• Yield rebound. Upside surprises in US retail sales & UK inflation has seen markets pare back rate cut expectations. Higher yields have supported the USD & GBP.

• Negative vibes. The shifting interest rate outlook & patchy China data has dampened risk sentiment. The AUD’s slide has continued.

• AU jobs. December labour force report released today. It could be a volatile month. Another positive result could help the AUD stabilise.

The rebound in bond yields and the USD, and pull-back in risk assets (including the AUD) has continued with stronger US retail sales and a re-acceleration in UK inflation raising further doubts central banks will quickly begin to reverse course. Patchy data out of China also weighed a bit on investor sentiment.

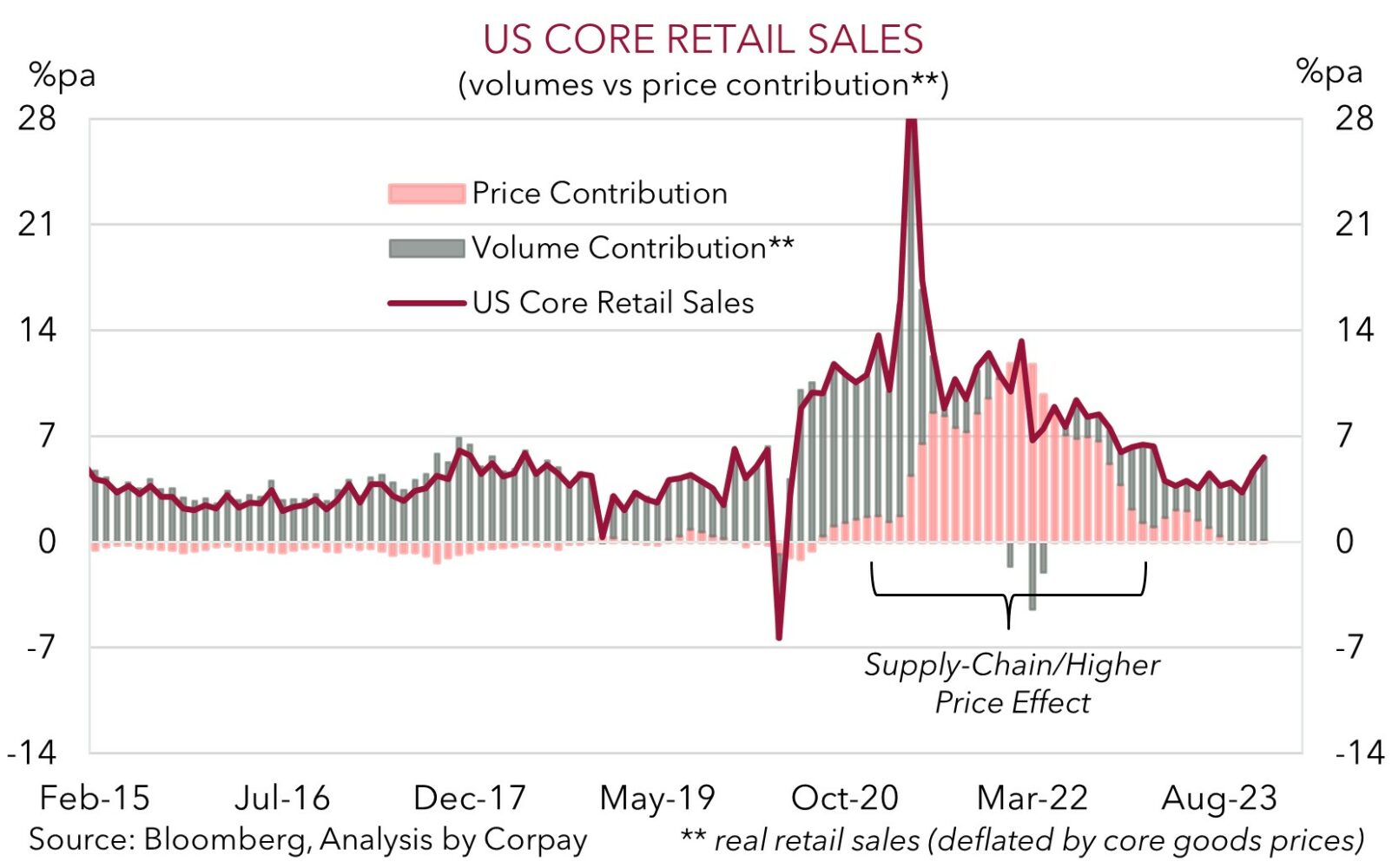

December US retail sales positively surprised with turnover increasing 0.6%mom, the strongest result in ~3-months. Although vehicle sales boosted the topline result, strength across other sub-categories indicates the US consumer is still holding up. Indeed, as our chart shows, rather than being driven by higher prices, the recent upturn in US retail sales has been a function of greater volumes. In the UK, inflation quickened to 4%pa with the upside surprise stemming from a lift in services prices. While the December data can be put down to swings in a few volatile items, it was also another shot across the bow of markets reminding them that the last phase of the inflation battle may be more difficult than assumed.

