• Softer US data. US consumer confidence & the JOLTS report came in weaker than expected. This weighed on US bond yields & the USD.

• US focus. US labour market trends will remain in the spotlight with ADP employment, jobless claims, & non-farm payrolls due over coming days.

• AU inflation. Monthly CPI indicator released today. It is an incomplete series, particularly so early in the quarter. The data may generate intra-day AUD volatility.

Downside surprises in the US economic data released overnight has generated a meaningful market reaction with equities higher (S&P500 +1.5%), bond yields lower (US 2yr yield -11bps, 10yr yield -8bps), and the USD giving back some ground as participants adjusted their US interest rate expectations. After gaining earlier in the day, the USD index reversed course pushing EUR up to ~$1.0880 and GBP to ~$1.2645. USD/JPY has tracked the dip in US bond yields to be back under ~146 (~1% below yesterday’s 2023 peak). The positive risk backdrop, as illustrated by the jump up in equity markets and firmer energy and base metal prices (WTI crude rose 1.3% while copper increased ~1%), and lower US yields boosted the NZD and AUD. The AUD (now ~$0.6481) is ~0.8% higher compared to this time yesterday. Media reports that there could be more incremental policy support out of China to reinvigorate its recovery is also likely to have given the AUD some support. According to Bloomberg, on the direction of the state, China’s largest banks may be preparing to cut interest rates on existing mortgages and deposits.

