• Jackson Hole. Chair Powell didn’t deviate much from the script. Fed prepared to tighten further if needed, & will hold rates at a “restrictive level” for some time.

• Market swings. A bit of volatility in markets, but with a ‘higher for longer’ view priced in equities reversed course. This gave the AUD a bit of support.

• Event risks. AU retail sales (today), the monthly CPI (Weds), China PMIs (Thurs), & US jobs report (Fri) are in focus this week.

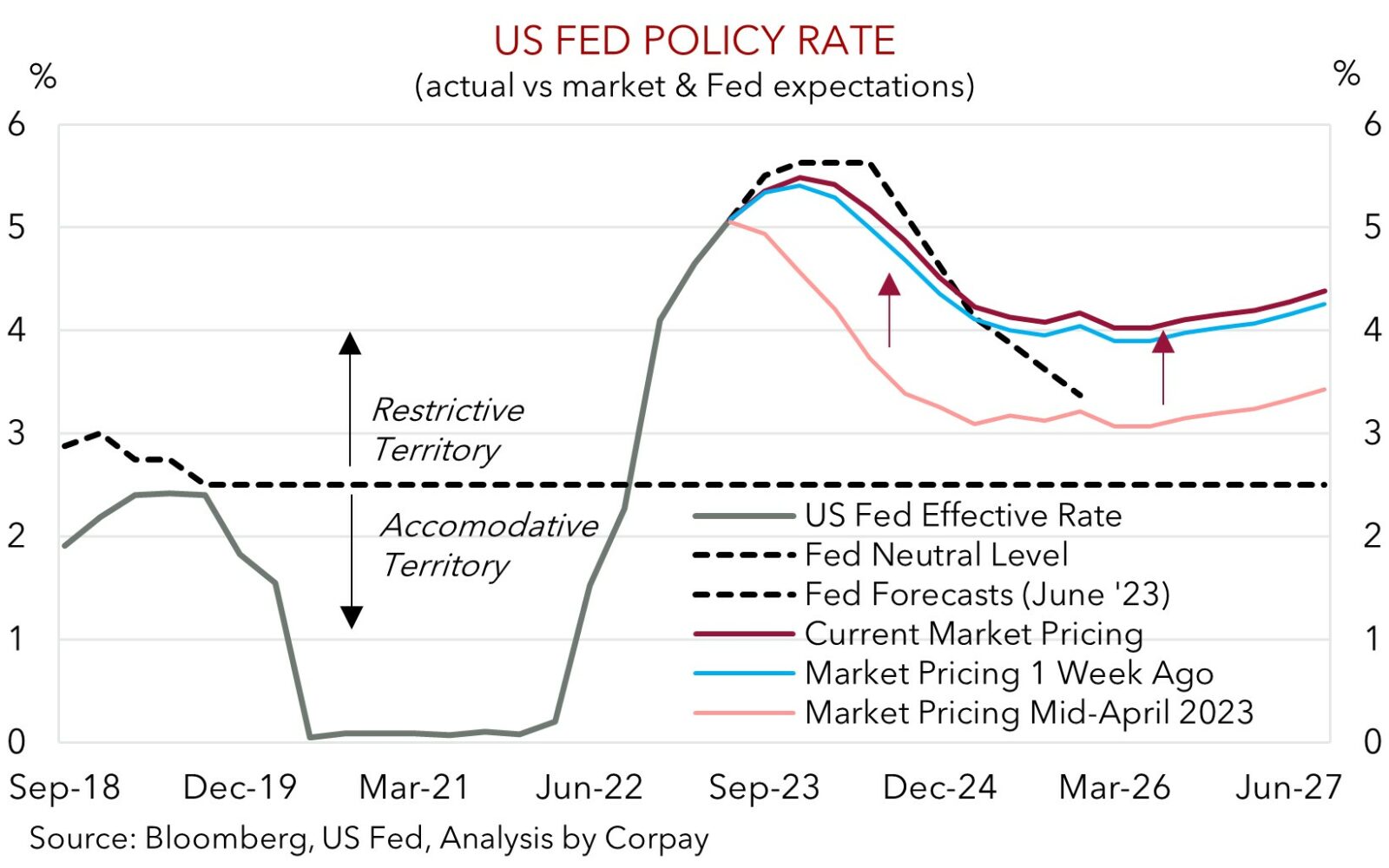

Markets endured a burst of volatility on Friday as US Fed Chair Powell delivered his much-anticipated Jackson Hole speech. In the end Chair Powell didn’t deviate much from the recent script. While he didn’t offer clear guidance about upcoming decisions, with the Fed now in a “position to proceed carefully” given the turn in inflation, Powell maintained optionality regarding more tightening if needed. According to Powell the Fed remains prepared to raise rates further and it will hold settings at a “restrictive level” until they are confident inflation is on a sustainable path down to target. And for that to happen a “period of below-trend economic growth as well as some softening in labor market conditions” is required. As a result, if there is evidence the US labour market isn’t continuing to soften, Powell noted that this could trigger a policy response. Lkewise, President Lagarde also reiterated that the ECB remains data dependent and that they will set rates at “sufficiently restrictive levels for as long as necessary” to get the inflation job done.

