Quiet markets. Equities consolidated on Friday. US yields & oil ticked up. In FX, the USD is tracking at high levels, with the AUD hovering just above its 2023 lows.

JPY focus. Japanese officials continue to ramp up the rhetoric about JPY weakness. BoJ Governor Ueda also gave a rather ‘hawkish’ interview.

Event risks. AU business conditions, US CPI, AU employment, US retail sales, the ECB meeting, & the China activity data are due this week.

Without any fresh economic news global markets were restrained on Friday. Across equities, the US S&P500 was slightly higher (+0.1%), while the European EuroStoxx50 outperformed (+0.4%) with the boost to energy stocks from rising oil prices a tailwind. WTI crude oil rose another 0.7%, its 10th increase in the past 11 trading days. At ~US$87.50/brl, WTI is ~31% up from where it was tracking ~3-months ago. This will generate a mechanical jump in global headline inflation over coming months.

Bond markets were mixed with German bunds little changed (the 10yr held steady near 2.61%). In the US, 2yr (+4bps) and 10yr (+2bps) rates nudged up to close the week at 4.99% and 4.26% respectively. Across FX, the USD Index consolidated at high levels. AUD has held its ground near ~$0.6383, EUR is hovering just above ~$1.07 (near the bottom of its ~3-month range), and GBP (now ~$1.2484) is around a multi-month low with the downward adjustment in UK interest rate expectations following the recent cautious comments from BoE Governor Bailey weighing on GBP. Elsewhere, the upswing in USD/JPY (now ~146.83) continues to irk policymakers. Finance Minister Suzuki stressed that they “will watch FX moves with a high sense of urgency”, and “will not rule out any options” to address the JPY’s slide. At current levels we think the JPY is quite undervalued, and there are uneven risks from here. The policy divergence between the BoJ and other major central banks which has underpinned the JPY weakness may be peaking. Notably, in a weekend interview, Governor Ueda noted that the BoJ could have enough information by year-end to judge it wages will continue to rise and thereby potentially end its negative interest rate regime.

