• USD rebound. The rise in US yields on the back of comments by the Fed’s Waller has supported the USD. AUD is under ~$0.66 for the first time in a month.

• Slow & steady. Waller noted cuts shouldn’t be rushed. March too soon to start, but markets already pricing in a slower & shallower cutting cycle than in the past.

• Volatility. China data released today, US retail sales due tonight, & the Australian jobs report is out tomorrow. The data flow points to more volatility.

A bout of market turbulence has come through with a jump in US bond yields supporting the USD and exerting some downward pressure on equities (S&P500 -0.5%). EUR has fallen to a ~1-month low (now ~$1.0875), GBP is near the bottom of its multi-week range (now ~$1.2633), the interest rate sensitive USD/JPY is above 147 for the first time since early-December, USD/SGD is around a ~1-month high (now ~1.3425), and the AUD has extended its January pull-back to be tracking sub-$0.66 for the first time since 13 December.

In a break from the recent trend US yields rose by 9-12bps across the curve with the benchmark 10yr rate (now ~4.06%) up towards the top of the range occupied the past month.

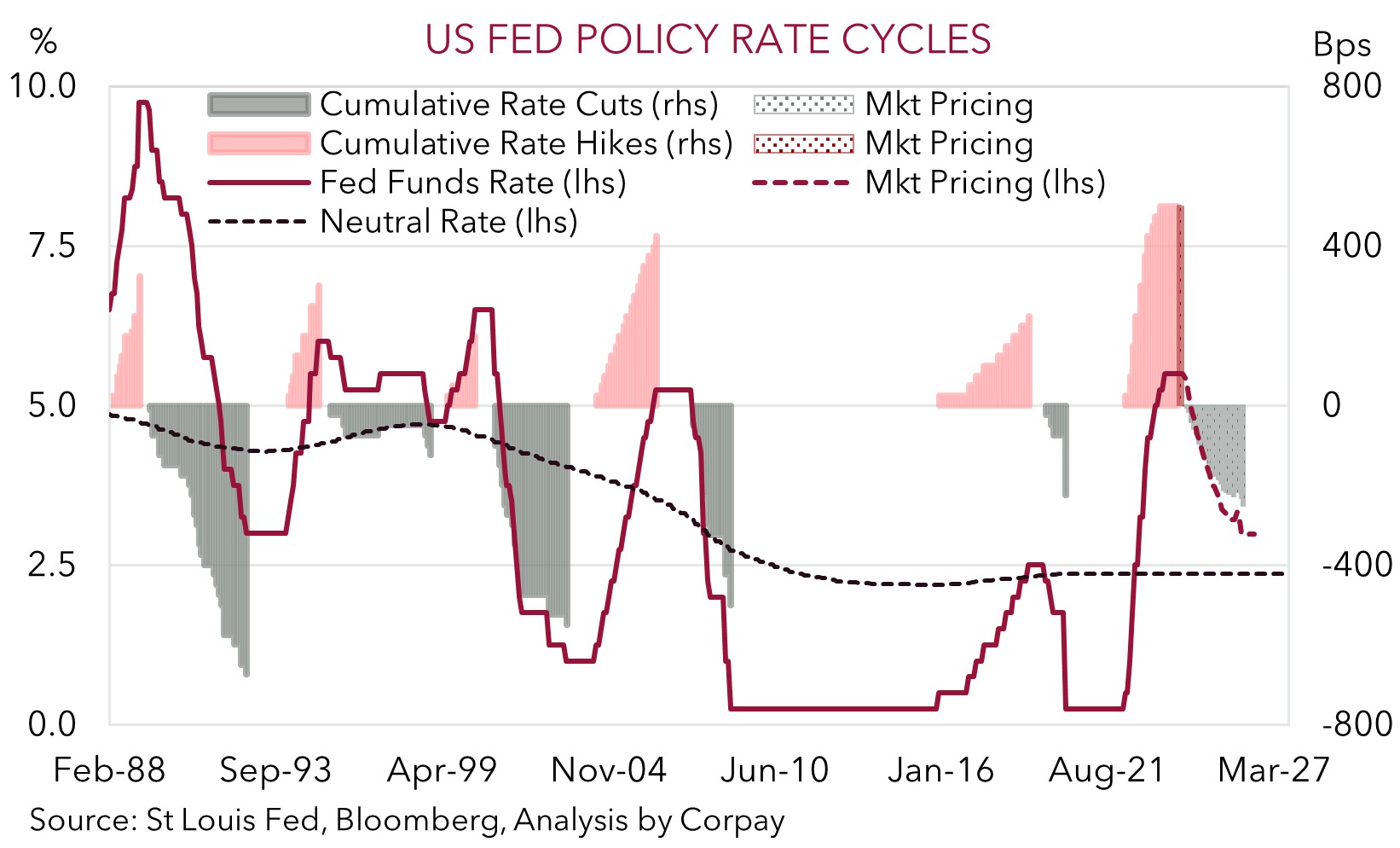

Comments by the Fed’s Waller were in focus with the policymaker noting that while he is “becoming more confident” inflation will fall to 2%pa, which in his view would enable rate cuts to start later this year, he pushed back on the markets enthusiasm that things could kick off soon. According to Waller “when the time is right to begin lowering rates, I believe it can and should be lowered mechanically and carefully” and with the economy in good shape and inflation falling he also sees “no reason to move as quickly or cut as rapidly as in the past”. An upside surprise in Canadian core inflation may have also raised concerns the latter stages of the inflation fight won’t be that easy and that central banks might need to stay the course longer.

Markets trimmed expectations for a March start to the Fed’s easing cycle with the probability of a move reduced to ~65%, although more than 150bps worth of cuts are still penciled in over 2024. As pointed out previously we also believe March is too soon for the Fed (and other central banks) to start to reverse course, and that spurts of volatility are likely as the data and policymakers temper the markets excitement. We continue to think a jumping off point for the US Fed around the mid-year looks probable (see Market Musings: US Fed pivot has further to run). That said, we also feel headline chasing markets could be over-reading Waller’s comments about the upcoming cycle. As shown, markets are already discounting a slower and shallower easing path by the Fed relative to the past. What is priced in for the next year is a bit more than half what has, on average, been delivered in the first 12-months.