After slipping back initially equity markets realised they had heard it all before and reversed course. The S&P500 ended the day 0.7% higher, helping the index post its first weekly gain in a month. Across bonds, the US 2-year yield rose ~5bps to 5.08% (near the top of its cyclical range) while the 10-year rate held steady at ~4.24%. As our chart shows, there has only been a modest shift in the markets US interest rate pricing over the past week, with a ‘higher for longer’ outlook already well discounted following the sizeable adjustment over the past few months. In FX, the USD whipsawed around during Powell’s speech. On net, the USD index edged a touch higher thanks to a lift in USD/JPY (now ~146.43, around its highest level since November). EUR consolidated under ~$1.08, with GBP tracking sub ~$1.26. NZD (now ~$0.5904) remains near the bottom of its 2023 range, with AUD recovering its initial lost ground post-Powell’s comments to be little changed (now ~$0.6413).

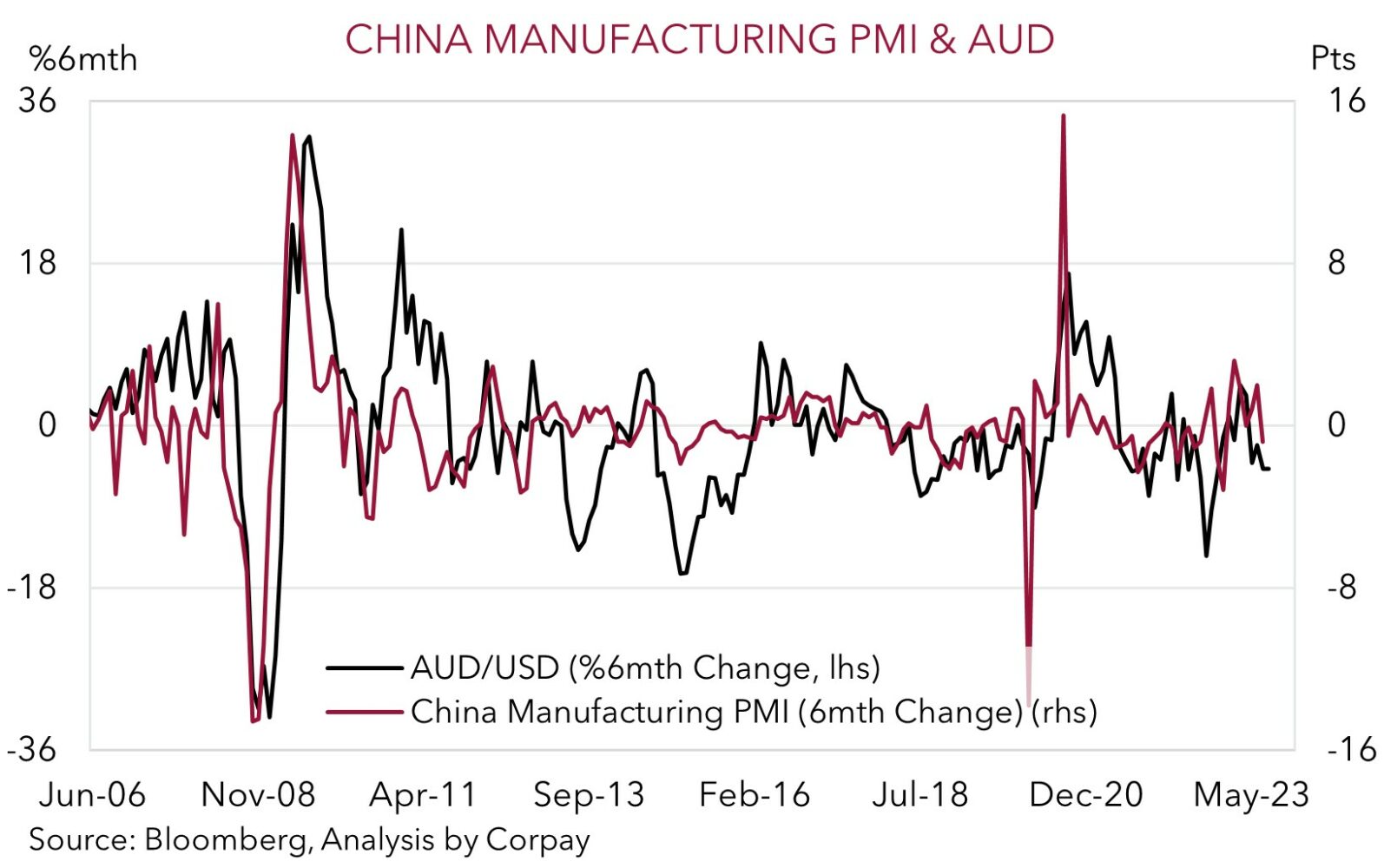

Offshore, there are several important releases later this week including the China PMIs, Eurozone CPI inflation, US PCE deflator (all Thursday AEST), the US labour market report (Friday AEST), and the US manufacturing ISM (Saturday AEST). Outcomes relative to expectations drive markets, and on this basis, we think that following its strong run and given what is factored in there are uneven risks around the USD with softer data (which is where we see the risks around this week’s US labour market report) likely to generate a larger negative reaction. Similarly, although the China PMIs are forecast to weaken a little more, we believe the growth slowdown is already well priced and markets may be more vulnerable to a changing narrative. Indeed, weekend news China lowered stamp duty on stock trades for the first time since 2008 to boost confidence adds to other small steps taken and suggests policymakers are trying to reinvigorate activity.

