• US CPI. Data slightly higher than forecast. This triggered a bout of market volatility. After an initial jump in yields & the USD, & drop in equities, markets reversed.

• Glass half full. US yields fell as some underlying inflation trends still support the outlook for eventual Fed policy easing, though a move in March looks too soon.

• AUD vol. Further bouts of AUD volatility likely given where we are in the cycle. Since the float the AUD has, on average, traded in a ~13cent range each year.

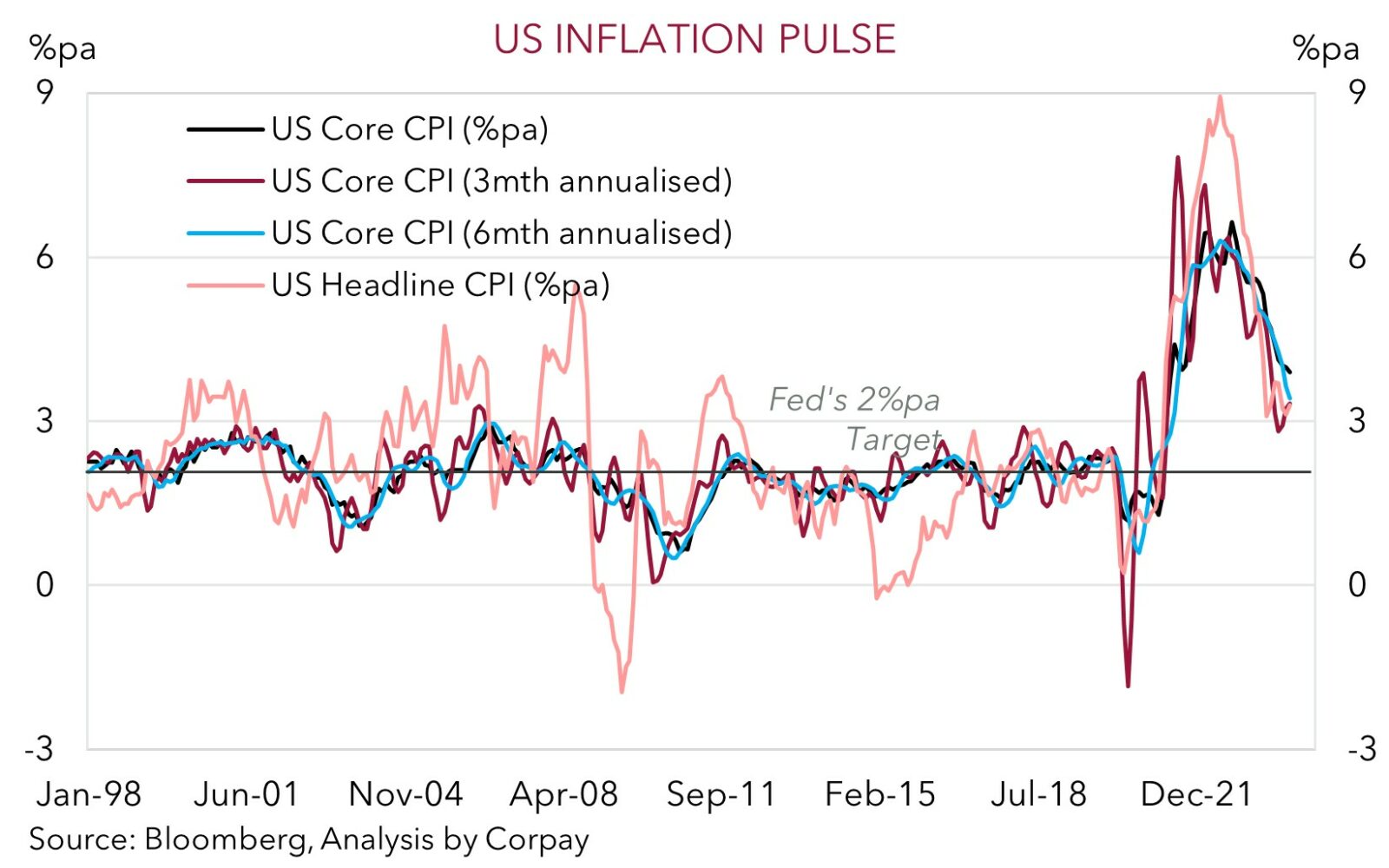

Markets endured a burst of volatility overnight in the wake of the latest US inflation data with stocks, bonds, and FX markets whipsawing around. US CPI rose slightly more than anticipated in December with the headline rate re-accelerating to 3.4%pa (its fastest pace in ~3-months). Core inflation (which excludes food and energy) also topped projections, with the slowdown a bit less than predicted (now 3.9%pa). A look under the hood shows that swings in oil/gasoline prices played a role in propping up headline CPI, that the decline in ‘goods’ prices stalled, and that the deceleration across services inflation is slow going given still solid growth in rents and wages.