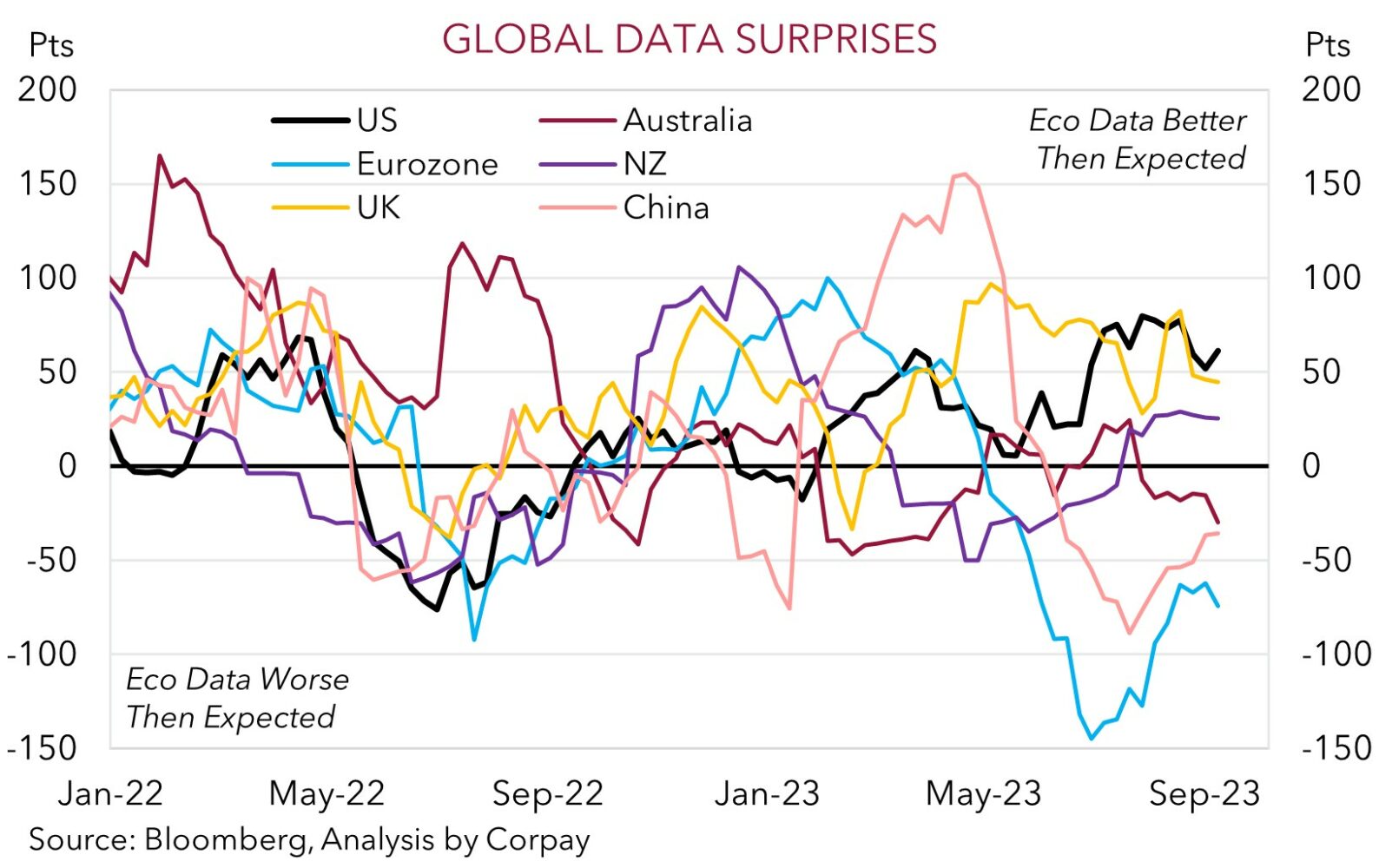

The economic calendar heats up this week with US CPI (Weds), US retail sales (Thurs), ECB Meeting (Thurs), and China activity data (Fri) on the radar. The run of stronger than anticipated US data and weaker results in the Eurozone and China has supported the USD. With a ‘higher for longer’ Fed interest rate outlook well priced, we think this trend has now largely played out, and the USD may give back some ground this week. FX is a relative price, and outcomes compared to expectations drive markets. While US headline inflation looks set to accelerate due to oil, core inflation (which is what policymakers are focused on) is set to slow as services prices moderate. Similarly, after a positive run, US retail sales risks underwhelming given low consumer confidence, dwindling excess savings, and resumption of student loan repayments. At the same time, we think the China activity data could exceed downbeat predictions, while in the Eurozone, despite slowing growth, inflation is too high. Another ECB rate hike is on the table. Markets and analysts are evenly split as to whether it occurs this week. If it does, we believe this can give the EUR (a major USD alternative) some support.

Global event radar: US CPI (Weds), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

For the third straight day the AUD consolidated just above its year-to-date lows on Friday (now ~$0.6383). On the crosses, the AUD has given back a little ground against the JPY (-0.2% to ~93.70). Comments from Japanese authorities about the extent of the currency weakness and monetary policy outlook have generated a bit of JPY support (see above). Elsewhere, AUD/CNH (+0.3% to ~4.6983) is just under its 200-day moving average, while AUD/EUR (now ~0.5958) is hovering just above its ~1-month average.

As mentioned above, there are several global macro events on the schedule this week (US CPI (Weds), US retail sales (Thurs), the ECB meeting (Thurs), and the China activity data batch (Fri)). On top of that, Australian business and consumer confidence (Tues), and the monthly jobs report (Thurs) are due. As discussed over the backend of last week, down around current levels we think a lot of negatives are factored into the AUD, and that there is a lot of positivity priced into the USD. The structural AUD supports stemming from Australia’s current account surplus (now ~1.2% of GDP), still high level of the terms of trade, an improvement in some cyclical trends (see below), and more positive seasonal patterns that tend to come through over Q4 (see Market Musings: History doesn’t repeat, but…), suggests to us that there are more upside than downside risks from here. Since 2015 the AUD has traded sub ~$0.6350 less than 2% of the time.

