• US holidays. Limited market moves with the US on holiday. The major currencies are little changed from where they ended last week.

• RBA today. No change in rates expected at Governor Lowe’s last meeting at the helm. But a mild conditional tightening bias is likely to be maintained.

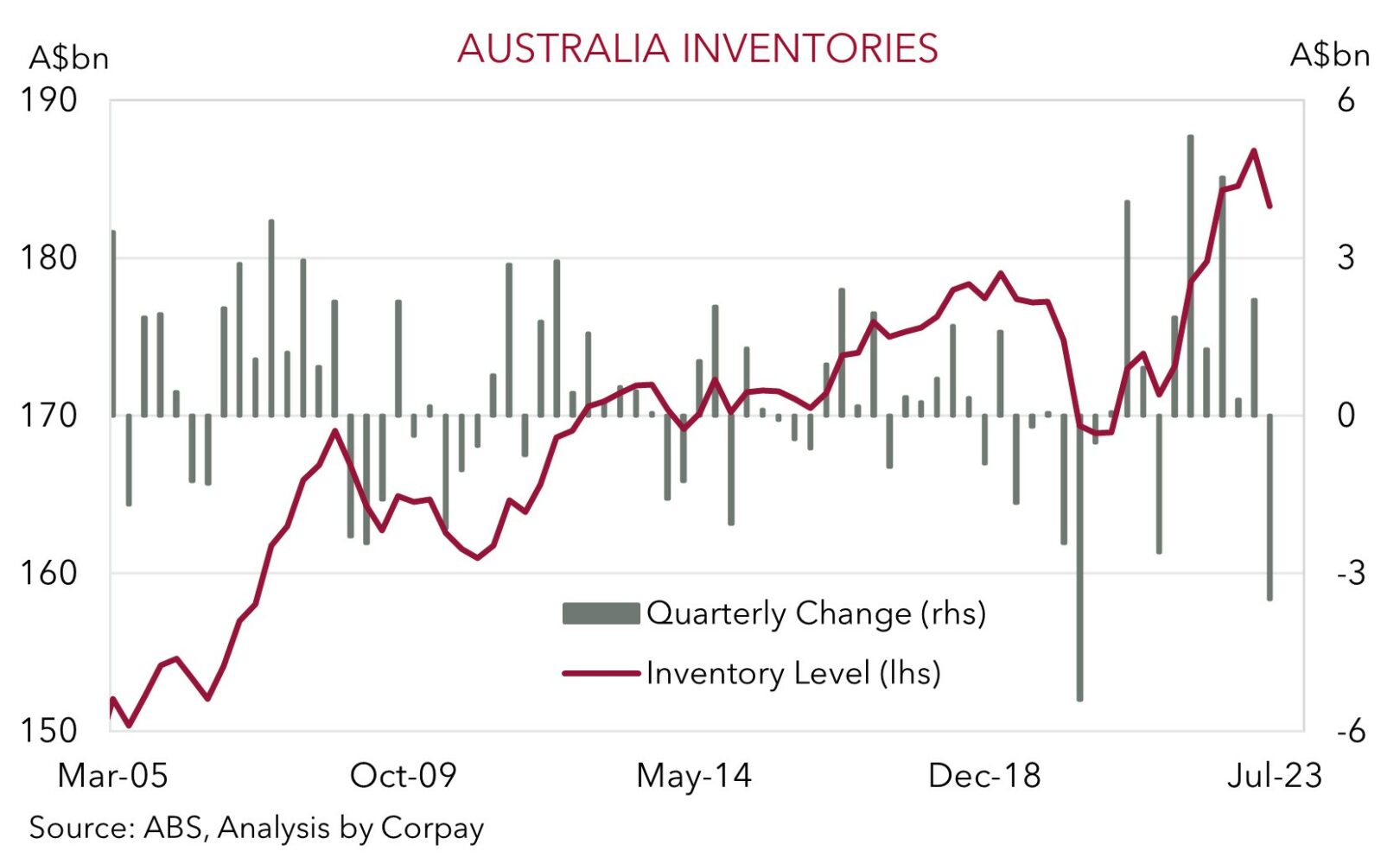

• AU GDP. Q2 GDP released tomorrow. A large inventory drawdown suggests there is a risk of a negative print. More inputs are released today.

