• Mixed markets. US equities rebounded & bond yields ticked up. Oil prices dipped. In FX, there were generally limited net moves. AUD near $0.67.

• AU inflation. Headline inflation decelerated more than expected. But things are still a long way from target. RBA to lag its peers when rate cuts come through.

• US CPI. December inflation data released tonight. Headline inflation forecast to nudge up, but core CPI predicted to slow. The data can generate USD volatility.

Ahead of the US CPI release markets put in a mixed performance overnight. On the one side, equities bounced back with a tech sector led rally supporting the US S&P500 (+0.6%). Bond yields also nudged up with the benchmark US 10yr rate ticking slightly higher to ~4.03% (+2bps). By contrast, energy prices dipped (WTI crude -1.1%), and the pullback in iron ore extended (-2.2%), though at ~US$132/tonne iron ore prices remain near the upper end of the range occupied since Q2 2022. In FX these crosscurrents generated limited net moves. The USD index eased modestly, with EUR (+0.3% to ~$1.0963) and GBP (+0.2% to ~$1.2733) firmer, while the JPY underperformed (pushing USD/JPY higher) as sluggish Japanese wage data dampened BoJ policy normalisation expectations. Elsewhere, USD/SGD consolidated just above ~1.33, and the AUD is hovering around ~$0.67.

