• Mixed markets. The USD clawed back ground against the softer EUR & GBP. AUD/USD held up with AUD/EUR and AUD/GBP rising.

• China pulse. Forward components point to a pick up in the manufacturing PMI. Authorities also continue to pull on policy support levers.

• US payrolls. US labour market in focus tonight. We think there could be an uneven reaction with a downside surprise likely to generate a larger (negative) jolt on the USD.

Markets consolidated overnight with the economic data generally inline with expectations, and with participants having one-eye on tonight’s US labour market report (10:30pm AEST). Equities drifted lower with European indices (EuroStoxx50 -0.4%) underperforming the US (S&P500 -0.2%). Bond yields also reversed course, particularly across Europe, as rate hike bets built up the previous day were pared back. German rates fell 8-9bps across the curve, with the 10yr yield (now 2.47%) back where it was trading a week ago. US bond yields ticked down slightly (US 2yr -2bps to 4.86%). The shift in relative interest rate expectations in favour of the US supported the USD Index with EUR (-0.8% to ~$1.0843) and GBP (-0.4% to ~$1.2670) unwinding yesterday’s push higher. But the USD revival wasn’t broad based. USD/JPY (-0.5% to ~145.50) has eased lower, inline with the dip in bond yields, the AUD has tread water around ~$0.6480 and NZD has oscillated near ~$0.5965.

Running through the data, in Europe after some higher-than-expected country level data there were fears inflation may blitz predictions. In the end, while Eurozone headline inflation defied forecasts by holding steady at 5.3%pa, core inflation slowed (now also 5.3%pa). This and comments from ECB heavyweights Schnabel and Guindos suggesting that another move at the mid-September meeting is still up for debate and far from certain saw traders reduce the odds of a hike to ~25%. Similarly, the Bank of England’s chief economist Pill indicated that while rates may have to stay high for some time, they may not rise much more from here. In the US, the activity data was firmer with personal spending higher, though the draining of ‘excess savings’ helped and that war chest could soon be depleted. Jobless claims remain low, while on the inflation front, the PCE deflator matched consensus estimates (3.3%pa).

