• Equities higher. Yesterday’s lift in Asian equities flowed through to other markets. The S&P500 rose, while US bond yields eased & the USD consolidated.

• AU retail. Australian retail sales exceeded expectations, with spending related to the women’s World Cup supportive. AUD a bit firmer.

• US data in focus. There is a string of US labour market releases over the next few days. Will the US’ relative economic strength continue?

At the start of a week jam-packed with important economic data, particularly in the US, equities have risen over the past 24hrs while US bond yields have eased, and the major currencies have consolidated. The weekend news that China had cut stamp duty on stock trades for the first time since 2008 to “invigorate capital markets and boost investor confidence” supported Asian equities yesterday. And although the Shanghai CSI300 gave back the bulk of its early gains, the index still ended the day 1.2% higher. This, and a continuation of the rally post Fed Chair Powell’s speech on Friday, spilled over into European markets (EuroStoxx50 +1.4%) and the US (S&P500 +0.6%). Bond yields ticked down a little in the US, with the 2yr and 10yr dipping ~3bps to 5.05% and 4.2% respectively. That said, US yields remain at high levels with the 2yr rate within striking distance of its cyclical highs.

In FX, the USD Index continues to track around the top of its ~3-month range with EUR/USD hovering just above its 200-day moving average (~$1.0809) and USD/JPY (now 146.54) at the upper end of the range it has occupied since mid-November. The NZD remains stuck down near its 2023 lows (now $0.5907), while the AUD has nudged up slightly (+0.2% to $0.6428) on the back of the lift in equities, better than expected Australian retail sales data, and efforts by policymakers in China to stimulate growth and stabilize the CNY. Yesterday policymakers once again set the daily CNY fix rate at a much stronger than expected level. The negative bias in the CNY fix over the past week has been historically large. This is a shot across the bow of markets and a sign of the discomfort about the recent CNY weakness.

