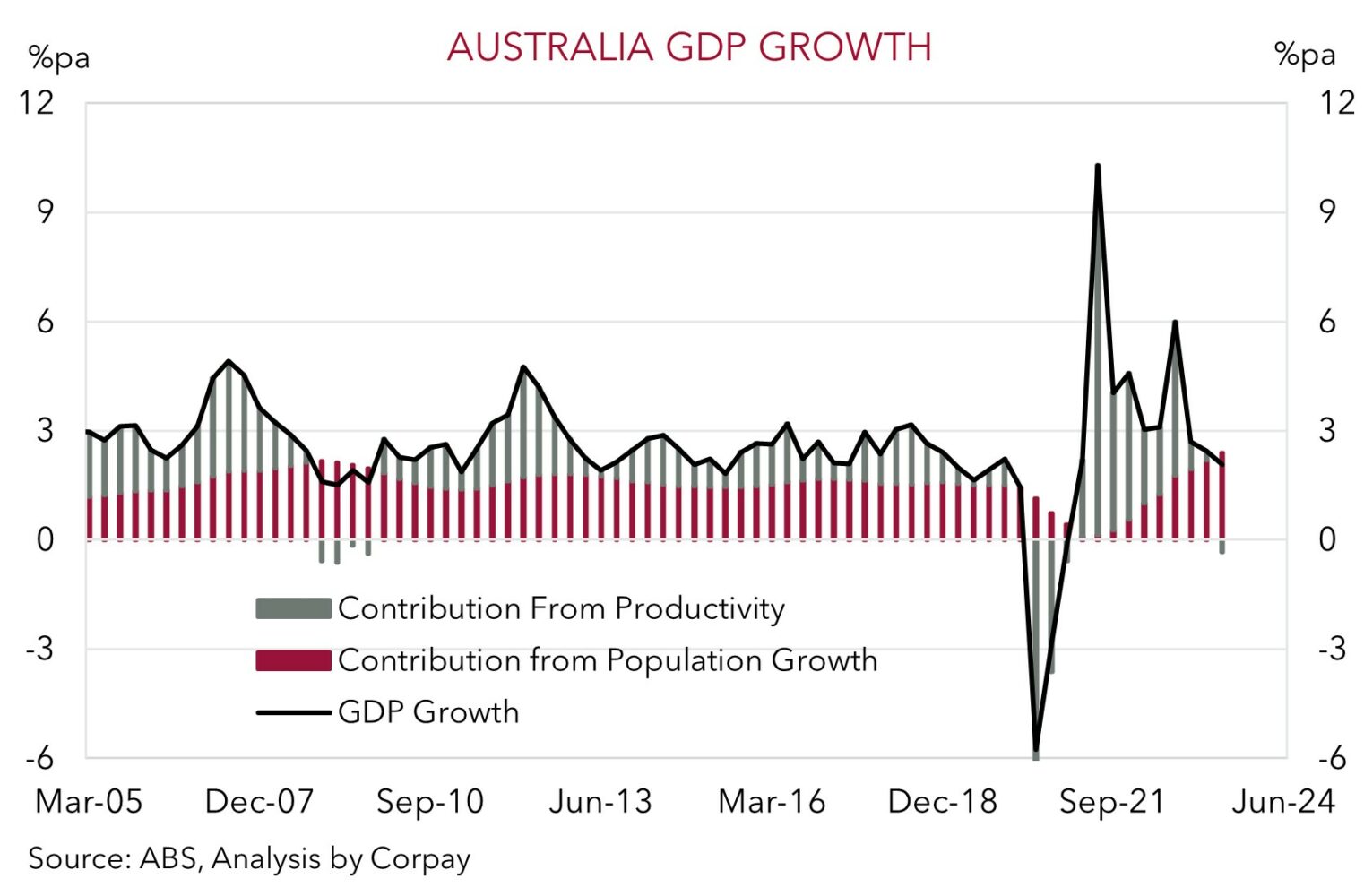

Locally, Q2 GDP was released yesterday. On net, the topline result was a bit better than anticipated, with the economy expanding by 0.4% in Q2. Upward revisions to history meant that annual growth is running at 2.1%pa. This was stronger than what the RBA had penciled in. That said, Australia’s booming population following the reopening of international borders played a role. GDP is a volume measure. When you strip out the boost from more people floating around underlying demand has weakened. GDP per capita went backwards for the 2nd straight quarter.

Leading indicators like forward orders point to slower growth over the next few quarters as higher mortgage costs and other cost of living pressures continue to bite. This is also the view of the RBA and consensus, and as such we think it should be priced into markets. But with unit labour costs and domestic/services price pressures still elevated, and productivity quite poor, we doubt the RBA will shift away from its conditional tightening bias for some time yet, indeed if the RBA were to do anything over the next ~6mths the balance is still towards another hike. The ~33% chance of another rise by Q1 assigned by markets could lift over the period ahead should the Australian data positively surprise. The ‘higher for longer’ and risk of further tightening message could be repeated by outgoing RBA Governor Lowe who gives his final speech today (1:10pm AEST).

As outlined over recent days, down around current levels we think a lot of negatives are factored into the AUD, while we also think alot of positives are priced into the USD (see above). Outcomes compared to expectations drive markets. With this in mind, combined with the fundamental supports stemming from Australia’s current account surplus (now ~1.2% of GDP) we think the AUD is beginning to level off and believe there is more upside than downside potential from here. Since 2015 the AUD has traded below ~$0.6350 less than 2% of the time. Cyclically various drivers may be turning. Authorities in China have been rolling out growth and FX supportive measures. A stronger economic pulse in China would be a tailwind for CNH, commodity demand and the AUD. On the flip side, following its strong run we think risks that the US economic data begins to undershoot higher hurdles has increased. If realised, this could take some of the heat out of the USD.

AUD event radar: RBA Gov. Lowe Speaks (Today), China Trade Data (Today), China CPI (Sat), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6591

SGD corner

The lift in US and European bond yields on the back of the solid US services ISM data and ‘hawkish’ rhetoric from various central bankers has boosted USD/SGD (see above). At ~$1.3625 USD/SGD is around its highest level since early-December. On the crosses, EUR/SGD (now ~1.4628) has ticked a little higher over the past day, while SGD/JPY (now ~108.25) has consolidated at historically high levels.

As flagged above and over the past few days, we think there are now a lot of positives factored into the USD. Additional gains in the USD, and USD/SGD, may be hard to come by from here, in our opinion, given a ‘higher for longer’ US Fed interest rate view appears well discounted, with authorities in other countries such as Japan and China starting to push back against the USD strength (see above), and with the US’ economic outperformance unlikely to last. A failure by the US economic data to match more elevated expectations could see markets pare back their US interest rate expectations. We think this, combined with improvement in China’s and/or the Eurozone’s growth pulse, could exert some pressure on the USD (and USD/SGD).

SGD event radar: China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3398, 1.3446 / 1.3690, 1.3711