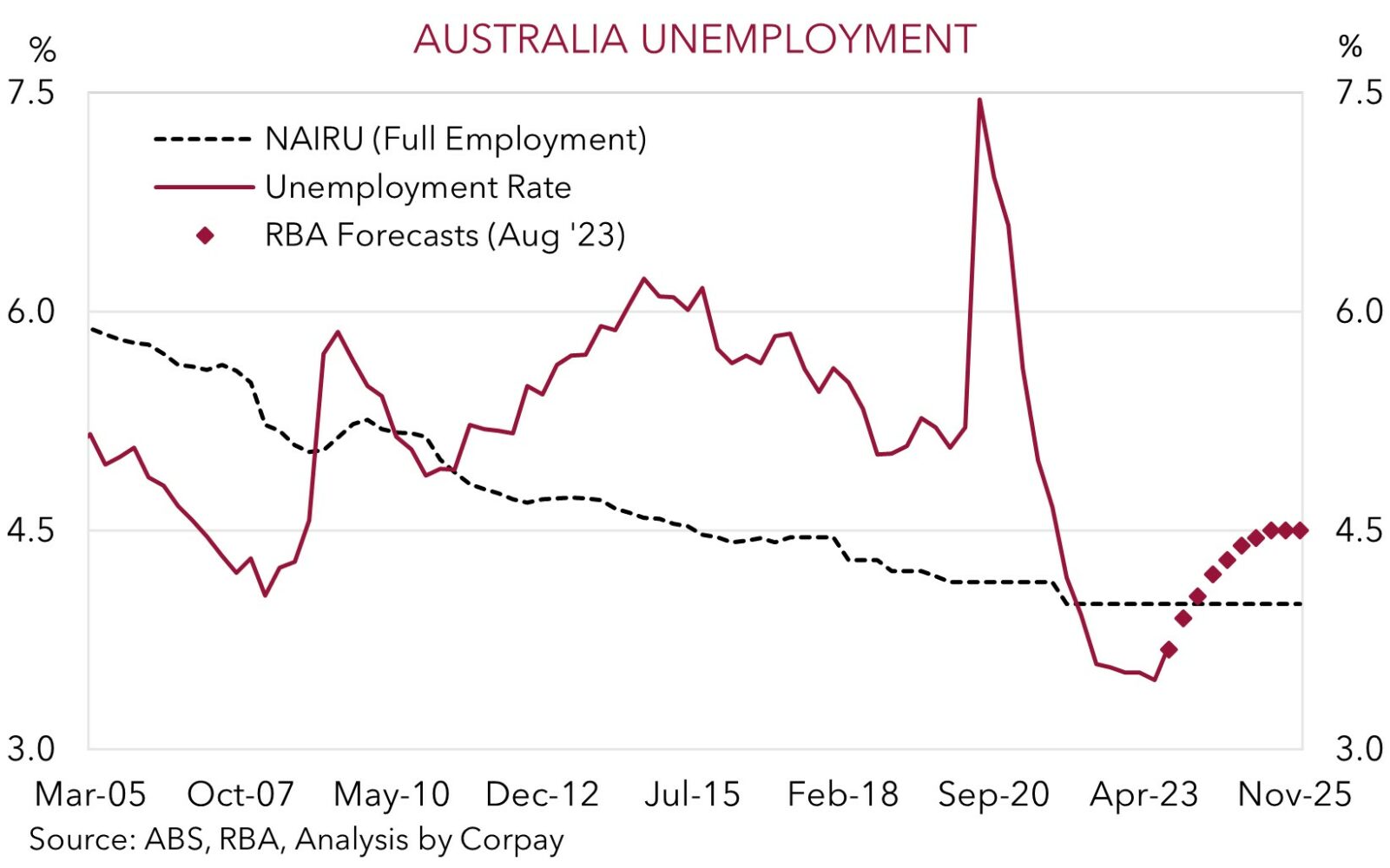

On net, we believe the incoming global and domestic data could see the AUD recover some lost ground this week. Offshore, we see risks that US core inflation and US retail sales disappoints analysts forecasts. If realised, this could see markets pare back their lofty US interest rate expectations, which in turn may exert some downward pressure on the USD. This could be compounded by another rate rise by the ECB, which is a genuine possibility given the still high Eurozone inflation, and signs that growth momentum in China is stabilising. Locally, employment is expected to rebound strongly (mkt +25,500), with the unemployment rate (now 3.7%) at risk of falling back. Last month the ABS noted that July included school holidays and that there has been a change around when people take leave or start a new job. This pattern was last seen in May, with a weak result back then more than unwinding the following month. A robust jobs report could raise a few doubts that the RBA rate hike cycle is truly over, generating some AUD support, in our opinion.

AUD event radar: US CPI (Weds), AU Jobs (Thurs), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6575

SGD corner

As per the consolidation in the USD Index, USD/SGD (now ~1.3653) has held fairly steady near the highest level it has traded since late-November (see above). On the crosses, EUR/SGD (now ~1.4623) has ticked up slightly, with this week’s ECB meeting in focus. SGD/JPY (now ~107.81) has drifted back with the JPY garnering some support from comments from Japanese officials about the recent currency weakness and monetary policy outlook (see above). That said, SGD/JPY remains historically high.

As outlined over the latter part of last week and above, we think there are now a lot of positives factored into the USD. In our judgement, further gains in the USD, and USD/SGD, may be hard to come by from here with a ‘higher for longer’ US Fed interest rate outlook priced in, and with the US’ relative economic strength unlikely to continue. If the incoming US inflation (Weds) and retail sales (Thurs) data undershoots market forecasts, which is where we think the risks reside, we believe the elevated USD could lose some ground. Softer US data, combined with a potential ECB rate rise and/or signs that China’s growth pulse is bottoming out, may exert some downward pressure on USD/SGD over the period ahead, in our opinion.

SGD event radar: US CPI (Weds), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3400, 1.3454 / 1.3690, 1.3711