• US data. Payrolls were a little stronger than expected, but greater labour supply pushed up unemployment. Manufacturing ISM a bit better than anticipated.

• Market volatility. US yields & the USD were whipped around by the US data. AUD spiked initially, but then reversed course as the USD rebounded.

• Event radar. Locally, the RBA meeting (Tues), GDP (Weds) & speech by Gov. Lowe (Thurs) are due. Offshore, China trade data & US services ISM are in focus.

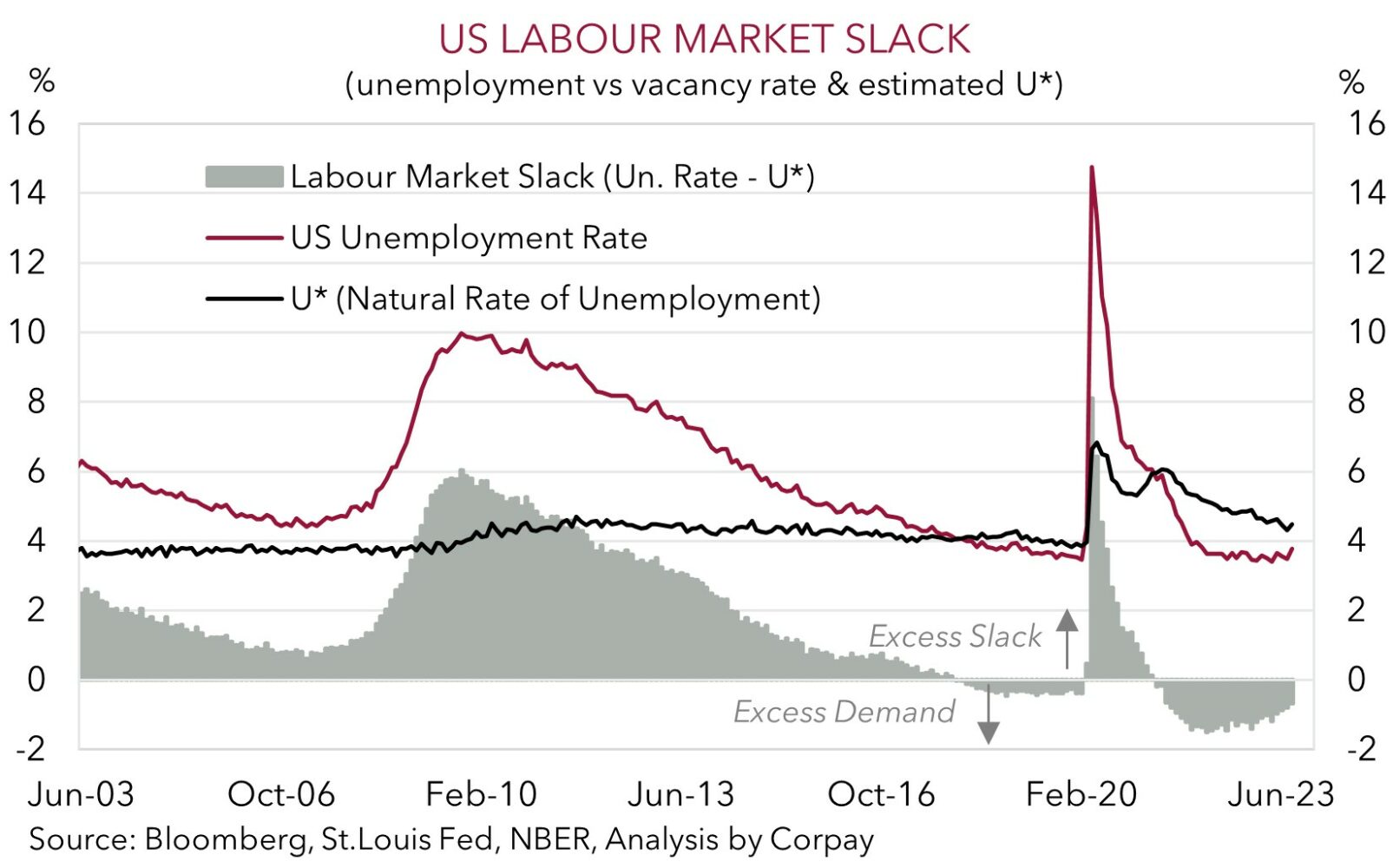

Markets were whipped around by the US economic data on Friday night with the latest jobs report in the spotlight. The data kept alive hopes of a goldilocks ‘soft landing’ for the US whereby the labour market gently loosens, and wages and inflation pressures cool. Jobs growth was solid in August with non-farm payrolls rising by 187,000. While this was slightly more than anticipated there were downward revisions to earlier months. At the same time, labour supply increased with the participation rate touching its highest level since early 2020. This mix pushed the unemployment rate up to 3.8%, a ~20-month high. As our chart shows, the US labour market is rebalancing with ‘excess demand’ fading, and in response growth in average hourly earnings eased.