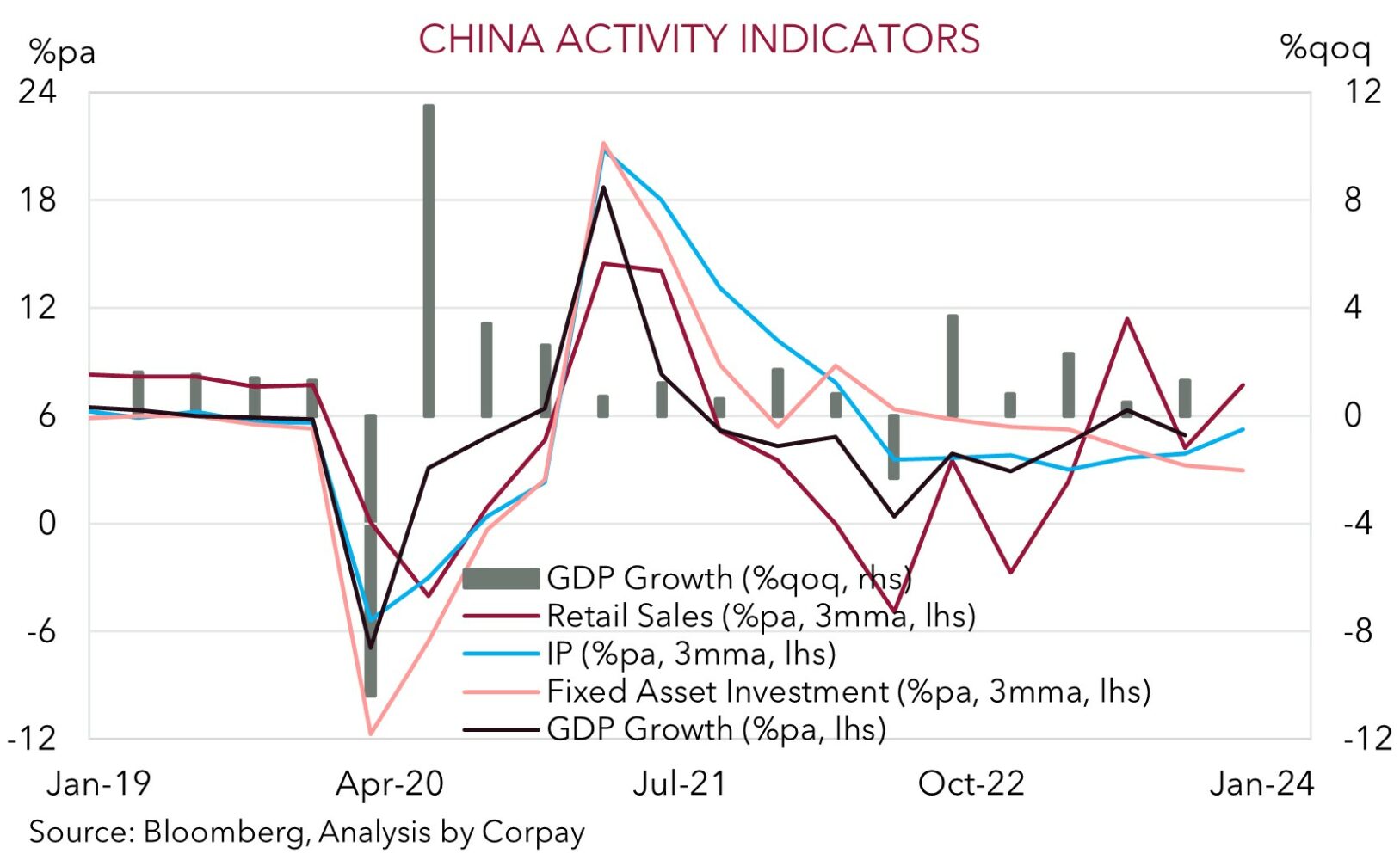

The China data batch, which includes Q4 GDP, is released today (1pm AEDT) and US retail sales are due tonight (12:30am AEDT). Positive base-effects, the upswing in credit, and stimulus boost point to activity in China improving. In the US, while auto sales should give headline retail sales a lift, core spending may remain sluggish as tighter credit, reduced savings, and low confidence bites. in our view, this type of mix could see US yields ease back, weighing a little on the USD.

AUD corner

The AUD’s new year slide has continued with the rebound in US bond yields on the back of comments by the Fed’s Waller (see above) dampening risk sentiment and giving the USD a boost. As a result the AUD has slipped back under ~$0.66 for the first time in a month to now be ~4.2% below its later-December peak. On the crosses, the AUD has also remained on the backfoot, though the moves have been more modest. AUD/JPY has eased under ~97, while AUD/EUR (now ~0.6055), AUD/GBP (now ~0.5212), AUD/CAD (now ~0.8886), and AUD/CNH (now ~4.7518) are near the bottom of their respective ~1-month ranges.

As mentioned, we believe FX markets may have over-reacted to Governor Waller’s comments about the speed/extent of the Fed’s upcoming easing cycle given markets are already discounting a slower and more limited rate cutting path compared to the past. As markets settle down we would expect the USD to give back some ground which in turn should help the AUD stabilise. That said, as also flagged previously, further bouts of volatility are likely near-term as geopolitical