• Negative vibes. A more cautious tone overnight with equities & bond yields lower. The USD remains firm, with EUR & GBP weakening.

• AUD consolidation. Despite the shaky risk backdrop the AUD has held its ground, albeit at low levels. A lot of negatives now look to be factored in

• Event radar. AU business conditions, US CPI, AU employment, US retail sales, the ECB meeting, & the China activity data are due next week.

A slightly cautious tone across markets overnight. Following on from the weakness in Asia the major European and US equity markets edged lower with the NASDAQ (-0.9%) underperforming the broader S&P500 (-0.3%). Further falls in Apple (-6.4% over the past 2 days) on the back of the recent news China had banned iPhone use by Government officials dampened sentiment across the tech sector. Global bond yields also declined, led by the UK (down 8-10bps across the curve) as markets continue to digest comments by BoE Governor Bailey that rates may be near the top of the cycle. This was compounded by data showing lower UK business inflation expectations. German bond yields also declined by ~4bps with growth concerns front of mind. Industrial production in Germany fell for the third straight month in July, to its lowest level since December, while Q2 Eurozone GDP was revised down. The Eurozone economy barely grew (+0.1%qoq), and various high frequency indicators point to a worse outcome in Q3. In the US, despite weekly jobless claims falling to their lowest since February, a sign of a still tight labour market, bond yields followed the global trend (US 2yr -6bps to 4.95%).

In FX, the USD index nudged up thanks to weakness in the major European currencies. EUR has slipped back under ~$1.07 for the first time in ~3-months, with GBP (now ~$1.2475) also near a multi-month low. The reduction in UK interest rate expectations has been a driver. Lower bond yields have exerted a bit of downward pressure on USD/JPY, although at ~147.28 it remains near its 2023 highs. And despite USD/CNY touching its highest level since late-2007, negative risk backdrop, and firmer USD the AUD has continued to consolidate, albeit at low levels (now ~$0.6378).