In China, the latest data batch was a mixed bag. GDP growth slowed to 1%qoq in Q4, though upward revisions to history meant annual growth came in as anticipated (i.e. 5.2%pa). Across the high frequency indicators retail sales were softer, however from a commodity demand perspective the uptick in industrial production and fixed asset investment was encouraging, especially as China’s improving credit impulse and other policy measures point to a further lift down the track.

In response to the data US Fed and Bank of England policy easing expectations were pared back. Odds of a rate cut by the US Fed at the March meeting have fallen to ~50% (they were up at ~80% at the end of last week). In the UK markets removed 1 BoE cut from their 2024 profile. As a result, the US 2yr yield increased ~13bps (now 4.35%), putting it back up where it was a week ago, and UK rates jumped up ~18-22bps across the curve. The re-evaluation of the policy outlook weighed on global equities. The EuroStoxx50 shed ~1%, the FTSE100 declined ~1.5%, and the US S&P500 fell ~0.7%. In FX, the USD Index touched its highest level since mid-December with EUR slipping to ~$1.0850 and the rate sensitive USD/JPY moving above ~148 for the first time in ~6-weeks. The backdrop pushed USD/SGD up towards its 200-day moving average (~1.3461). The AUD’s slide extended with it back down around its December lows (now ~$0.6541). By contrast, GBP outperformed with higher UK yields supportive.

Tonight, US housing starts/building permits, initial jobless claims, and the Philly Fed are due (12:30am AEDT), with the Fed’s Bostic also speaking (11:30pm and 4:05am AEDT). While we believe the USD’s rebound should eventually fade as the positioning adjustment runs its course and the medium-term theme for lower US rates re-asserts itself, in the short-term volatility could continue with markets clearly still vulnerable to more positive US data and/or push back by Fed officials.

AUD corner

The AUD’s January pull-back has continued. Higher US bond yields on the back of positive US retail sales and a paring back of rate cut expectations has compounded yesterday’s comments by the Fed’s Waller and patchy China data (see above). At ~$0.6541 the AUD has undergone a round trip to be ~4.8% under its late-December peak and back near the bottom of its ~6-week range. On the crosses, the AUD has continued to underperform. AUD/EUR (now ~0.6018) is at its lowest level since end-November, AUD/NZD is tracking near the bottom of its recent range (now ~1.0718), AUD/CNH is back below its 1-year average (now ~4.7279), and the jump up in UK bond yields has seen AUD/GBP tumble to ~4-month low (now ~0.5161).

As discussed previously, it shouldn’t be forgotten that the AUD is an inherently volatile currency and swings like recent moves aren’t out of the ordinary. Especially at this point in the economic cycle given visibility of how things are travelling often becomes murkier at macro turning points, and trend following markets often overextend themselves (in both directions). Indeed, while it may appear large, the ~3.1 cent range the AUD has tracked in so far this January is only on par with the average monthly range it has traded since the mid-1980s. Moreover, it is also worth remembering that since the AUD was floated ~40yrs ago the currency has, on average, traded in a ~13 cent (or ~20%) range each calendar year.