The report makes a ‘pause’ by the US Fed at the 21 September meeting more likely. Indeed, markets are now only assigning a ~30% chance the Fed hikes again this cycle. In the wake of the data US bond yields and the USD dipped, though those initial moves couldn’t be sustained with the slightly higher than predicted US ISM manufacturing index generating a reversal later in the session as the jump up in the ‘prices paid’ component raised some concerns about the inflation pulse. On net, US equities ended Friday marginally higher (S&P500 +0.2%), with the US yield curve steepening as 10-yr yields closed the week at 4.18% (+6bps) and the US 2-year ended little changed (now 4.88%). Commodity prices rose with WTI crude oil up ~2.3% and base metals like copper (+1%) also firmer. In FX, as mentioned the USD’s knee-jerk falls more than unwound with EUR slipping back under ~$1.0780 and USD/JPY (now 146.20) rebounding by ~1.2% from its intra-day day low. In line with the USD volatility the AUD also swung around, trading in a ~1.3% range on Friday. At ~$0.6448 the AUD is tracking near last week’s average.

Offshore, it looks set to be a quieter week with the US on holiday today and only a few major economic events on the schedule. In Canada, the BoC is widely expected to keep rates on hold (Thurs AEST), and in China the contraction in export and import growth looks set to lessen (Thurs AEST). If realised, we think this could ease some worries about global growth momentum and exert a little downward pressure on the USD, particularly if authorities in China continue to roll out incremental policy support and/or the US services ISM (Thurs AEST) undershoots consensus forecasts. The relative strength in the US data and resultant upward repricing in US interest rate expectations has been a USD tailwind over the past few weeks. We think this has now largely run its course with a “higher for longer” US rates outlook now appearing adequately factored in.

Global event radar: RBA Meeting (Tues), China Trade Data (Thurs), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD endured another bout of intra-day volatility on Friday with the initial spike up towards ~$0.6520 following the US labour market report more than unwinding as the USD rebounded later in session (see above). At ~$0.6448 the AUD is ~1.1% below Friday’s peak, though it is near last week’s average. In a sign that the AUD swings were USD driven the AUD is little changed on most of the major crosses compared to this time Friday. AUD/CNH is an exception with the pair declining by 0.6% to ~4.69 with the CNH supported after policymakers in China reach into their toolkit once again. On Friday the PBoC announced that the FX reserve requirement ratio will be cut by 2%pts (from 6% to 4%). The move boosts the amount of foreign currency available in the local market, in turn making it more appealing for participants to hold the yuan. This lever was pulled in 2022, and in combination with the stronger than expected daily CNY fixings, is another shot across the bow of markets aimed at limiting yuan weakness.