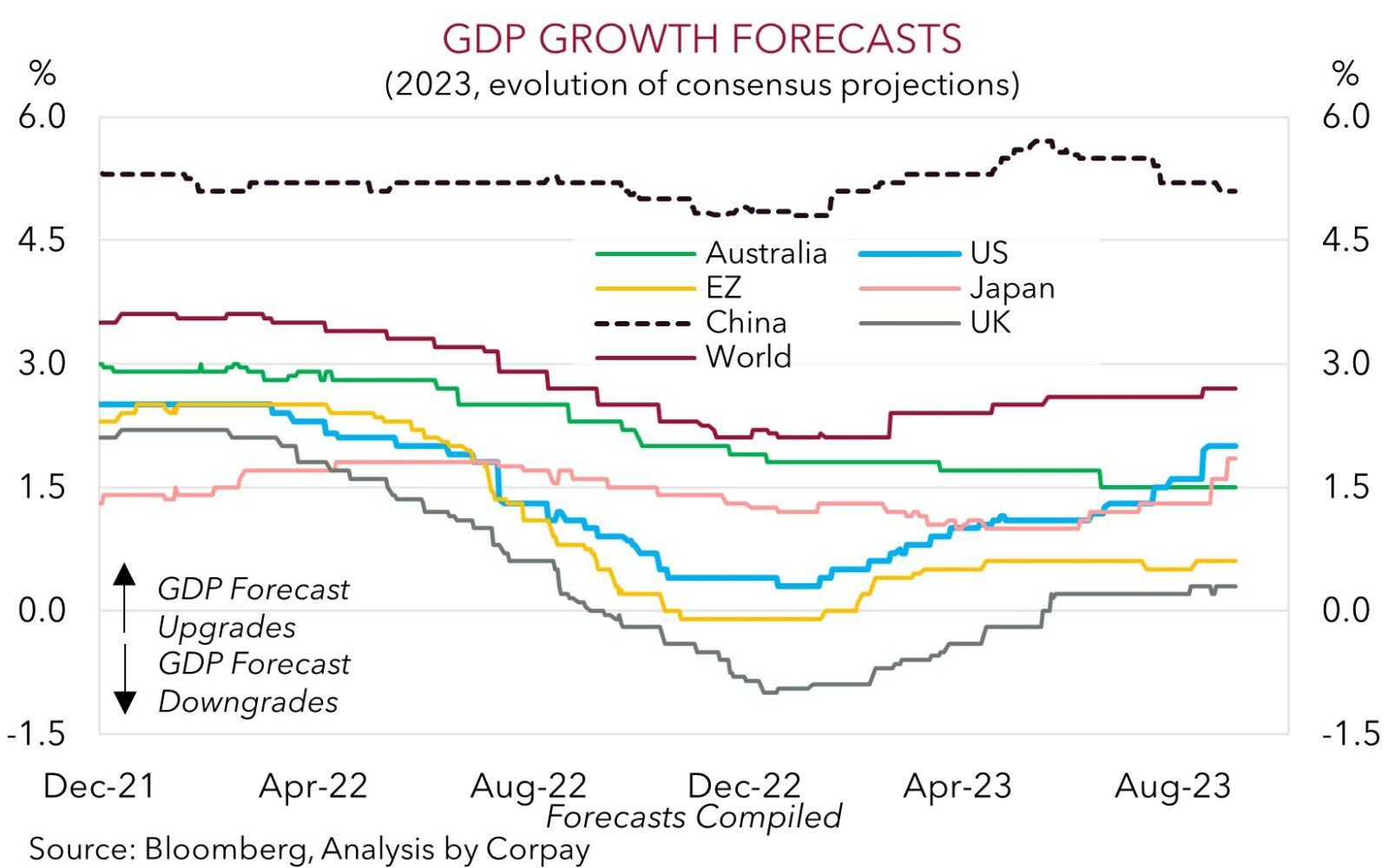

As our chart shows, growth expectations have been shifting in favour of the US over the past few months. The resilience in activity has seen analysts upgrade their 2023 forecasts for US GDP, while at the same time forecasts for other major economies like China have been revised down. This relative swing has been a tailwind for the USD. But we think this trend has now largely run its course, with a ‘higher for longer’ Fed interest rate outlook also looking well factored in. Outcomes compared to expectations drive markets. In our view, the US data could be hard-pressed to exceed the higher hurdles, and expectations elsewhere now appear quite downbeat. We believe that slippage in the US data and/or signs of stabilisation/relative improvement in other economies, particularly China, could take some of the heat out of the USD. It is a big week next week with US CPI (Weds), US retail sales (Thurs), the ECB Meeting (Thurs) and China activity data (Fri) on the schedule.

Global event radar: China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

Despite the shaky risk backdrop, as illustrated by the dip in global equities and bond yields, the AUD has held its ground, albeit at low levels with AUD/USD (now ~$0.6378) still tracking just above its year-to-date lows. On the crosses, the AUD has ticked up against the softer EUR and GBP (+0.2%), and it has also clawed back some ground against the CAD (+0.3%) and CNH (+0.2%) over the past 24hrs. By contrast, AUD/JPY (-0.3%) is back under ~94 with the environment generating a bit of JPY strength.

The local and global macro calendar is limited today, although this won’t last for long with several events on the radar next week. The list includes Australian business conditions (Tues), US CPI (Weds), Australian employment (Thurs), US retail sales (Thurs), the ECB meeting (Thurs), and the China activity data batch (Fri). As discussed over the past few days, down around current levels we believe a lot of negatives are priced into the AUD, and at its current lofty heights we think there is a lot of positivity factored into the USD. FX is a relative price, and results compared to expectations is what matters for markets. Given this, and the structural AUD supports stemming from Australia’s current account surplus (now ~1.2% of GDP) and still high level of the terms of trade, we are of the view that the AUD is beginning to level off and that there are more upside than downside risks from here. Since 2015 the AUD has traded sub ~$0.6350 less than 2% of the time.

