• Macro divergence. Regional Eurozone inflation positively surprised, while US GDP & ADP employment undershot forecasts. This pushed up the EUR.

• AUD volatility. AUD spiked to a ~2-week high overnight before easing back. USD & China trends remain more influential than the local data.

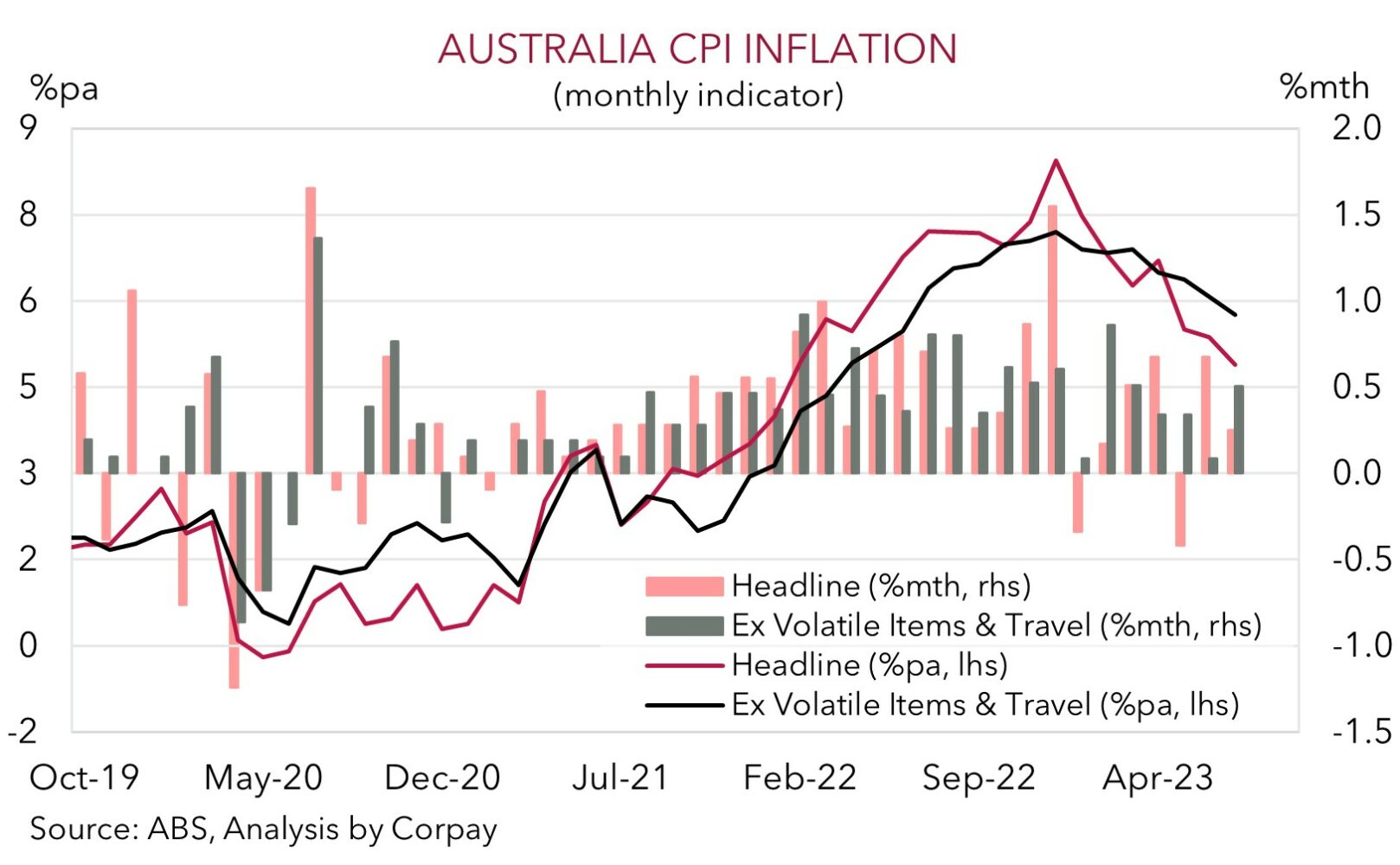

• AU inflation. Headline inflation slowed to 4.9%pa. But this was due to volatile items. Higher petrol prices point to a re-acceleration next month.

Mixed fortunes across US and European markets overnight, inline with the divergence in the incoming data. European equities slipped back (EuroStoxx50 -0.3%) and bond yields rose (German rates increased ~3bps across the yield curve) after regional inflation data topped expectations. Core inflation in Spain eased less than forecast (now 6.1%pa) as did headline inflation in Germany (now 6.4%pa). The data provided a reminder to markets that the fight against inflation may have a few more rounds to go. Market pricing for further ECB rate hikes ticked up, with a greater than 50% chance of a move at the mid-September meeting now discounted and almost a full hike assumed by year-end. The Eurozone inflation report is released today (7pm AEST).