With the US on holiday and no major data or events of note elsewhere it has been a quiet start to the week for markets. European equities consolidated (the EuroStoxx50 ended flat) with early gains inspired by yesterday’s lift in China fading. The Shanghai Composite rose 1.4%, the 5th increase in the past 6 trading days, with the recent run of policy easing steps boosting investor confidence. European bond yields ticked up slightly (German and UK 10yr rates +3bps), and across commodities oil prices are firmer (WTI crude +0.5%) while copper eased (-0.4%). At ~US$86/brl WTI crude oil prices are now around their highest level since mid-November, with the ~28% jump up over the past ~3-months set to unwind some of the improvement and generate a burst of higher headline inflation around the world over the coming months. In FX, the major currencies are within 0.2-0.3% of where they ended last week. EUR is tracking just under ~$1.08, USD/JPY is near ~146.50, and the AUD (now ~$0.6462) is fractionally above its ~3-week average.

As noted yesterday, it looks set to be a quieter week with only a handful of major macro events on the radar. Today, the RBA is widely expected to keep rates steady (2:30pm AEST), as is the Bank of Canada later this week (Thurs AEST). In China the contraction in export and import growth may let up a bit (Thurs AEST). If realised, we believe this could alleviate some concerns about the momentum in global industrial activity, exerting a little downward pressure on the USD, especially if policymakers in China continue to roll out FX/economic support measures and/or the US services ISM (Thurs AEST) comes in below analyst forecasts.

