• Stronger USD. Softer data out of China & higher US bond yields on the back of a lift in oil has supported the USD. The JPY, AUD, & NZD hit fresh 2023 lows.

• AUD underperformance. The AUD has weakened. As expected the RBA kept rates on hold, though it retained its mild conditional tightening bias.

• Relative expectations. We think a lot of positives are factored into the USD & negative AUD sentiment is high. AU Q2 GDP & US services ISM released today.

The USD has strengthened over the past 24hrs. Softer than expected second tier China Caixin Services PMI data (from 54.1 to 51.8 in August, a low since December), downward revisions to the Eurozone PMIs, and higher bond yields as markets factor in what the rebound in oil prices could mean for inflation has dampened risk sentiment and underpinned the USD. WTI crude oil rose another 1.3% to ~$86.70/brl after Saudi Arabia announced it will continue its unilateral production cutback of 1 million barrels a day until December. This is its highest level since mid-November, with the ~28% lift over the past ~3-months set to once again mechanical boost headline inflation over coming months, something central banks won’t want to see given their focus on not letting higher inflation expectations becoming entrenched.

After being closed yesterday, US bond yields played catch up, with the 2yr and 10yr rates up ~8bps to 4.96% and 4.26% respectively, while in Europe, German 10yr yields ticked up another ~3bps (now 2.61%). By contrast, global growth jitters and higher bond yields exerted a bit of downward pressure on the major US and European equity markets which declined by ~0.2-0.3%. In FX, as mentioned the backdrop has supported the USD. EUR has slipped down towards ~$1.0720, near the bottom-end of its 5-month range, and GBP (now ~$1.2570) touched its lowest level since mid-June. Elsewhere, the JPY, AUD, and NZD hit fresh 2023 lows against the USD, with USD/CNY also within striking distance of its year-to-date peak.