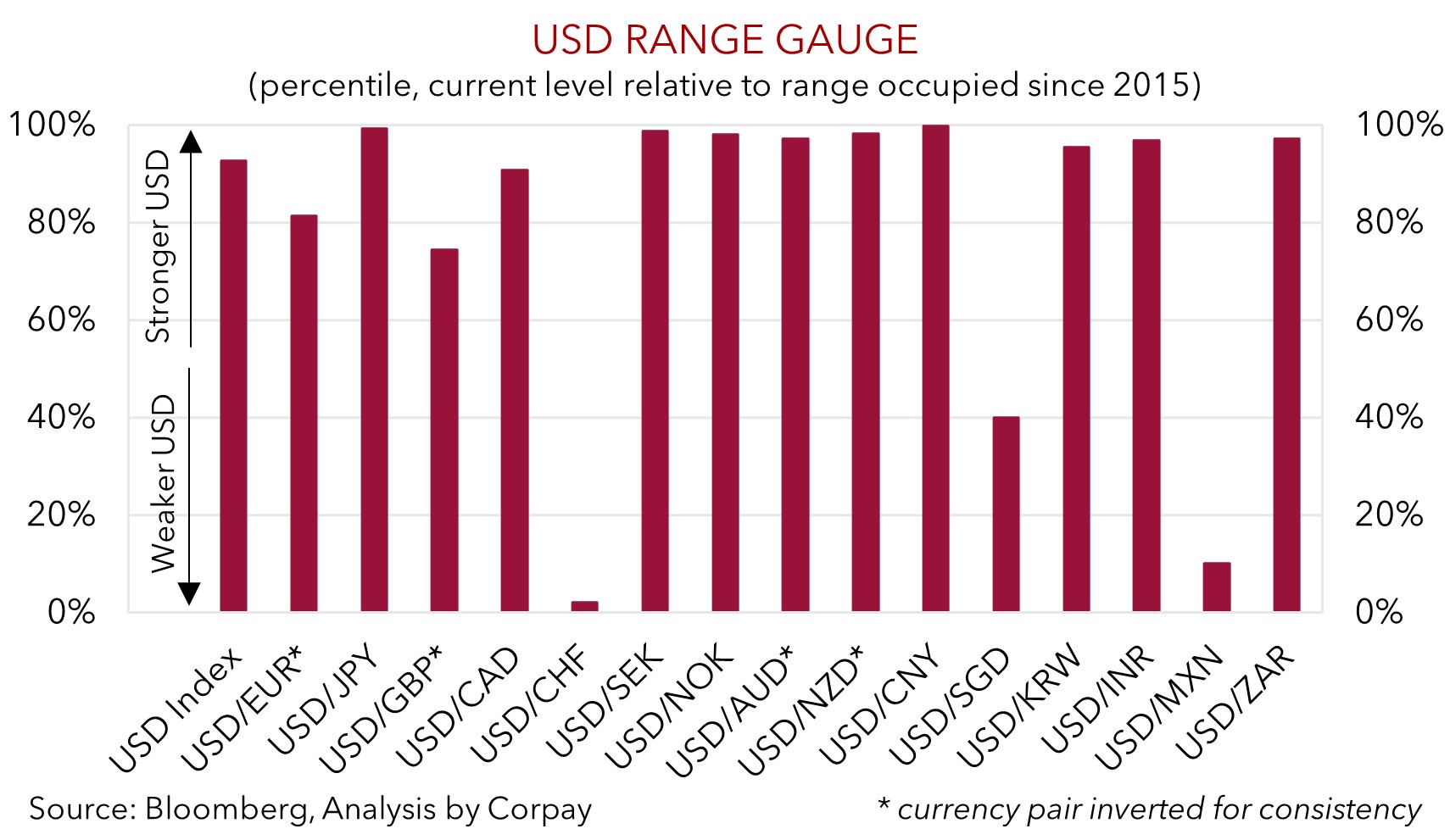

Trends in the US labour market are important for underlying inflation, and in turn the outlook for US monetary policy and the USD. Over the next few days there is a string of US labour market releases (JOLTS job openings tonight 12am AEST, ADP employment (Weds night AEST), jobless claims (Thurs night AEST)), with the non-farm payrolls report rounding things out (Fri night AEST). The run of better-than-expected US data and upward repricing in US interest rates, combined with sluggish momentum in China and Europe, has supported the USD over recent weeks. As our chart shows the USD is now at or near the top of its multi-year range against several currencies. As discussed yesterday, we think that after its upswing and with a ‘higher for longer’ US interest rate outlook now looking well priced, the USD faces risks going forward. Outcomes relative to expectations drive markets. In our judgement, given where things now sit, softer than anticipated US data could generate a negative USD reaction. This is where we see the risks around this week’s US data.

Global event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), Bank of Canada Meeting (7th Sep), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD corner

The AUD has ticked up a bit over the past 24hrs (+0.2% to $0.6428), with positive risk sentiment (as illustrated by the lift in global equities), steps by Chinese policymakers to bolster investor confidence and stabilize the CNY, and stronger Australian retail sales generating some support (see above). The AUD is also slightly firmer on some of the major crosses with gains of 0.2-0.3% recorded against the JPY, NZD, CAD, and CNH.