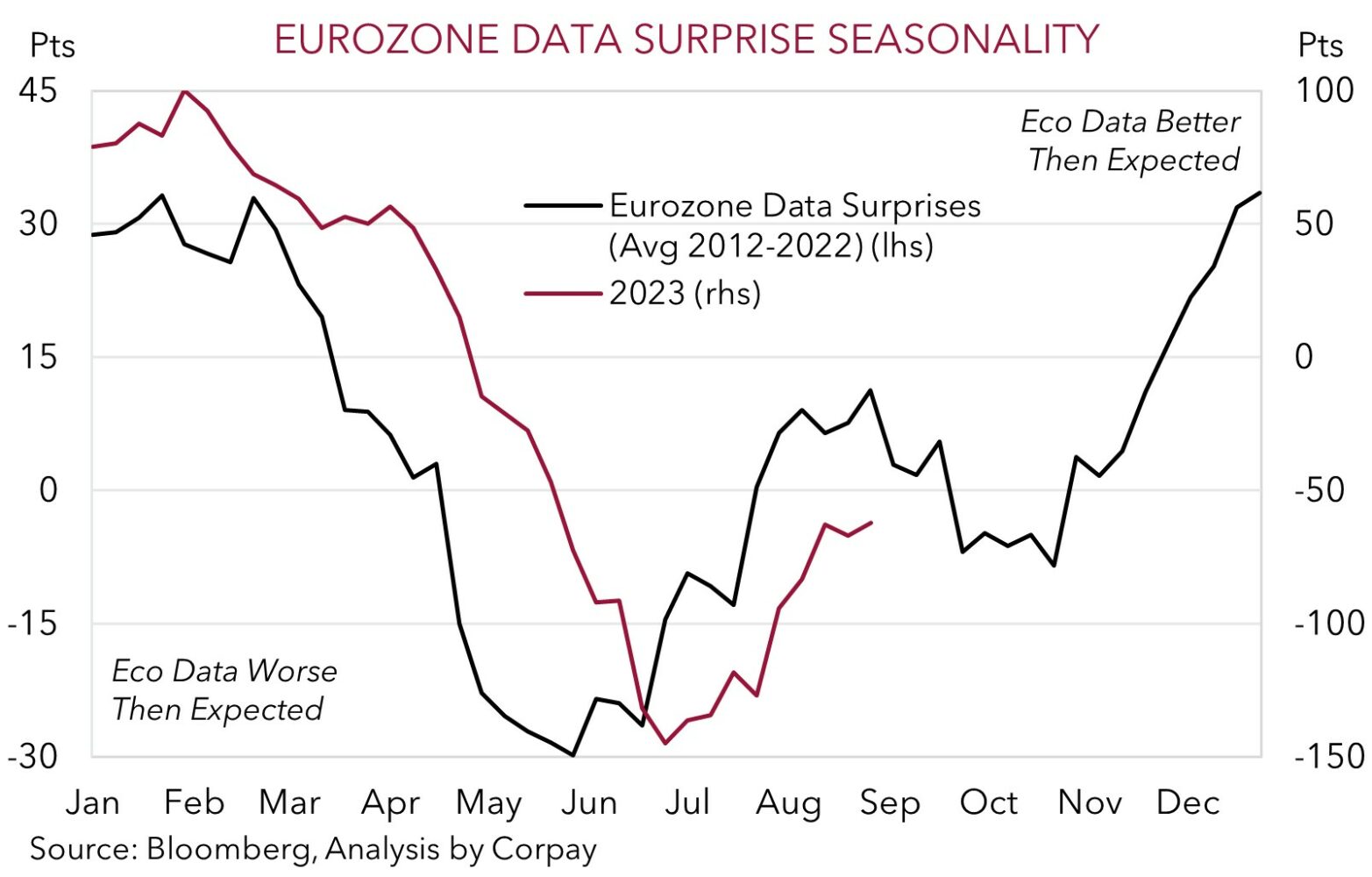

The outperformance of the US economy over the past few months has been a tailwind for the USD. FX is a relative price and outcomes compared to expectations drive markets. Given a ‘higher for longer’ US Fed interest rate view now appears to be adequately factored in we think the USD may be vulnerable to a run of softer US data and/or relative improvement across the other major economies. This is the usual seasonal pattern that comes through over the back end of the year with the USD typically losing ground (see Market Musings: History doesn’t repeat, but…). Indeed, as our chart shows Eurozone data surprises (i.e. how the economic data is tracking compared to analysts forecasts) have started to turn around, and as illustrated there is a tendency for this run to continue into year end.

Global event radar: RBA Meeting (Today), China Trade Data (Thurs), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD has remained range-bound in subdued US holiday impacted trade over the past 24hrs. At ~$0.6462 the AUD is slightly above its ~3-week average, with limited moves also coming through across the major cross-rates. AUD/JPY is a touch firmer (+0.4% to ~94.60), while the AUD has also edged up by ~0.2-0.3% against the NZD, CAD, and CNH.

Locally, the RBA meets today (2:30pm AEST). This is the last meeting with Governor Lowe at the helm. No change is expected with the RBA set to keep the cash rate at 4.1% once again. That said, we think the RBA may continue to keep its options open and retain a mild conditional tightening bias (i.e. “some further tightening of monetary policy may be required”) given the lingering concerns about the stickiness of services inflation. A repeat of this message may give the AUD some intra-day support. However, from a growth perspective we doubt the RBA will have to tightening policy any further with the cashflow hit on the indebted household sector set to intensify as more mortgage holders shift from low cheap fixed rate loans to much higher variable rates. The hit to the economy is already coming through with Q2 GDP (released tomorrow) at risk of showing a contraction following the substantial inventory drawdown that occurred in the quarter and given the sluggishness in consumer spending (see chart). There are more GDP inputs released today (net exports and government spending at 11:30am AEST).

While the local GDP trends seem AUD bearish, when it comes to markets, what is priced in matters. Given the sharp falls in the AUD that have occurred over the past month we think that down around current levels there are a lot of negatives already factored in. And while slower domestic growth should be an AUD headwind, developments in China and/or swings in the USD are likely to have more of a bearing on the AUD from here, in our view. And on these fronts, as mentioned above, we believe the USD could give back some ground should the US services ISM underwhelm (Thurs AEST), particularly as the ‘higher for longer’ US interest rate outlook now appears well discounted, the China data exceeds expectations (China export/import growth is released on Thursday), and/or policymakers in China announce more growth/FX supportive measures.

AUD event radar: RBA Meeting (Today), AU GDP (Weds), RBA Gov. Lowe Speaks (Thurs), China Trade Data (Thurs), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6365, 0.6403 / 0.6547, 0.6602

SGD corner

As per the limited volatility in markets and the USD over the past 24hrs, USD/SGD (now ~$1.3550) has traded in a tight range at the start of the new week (see above). On the crosses, EUR/SGD (now ~1.4630) has nudged up slightly with the pair approaching its 100-day moving average, while SGD/JPY (now ~108.08) remains at historically high levels.

As outlined above, it is likely to be a quieter week across financial markets with only a few releases of note such as the China trade data and the US services ISM on the schedule. On net, we think that with a ‘higher for longer’ US interest rate view now discounted any relative weakness in the US data and/or improvement in the other major economies such as China or the Eurozone could see the USD lose ground, dragging USD/SGD lower.

SGD event radar: RBA Meeting (Today), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3399, 1.3442 / 1.3590, 1.3690