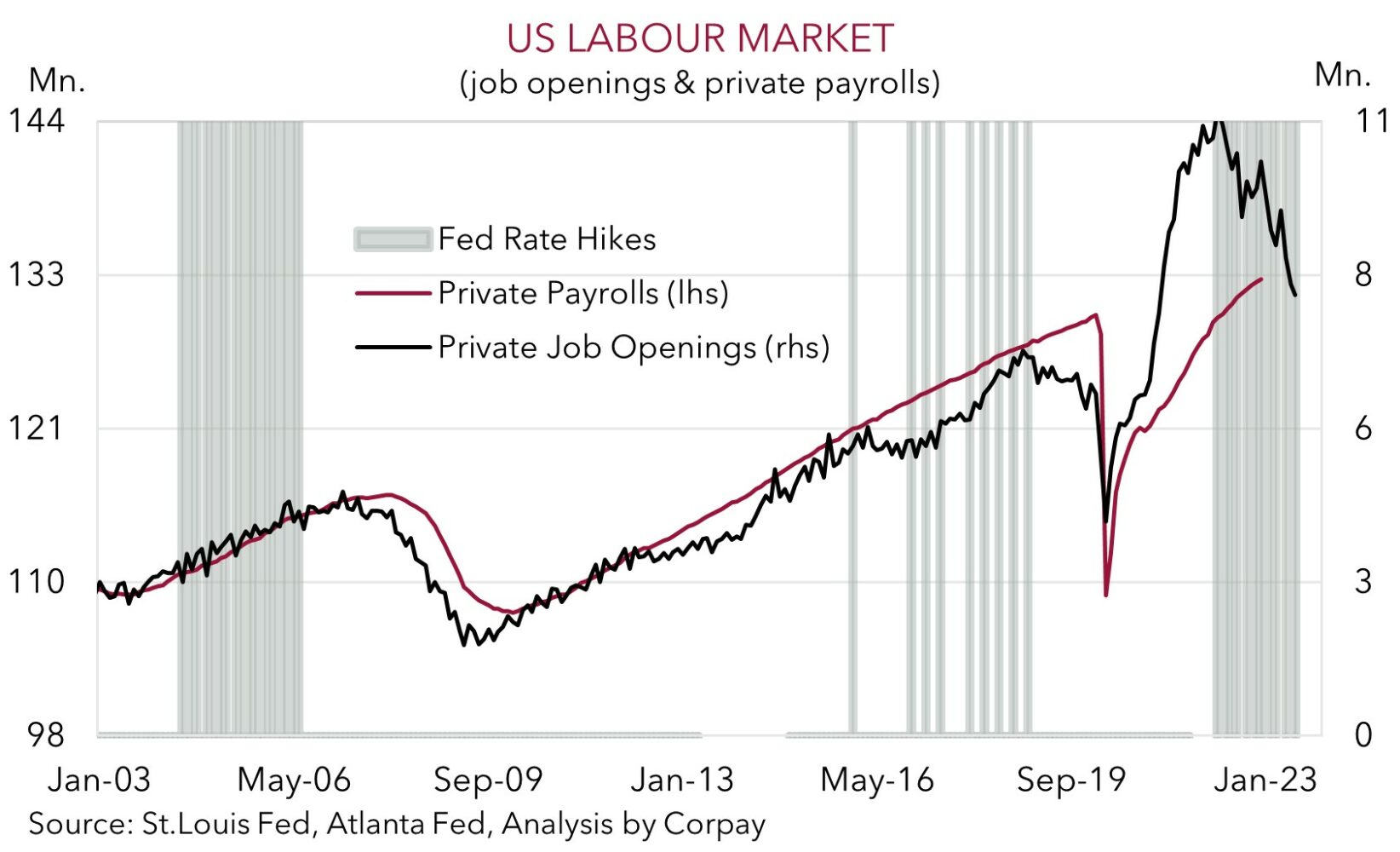

In terms of the data, US consumer sentiment fell more than anticipated with the Conference Board measure declining to 106.1 as households turned more pessimistic about the current state of play and the outlook. The pull-back in confidence suggests the strength in US consumer spending, the engine room of the US economy, won’t last as cost of living pressures and dwindling ‘excess savings’ hit home. Importantly, the US labour market is cooling. According to the JOLTS report, job openings slumped to a more than 2-year low. Job openings have now declined in 6 of the past 7 months, and as a result there are now ~1.5 job vacancies for each unemployed person. This ratio peaked at ~2 late last year. The US Fed is looking for this ratio to fall towards ~1 for wage growth to be consistent with its 2%pa inflation target. Notably, the ‘quit rate’ has also fallen to its lowest since early-2021 (now 2.3%). A lower quit rate illustrates that there is less confidence in the ability to find another job with less labour turnover generally foreshadowing slower wage growth and in turn lower inflation down the track.

As flagged over recent days we believed that the “higher for longer” US interest rate outlook had become well priced, and that after an extended run of strong data the USD was (more) vulnerable to negative surprises. Outcomes relative to expectations drive markets. US labour market trends will remain in focus over coming days with ADP employment (10:15pm AEST), jobless claims (Thurs night AEST), and non-farm payrolls (Fri night AEST) due. In our opinion, while it could be a bumpy ride, on net, given we continue to see downside risks to the key upcoming US releases we think the USD’s pull-back can continue over the near term.

Global event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), Bank of Canada Meeting (7th Sep), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD corner

The softer USD stemming from the weaker than anticipated US data and lower bond yields has given the AUD a bit of a boost (see above). At ~$0.6481 the AUD is ~0.8% higher compared to this time yesterday. The positive risk vibes, with equities and base metal prices pushing higher, and reports that further steps could be taken in China to boost confidence and re-energise its stumbling recovery (see above) have also helped the AUD strengthen on most of the crosses. AUD has recorded gains of ~0.3-0.7% over the past 24hrs against the EUR, JPY, GBP, CAD, and CNH.