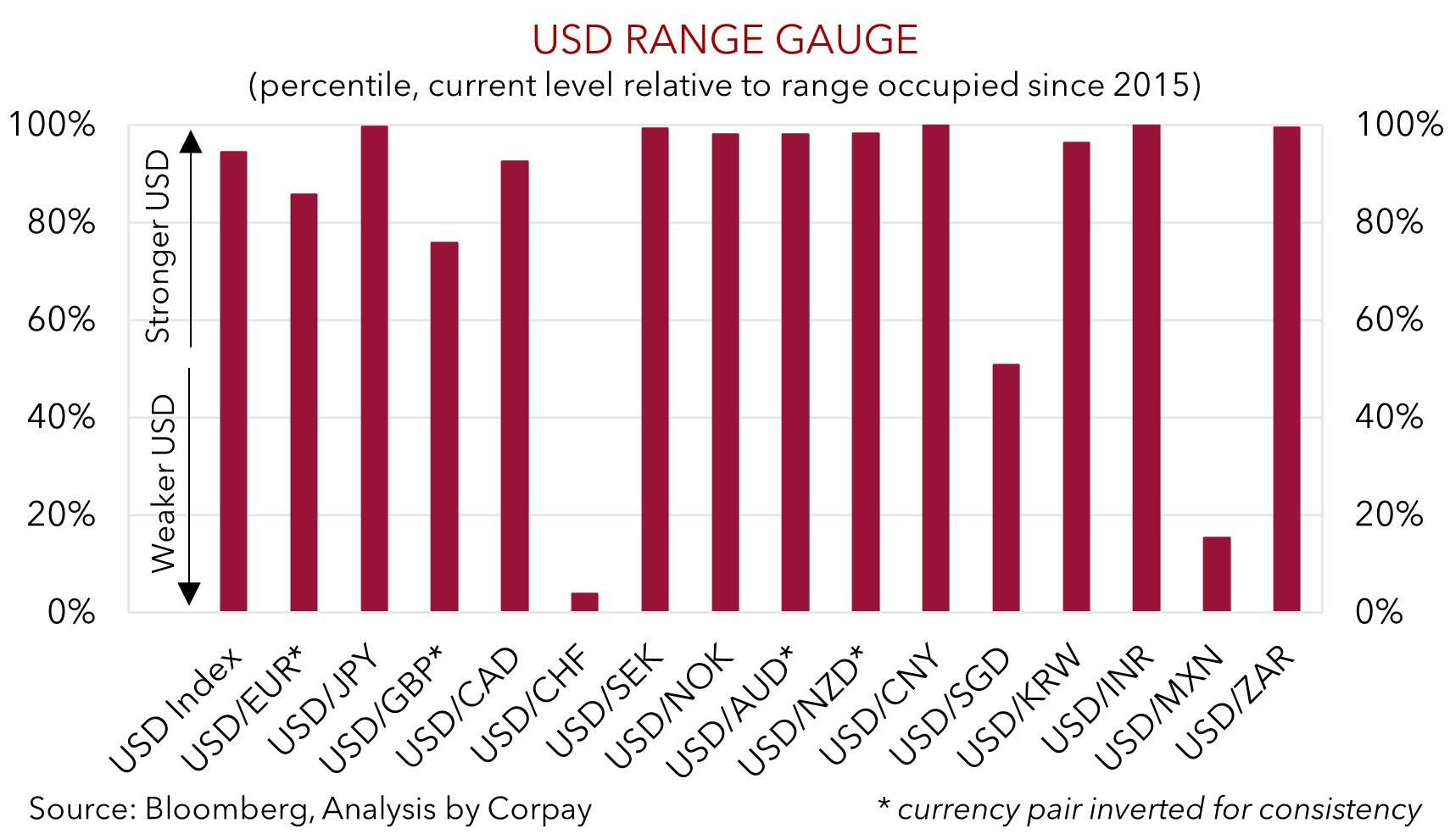

As our chart shows, the USD is now at the upper end of its multi-year range against a range of currencies. The run of stronger than expected US data and relative outperformance of the US economy has been a tailwind for the USD. But as we have been noting, FX is a relative price and outcomes compared to expectations are what drive markets. With this in mind we think the USD upswing could be nearing its end. A ‘higher for longer’ US Fed interest rate view now appears adequately factored in. Indeed, overnight Fed Governor Waller stressed that policymakers could afford to “proceed carefully” and that he favoured a pause at the 21 September meeting given “there is nothing that is saying we need to do anything imminent anytime soon”. And on the data front, with US ‘excess savings’ now largely depleted, credit standards tightening, and the labour market starting to turn south, risks that the US growth pulse starts to undershoot more optimistic projections look to have increased. We believe a run of softer than anticipated US data could see markets pare back now elevated US interest rate expectations which in turn could weigh on the USD. The US services ISM survey is released tonight (12am AEST), while in Canada the central bank is widely expected to keep rates on hold at 5%.

Global event radar: Bank of Canada Meeting (Tonight), China Trade Data (Thurs), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD has underperformed over the past 24hrs. The mix of a stronger USD, higher US bond yields, and sluggish China and Eurozone PMI data (see above) has weighed on the AUD, with the currency touching a new 2023 low against the USD overnight (now ~$0.6380). The AUD has also lost ground on the crosses, with falls of 0.3-0.9% recorded against the other major currencies compared to this time yesterday. AUD/EUR has dipped back under ~0.5950, AUD/GBP is below ~0.5080, and ahead of tonight’s Bank of Canada meeting (12am AEST) where no change in rates is expected AUD/CAD (now ~0.87) has declined to be within 1.2% of its cyclical low.

Locally, as was widely expected, the RBA kept rates on hold at 4.1% for the third straight month. The decision to hold steady has also been pointed to as a reason behind the AUD’s weakness. We think this is a bit of an overreach as the accompanying statement was little changed with the RBA once again retaining its mild conditional tightening bias (i.e. “some further tightening of monetary policy may be required”) (see Market Wire: RBA: Rinse & Repeat). Indeed, RBA interest rate expectations are little different from a day ago with markets still assigning a slight chance (~35%) of another hike by Q1.