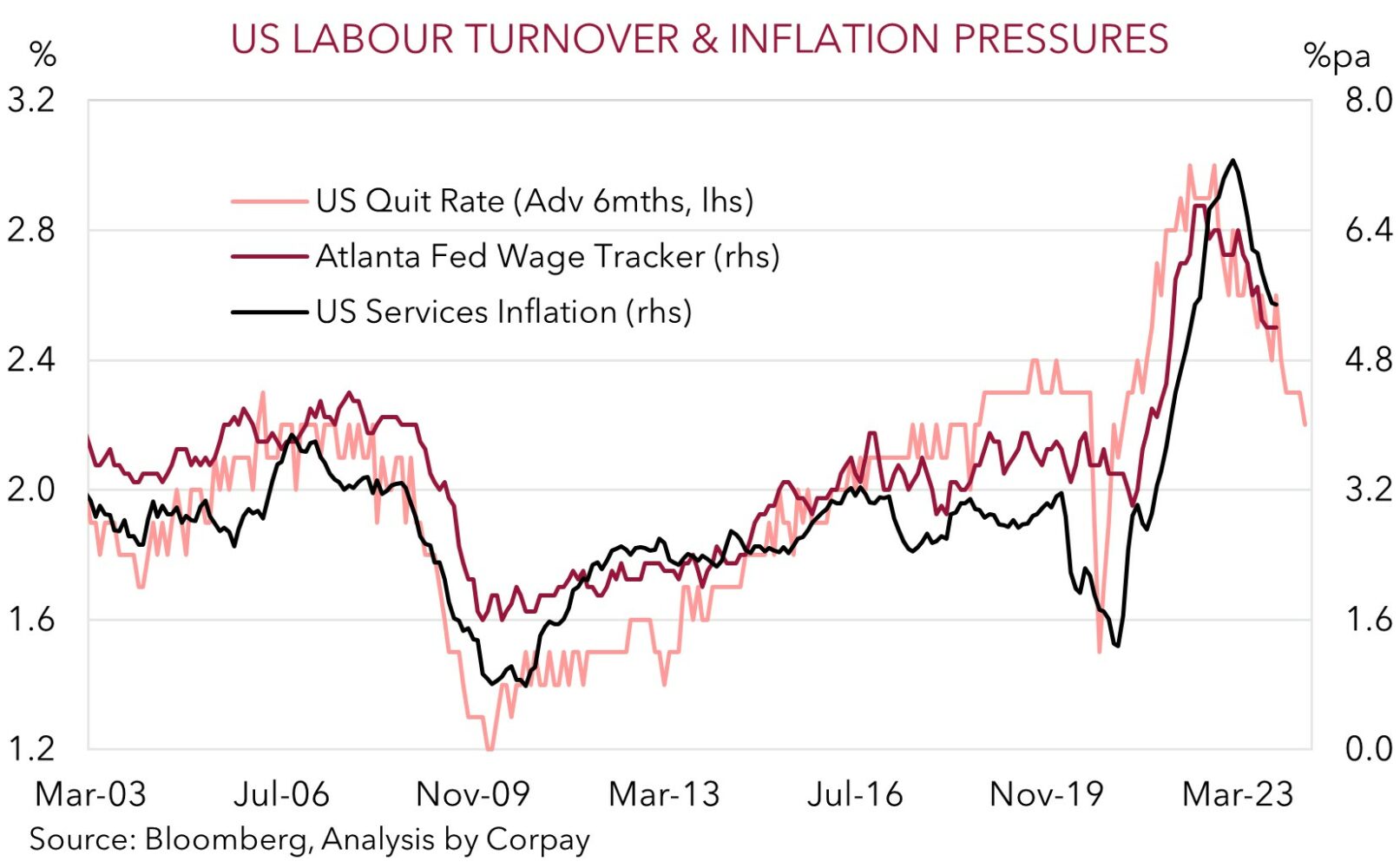

Monetary policy wise NY Fed President Williams spoke this morning and he made a few observations. According to Williams US interest rates now appear “restrictive enough” for inflation to reach the 2%pa goal, with the inflation situation having improved quite a bit. According to Williams when it comes to policy easing the Fed “must be confident” inflation is sustainably on the right path before acting. That said, Williams also made the point that as inflation falls it would be natural for interest rates to also normalise. These views generally align with our expectations that while the bar to a rate cut as soon as the March meeting is high (markets are still assigning a ~64% chance this happens), based on past cycles and the signal from the Fed’s ‘policy rules’ a recalibration from mid-2024 to keep pace with the drop in inflation and ensure settings don’t mechanically become overly ‘restrictive’ should occur (see Market Musings: US Fed pivot has further to run).

As mentioned US inflation data for December is in the spotlight (tonight 12:30am AEDT). Swings in gasoline prices, less favourable base-effects, and stickiness across some services components points to headline CPI modestly reaccelerating (mkt 3.2%pa). However, we think markets (like policymakers) should be more attuned to slower core inflation (mkt 3.8%pa). If realised, this would be the lowest US core inflation run-rate since early-2021. In our opinion, such an outcome should reinforce expectations looking for Fed policy easing over 2024, which in turn can exert downward pressure on the USD.

AUD corner

The AUD has consolidated around ~$0.67 over the past 24hrs with the lift in US equities (S&P500 +0.6%) and slightly softer USD (see above) offsetting a dip in oil (WTI crude -1.1%) and iron ore (-2.2%) prices. On the crosses the AUD has been mixed. While the AUD has lost a bit more ground against the EUR (-0.2%, now ~0.6107), the AUD has strengthened against the NZD (+0.5%, now ~1.0771) and JPY (+1%) with tepid Japanese wage data tempering BoJ policy normalisation bets. At ~97.58 AUD/JPY is back near the top of the range it has occupied since mid-December. Over the medium-term we continue to see more downside than upside potential in AUD/JPY with the downtrend in global bond yields as policy easing unfolds outside of Japan a key driver. We would also point out that statistically AUD/JPY is tracking at somewhat rarefied air. Since 2010, AUD/JPY has only traded above current levels ~3% of the time.