The data reinforces the view that the last leg of disinflation marathon won’t be straight forward, and supports our thoughts that market pricing factoring in a high chance of Fed rate cuts kicking off in March (now ~69% probability) is misplaced. This is something the Fed’s Mester and Goolsbee also stressed when speaking post the CPI release with both essentially reiterating that they need to see more data before thinking about easing. Nevertheless, after an initial knee-jerk jump up in bond yields and the USD, and drop in equities in the wake of the US inflation outcome, markets reversed course as the session rolled on. Participants took be taking a more glass half full view that the inflation genie is still being put back in the bottle given the ongoing moderation in the pulse rate of US core CPI (see chart below).

On net, the US S&P500 ended modestly lower (-0.1%, it was down close to 1% early on). Elsewhere, US bond yields declined with the policy expectations driven 2-year rate falling by ~10bps (now ~4.26%) and the 10yr rate shedding ~5bps (now ~3.98%) as markets continue to discount an eventual policy turn by the US Fed. In FX, the USD gave back its post data gains, with EUR ticking back up to ~$1.0960, GBP rebounding to ~$1.2750, and the yield sensitive USD/JPY slipping to ~145.40. USD/SGD experienced a round trip to be little changed from a day ago (now ~1.3315), and the AUD (now ~$0.6683) clawed back a large chunk of its initial losses as sentiment improved.

Today, the China trade (no set time) and inflation (12:30pm AEDT) data are due, while US Producer Price Inflation is released tonight (12:30am AEDT). In our view, signs China’s export growth is accelerating and/or that import growth is improving (a signal that domestic demand is strengthening) could be supportive for risk sentiment and growth-linked assets. This, and a tepid US PPI may, in our opinion, see the USD come under pressure as markets continue to factor in the next Fed easing cycle.

