• US yields. Softer US producer prices supported views inflation pressures are receding. Expectations of multiple Fed cuts in 2024 remain. US 2yr yields fell.

• Stable FX. Despite the drop in US yields the USD consolidated. AUD is hovering just under ~$0.67. The RBA outlook continues to diverge from its peers.

• Event radar. Offshore the China data batch, US retail sales & comments by Fed/ECB officials will be in focus. Locally, the December jobs report is due.

A quiet end to last week across FX markets with the major currencies range bound on Friday. The USD Index held its ground despite a sizeable drop in US bond yields as softer than anticipated US producer price data supported views that underlying inflation pressures are receding and that a US Fed-led global easing cycle may be approaching. EUR is hovering around ~$1.0950, GBP is near ~$1.2750, the interest rate sensitive USD/JPY has slipped back under ~145, and the AUD is less than 0.5% from where it started last week (now ~$0.6688).

Importantly, the bits and pieces from last weeks US CPI and PPI data that flow through to the PCE deflator (the US Fed’s preferred inflation gauge which is released on 27 January) point to a further slowdown in inflation over the period ahead. On the back of the PPI report the US 2yr yield declined another ~10bps on Friday, with the drop in yields helping to prop up US equities (the S&P500 is within striking distance of its early-2022 record highs). The downtrend in bond yields has continued with the cumulative ~24bp decline over the week pushing the US 2yr rate to its lowest since last May (now ~4.14%). Markets are discounting close to ~170bps worth of rate cuts by the US Fed in 2024 with a close to 80% chance things kick off in March. We continue to think that March is too soon for the Fed to start to reverse course, and that bursts of volatility are likely as the incoming data and comments by policymaker’s tempers (or reinforces) the markets enthusiasm. However a jumping off point around the middle of the year still looks probable, in our view, based on our analysis of past Fed cycles and the signals from its ‘policy rules’ (see Market Musings: US Fed pivot has further to run).