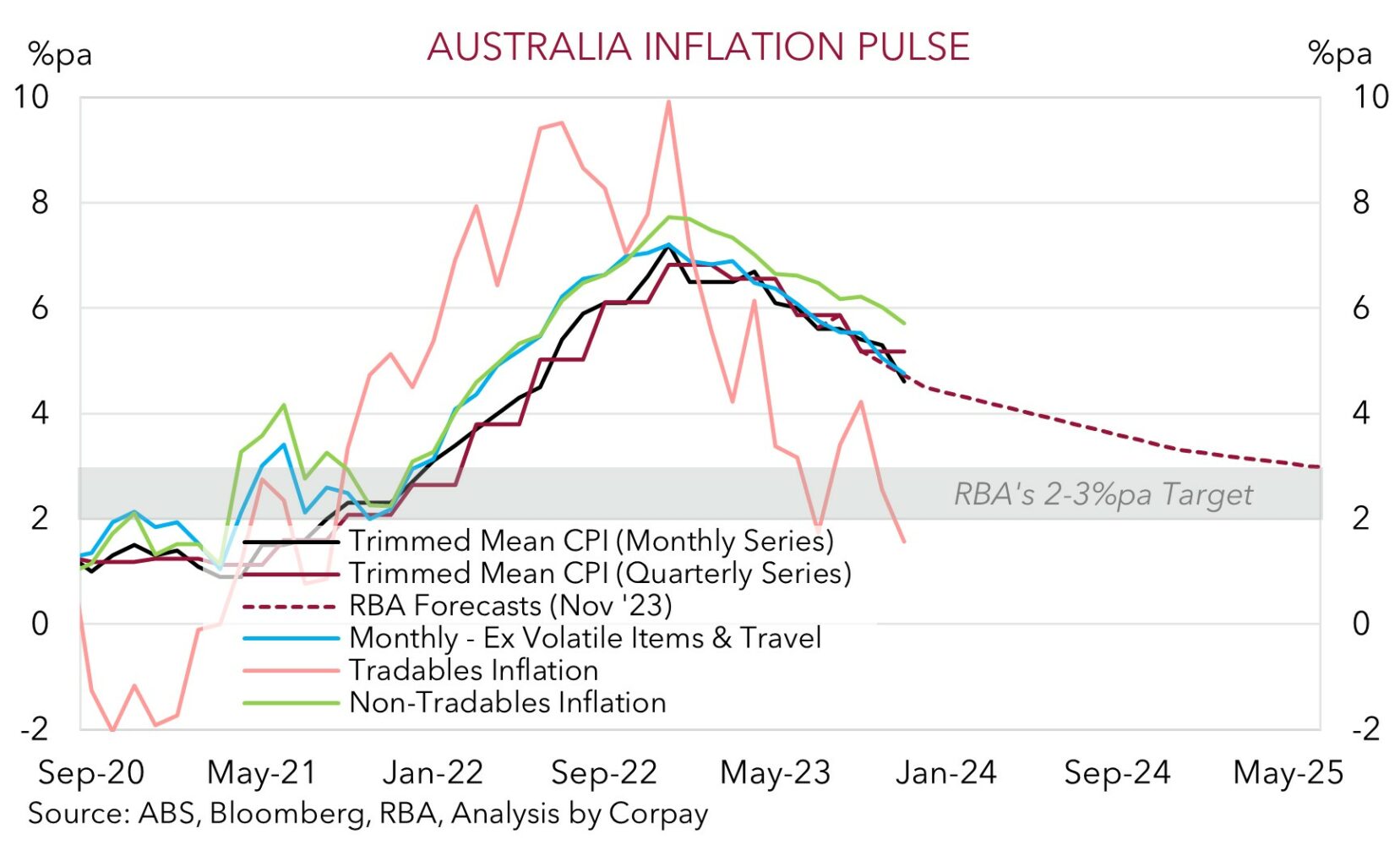

Locally, the November reading of the monthly CPI indicator was released yesterday. There was a slight downward surprise in headline inflation with annual growth falling from 4.9%pa to 4.3%pa, a low since early-2022. A scan of the drivers shows that growth in food prices, petrol, and broader ‘goods’/tradables inflation slowed, with the government’s rent assistance subsidy and electricity rebates also artificially holding things down. Outside of that ‘services’ and non-tradables (i.e. domestic) inflation, which are areas the RBA has been focused on, is moderating however the improvement is slower. Services inflation is running at 4.7%pa. Although it is moving in the right direction it is still a long way from where it needs to be. This more gradual disinflation trend supports our view that while the RBA’s hiking phase has ended thoughts of rate cuts may be some way off.

Short-term the AUD should be driven by swings in risk sentiment with market attention focused on tonight’s US CPI print (12:30am AEDT). Signs of a further slowdown in the US’ core inflation pulse could, in our opinion, be a positive for risk sentiment and in turn cyclical currencies like the AUD. More broadly, we continue to think that domestic inflation impulses, the support to aggregate demand from a larger population, the incoming Stage 3 tax cuts, and stimulus measures being taken in China are likely to see the RBA lag its counterparts in terms of when it starts and how far it goes as the next global easing cycle takes place. Over the next few months, we believe the divergence between the RBA and other central banks should see short-dated yield differentials continue to shift in favour of a slightly higher AUD.

AUD levels to watch (support / resistance): 0.6610, 0.6650 / 0.6720, 0.6780