AUD corner

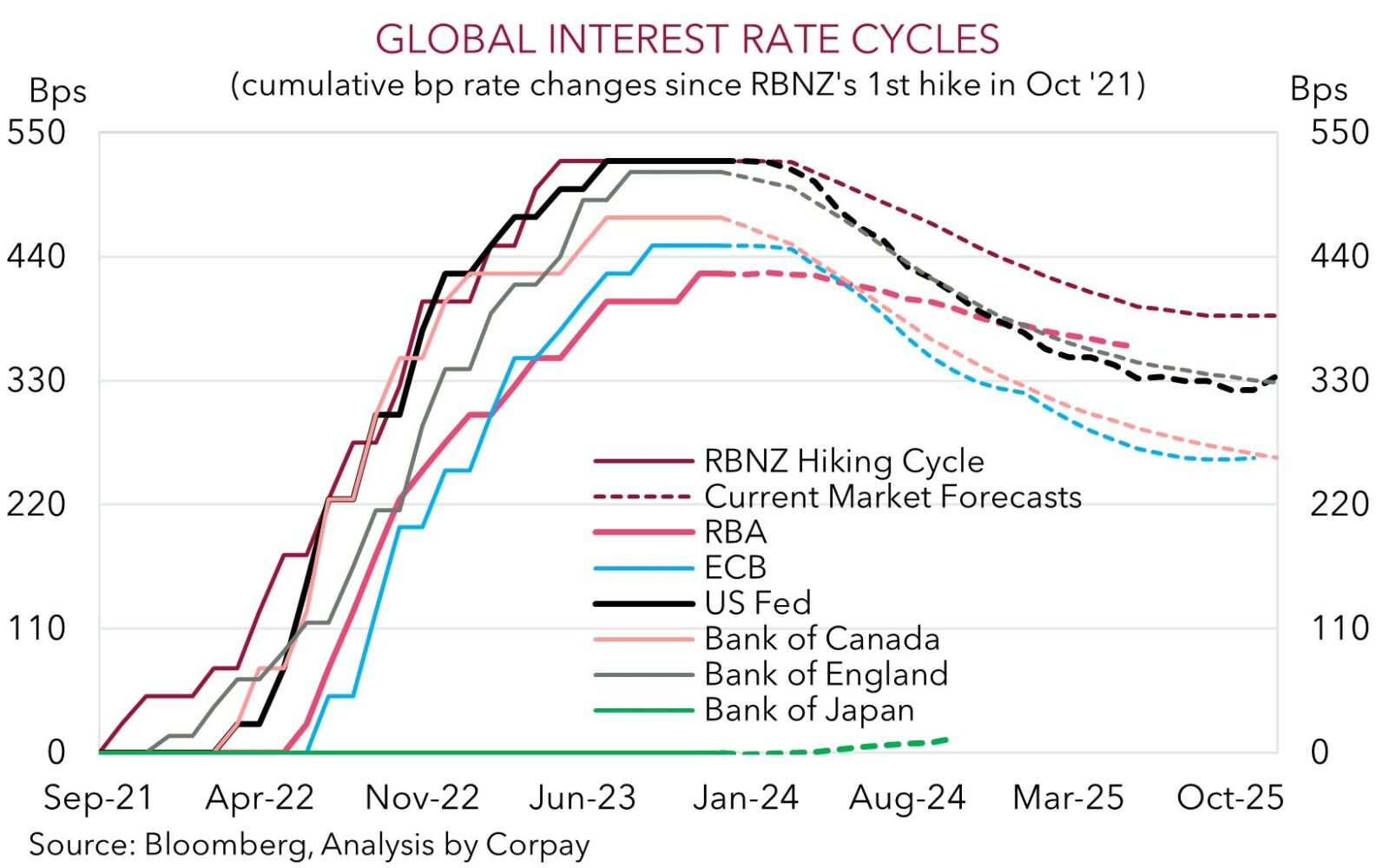

The AUD whipped around overnight. As discussed, the initial strength in the USD and negative risk sentiment post the slightly higher than expected US CPI faded as the session progressed and participants focused in on the disinflation trends still unfolding across key areas. The subsequent drop in the US bond yields exerted downward pressure on the USD and the shift in relative interest rate expectations in turn helped the AUD recoup the bulk of its earlier losses (now ~$0.6683). That said, on the crosses the AUD has remained sluggish. Over the past 24hrs the AUD depreciated by ~0.4% against the JPY, GBP, and NZD, ~0.3% versus the CNH, and ~0.2% relative to the EUR. Out of this bunch we continue to have an expectation that AUD/JPY should continue to weaken over the medium-term with the downtrend in global bond yields as policy easing occurs outside of Japan a key driver that can be JPY supportive.

As mentioned above today the China trade (no set time) and inflation (12:30pm AEDT) data are released, with US PPI inflation due tonight (12:30am AEDT). Next week there are a few other noteworthy data points with the China activity data (Weds), US retail sales (Thurs), and the Australian jobs report (Thurs) on the radar. Further bouts of intermittent AUD volatility are likely as the global and local data rolls out and participants adjust their policy easing assumptions. This is not unusual as visibility of how things are travelling often becomes more limited at turning points in the economic cycle. It also shouldn’t be forgotten that the AUD is an inherently volatile currency. Since the AUD was floated ~40yrs ago the currency has, on average, traded in a ~13 cent (or ~20%) range each calendar year. So far this year the AUD has only traded in a ~2 cent range.

FX markets seldom move in straight lines and there will be stops and starts along the way as geopolitical risks wax and wane, economic data undershoots or exceeds forecasts, and interest rate pricing swings around. But on net, our base case continues to be for the AUD to oscillate around ~$0.67 over the next few months before gradually kicking on later in the year. While we don’t see the RBA raising interest rates again, we continue to think that domestic inflation trends, especially around services, the support to aggregate demand from a larger population, and helpful boost from the incoming Stage 3 tax cuts is likely to see the RBA lag its counterparts in terms of when it starts and how far it goes as the next global easing cycle takes place. We believe the divergence between the RBA and other central banks should see short-dated yield differentials continue to move in favour of a higher AUD. When combined with our outlook looking for activity in China to improve as policy stimulus measures gain traction, and for US bond yields to trend lower and weigh on the USD, we continue to see the AUD edging up to ~$0.70-0.71 by Q3.

AUD levels to watch (support / resistance): 0.6610, 0.6650 / 0.6720, 0.6780