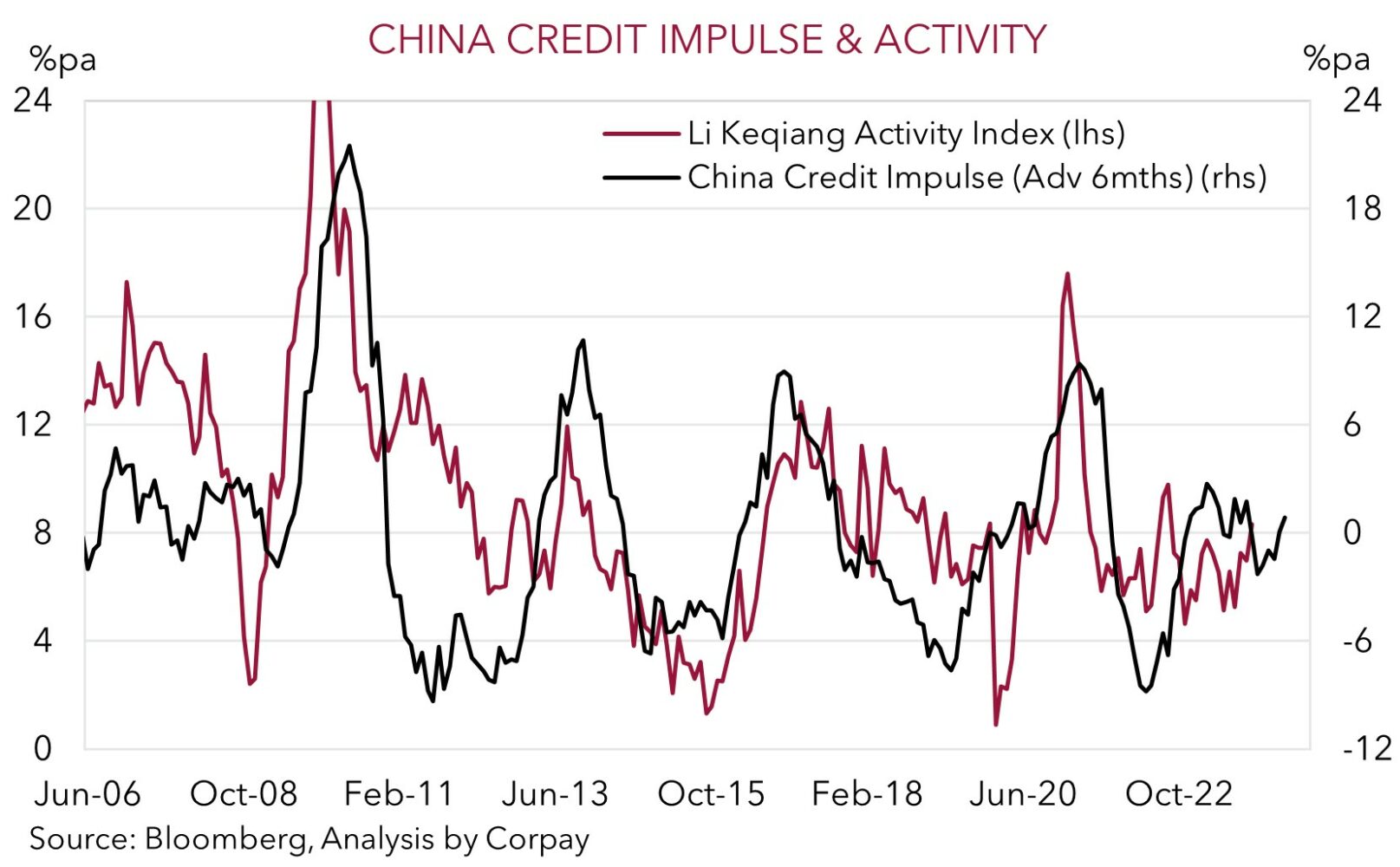

This week the global economic focus will be on the US and China. In China the December activity data batch, which includes Q4 GDP, is due on Wednesday, while in the US retail sales (Thurs AEDT), industrial production (Thurs AEDT), and various housing stats (Fri AEDT) are released with a few Fed officials also set to speak later in the week. In our view, positive base-effects as last years COVID impacts unwind, the upswing in the credit impulse and boost from stimulus injections point to growth momentum in China improving. At the same time, while auto sales may give headline US retail turnover a lift, core spending should remain rather sluggish as tighter credit conditions, reduced excess savings, and low confidence bites. If realised, we believe these diverging macro trends should be supportive for risk sentiment and cyclical currencies like the AUD, with the USD expected to be on the backfoot as markets continue to price in the next Fed easing cycle and US yields continue to move lower.

AUD corner

The AUD endured a bit more intra-day volatility on Friday night in and around the release of the US producer price inflation data. But on net, at ~$0.6688 the AUD is little changed from where it was tracking at this time on Friday morning, and is less than ~0.5% below where it started last week despite the upside surprise in US inflation and weaker than predicted Australian monthly CPI indicator. On the crosses, the AUD was mixed, though much like the major currencies the moves have been modest. AUD/EUR has ticked back above ~0.61, AUD/NZD has eased towards ~1.0710 (its lowest since mid-December), and AUD/JPY is near its 50-day moving average (~96.87). We continue to think that AUD/JPY should soften over the medium-term with the decline in global bond yields as policy easing occurs outside of Japan a JPY positive.