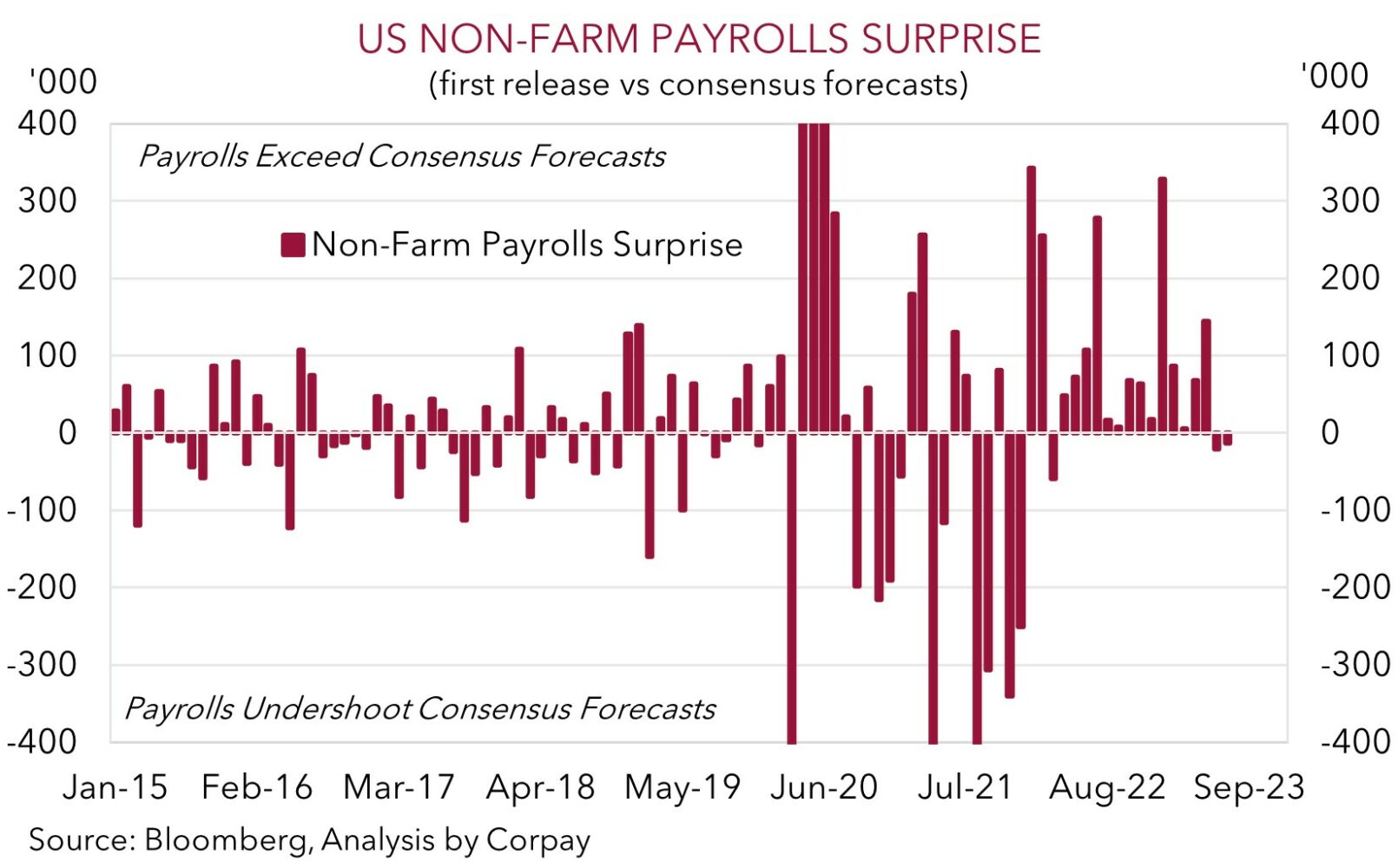

In terms of tonight’s US labour market report, as discussed over the past few days, given a ‘higher for longer’ US interest rate view now appears well priced, we think a greater reaction could be generated by a softer set of figures, with bond yields and the USD likely to fall if unemployment rises (mkt 3.5%), payrolls growth undershoots (mkt 170,000), and/or wage growth disappoints (mkt 4.3%pa). Cracks in the US labour market are beginning to show, with job openings falling and the quit rate declining, and they should widen over the period ahead as tighter credit conditions bite. As our chart shows, after a super strong run where payrolls exceeded analysts forecasts during the post COVID recovery, the data has come in below estimates over the past two months.

Global event radar: US Jobs (Tonight), US ISM (Tonight), RBA Meeting (5th Sep), Bank of Canada Meeting (7th Sep), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD corner

The AUD has held its ground in the face of a tick up in the USD overnight. The AUD has traded in a range centered on ~$0.6480 over the past 24hrs with higher energy prices (WTI crude +2.5%), solid domestic data, positive policy signals from China, and outperformance against the major European currencies offsetting the USD rebound and dip in equities (see above). AUD/EUR (+0.9% to ~0.5980) has edged up to its highest level since 10 August and AUD/GBP (+0.5% to ~0.5117) is also firmer.

Locally, Q2 capex was better than anticipated and showed higher spending/investment by businesses across several industry sectors. An increase in vehicle spending (given the end of the full expensing tax incentive on 30 June), and investment related to mining projects for resources such as lithium played a role. The forward-looking investment intentions for FY24 also came in higher. A still positive CAPEX cycle can be a source of support for the Australian economy as the household sector slows on the back of higher mortgage rates.