Global event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), Bank of Canada Meeting (7th Sep), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD corner

The AUD, like the USD and equity markets, experienced a bit of intra-session volatility on Friday around US Fed Chair Powell’s speech (see above). But after slipping under ~$0.64, the AUD tracked the rebound in US equity markets to be little changed from this time on Friday (now ~$0.6413). Some relative strength on a few of the AUD crosses also provided a bit of a helping hand. AUD/JPY (+0.4% to ~93.90) edged higher on the back of the improved risk sentiment and some relatively more dovish comments from BoJ Governor Ueda, while AUD/NZD (+0.3%) is hovering above its 50-day moving average (~1.0829).

In addition to the major offshore releases (the China PMIs, Eurozone CPI inflation, US PCE deflator (all Thursday AEST), the US labour market report (Friday AEST), and the US manufacturing ISM (Saturday AEST)), there are a few local events on this weeks calendar. The July retail sales data is due today (11:30am AEST), RBA Deputy Governor Bullock speaks tomorrow, and the monthly CPI indicator is released on Wednesday. As discussed above, outcomes compared to expectations influence markets, and when it comes to the AUD offshore developments tend to have a longer lasting impact. Locally, while the goods-heavy monthly inflation gauge looks set to step down in the year to July as base-effects continue to roll through, with little further RBA policy tightening factored in to the interest rate curve we doubt this should shift the dial. However, signs that consumer spending has rebounded, coupled with risks that the US data, particularly the week ending labour market report, fails to match lofty ambitions, and/or signs the China growth pulse is stabilizing could generate support for the beleaguered AUD, in our opinion.

Beyond the near-term volatility, as outlined previously, down around current levels we expect the AUD to find solid support. Fundamentals including Australia’s current account surplus (now ~1.4% of GDP), the still high level of the terms-of-trade, efforts by China to restrain CNY weakness, and flows related to the increasing pool of offshore investments undertaken by the superannuation industry should, in our judgement, help the AUD find a base. Further ahead, with the USD downtrend expected to recommence as seasonal trends become more negative (see Market Musings: History doesn’t repeat, but…), as the US’ relative economic outperformance fades, and/or as China injects further stimulus to reinvigorate its faltering recovery, we continue to forecast the AUD to grind back into the low 0.70’s by mid-2024.

AUD event radar: AU Retail Sales (Mon), RBA Deputy Gov. Bullock Speaks (Tues), AU CPI (Weds), China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), RBA Meeting (5th Sep), AU GDP (6th Sep), RBA Gov. Lowe Speaks (7th Sep), China Trade Data (7th Sep), Bank of Canada Meeting (7th Sep), China CPI (9th Sep), US CPI (13th Sep), AU Jobs (14th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep).

AUD levels to watch (support / resistance): 0.6310, 0.6365 / 0.6547, 0.6600

SGD corner

Inline with the USD swings around US Fed Chair Powell’s speech on Friday, USD/SGD experienced a bit of volatility (see above). However, on net, USD/SGD ended the day little changed with the pair continuing to track near ~$1.3560 (near the top of the range it has occupied since last December). On the crosses, EUR/SGD (now ~1.4639) is hovering just below its 100-day moving average (~1.4656) with the bout of EUR weakness last week the driver behind the recent pullback. By contrast, SGD/JPY (now ~108.03) has ticked up to a historically high level.

As mentioned above there are several offshore data points in focus this week with the China PMIs, Eurozone CPI inflation, US PCE deflator (all released Thursday), the US labour market report (released Friday), and the US manufacturing ISM the pick of the bunch. As discussed, we believe that after its upswing and with a ‘higher for longer’ US interest rate outlook now looking well priced, the USD may face some risks going forward with softer US data likely to generate a greater negative reaction, in our view. And this is where we think the risks reside with this week’s US labour market report. If realised, we believe softer US labour market data could see US interest rate expectations edge lower, weighing on the USD (and USD/SGD).

SGD event radar: China PMIs (Thurs), Eurozone CPI (Thurs), US PCE Deflator (Thurs), US Jobs (Fri), US ISM (Sat), US CPI (13th Sep), US Retail Sales (14th Sep), ECB Meeting (14th Sep), China Activity Data (15th Sep), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Singapore CPI (25th Sep).

SGD levels to watch (support / resistance): 1.3400, 1.3437 / 1.3590, 1.3690