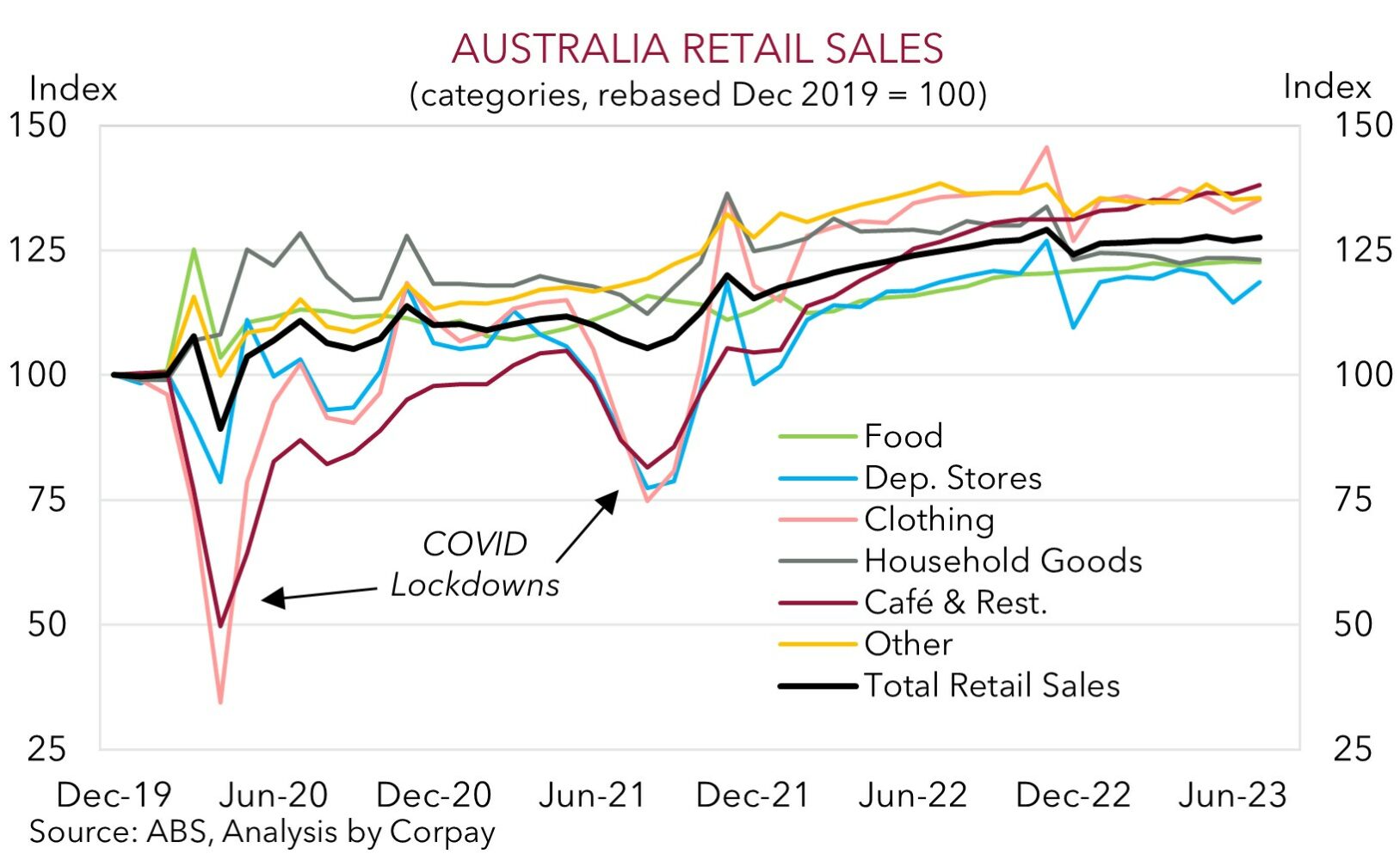

In terms of the local data, retail sales rose 0.5% in July (mkt +0.3%). This follows a weak June, with the sub sectors that fell heavily like department stores and clothing & footwear bouncing back. Also stronger was spending at cafes, restaurants & takeaway services with the ABS noting that the school holidays and extra catering linked to the women’s world cup played a role. As our chart illustrates, retail turnover is little changed from last September, with higher prices offsetting weaker volumes. The cashflow hit stemming from higher mortgage costs, combined with other cost-of-living pressures and lower confidence means that spending headwinds should remain in place for some time, and the July rebound may not be the start of a new trend.

Today, RBA Deputy Governor Bullock, who takes the top job in a few weeks, is speaking on “Climate Change and Central Banks” (5:40pm AEST). There is a Q&A session, so there is scope for some AUD intra-day volatility, though we doubt that Dep. Gov. Bullock will deviate from the recent script (i.e. that there may be scope for some further tightening depending on how the data pans out). The monthly CPI gauge is released tomorrow. That said, we continue to think that the upcoming US data (and USD trends) should be more impactful on the AUD. This is generally the case. And as mentioned above, we are of the view that the risks around the incoming US data, particularly the week ending non-farm payrolls report, are tilted to the downside. Given where things are now tracking, softer than predicted US data could generate a relatively larger pullback in US bond yields and the USD, in our opinion.

As discussed before, we expect fundamentals such as Australia’s current account surplus (now ~1.4% of GDP), the still high level of the terms-of-trade, efforts by China to restrain CNY weakness, and flows related to the increasing pool of offshore investments undertaken by the superannuation industry to be AUD supportive down near current levels. And further out, as the US’ relative economic strength fades and/or as China injects more stimulus to reinvigorate its stumbling recovery, we continue to see the AUD pushing back up into the low 0.70’s by mid-2024.

AUD event radar: RBA Deputy Gov. Bullock Speaks (Today), AU CPI (Weds), China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep), China Trade Data (7th Sep), Bank of Canada Meeting (7th Sep), China CPI (9th Sep), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6365 / 0.6547, 0.6600

SGD corner

USD/SGD has tread water around ~$1.3560 (the top end of the range it has traded in since last December) at the start of the new week, with the consolidation in line with the trends in the USD and other major currencies (see above). On the crosses, EUR/SGD (now ~1.4672) has ticked back above its 100-day moving average (~1.4658) with the lift in European equities and slight improvement in sentiment in China generating a modest amount of EUR support. SGD/JPY (now ~108.07) has edged up further to a fresh high.

As discussed above the US data, particularly around the labour market, will be in focus this week. The JOLTS job openings report is released tonight, with ADP employment (Weds), jobless claims (Thurs), and the important non-farm payrolls print (Fri) due over the next few days. The resilience in the US economy and relative economic strength has supported the USD over the past few months. In our view, given the ‘higher for longer’ US interest rate outlook now looks more appropriately discounted, the USD may be more vulnerable to softer than predicted incoming US data. If realised, we think negative US labour market surprises could see US rate expectations, the USD, and USD/SGD slip back.

SGD event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Singapore CPI (25th Sep).

SGD levels to watch (support / resistance): 1.3405, 1.3437 / 1.3590, 1.3690