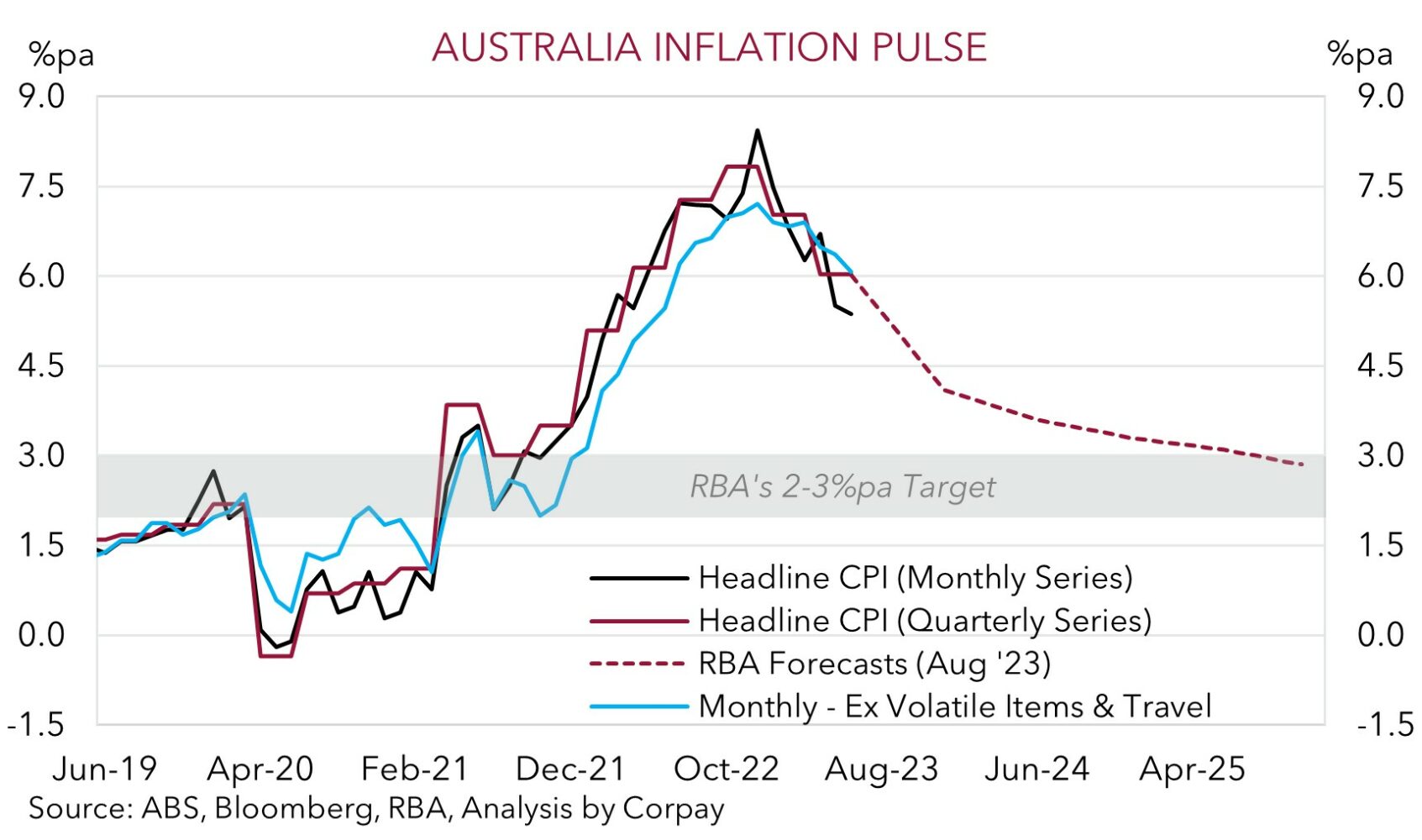

Locally, incoming RBA Governor Bullock spoke yesterday. In terms of policy, Bullock (who takes the top job on 18 September) reiterated the RBA’s soft conditional tightening bias by noting that inflation was still too high and that the bank “may have to raise rates again” but they are “watching the data very carefully” with upcoming decisions to be taken on a “month-by-month” basis. Markets are assigning a ~50% chance the RBA hikes again by end-Q1.

Today, building approvals and construction work done are on the data release schedule, but main attention will be on the monthly CPI indicator (11:30am AEST). The CPI indicator is an incomplete series, particularly so early in the quarter (~40% of prices in the CPI basket, mainly services, are not updated in July). With this in mind, we think a greater skew towards ‘goods’ prices in July, which are undergoing a bout of ‘disinflation’ as demand slows and supply-chains improve, suggests that there are downside risks to consensus projections looking for annual inflation to tick down from 5.4%pa to 5.2%pa. While a softer CPI print may generate an intra-day drag on the AUD, as we have pointed out before, the upcoming US data and USD trends should have more of a lasting AUD impact going forward. And on this front, we remain of the view that the incoming US data, particularly the week ending non-farm payrolls report, risks falling short of consensus forecasts. The overnight JOLTS report could be one of the first cabs off the rank. We believe a run of subpar US data could see US bond yields and the USD fall back further, boosting risk sentiment and the AUD over the period ahead.

This fits with our long-standing thoughts that fundamentals such as Australia’s current account surplus (now ~1.4% of GDP), the still high level of the terms-of-trade, efforts by China to restrain CNY weakness, and flows related to the increasing pool of offshore investments undertaken by the superannuation industry should be AUD supportive down near current levels. Further ahead, as the US’ relative economic strength wanes and/or as China’s growth momentum re-accelerates as more stimulus measures are rolled out, we are projecting the AUD to grind up into the low 0.70’s by mid-2024.

AUD event radar: AU CPI (Today), China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep), China Trade Data (7th Sep), Bank of Canada Meeting (7th Sep), China CPI (9th Sep), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6365 / 0.6547, 0.6600

SGD corner

USD/SGD has fallen back under ~$1.35 with the decline in US bond yields and weaker USD in the wake of the softer than predicted US consumer confidence and JOLTs labour market data the driver (see above). On the crosses, the resultant rebound in the EUR has pushed EUR/SGD (now ~1.4683) a bit higher, while SGD/JPY (now ~108.05) has consolidated near its historic highs.

As outlined above and over recent days, focus will remain on US labour market trends over the next few days. The ADP employment report is released tonight, with weekly jobless claims (Thurs), and the non-farm payrolls data (Fri) due later this week. As we have indicated recently, in our judgement, with the ‘higher for longer’ US interest rate outlook looking more adequately discounted, the USD appears more susceptible to a run of negative US data surprises. We think the upcoming US labour market prints could follow the JOLTS reports lead and may also undershoot expectations. If realised, we think a softer US data pulse could generate further falls in US interest rate expectations, the USD, and USD/SGD.

SGD event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Singapore CPI (25th Sep).

SGD levels to watch (support / resistance): 1.3404, 1.3438 / 1.3590, 1.3690