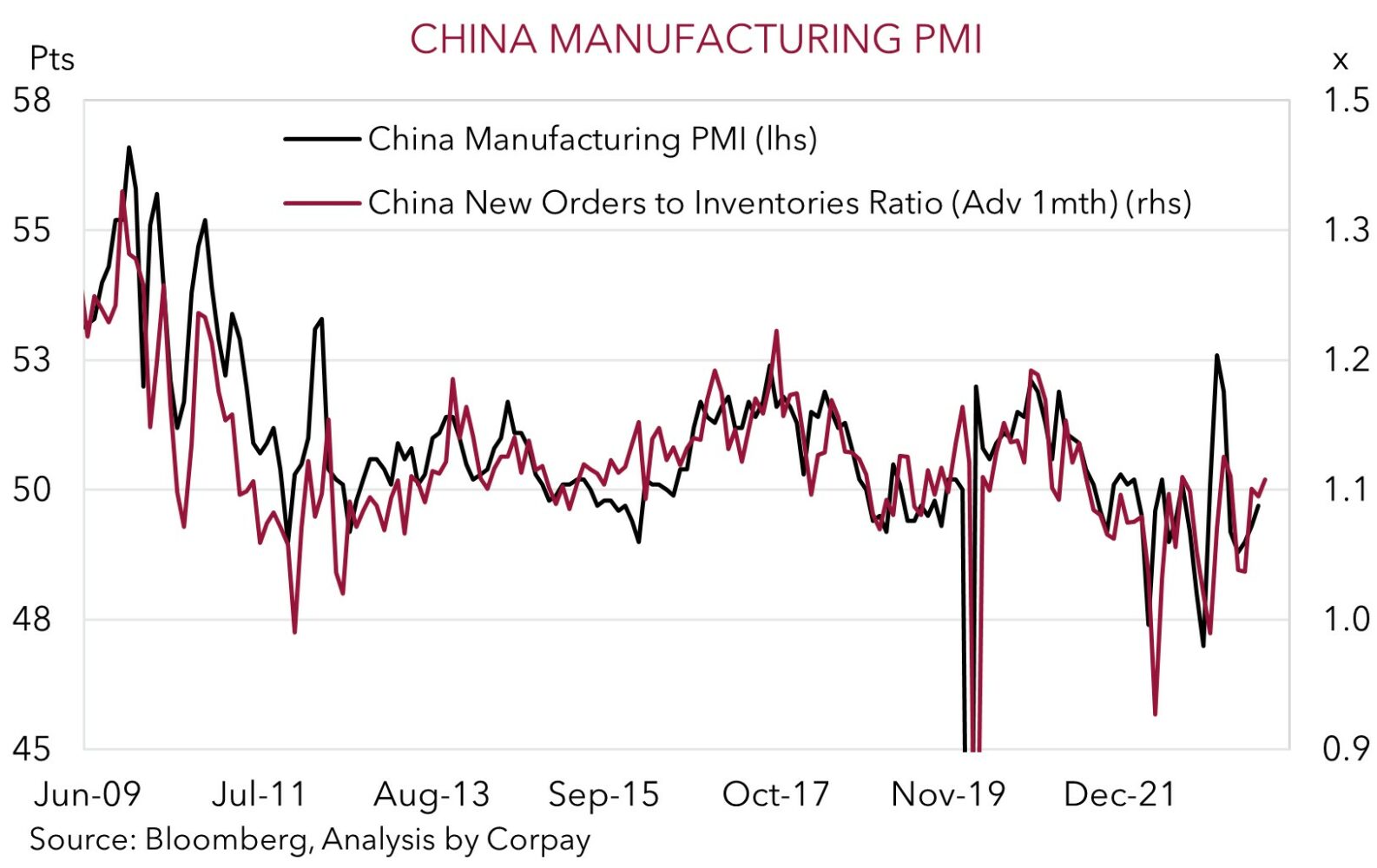

In China, the manufacturing PMI rose to a 5-month high (now 49.7), and while the services measure softened it remains in ‘expansionary’ territory. Notably, the subcomponents of the manufacturing gauge indicate that new orders and production improved, while inventories were run down. As our chart shows, this mix normally points to a further improvement in the manufacturing PMI over the next few months. This is typically AUD supportive. Added to that authorities in China continue to pull support levers. Overnight, policymakers lowered the down payment requirement for first-time home buyers to 20% and a rate cut on existing mortgages for first homes was also approved. All these smaller measures add up. We think that the policy shift, with more likely to come through, can help China’s growth pulse bottom out and turn the corner over the period ahead. This, in our opinion, should be helpful the CNH and in turn the AUD down the track given the tight correlation between the pairs.

Today, markets will be focused on the US payrolls report (10:30pm AEST). As discussed, we think risks are tilted to the US data underwhelming expectations which if realised may weigh on US bond yields and the USD given the current high level of market interest rate pricing, and be supportive for risk sentiment and the AUD. There will be bumps along the way, but we continue to see the AUD grinding back up into the low $0.70’s by mid-2024 as the US’ relative economic strength fades, as China’s growth momentum re-accelerates as stimulus measures are rolled out, and given the flow and valuation support stemming from Australia’s current account surplus (now ~1.4% of GDP) and high level of Australia’s terms-of-trade.

AUD event radar: US Jobs (Tonight), US ISM (Tonight), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep), China Trade Data (7th Sep), Bank of Canada Meeting (7th Sep), China CPI (9th Sep), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD levels to watch (support / resistance): 0.6365 0.6403 / 0.6547, 0.6600