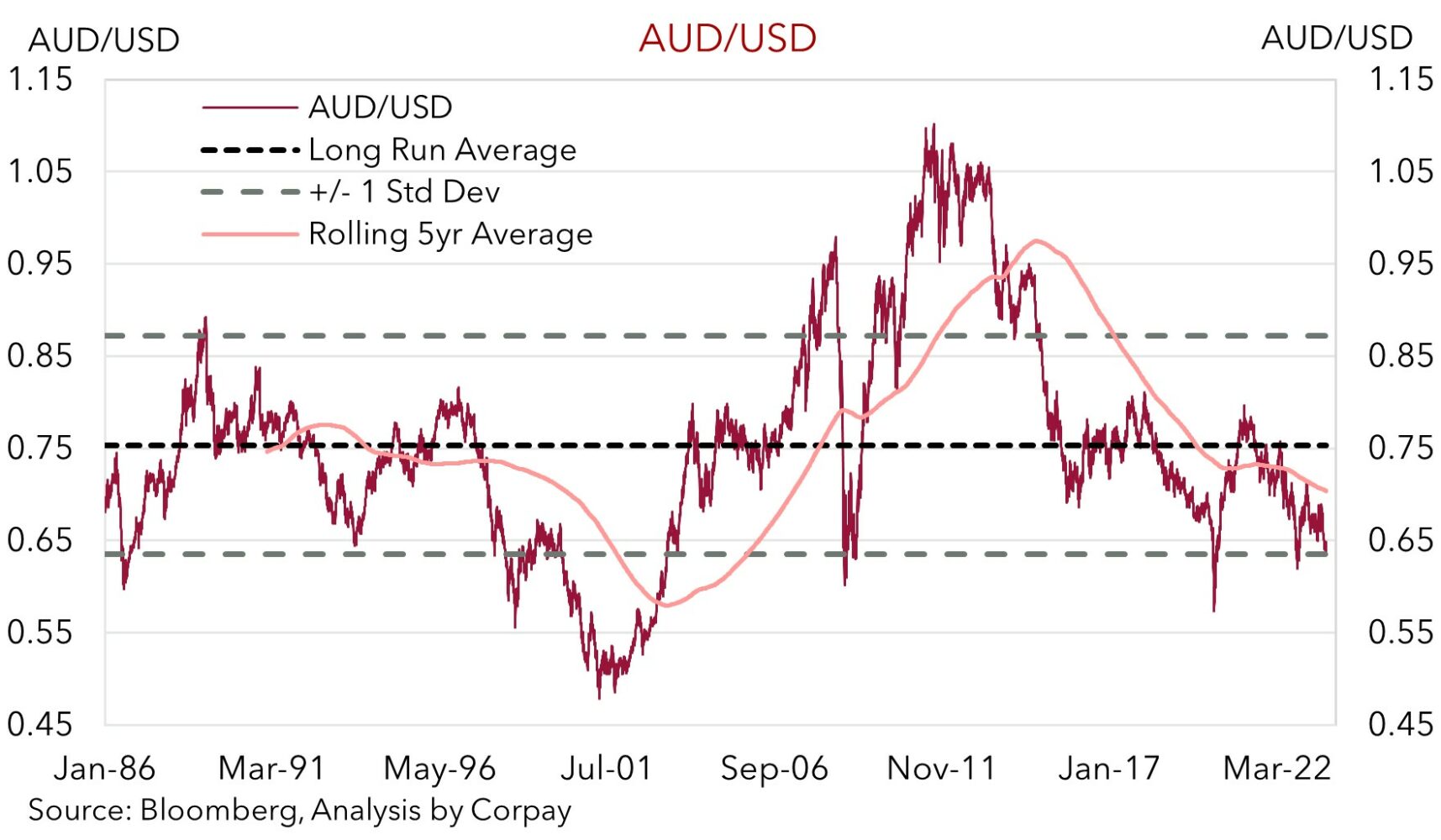

Down around current levels we think a lot of negatives are factored into the AUD, much like we believe there is quite a bit of positivity now priced into the USD (see above). As our chart shows, the AUD is tracking in somewhat rarefied air. Since the float the AUD has seldom been sub~$0.6350 (which is 1 standard deviation below its long run average). When structural supports such as Australia’s switch to a current account surplus (now ~1.2% of GDP) kicked in, it has been even less frequent. Since 2015 the AUD has traded below ~$0.6350 less than 2% of the time.

Cyclically we think the tide may also soon turn in favour of a AUD rebound. Authorities in China have started to roll-out growth and FX supportive measures. A relative improvement in China’s economic fortunes should be a tailwind for regional growth, commodity demand, and the AUD over time. While in Australia some positive data could boost sentiment towards the AUD, and raise some questions about whether the RBA has reached the end of its hiking phase. Based on the partial data, we see upside risks to consensus forecasts (mkt 0.4%) for today’s Q2 GDP print (11:30am AEST). Conversely, as outlined above, following its recent strong run we think risks now reside with the US economic data starting to underwhelm loftier hurdles. If realised, this could weigh on the USD. The US services ISM is due tonight (12am AEST).

AUD event radar: AU GDP (Today), Bank of Canada Meeting (Tonight), RBA Gov. Lowe Speaks (Thurs), China Trade Data (Thurs), China CPI (Sat), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6365 / 0.6547, 0.6595

SGD corner

Inline with the stronger USD stemming from growth worries generated by subpar China and Eurozone PMI data, and the lift in bond yields as higher oil prices renew inflation concerns, USD/SGD has risen (see above). At ~$1.3610 USD/SGD is just under its 2023 year-to-date highs. On the crosses, EUR/SGD (now ~1.4598) has dipped with the weaker EUR a driver, while SGD/JPY (now ~108.50) remains historically high.

As mentioned above, we believe there are a lot of positives now priced into the USD. Further gains in the USD, and USD/SGD, may be hard to come by given a ‘higher for longer’ US Fed interest rate view now appears well factored in, and with the US’ relative economic outperformance unlikely to last, in our opinion. A softening in the US data, or a failure to meet the now more elevated expectations, could see markets trim their US interest rate expectations. This, coupled with some improvement in China’s and/or the Eurozone’s growth pulse, could exert pressure on the USD (and USD/SGD). The US services ISM survey is released tonight.

SGD event radar: Bank of Canada Meeting (Tonight), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3398, 1.3444 / 1.3690, 1.3711