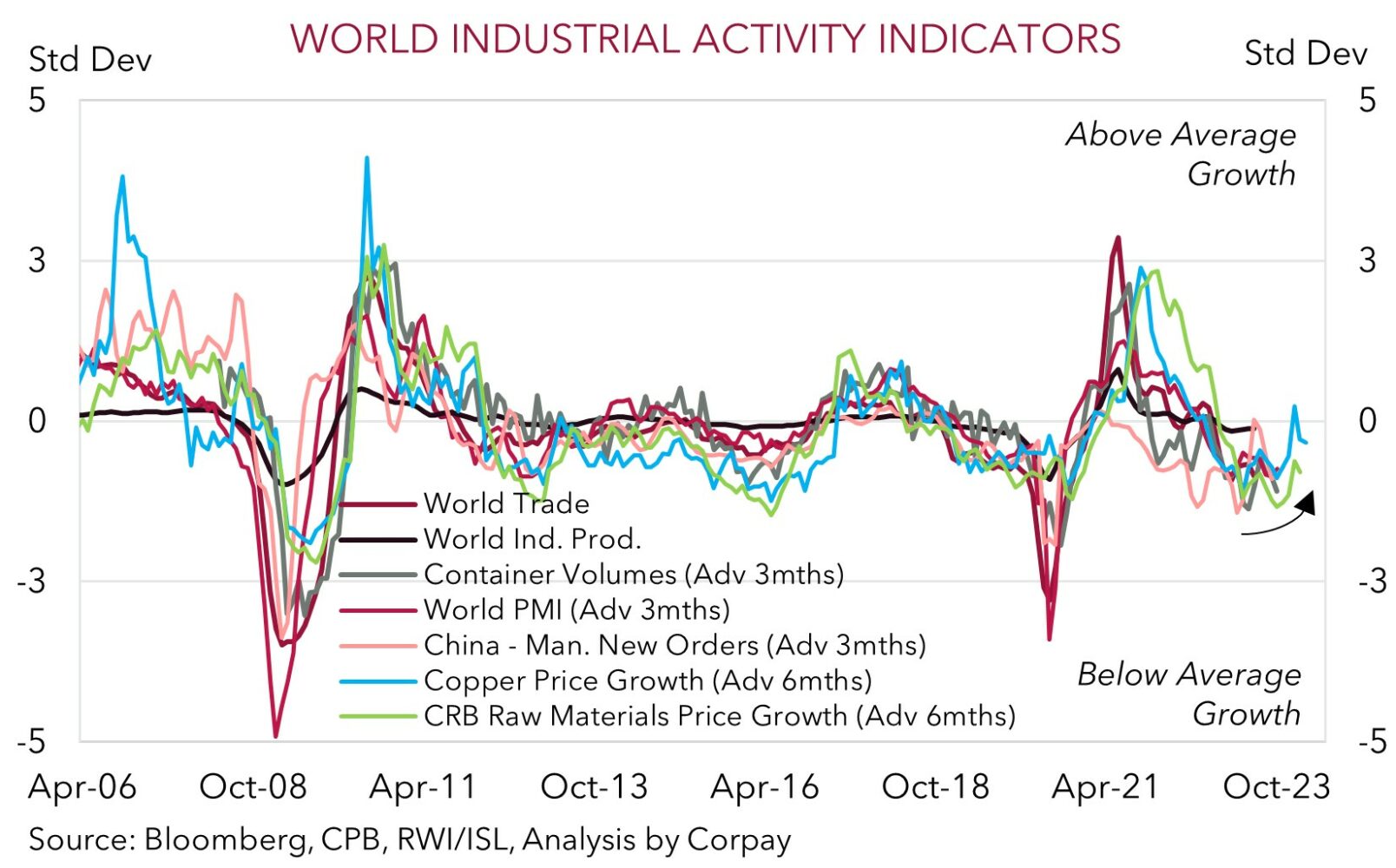

Things always appear darkest before the dawn. And while the global economy is slowing, a range of forward-looking indicators for industrial activity such as new orders out of China, the copper price, and raw material demand suggest things may be starting to turn the corner (see chart below). Authorities in China have been rolling out growth and FX supportive measures. A stronger economic pulse in China should be supportive for global/regional growth expectations and in turn the AUD over the period ahead, in our opinion. Conversely, after a positive run we think the US economic data may begin to underwhelm more upbeat predictions. It will be a bumpy ride, but in our judgement, if realised, this and the more negative seasonal forces that tend to come through over Q4 (see Market Musings: History doesn’t repeat, but…), point to the USD weakening from here.

AUD event radar: China CPI (Sat), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6586

SGD corner

The firmer USD Index, generated by the more negative risk environment and softer EUR and GBP, has supported USD/SGD (see above). At ~$1.3657 USD/SGD is near its highest level since late-November. On the crosses, EUR/SGD (now ~1.4610) has drifted a little lower over the past 24hrs, while SGD/JPY (now ~107.82) has also given back a bit of ground, although it remains historically high.

As mentioned over the past few days and above, we believe there are now a lot of positives priced into the USD. Additional gains in the USD, and USD/SGD, may be difficult to come by from here, in our view, with a ‘higher for longer’ US Fed interest rate view discounted, and with the US’ relative economic outperformance unlikely to last. Should the upcoming US economic data fail to exceed (or match) more elevated expectations, we think markets could pare back US rate expectations which in turn may weigh on the USD. In our opinion, this, in conjunction with an improvement in China’s growth momentum, could exert some downward pressure on USD/SGD over the period ahead.

SGD event radar: China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3399, 1.3448 / 1.3690, 1.3711