By contrast, in the US it was a case of “bad news is good news” with sentiment boosted by an extension of the run of softer data. Q2 US GDP growth was revised down (the US economy is now estimated to have expanded at a 2.1% annualized pace), while ADP employment undershot forecasts (+177,000 vs mkt +195,000). This was the slowest pace of jobs growth on the ADP measure in 5-months. As a result, US bond yields unwound their European inspired lift to end the day a fraction lower, and US equity markets increased (S&P500 +0.4%). In FX, the relative data trends saw the USD Index lose some more ground with the major European currencies outperforming. EUR has pushed back up towards its 100-day moving average (~$1.0925), and GBP has risen back over ~$1.27. USD/JPY has consolidated just above ~146, and after rising to a ~2-week high overnight the AUD has drifted back to be little changed compared to this time yesterday (now ~$0.6476).

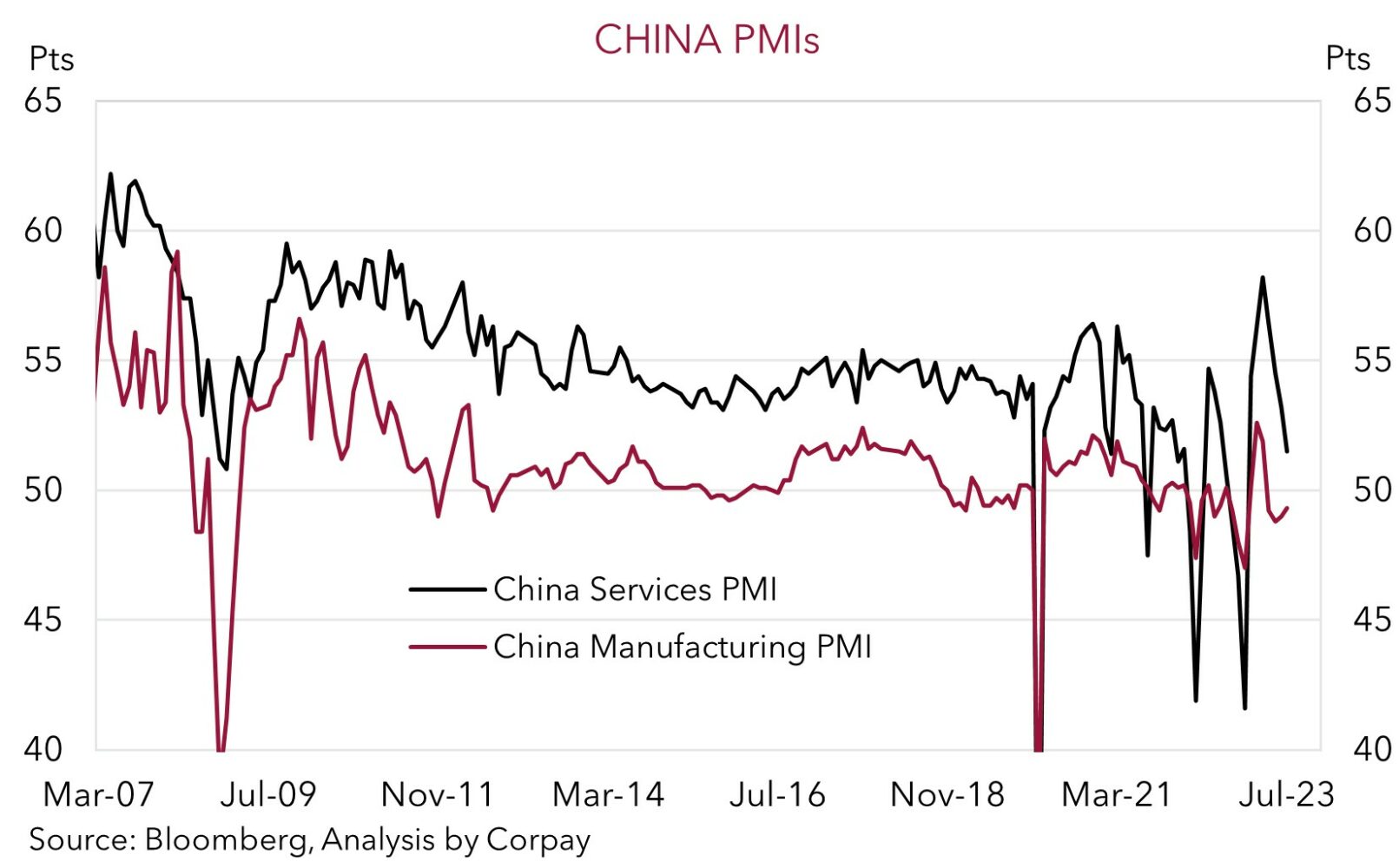

In addition to Eurozone inflation, the China PMIs (11:30am AEST), US jobless claims, and the US PCE deflator (the US Fed’s preferred inflation gauge) (both 10:30pm AEST) are released today, with the US non-farm payrolls report due tomorrow night. Outcomes relative to expectations drive markets. Although the China PMIs are projected to weaken a little more, we believe the growth slowdown may now be well priced and markets may be more vulnerable to better than anticipated results. Similarly, as we have been highlighting over the past week, given our thoughts that the “higher for longer” US interest rate outlook was more appropriately factored in, and our judgement that there are greater risks the incoming US data falls short of consensus forecasts, we believe the USD’s pull-back can continue over the near-term.

Global event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), Bank of Canada Meeting (7th Sep), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD corner

The AUD has endured some intra-day volatility over the past 24hrs. The AUD spiked up to a ~2-week high overnight following the release of the weaker than predicted US GDP and ADP employment data (see above) before easing back later on to now be little different from this time yesterday (now ~$0.6476). The relative strength across the major European currencies following the higher than forecast regional Eurozone inflation data and shift up in Eurozone bond yields has pushed AUD/EUR (-0.5% to ~0.5928) and AUD/GBP (-0.7% to ~0.5091) lower.

Locally, building approvals (-8.1% in July) and construction work done (+0.4% in Q2) came in weaker than anticipated yesterday, as did the monthly CPI indicator. Headline inflation slowed to 4.9%pa in July, though a closer look shows that the drop was heavily influenced by volatile items such as fruit & veg prices. Rebates for rising electricity costs also played a role. Excluding the volatile items there was less joy with inflation now running at 5.8%pa on this basis. This is something the