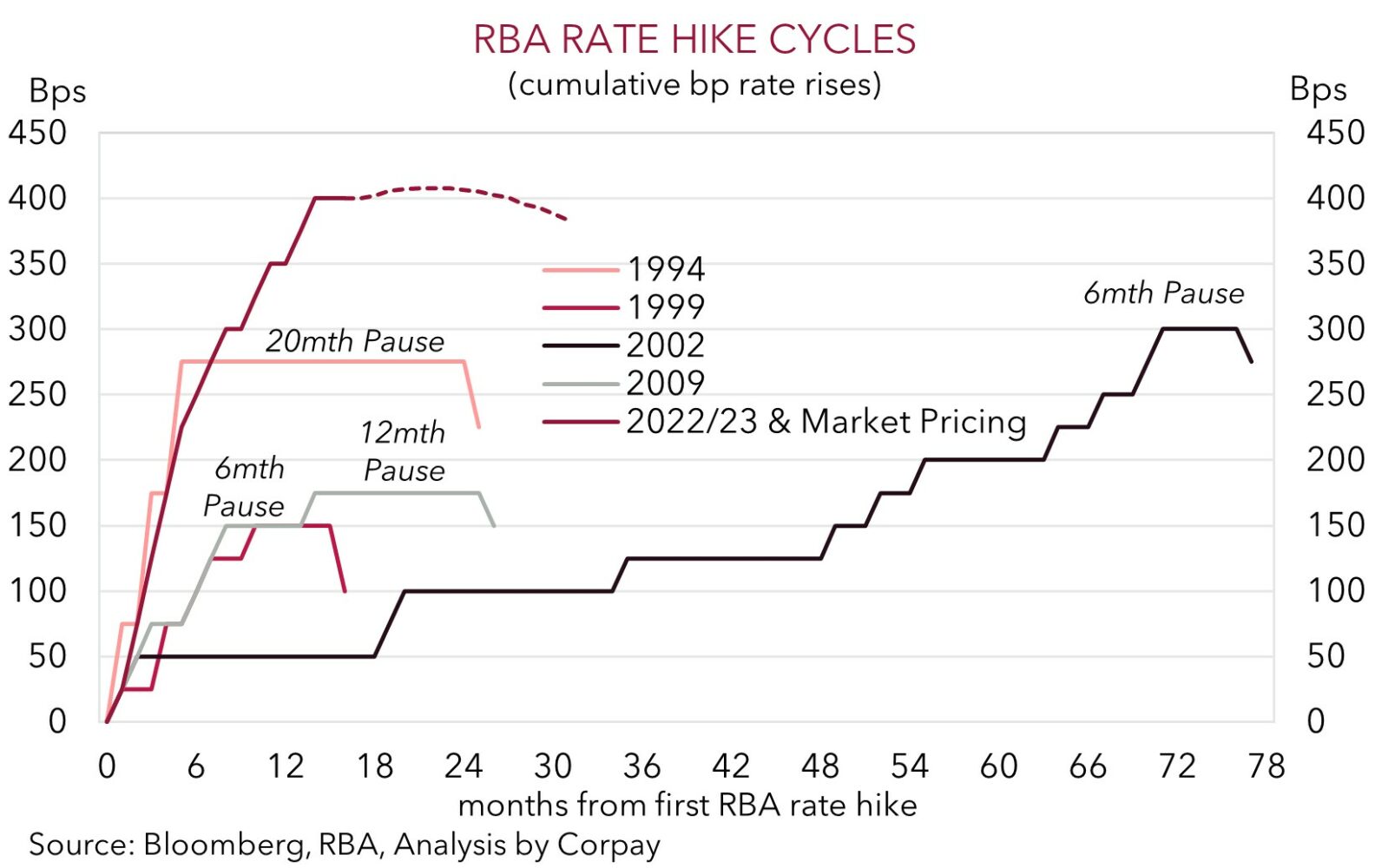

Locally, there are a few macro focal points this week with the RBA meeting (Tues), Q2 GDP (Weds), and last speech by RBA Governor Lowe (Thurs) on the radar. On net we believe the events could generate a little support for the AUD. While the RBA is expected to keep rates on hold at 4.1% once again, we expect its mild conditional tightening bias to be maintained. The risk of needing to do more should the data positively surprise and/or need to keep rates at high levels for some time to sustainably lower inflation could also be repeated by Governor Lowe. Data wise, while growth is weakening on the back of higher mortgage costs we think the balance of risks are tilted to a slightly stronger than predicted GDP print (mkt +0.3%qoq, +1.8%pa). Offshore, as discussed above, we also think the USD could give back some ground should the US services ISM underwhelm, particularly as the ‘higher for longer’ US interest rate outlook now appears well discounted, and with tentative signs that momentum in China may be bottoming out.

Added to that, as outlined previously, we expect fundamentals such as Australia’s current account surplus (now ~1.4% of GDP), the still high level of the terms-of-trade, efforts by China to restrain CNY weakness, and flows related to the increasing pool of offshore investments undertaken by the superannuation industry to be AUD supportive down around current lower levels. Looking further ahead, we remain of the opinion that as the US’ relative economic strength wanes, seasonal forces turn more positive over coming months, and/or as China’s growth pulse re-accelerates as more stimulus measures are pushed through, the AUD could make its way back into the low 0.70’s by mid-2024.

AUD event radar: RBA Meeting (Tues), AU GDP (Weds), RBA Gov. Lowe Speaks (Thurs), China Trade Data (Thurs), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6365, 0.6403 / 0.6547, 0.6601

SGD corner

The volatility in the USD following the release of the US payrolls and ISM manufacturing data on Friday night (see above) generated a bit of movement in USD/SGD. But on net, at ~$1.3540 remains a bit under its ~3-week average. On the crosses, the resultant pull-back in the EUR has weighed on EUR/SGD (now ~1.4592) with the pair near the bottom of the range occupied since mid-June. SGD/JPY (now ~107.91) has drifted off from the historic highs touched earlier last week.

As discussed above, it looks set to be a quieter week on the global economic data front, with only a few key releases of note such as the China trade data and the US services ISM. On balance, we continue to believe that with a ‘higher for longer’ US interest rate view now well priced into markets, any slippage in the US data and/or relative improvement in the other major economies such as China should see the USD lose steam, dragging USD/SGD lower. This is where we think the risks reside over the period ahead.

SGD event radar: RBA Meeting (Tues), Bank of Canada Meeting (Thurs), China CPI (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3399, 1.3441 / 1.3590, 1.3690