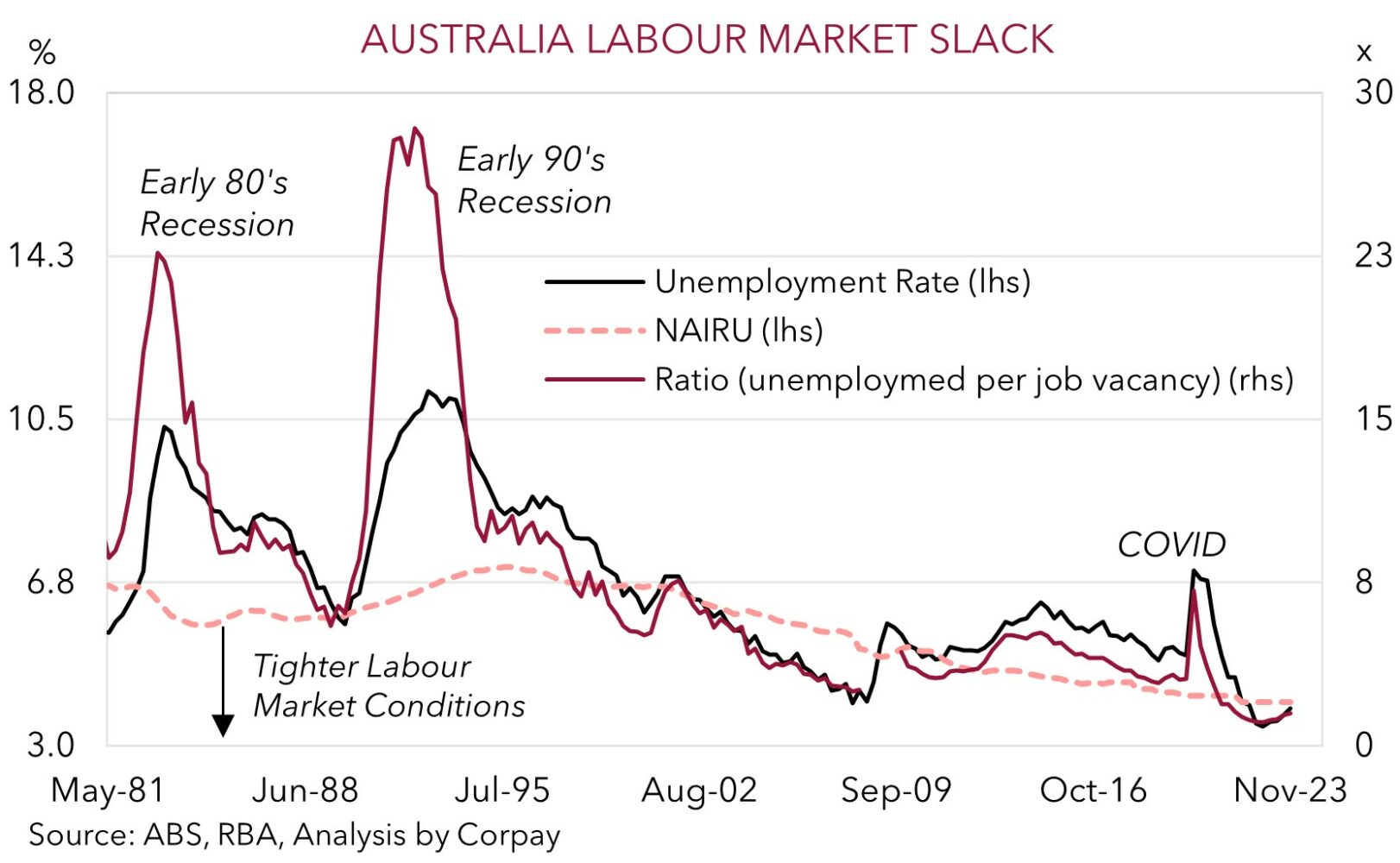

This week the local data highlight is the December jobs report (Thurs AEDT). It should be another volatile month for the labour force survey following a couple of strong gains in October and November, and with shifting seasonal patterns following COVID disruptions continuing to wash through. On balance, while labour demand is softening various indicators like job ads and hiring intentions are still pointing to solid job creation. We think that this should see the unemployment rate remain at levels consistent with ‘tight conditions’. Another low unemployment print (mkt 3.9%) would reinforce our thinking, and market pricing, looking for the RBA to lag its counterparts in terms of when it starts and how far it goes as the next global policy easing cycle takes place. In our judgement, the underlying shift/narrowing in short-dated yield differentials in Australia’s favour, coupled with signs of improvement in China’s economy (data released Weds AEDT) and/or a moderation in US consumer spending (released Thurs morning AEDT) should be AUD supportive.

There will be stops and starts along the way as geopolitical risks wax and wane, data exceeds or underwhelms forecasts, and interest rate expectations swing around. This is not unusual at this point in the economic cycle as visibility of how things are travelling often becomes more limited at turning points. That said, our base case continues to be for the AUD to oscillate around ~$0.6650-0.68 over the next few months before kicking on later in the year as the combination of a slower and more limited easing cycle from the RBA, improvement in China’s economy as policy stimulus measures gain traction, and a weaker USD on the back of lower US bond yields sees the AUD edge up to ~$0.70-0.71 by Q3.

AUD levels to watch (support / resistance): 0.6610, 0.6650 / 0.6730, 0.6780

SGD corner

Despite the falls in US bond yields over the past week the USD and USD/SGD have remained somewhat range bound. USD/SGD is hovering just over ~1.33, where it was trading in mid-December. On the crosses, EUR/SGD has edged slightly higher (now ~1.4579) with the pair tracking above its ~3-month average. Elsewhere, SGD/JPY is consolidating slightly below its 100-day moving average (~109.10).

As mentioned, the global focus this week will be the China activity data, US retail sales, and comments from US Fed officials about the policy outlook. In our opinion, based on the upturn in China’s credit impulse and past stimulus measures, growth momentum should have improved at the end of 2023. While at the same time, spending by US consumers may underwhelm consensus forecasts given the reduction in ‘excess savings’ and below average sentiment. This mix could, in our view, weigh on the USD and give cyclical Asian currencies like the SGD a boost. Over the next few quarters we expect the downward pressure on the USD to return with USD/SGD projected to fall towards ~1.30 as US bond yields continue to slide, growth in China quickens, and/or stronger than anticipated Singapore GDP and inflation sees the MAS maintain its ‘hawkish’ bias for a while longer.

SGD levels to watch (support / resistance): 1.3220, 1.3280 / 1.3350, 1.3400