risks wax and wane, data exceeds or underwhelms forecasts, and interest rate expectations continue to swing around. This is typical for this point in the economic cycle given visibility of how things are travelling often becomes more limited at macro turning points. It also shouldn’t be forgotten that the AUD is a volatile currency. Since the AUD was floated ~40yrs ago the currency has, on average, traded in a ~13 cent (or ~20%) range each year. So far in 2024 the AUD has traded in a less than a ~3 cent range.

We think AUD volatility could continue over the coming sessions given the China data batch (today 1pm AEDT), US retail sales (tonight 12:30am AEDT), and the Australian December jobs report (Thurs AEDT) are due. After its torrid spell, on balance, we think a combination of signs of improvement in China’s economy (which is typically a tailwind for commodities), a moderation in US consumer spending (the engine room of the economy given it is ~3/4’s of US GDP), and/or another low Australian unemployment print (mkt 3.9%) should reinforce market pricing looking for the RBA to lag its peers in terms of when it starts and how far it goes as the next global policy. From our perspective, the still elevated equity markets and prices for key commodities like iron ore (which is ~10% above its 5-year average), coupled with the narrower Australia-US yield spreads (at -35bps, the 2yr AU-US differential is near its narrowest since Q4 2022) should see the AUD find some support and rebound over the period ahead.

AUD levels to watch (support / resistance): 0.6510, 0.6560 / 0.6630, 0.6680