RBA is monitoring closely. It is important to remember that the CPI indicator is an incomplete series, particularly so early in the quarter (~40% of prices in the CPI basket, mainly services, weren’t updated in July). Sticky services prices remain quite high (now 5.6%pa) and the improvement on this side of the ledger remains slow going. Next month’s CPI indicator will include more services prices, and it will also incorporate the sharp rise in petrol that has come through, so it could re-accelerate, in our opinion.

Today, the China PMIs (11:30am AEST) are in focus, with Eurozone inflation (7pm AEST), US jobless claims, and the PCE deflator (10:30pm AEST) released tonight ahead of tomorrow nights US payrolls report. As outlined above, barring a substantial miss we think the slowdown in China may already be largely factored into the AUD down at these levels, and as we have noted over recent days the incoming US data and USD trends should have more of a lasting AUD impact. And on the latter, we remain of the opinion that the US data pulse, particularly the week ending non-farm payrolls report, risks coming up short. Inline with the past few days we think that further negative US data surprises could see US bond yields and the USD give back more ground, this in turn could support risk sentiment and the AUD over the near-term.

AUD event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep), China Trade Data (7th Sep), Bank of Canada Meeting (7th Sep), China CPI (9th Sep), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD levels to watch (support / resistance): 0.6365 0.6403 / 0.6547, 0.6600

SGD corner

USD/SGD has whipped around a little over the past 24hrs, but on net the pair is little different relative to this time yesterday (now ~$1.3496). On the crosses, the bounce in the EUR stemming from the higher than expected regional inflation data and shift in relative interest rate expectations has pushed EUR/SGD (now ~1.4748) back above its 50-day moving average (see above). SGD/JPY (now ~108.29) has consolidated near its historic peak.

As discussed above, there are a string of global data points in focus over the next few days with the China PMIs, Eurozone inflation, US jobless claims, and US PCE deflator due today, and US non-farm payrolls data released tomorrow. In our opinion, with the slowdown in China and ‘higher for longer’ US interest rate outlook looking more adequately discounted, markets remain more at risk of positive China and/or negative US data surprises. We continue to think that downside risks to the US data remain in place, particularly the week ending labour market report. If realised, we expect softer US data to generate further falls in US bond yields and in turn USD/SGD.

SGD event radar: China PMIs (Today), Eurozone CPI (Today), US PCE Deflator (Today), US Jobs (Fri), US ISM (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Singapore CPI (25th Sep).

SGD levels to watch (support / resistance): 1.3403, 1.3440 / 1.3590, 1.3690