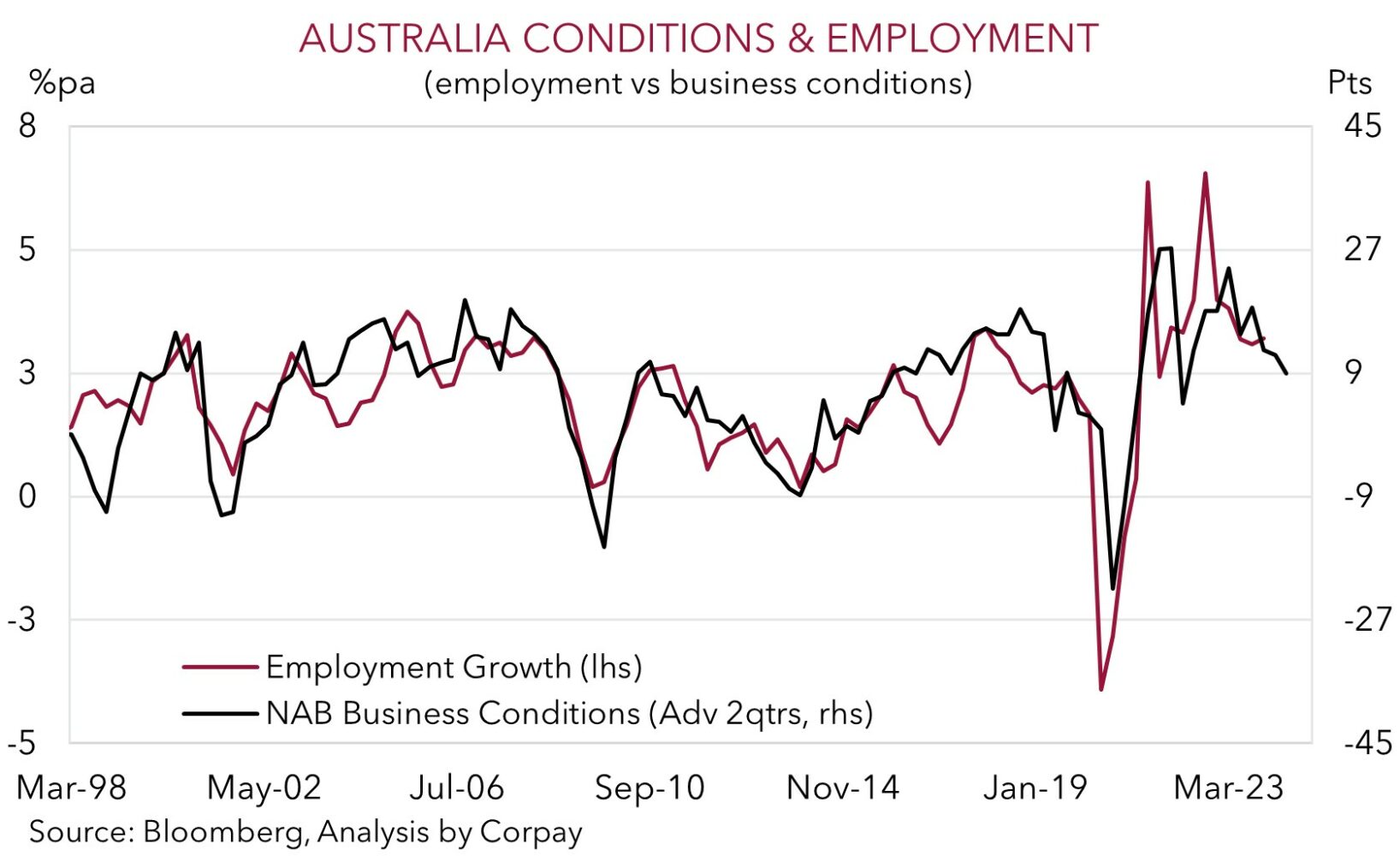

In our view, further bouts of AUD volatility should be anticipated this year as geopolitical risks wax and wane, questions about the growth/inflation outlook continue to be raised, and interest rate expectations consequently adjust. Today, the local data focus will be on the December labour force report (11:30am AEDT). It should be another volatile month for the labour force survey following a couple of strong gains in October and November, and with shifting seasonal patterns following COVID disruptions continuing to wash through. On balance, although labour demand is softening as economic activity moderates, various indicators like job ads and hiring intentions are still pointing to solid job creation (mkt 15,000 jobs) and for the unemployment rate to remain at levels consistent with ‘tight conditions’. Another low unemployment print (mkt 3.9%) would support our thinking looking for the RBA to lag its counterparts in terms of when it starts and how far it goes as the next global policy easing cycle takes place.

While we think this type of outcome should give the AUD some renewed support, we believe in the current stronger USD environment and with risk sentiment shaky, it may come through more durably on crosses such as AUD/EUR, AUD/NZD, and AUD/CNH given various relative fundamentals are still in Australia’s favour. That said, participants should also be aware that given the backdrop and prevailing negative sentiment, a downside surprise in the Australian labour report is likely to exert more pressure on the AUD, with the 100-day moving average (~$0.6517) the next support level.

AUD levels to watch (support / resistance): 0.6480, 0.6510 / 0.6590, 0.6630